During Kering’s Q3 FY2025 earnings call (22 October), Chief Operating Officer Jean-Marc Duplaix and Chief Financial Officer Armelle Poulou outlined the Group’s ongoing transformation under new CEO Luca de Meo, led by a landmark agreement with L’Oréal, intensified cost-efficiency drives and strategic store rationalisation.

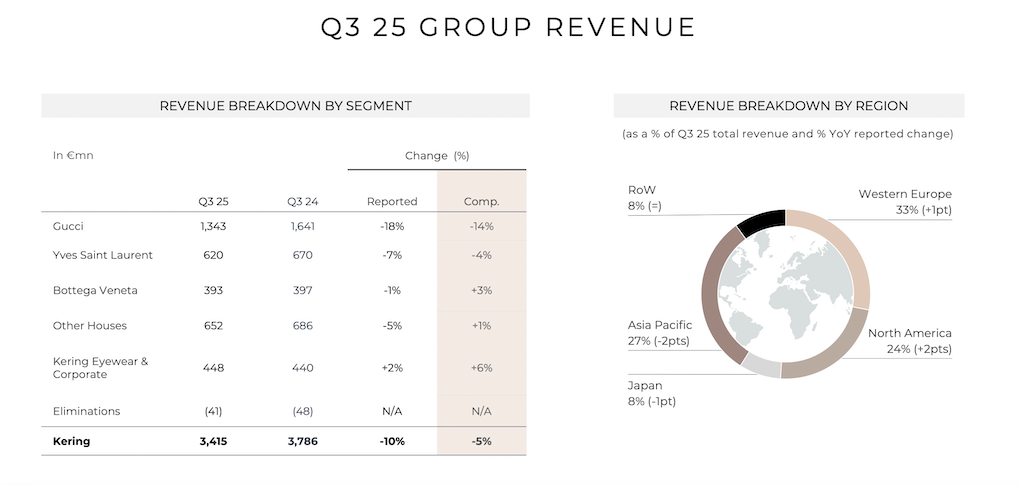

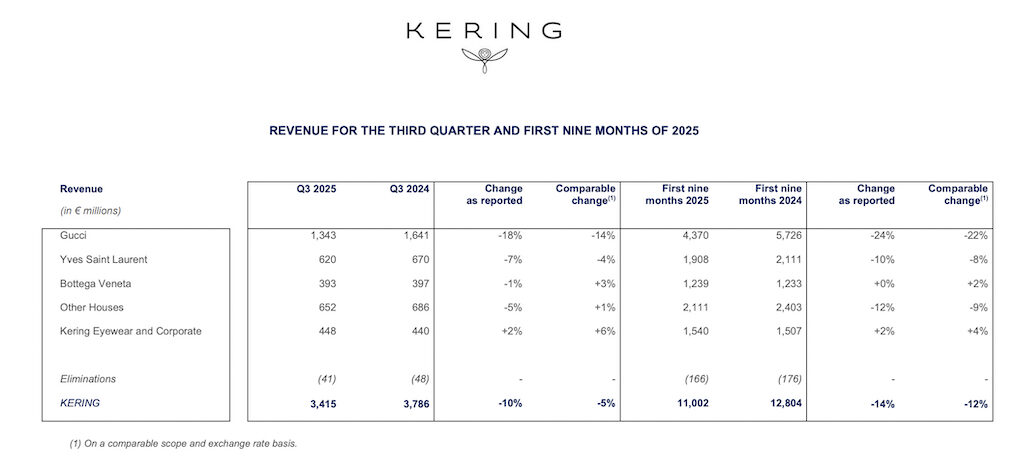

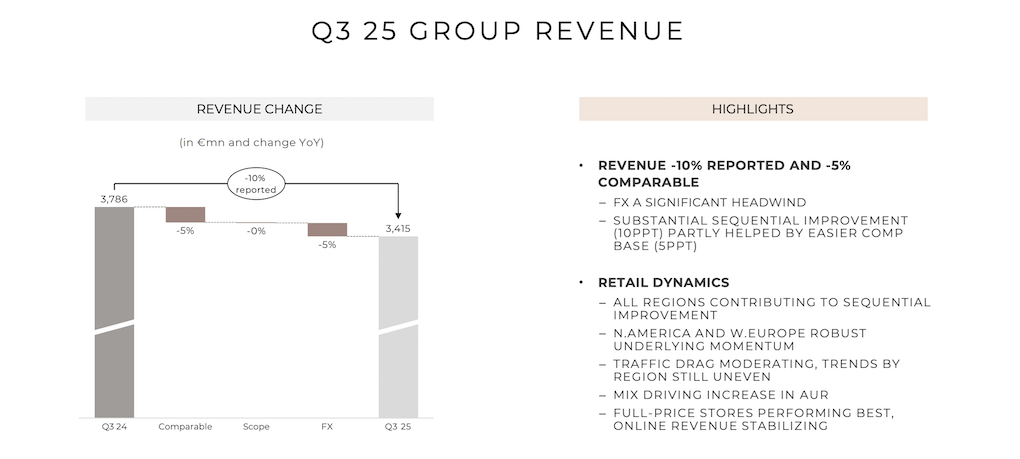

As reported, Kering recorded group revenue of €3.4 billion for the third quarter of 2025, a -10% decline as reported and -5% on a comparable basis. Revenues reflected a -5% negative currency effect. The result marks a sequential improvement from the -15% comparable decline posted in Q2

A blockbuster development in beauty

Kering’s biggest move of the quarter came with the announcement of its wide-ranging partnership with L’Oréal Group for the sale of Kering Beauté and an exclusive joint venture to explore business opportunities in wellness and longevity.

“The announcements we made on Sunday [19 October] to join forces with L’Oréal to boost the beauty potential of our houses represents a major step forward,” Duplaix said. “This alliance with a global industry leader, a firm with which we share values and have a long-standing working relationship, secures the growth of our brands into beauty at an attractive valuation.”

The transaction, valued at around €4 billion, includes the sale of The House of Creed and the transfer of beauty licences for Bottega Veneta and Balenciaga. Kering also has an option to grant the Gucci licence to L’Oréal upon expiration of its agreement with Coty.

“It’s a comprehensive deal through which L’Oréal and Kering are becoming long-term partners in beauty. This deal encompasses the sale of Kering Beauté as a company with all the subsidiaries and all the activities. It means the sale of Creed and the fact that we are granting the Bottega Veneta and Balenciaga licences to L’Oréal,” Duplaix commented.

