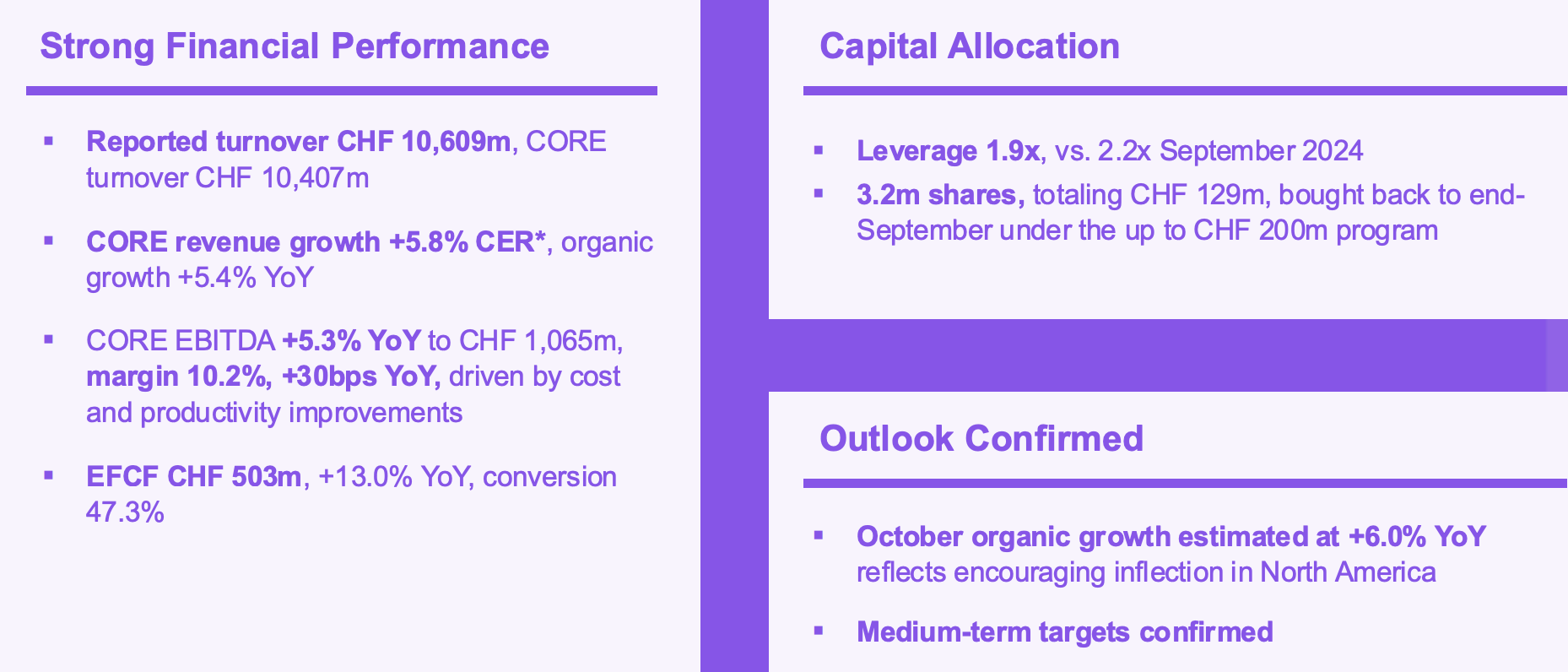

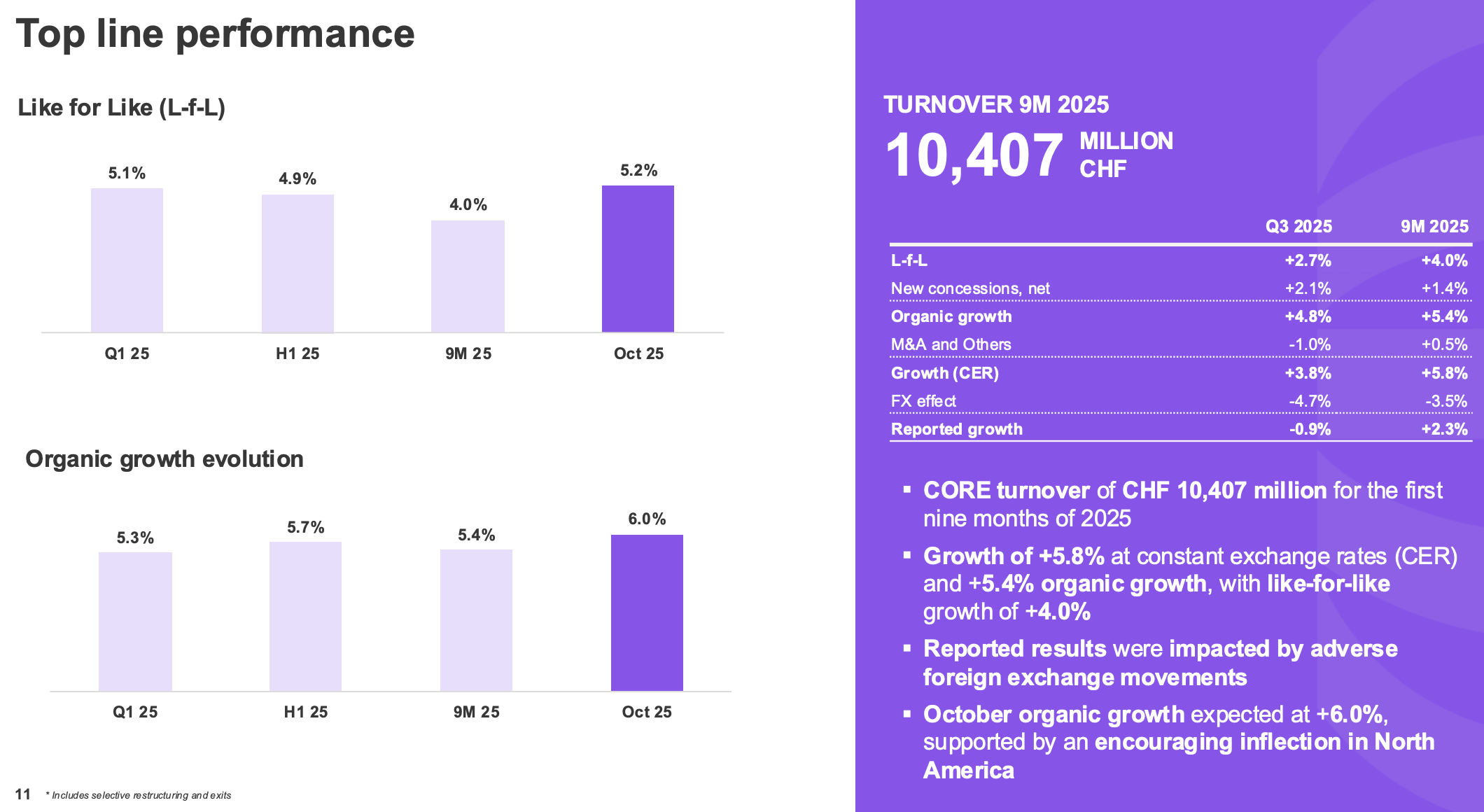

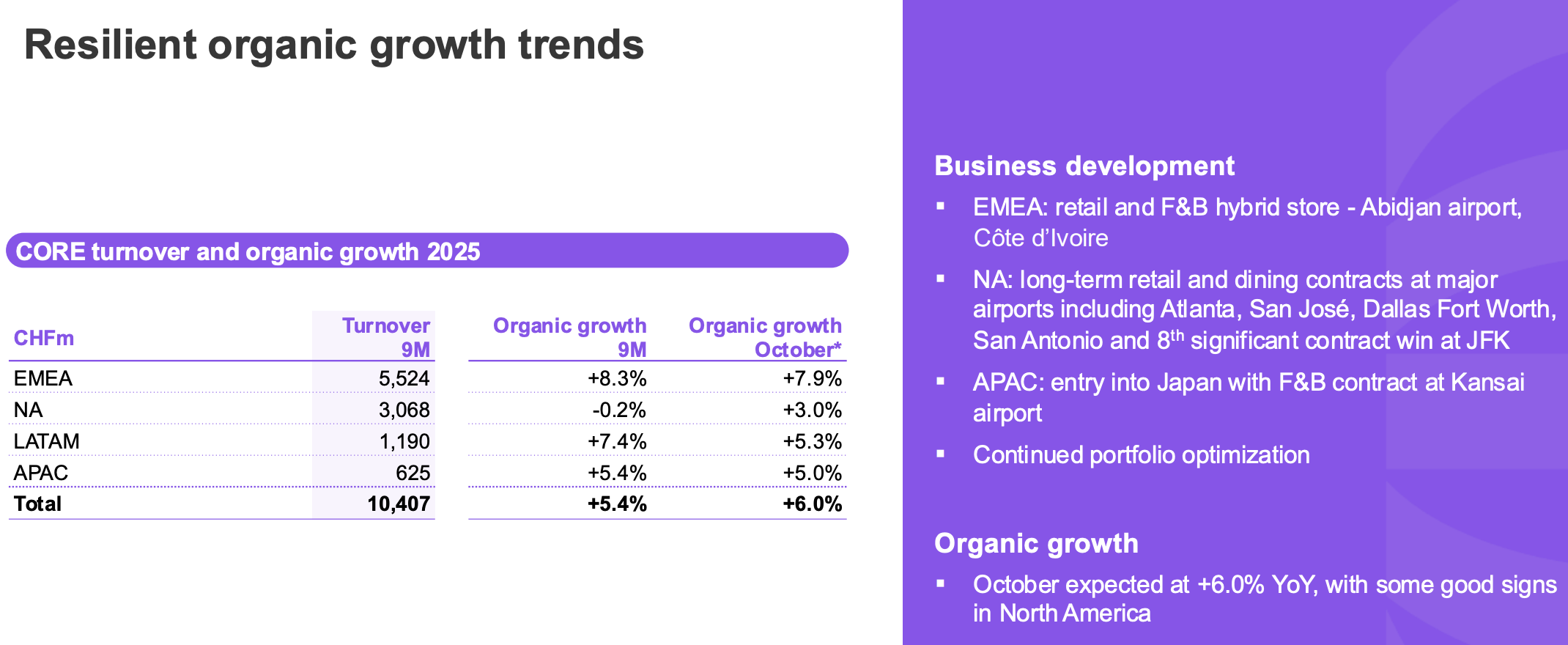

INTERNATIONAL. Global travel experience player Avolta today (30 October) issued a nine-month trading update, with core turnover rising +5.8% year-on-year at constant exchange rates, and +5.4% in organic terms to CHF10,407 million (US$13,026 million).

Reported turnover in the period hit CHF10,609 million (US$13,280 million); core turnover noted above excludes fuel sales from the motorway business.

In October, the company said it expects to generate organic growth of +6.0% year-on-year, highlighting some positive trading signs in North America.

Core EBITDA in the nine months reached CHF1,065 million (US$1,333 million) with an EBITDA margin of 10.2%, +30 basis points year-on-year. For Q3, the EBITDA margin was 11.9%, up +37 basis points year-on-year, despite continued slower sales growth in North America but with cost and productivity improvements making an impact.

