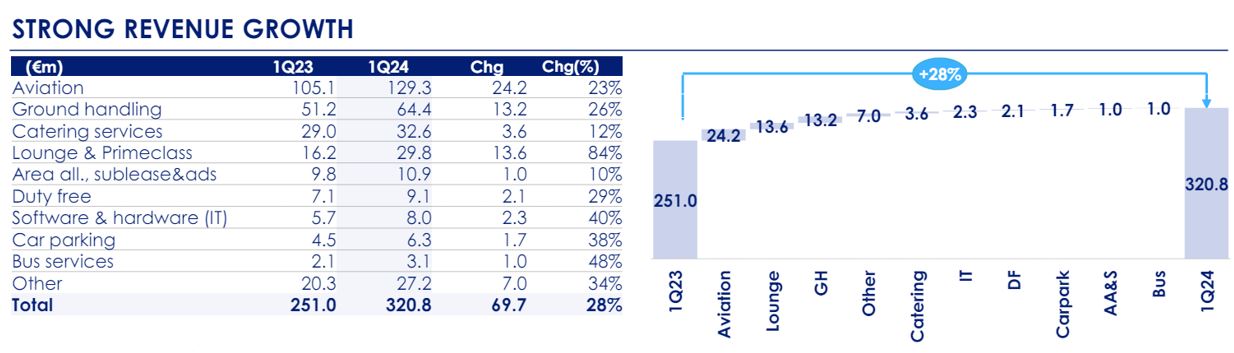

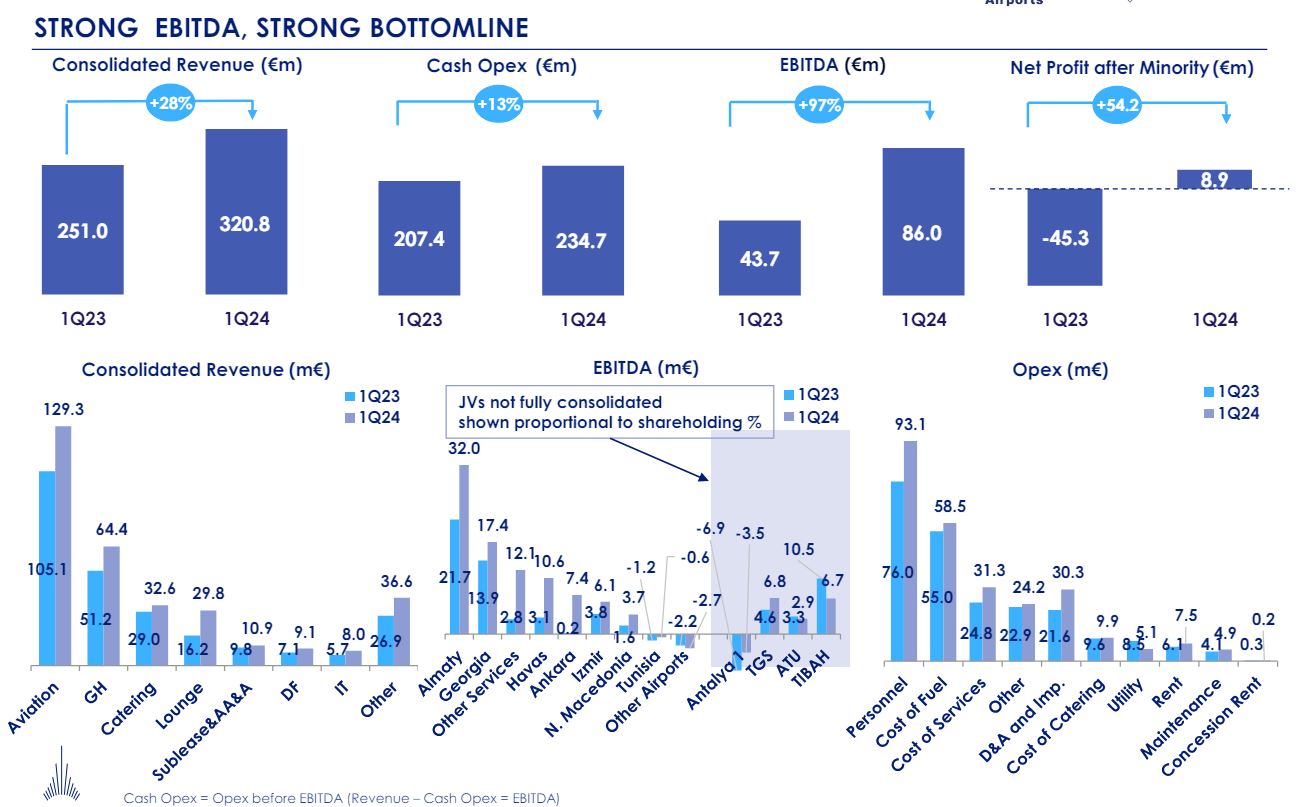

TÜRKIYE. Duty-free retail and food & beverage sales grew strongly as TAV Airports Holding’s (TAV) Q1 revenues climbed +28% year-on-year to €321 million. EBITDA surged by +97% to €86 million. Despite the low season, net profit turned to positive, reaching €9 million.

A strong recovery in passenger traffic contributed to year-on-year growth for most retail revenue sources. Duty-free sales rose +29% to €9.1 million while food & beverage revenue increased +12% to €32.6 million. Duty-free spend per pax, however, dipped slightly by -1% to €8.5 million in Q1.