“In terms of capital employed at group level in our balance sheet, the capital employed attached to the beauty business is below €4 billion. So, you take it the way you want. But at the end of the story, it will be a net gain before tax for the Group.

“The rationale behind the beauty transaction was not driven by the deleveraging ambition that we had,” he clarified. “It is a win-win deal in the sense that it fulfils both our strategic objectives. And of course, it does contribute massively to decrease the debt of the Group.”

Beyond the immediate financial impact, Kering sees this as a foundation for future growth. “Even if the beauty business is no longer internalised, what we hope is to increase the level of royalties, which is a solid contribution in terms of EBIT and to explore the full potential of our brands in that segment,” Duplaix said. “So, we’ll still benefit from this cycle of the beauty business.”

The transaction also sets the stage for a new frontier in wellness. “Our planned joint venture with L’Oréal in luxury longevity and wellness enables us to combine our strengths in an area that is sure to reach new milestones in coming years,” Duplaix noted.

“We are convinced in the potential of wellness and longevity. Today’s high-net-worth individuals and many top clients of our brands are reallocating wallet to experience, resort, travel, restaurant and also wellness and longevity, which has become clearly a topic for billionaires and high-net-worth individuals.”

He added: “We are at the early days of this joint venture. We want to provide a unique experience, mixing wellness and medical care to a certain extent, in a pleasant environment with a luxury experience. The market is very fragmented, and there is an opportunity to consolidate and become a major player.”

Amid speculation surrounding potential asset reviews following the L’Oréal transaction, Duplaix made clear that Kering Eyewear remains a core pillar of the Group’s luxury strategy and will not be subject to divestment.

