INTERNATIONAL. Challenging market conditions are severely hitting airport non-aeronautical revenues as the travel industry emerges from the COVID-19 crisis.

This was a key takeaway from new data shared exclusively by Airports International Council (ACI) World at last week’s Trinity Forum in Ho Chi Minh City, Vietnam (5-6 November).

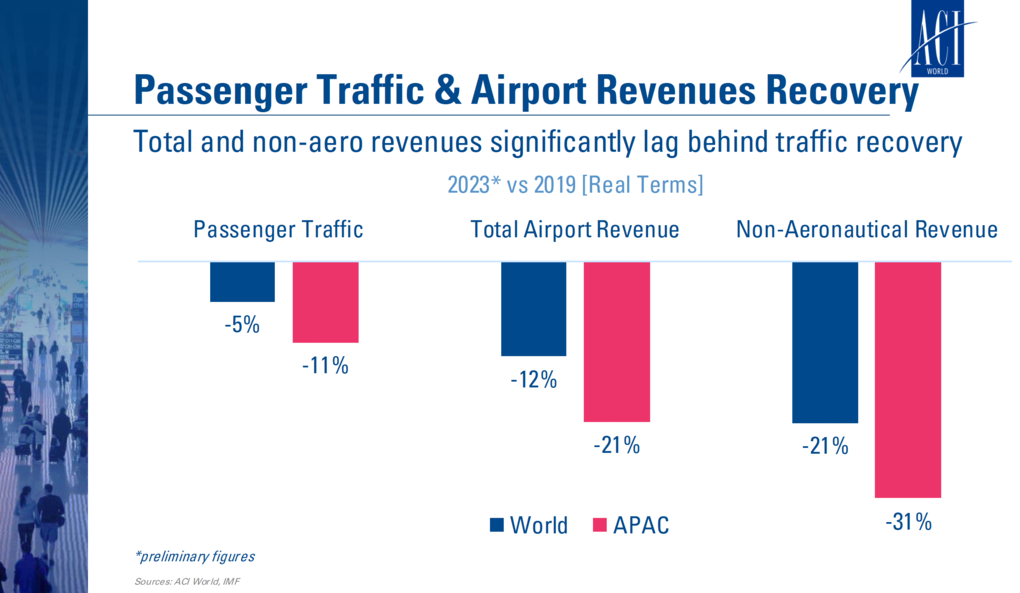

According to ACI World’s preliminary figures, garnered from more than 1,000 global airports accounting for 82.7% of passenger traffic in 2019, non-aeronautical revenues in 2023 lagged -21% behind the pre-COVID number, despite a passenger shortfall of just -5%.

The issue was even more pronounced in Asia Pacific, where non-aeronautical revenues trailed the 2019 number in 2023 by an alarming -31%, despite passenger numbers being just -11% in arrears.

