L’OCCITANE Group has reported net sales of €2.8 billion for the full year ended 31 March 2025, marking an +11.7% year-on-year increase at constant exchange rates.

The performance underscores a period of significant transformation for the group, which moved into private ownership during the year and implemented a revised governance structure to support long-term sustainable growth.

L’OCCITANE Group, which operates across more than 90 countries with over 3,000 retail outlets, described FY2025 as a “watershed year”. The company said the move to private ownership has enabled it to sharpen its focus on its mission, purpose and triple bottom line: people, planet and profit.

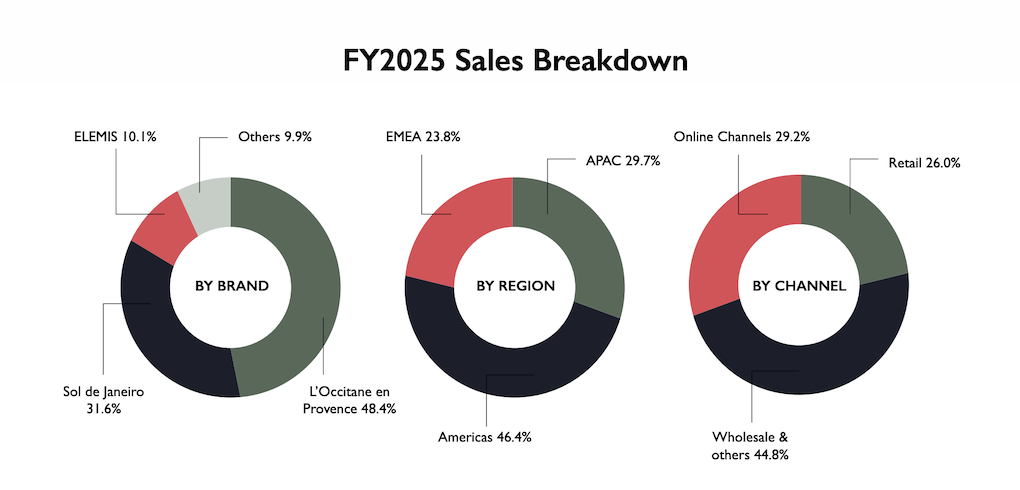

The Americas emerged as the fastest-growing region in FY2025, accounting for 46.4% of global sales, followed by Asia Pacific (29.7%) and EMEA (23.8%). The wholesale channel was the strongest-performing distribution model, representing 44.8% of sales, ahead of online (29.2%) and retail (26%).

By brand, L’Occitane en Provence remained the largest contributor to Group turnover, accounting for 48.4% of total sales. Sol de Janeiro continued its impressive momentum, representing 31.6% of the business and maintaining its position as Sephora North America’s top beauty brand and Amazon US’s number one fragrance brand.

Erborian was highlighted as the group’s fastest-growing brand, topping Earned Media Value rankings in French skincare, while ELEMIS led the UK market with its Pro-Collagen range. L’Occitane en Provence enjoyed good sell-out performance in the USA with the Almond Shower Oil becoming the top body cleaner.

Looking ahead to FY2026, the company said it would proceed with ‘cautious optimism’ while continuing to invest in its brands, people and environmental commitments.

In a statement, the company said: “FY2025 was a watershed year for the L’OCCITANE Group, as it transitioned into private ownership. With the premium beauty industry undergoing profound shifts, privatisation was a natural evolution for the Group, allowing us to focus on our purpose, core values and sustainable growth.

“Post-privatisation, the Group has refined its governance structure to balance Group oversight and brand autonomy for a stronger and more agile organisation in the years to come.

“The Group starts the new financial year (FY2026) with cautious optimism, as we navigate an uncertain and volatile macroeconomic environment. As a global group with a diversified portfolio of strong and unique premium beauty brands, we are more resilient to brand- or region-specific pressures.

“Looking to the future, we believe we are well positioned to drive healthy and sustainable growth.” ✈