“We’ll review the relevance of the assets we have in the portfolio. But I want to be clear that Kering Eyewear is core in the strategy of Kering and is doing extremely well. It is the leader on its segment. Its performance in Q3 was more than robust. So, we are very pleased with the investments we have in Kering Eyewear, which is instrumental in the development of the group,” he said.

A structural rethink under Luca de Meo

Duplaix said the quarter reflected not just financial progress but also deeper organisational change as the Group accelerates cost efficiency and operational discipline.

“The third quarter has been quite an interesting period, during which we started seeing positive signs of inflection,” he said. “Some were helped by easy comps; others clearly reflect early impacts of our actions. Numbers are one thing. Another is the acceleration of our initiatives to regain our footing, and more broadly set our strategic priorities for the coming years.”

He added: “Luca’s arrival has reenergised the organisation. He has met with dozens of managers across the Group and across regions. Our number one priority is to reignite the top line. From that standpoint, the progress we made this quarter is encouraging.”

Under de Meo’s leadership, Kering has sharpened its focus on efficiency. “We are accelerating and amplifying our cost and efficiency initiatives,” said Duplaix.

“We are further rightsizing the store network and focusing on durably improving sales density. We are enhancing the productivity of our marketing investments, and we are using every available lever to reduce our cost base. Solid progress has been made on all these fronts, and we are keeping the pace.”

He added a candid reflection on Kering’s mindset: “Our task is to implement structural solutions to the Group’s challenges and reduce our sensitivity to cycles. In this endeavour, there are no sacred cows.

“We are assessing every aspect of our houses, from brand positioning to client excellence, as well as the role the Group should play in areas such as supply chain, sell-through optimisation, or customer relationship management. Speed is of the essence, but we are also fully aware that some of these actions will take longer than others.”

Store rationalisation: fewer stores, stronger focus

A key component of Kering’s reset has been the rationalisation of its retail footprint with a focus on enhancing sales density in key locations.

“Regarding the store closures, we are progressing and have closed 14 stores in the quarter, 55 year-to-date. Half of it roughly is attributable to Gucci,” said Poulou. “What does this mean in terms of recouping the business? Of course, it varies from one store to another because it depends on the location and the store. Generally, we recoup between 30% and 80% of the business.”

Duplaix added: “We will continue to work on the network rationalisation. We want to concentrate on some key locations and not distract our brands with too many locations because this increases the structure and the costs associated. Among the weaknesses we have acknowledged in the past few years was probably that we went a little bit too far in terms of expansion of the network.”

He stressed the strategy was not simply about cost cutting: “We don’t streamline the network just for the sake of making some savings on the rental cost. The idea is to be sure that we have the right set-up brand by brand.

“I think there was a wave of retailisation in the past few years, which was made across the board for all the brands. However not all brands were at the right situation to be 80% or 90% retailised.

“The idea is just to be sure that we have the right set-up, we don’t multiply points-of-sale and that we keep the most efficient ones where we are able to increase the sales density. The problem of the Group is not so much about the rental cost – there will be opportunities to reduce that for sure – but it’s more about the sales density.”

“The ambition is, first of all, to maximise the efficiency of the network to reignite the top line,” he said. “Without providing any figures, you can assume that in the two coming years, we’ll continue to rationalise quite drastically the network.”

