Rémy Cointreau CEO Franck Marilly today (27 November) announced a plan to “rethink, reset and reignite” the business amid a tough trading period, as the French drinks company reported first-half financial results to 30 September.

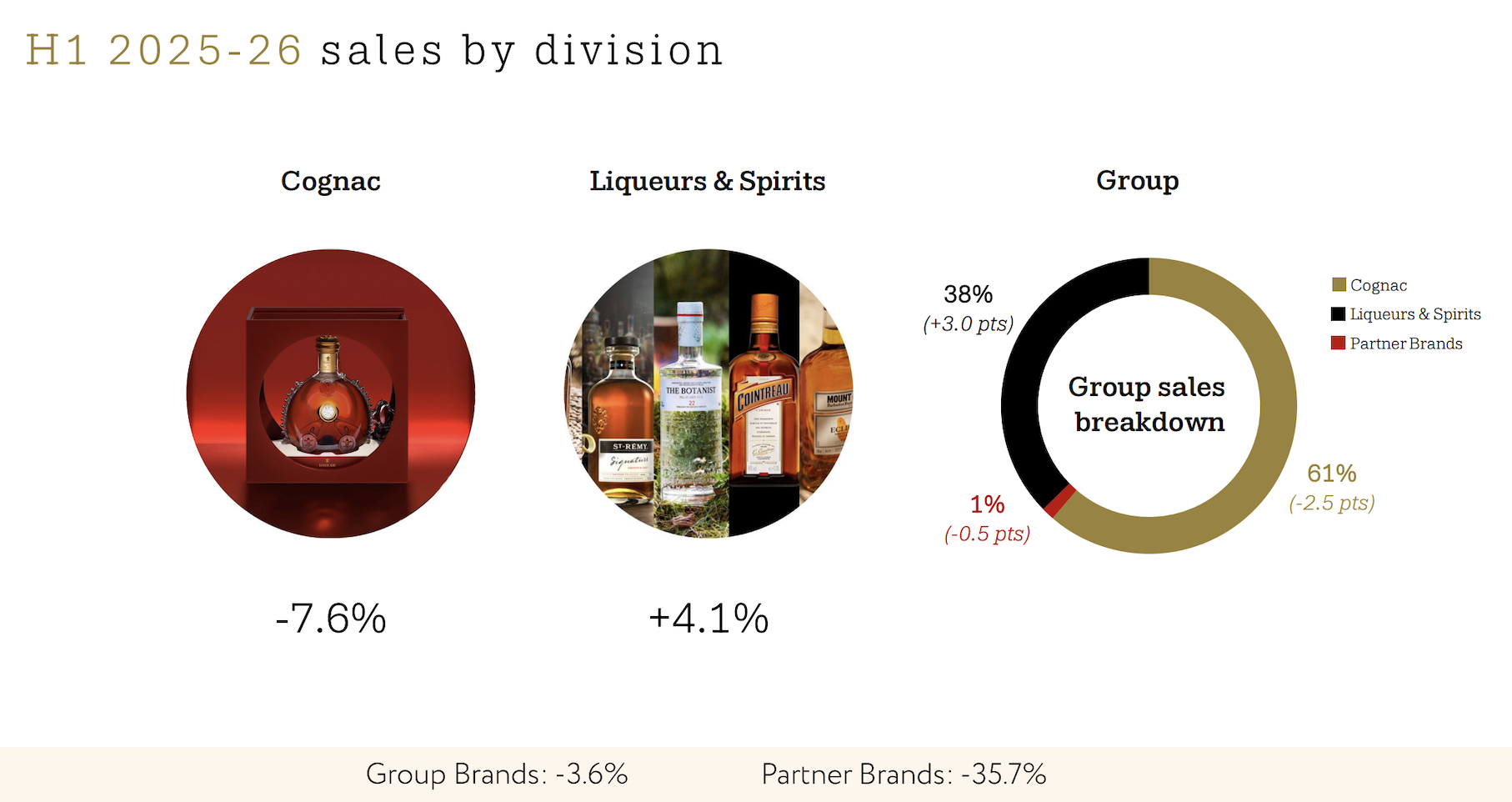

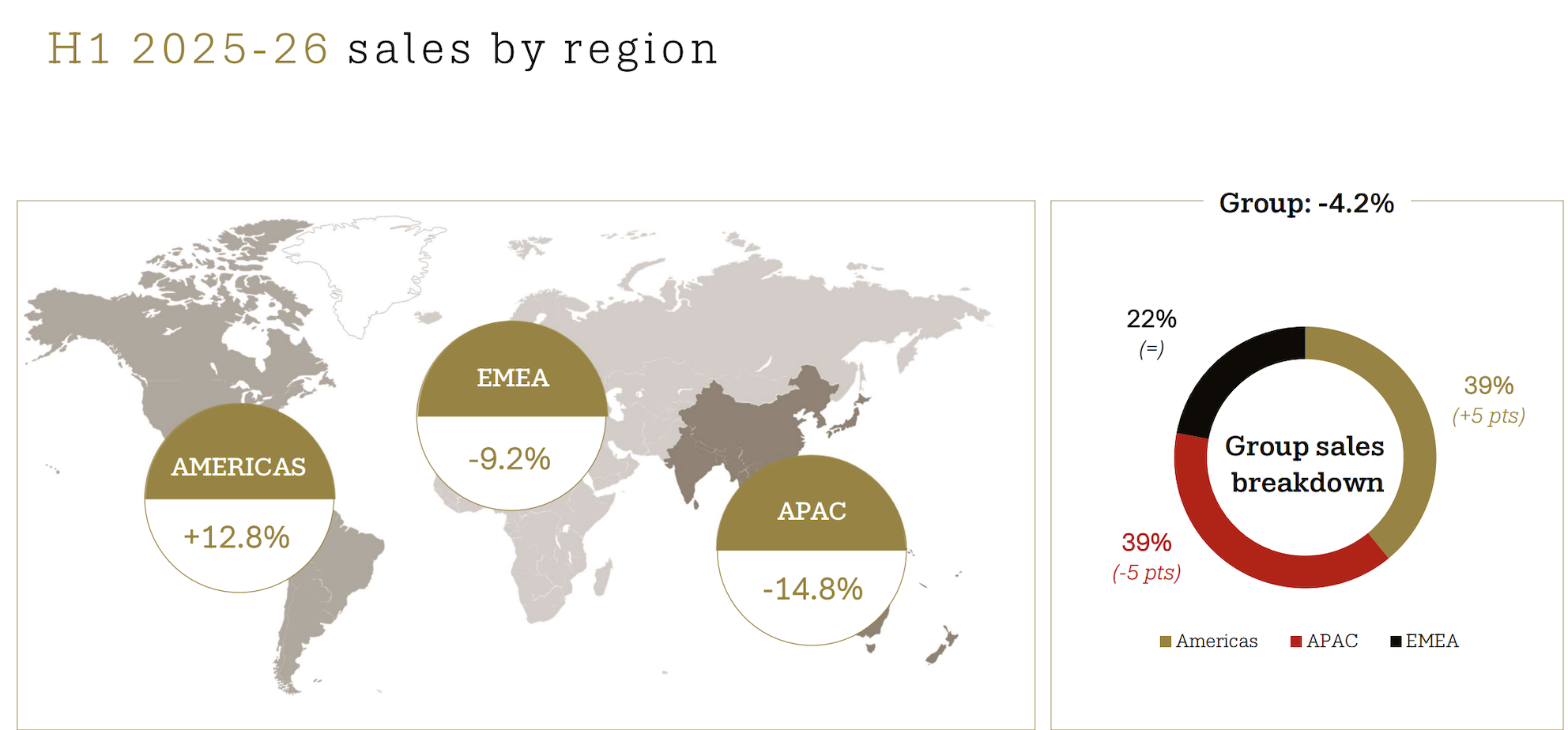

Total group sales reached €489.6 million, down -8.3% year-on-year on a reported basis and -4.2% in organic terms. Current operating profit in the half was €108.7 million, down -26.2% on a reported basis and -13.6% in organic terms. Group share of net profit fell -31.3% (-16.2% organic) to €63.1 million, with net margin at 12.9%, down -4.3 points.