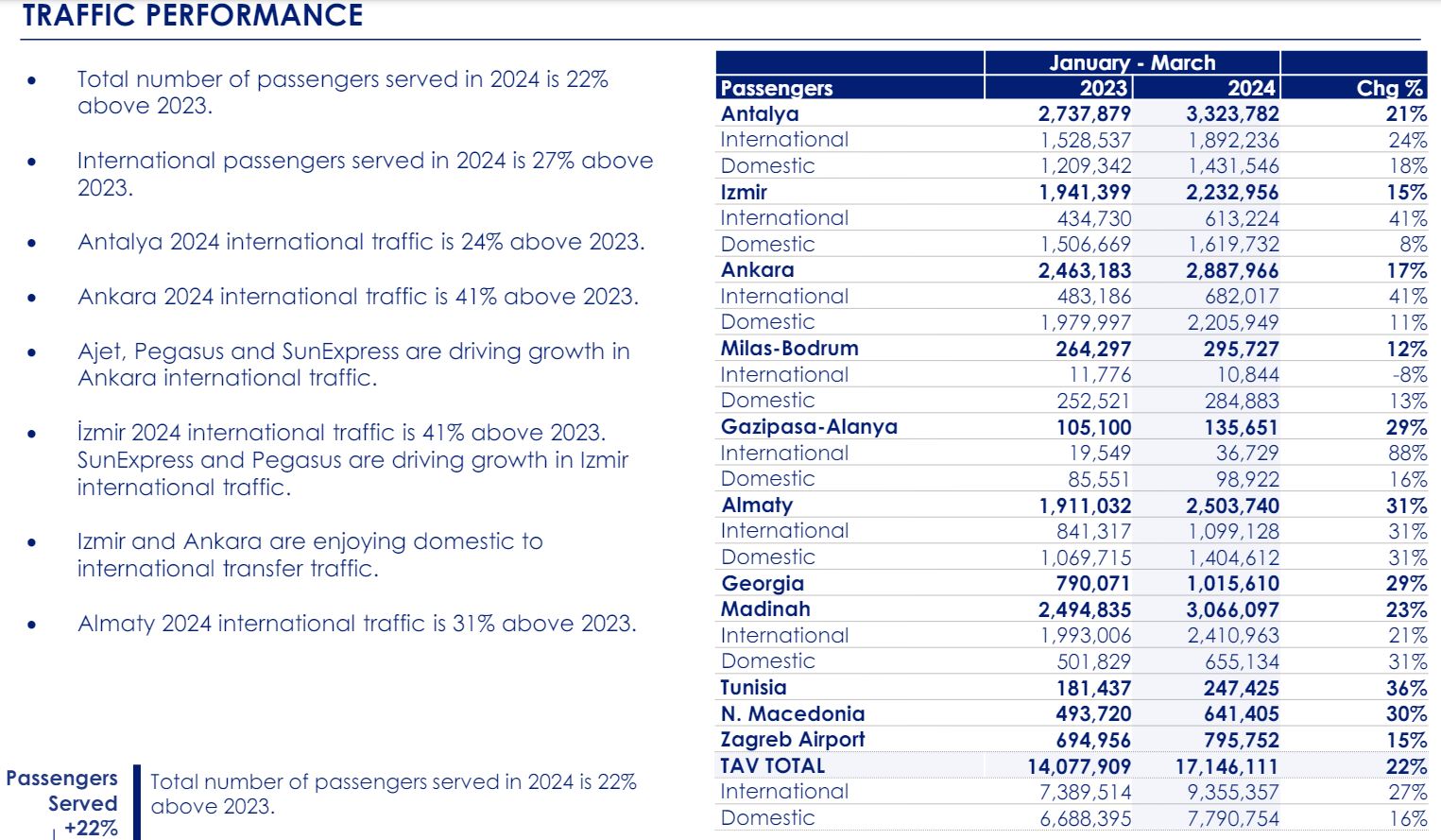

The main growth driver was a continued recovery in passenger volume across TAV airports, which jumped by +22% year-on-year to 17 million. Antalya was the best-performing airport during the period, with international traffic reaching 3.3 million up by +21% from the previous year.

TAV Airports CEO Serkan Kaptan said: “Aided by a longer tourism season and the fleet growth strategies of airlines, we had a very strong first quarter in terms of passenger traffic. Our international passengers grew +27% year over year and total passengers grew +22%. Both Izmir and Ankara are enjoying a focus on domestic to international transfer passengers by Ajet, Pegasus and SunExpress.

“The strength in our operations was fully reflected in our financial results. Revenue grew +28% and reached €321 million. EBITDA grew +97% and reached €86 million and net income turned to positive despite being in low season and came in at €9 million. Thus, we made a great start to the year and early booking data is also indicative of a robust summer season.”

