L’Oréal CEO Nicolas Hieronimus has spelled out the impact of a rapidly declining downtown duty-free market (particularly in North Asia) that he says is reshaping the travel retail channel.

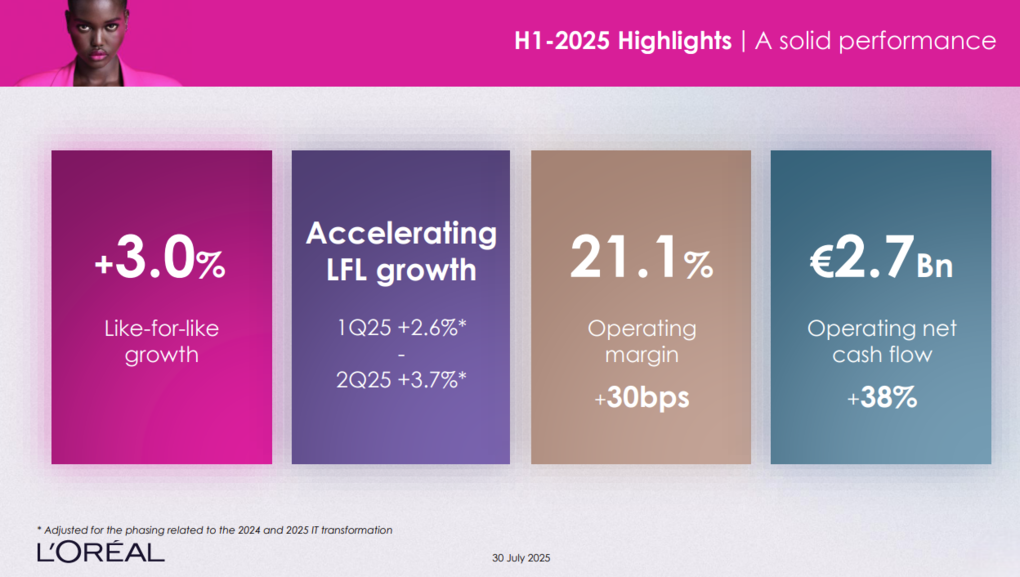

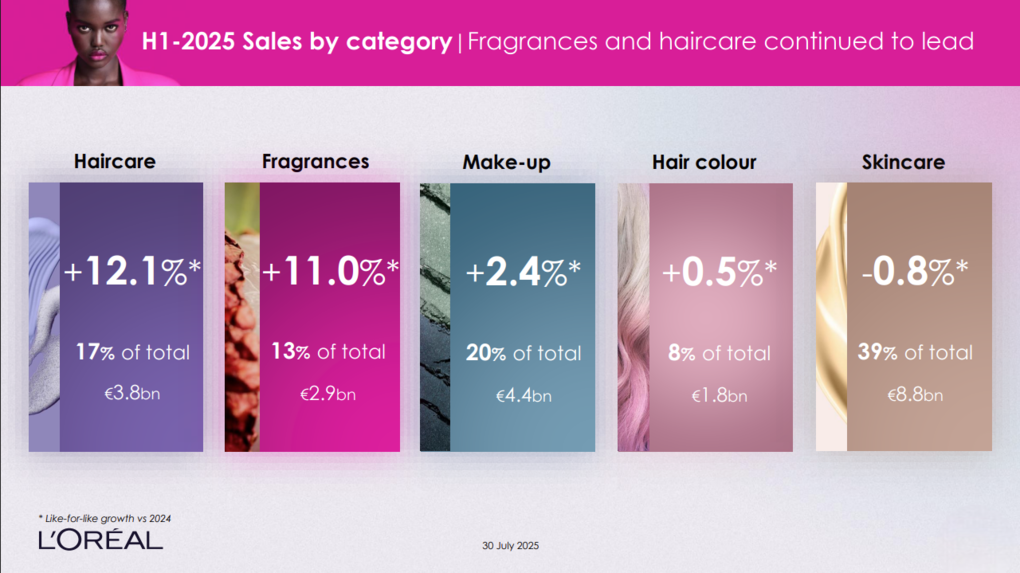

As reported yesterday (30 July), the French beauty products leader posted a +1.6% rise (reported; +3.0% like-for-like) in H1 revenues to €22,473.3 million. Q2 saw a -1.3% decline (reported; +2.4% like-for-like) to €10,738.6. Net profit excluding non-recurring items rose +1.0% to €3,783.0 million.

The downtown duty-free woes were felt most in the key North Asia region, which declined -1.1% year-on-year, held back by travel retail. Excluding the channel, growth turned positive in the first half, driven by a recovering Mainland China domestic market.

Asked on a H1 earnings call about the extent of travel retail’s struggles, Hieronimus said: “The [global travel retail] market is high-teens negative and we are low-teens negative. So we are gaining share. It’s really a tale of two cities because you see on the one hand the traffic is increasing; the airports are really growing.