Equity Free Cash Flow (EFCF) amounted to a record CHF503 million (US$629 million) in the nine months, up +13% year-on-year. In Q3 this figure hit CHF287 million (US$359 million), +23.7% over last year and “comfortably ahead of expectations”, said Avolta.

CEO Xavier Rossinyol said: “Nine-month revenues are in line with expectations. As a seasonal business, our Q3 revenues were affected by a strong basis of comparison, specifically in Europe and Argentina. As we entered Q4 we saw an acceleration of organic growth to +6.0% year-on-year in October, and positive growth in North America.

“Furthermore, the increase in the EBITDA margin (+30bps to 10.2%) reflects an active approach to cost and productivity, while the record EFCF performance and continued deleveraging demonstrates our financial discipline and highlights our ability to achieve our targets despite ongoing global volatility.

“Overall, this underscores the power of our agile business model and our deep customer connections. We continue our commitment to our capital allocation policy, growing the business, deleveraging, and delivering strong returns to shareholders.” {Main story continues below the following subscription message}.

In its trading statement, Avolta highlighted its continued recent geographical diversification, highlighting entry to Japan through a new F&B concession at Kansai International Airport, which it singled out as “a key milestone in Asia Pacific growth”.

In North America, Avolta secured long-term retail and dining contracts at key airports, including Atlanta, San José, Dallas Fort Worth and San Antonio. As announced yesterday (29 October), Avolta has secured an 11-year duty-free contract at JFK International Airport Terminal 8, marking the eighth big contract gain at the airport over the past year.