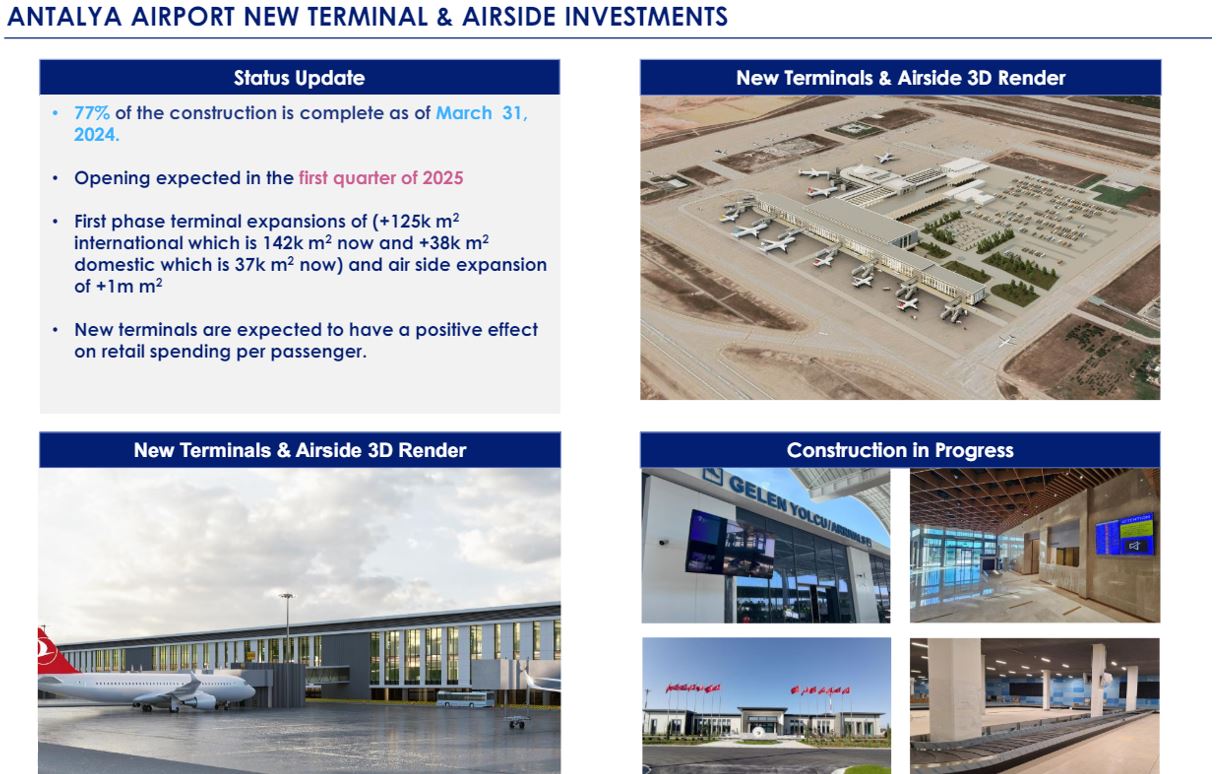

The company said new terminals are expected to have a positive effect on retail spending per passenger.

Its major investment programme is well underway, including projects in Antalya, Almaty and Ankara, in addition to other airports and service businesses.

Kaptan added: “Our Almaty investment is 94% complete and we plan to open the new terminal in June 2024. With the opening of the new terminal, we will see a dramatical increase in service quality and passenger experience in Almaty Airport.