“The market in airports is overall very positive, like +8 or something like that. And it’s very negative in what used to be called the downtown stores, which had been opened by many players back in the days when there was less travelling and also were fuelled with the daigou business.

“You’ve seen in Korea, many of these downtown stores in Seoul are closing. You see the example of France, where Samaritaine has been transferred [from DFS Group] under the leadership of Le Bon Marché because as the Chinese tourists do not travel so much in groups, it was less relevant.

“And we see that Hainan – despite being pretty heavy in traffic – remained very negative, minus 25-ish in terms of sell-out. So we have a reconfiguration of travel retail back to what it was and should have remained, which is individual travellers, a business opportunity and a brand exposure opportunity. And clearly… as we said, had it not been for travel retail, our North Asia business would have been positive for this first half.” ✈

Downtown and downwardL’Oréal CEO Nicolas Hieronimus’s bleak perspective on the downtown duty-free sector is strongly validated by events in the channel over recent years. The long-time cornerstone of North Asian travel retail (most notably in South Korea, Macau and Hong Kong), downtown duty-free has been devastated by a series of structural changes in recent years that has resulted in multiple store closures. In 2019, just before the COVID-19 pandemic, Seoul lay dubious (and ultimately untenable) claim to having 13 downtown duty-free shops, while the Republic as a whole had 22. By mid-2024 those numbers were down to eight and 16, respectively, and the attrition (see below) has continued. Closures in North Asia and elsewhere over recent years include: 2016 WalkerHill Duty Free (SK Networks), Seoul, South Korea, May 2019 Hanwha Galleria Duty Free, Seoul, South Korea, September 2020 Doota Duty Free (Doosan Corp), Seoul, South Korea, April SM Duty Free – Seoul, South Korea, September Entas (Kyung Bok Kung) Paradise Complex, Yeongjong Island, Incheon, South Korea, November 2021 Shinsegae Duty Free, Gangnam, Seoul, South Korea, July 2022 Lotte Duty Free COEX, Seoul, South Korea, September 2024 Lotte Duty Free, Melbourne, Australia, May La Samaritaine, Paris, France – divested by DFS to majority parent company LVMH  2025 Shinsegae Duty Free, Busan, South Korea, 24 January DFS Saipan downtown and airport stores, 30 April DFS Group T Fondaco dei Tedeschi, Venice, Italy, 30 April Lotte Duty Free, Da Nang, Vietnam, May DFS Macau M8, May Hyundai Duty Free Dongdaemun, Seoul, South Korea store – closing today, 31 July DFS Hong Kong, Tsim Sha Tsui East (Chinachem) store – 31 August DFS downtown stores in Sydney, Auckland and Queenstown, marking the retailer’s exit from Oceania – 10 September (Sydney) and 30 September (New Zealand). King Power downtown duty-free shops in Thailand – Srivaree and Mahanakhon in Bangkok and Pattaya – closing on a phased basis from September. Source: ©Moodie Davitt Research Also read: Guest editorial – The past, present and future of the South Korean duty-free industry |

TALKING POINTS

EMERGING MARKETS ON THE RISE

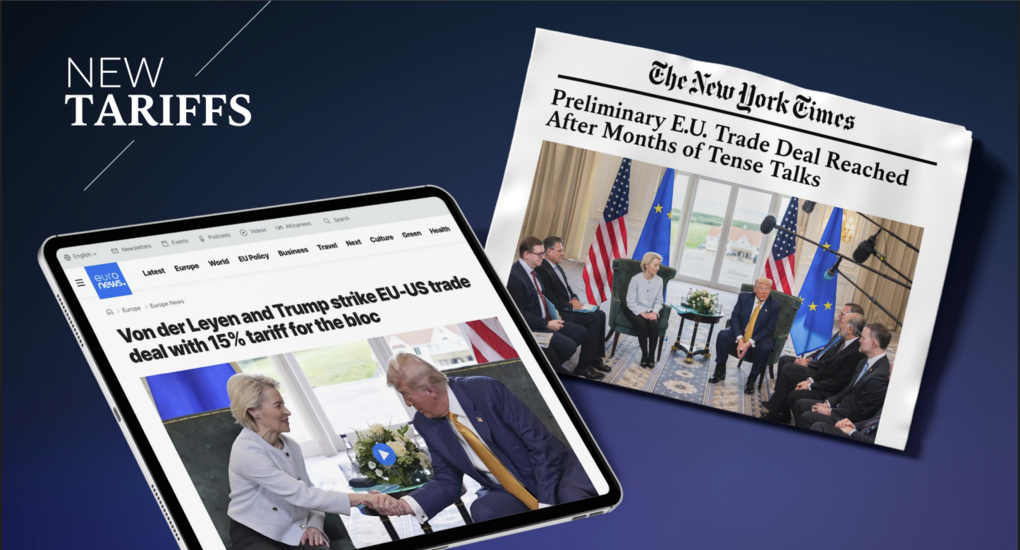

MITIGATING TARIFFS

PROMISING INNOVATION PIPELINE

SECOND-HALF OPTIMISM