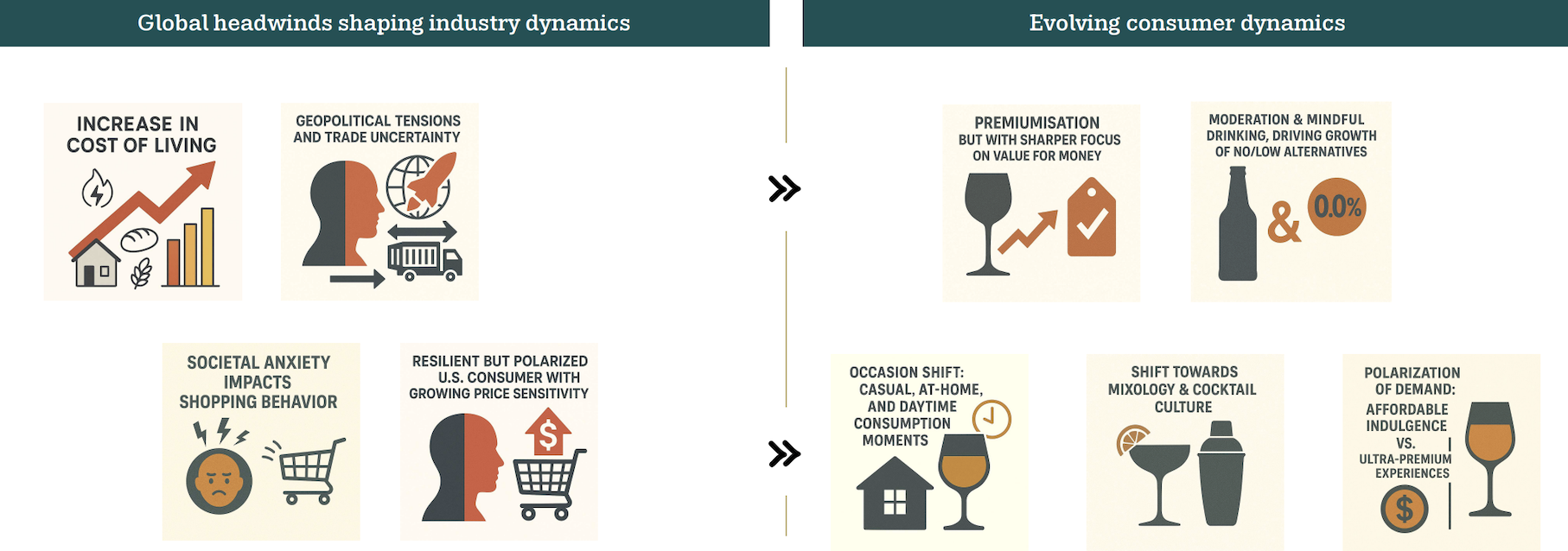

Marilly said: “The first half of the year was challenging but it also marks the start of a new era for Rémy Cointreau. Since my arrival in June, I have taken the time to conduct a diagnostic. Despite a tough environment we remain confident in our ability to grow in the second half. It is time to challenge how we think and operate.

“I identified five levers to regain agility and drive performance: adapting our organisation, rebalancing our commercial resources, redefining how our brands express their DNA, sharpening our value-driven strategy, and re-evaluating our investment model to focus resources on our top priorities.”

The company noted a sharp negative impact on Cognac sales from “a tough market environment in China, compounded by the inaccessibility of Chinese duty free” in the first half.

In the key Cognac division, organic sales fell -7.6% year-on-year in the half (-12.1% on a reported basis), with Asia Pacific and in particular China market weakness a core factor.

What the company recently called “lingering disruptions in travel retail” relates largely to the suspension of Cognac imports to the China duty-free market since December 2024, resolved since July 2025, with shipments now resuming.

As reported, travel retail sales overall fell -1.5 points year-on-year in Q2 and -3 points in H1. In China alone travel retail dipped -0.7 basis points in Q2 and -1.4% in H1. Rémy Cointreau noted that travel retail was now “on a path to normalisation”.

In an investors’ call today, Marilly said: “China was increasingly challenged in the half with the environment softening over the period, and with sales down mid-teens in the half. Inventory levels remain healthy with solid fundamentals in place ahead of Chinese New Year.

“Consumers in China are increasingly selective and value-driven… but we see early green shoots for the mid-term.”

As reported previously, Rémy Cointreau has downgraded its outlook for the full financial year, based on the weak performance of the China market and a slower than expected rebound in the USA.

The company said it expects organic sales growth to range between stable and low single-digits, having previously been anticipated to grow by mid single-digits. Current operating profit is now forecast to decline (in organic terms) by low single-digits to mid-teens (versus a mid single-digit decline previously).

Marilly said that top-line growth and generating cash are big priority areas, as is diversifying the business. Citing global travel retail, he said: “GTR offers a wealth of opportunities. 80% of our GTR business is done in airports but we can go further into other channels such as cruise.”

On the way ahead for Rémy Cointreau, Marilly said a mid-term roadmap would be devised over the coming year, including a more agile organisation that operates with “more alignment and fewer silos”.

Asked about possible disposals, Marilly said there are “no taboos on the portfolio. We need to strengthen our core, not be dilutive on our spending and set priorities for our brands. We have taken no decisions but are looking into it.”

Chair Marie-Amélie de Leusse told investors: “Momentum is occurring across categories but we are far from where we need to be. That’s why under our new CEO we are at a turning point, anchored around revitalising Cognac, and accelerating the expansion of Liqueurs & Spirits.” ✈