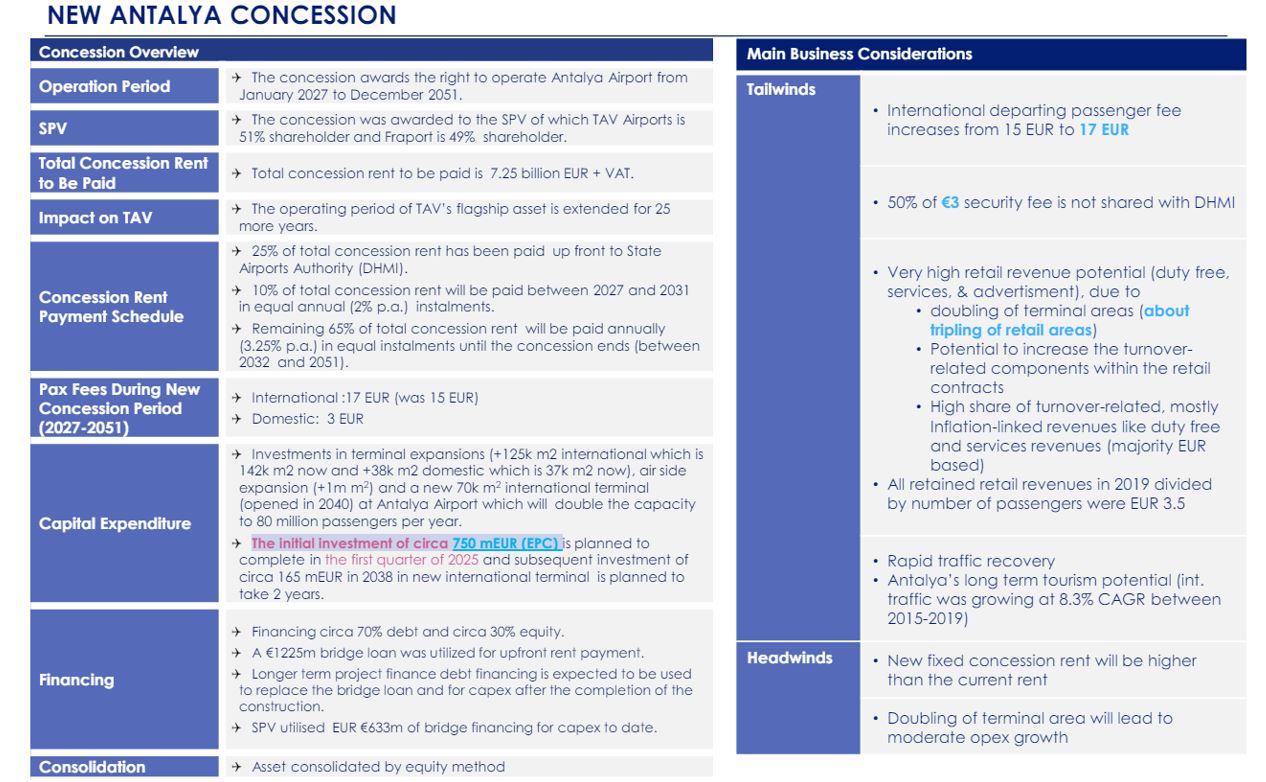

“Our Antalya investment is 77% complete and we expect opening in the first quarter of 2025. Ankara is 42% complete and we expect to finalise in the last quarter of 2025. We will also participate in additional investments into Madinah Airport that will increase its capacity from 8 million passengers per year to 18 million passengers per year in two phases.

“As a result of our investment programme, our average concession duration, which was eight years in 2020, increased to 29 years in 2024.

“Including the acquisition price and upfront rents paid for Almaty, Antalya and Ankara and other investments we