Mainland China: slow but steady recovery

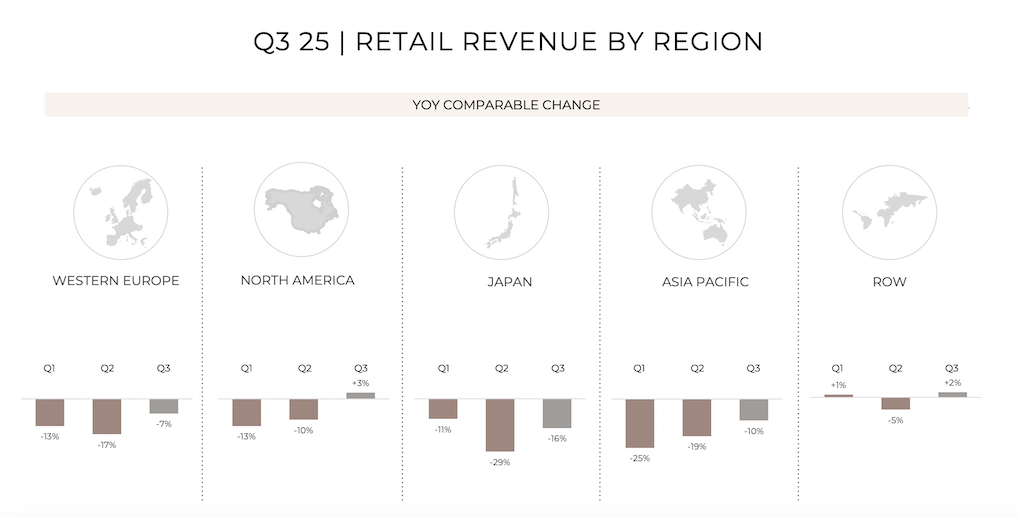

Turning to regional dynamics, Poulou pointed to cautious optimism in the recovering Chinese market. “Consumer spending in Mainland China is still not back, but we are seeing some sequential improvement,” she said. “We are working on the product offer, the retail network, and things are progressing. Things are going in the right direction.

“The Chinese cluster improved slightly sequentially for all brands,” she added. “The improvement is driven both by the domestic market and by the tourist, with slight improvement on the tourists, but still double-digit negative trend in all regions, especially in Japan due to the higher comp base and also the less attractive price.

“Regarding Golden Week, consumer spending is not very supportive in Mainland China. And overall, this year’s Golden Week is not changing the picture, even if some brands are posting better results than last year.”

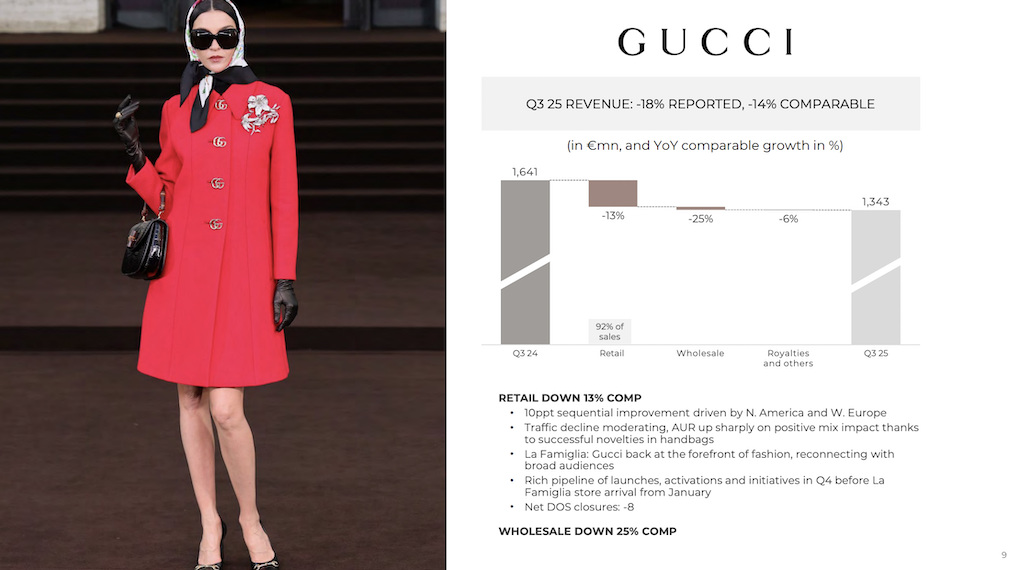

Gucci’s new creative chapter under Demna Gvasalia

Kering also highlighted early encouraging reactions to Gucci’s creative transition under Demna Gvasalia, whose debut collection marked a new creative era for the brand.

Poulou said: “Demna’s La Famiglia collection was presented in ten stores all over the world in every region. We had a very good response in the USA, Europe and Japan, especially with local Japan customer.

“We had already a pretty good response in China. I think, very positive to see that the looks that Demna presented. It showed how diverse and rich the Gucci brand can be and very true to the DNA of the brand.” ✈