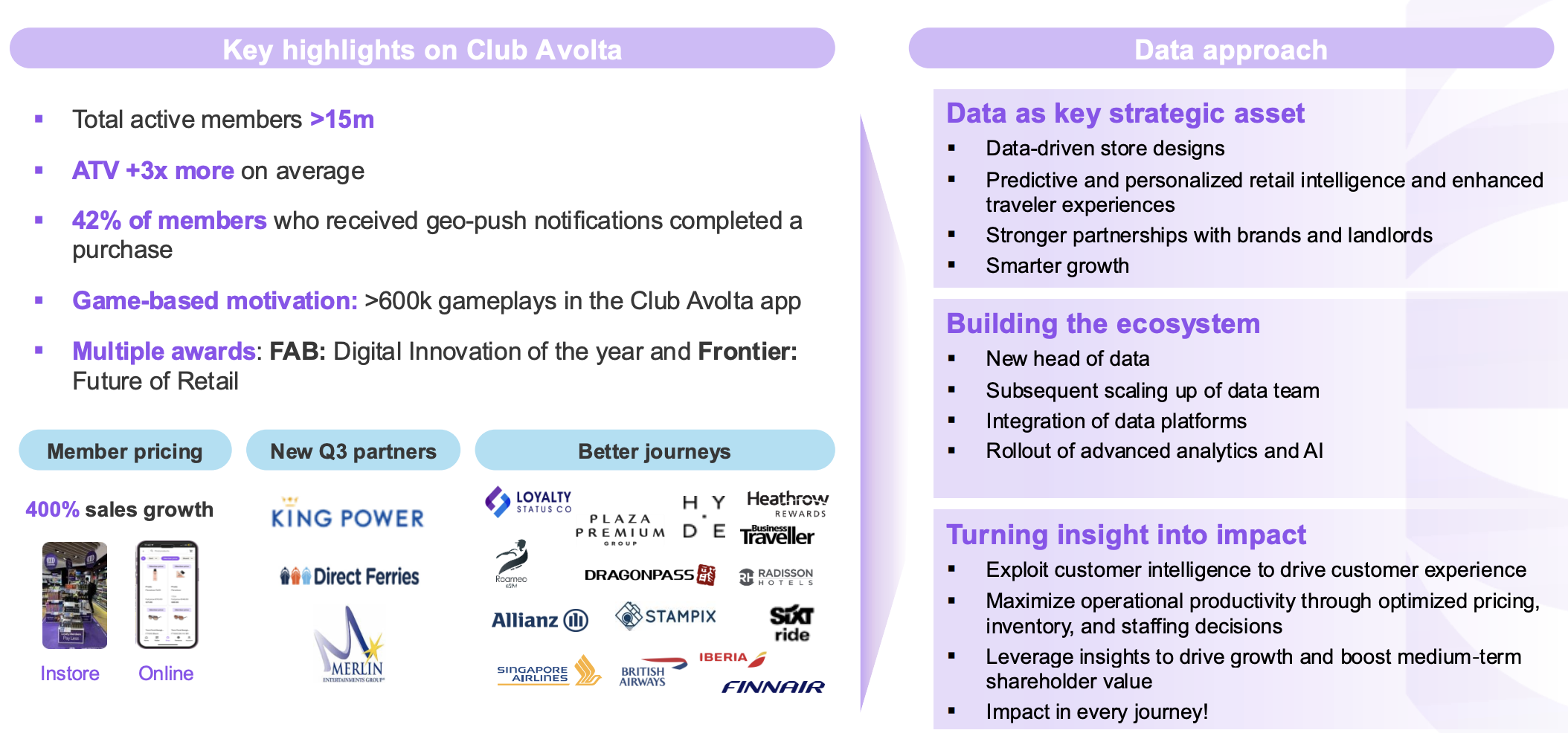

In Q3, the company marked one year of its global loyalty programme Club Avolta, which now counts more than 15 million members. Over time the increased access to member data is expected to boost Avolta’s financial performance, noted the company.

The company noted that the improved financial performance year-on-year came “despite significant FX headwinds affecting reported results”.

The group’s financial net debt decreased to CHF2,445 million (US$3,058 million) by end of September, implying a leverage (net debt/CORE EBITDA) of 1.9x, despite the purchase of shares totalling CHF129 million (US$161.4 million) under its 2025 share buyback programme during the nine months. In October, Avolta extended the maturity of its revolving credit facility (RCF) by one year to 2030.

Avolta confirmed its organic growth target of 5%-7% per year and its commitment to delivering +20-40bps of core EBITDA margin improvement and +100-150bps EFCF conversion per year. At current exchange rates, 2025 currency translation is expected to be -3%.

Avolta also saluted recent industry recognition, including at the Frontier Awards, where it received multiple honours, including The Future of Retail, Best Speciality Concept, People & Planet, Influential Woman in Travel Retail and Team of the Year awards. ✈