have made elsewhere in our assets, we will have invested around a massive sum of €2.5 billion by 2025. The size of our investment shows our commitment to and belief in the future of aviation.”

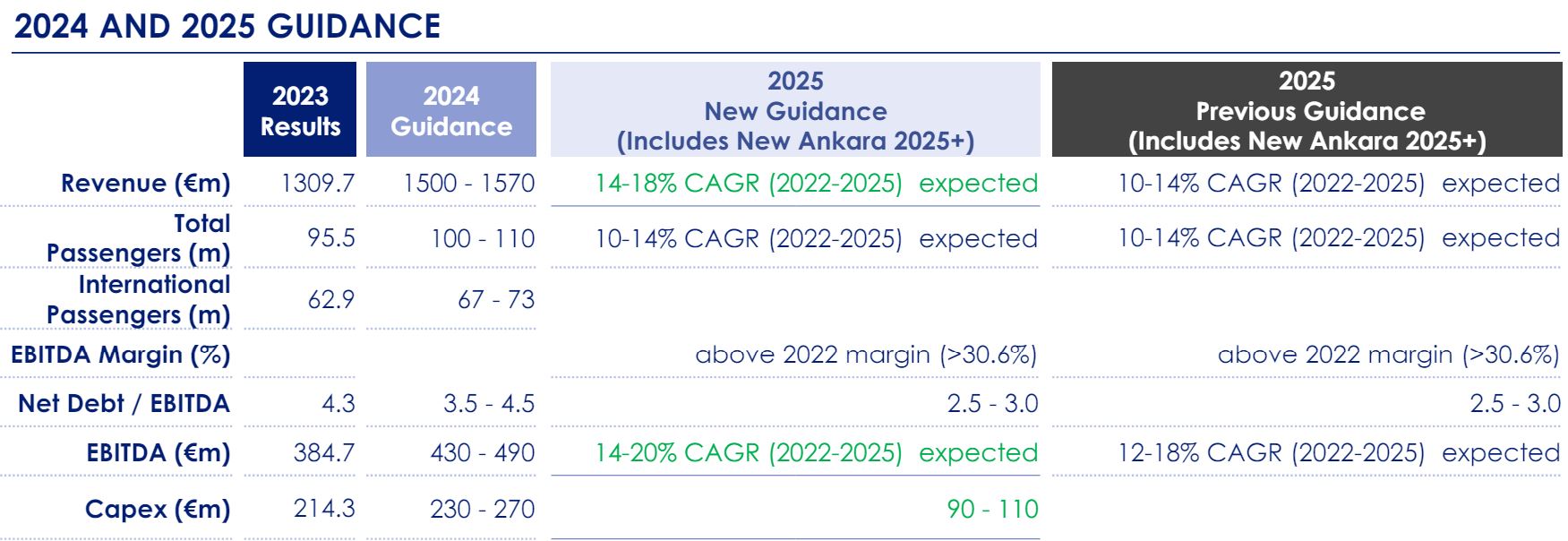

Looking ahead, Kaptan said: “As we approach the end of our programme we have started to reap the benefits of our investments. For 2024, we continue to expect an EBITDA between €430 million to €490 million. Within this context of increasing returns from our investments, our first mid-term goal is to go above the all-time high EBITDA we had recorded in 2018 which was €573 million. This goal is well within reach now.” ✈