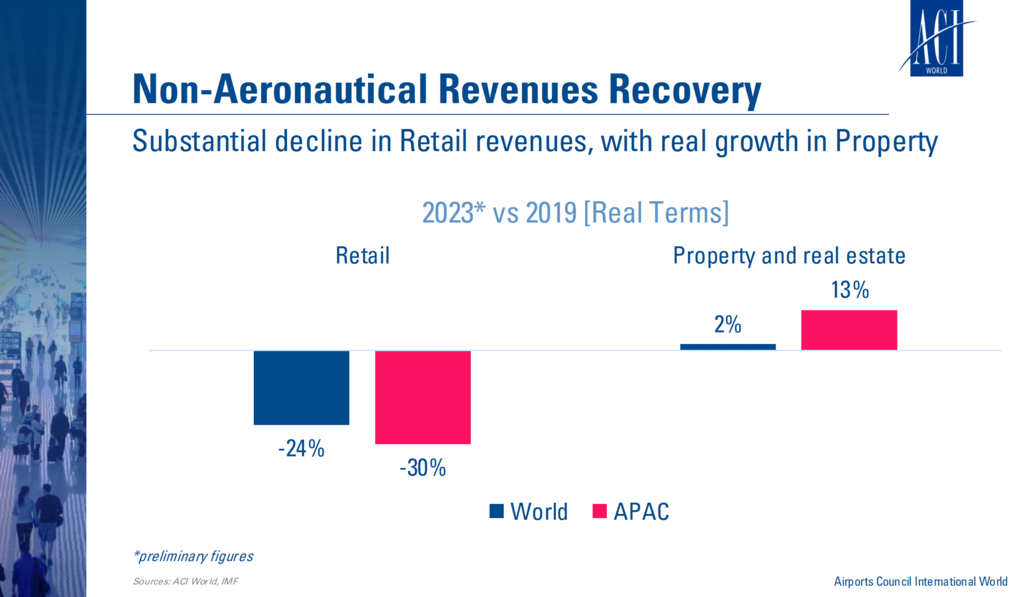

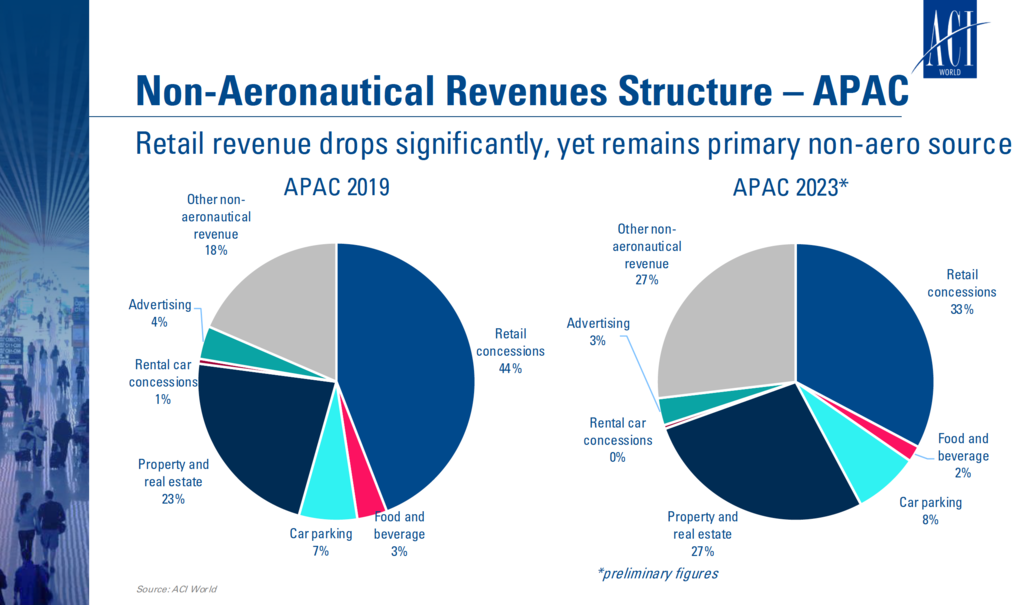

These numbers were closely mirrored when considering retail revenues only, with the segment down globally -24% (including Asia Pacific -30%) comparing 2023 to 2019. This came despite growth in the value of airport property and real estate of +2% globally and +13% in Asia Pacific.

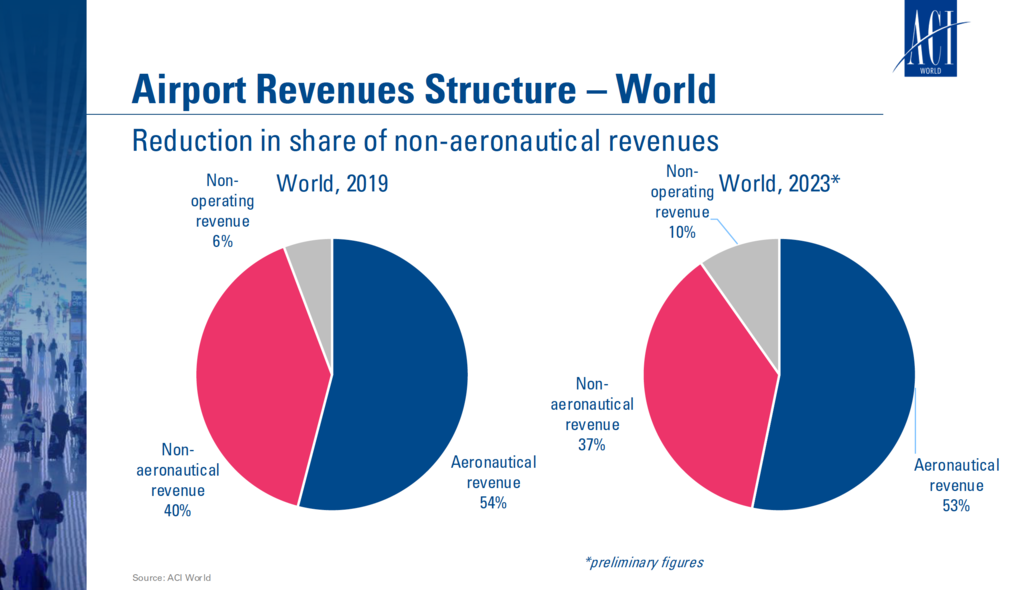

The ACI World data showed non-aeronautical revenues’ share of overall global airport revenues fell from 40% in 2019 to 37% in 2023.

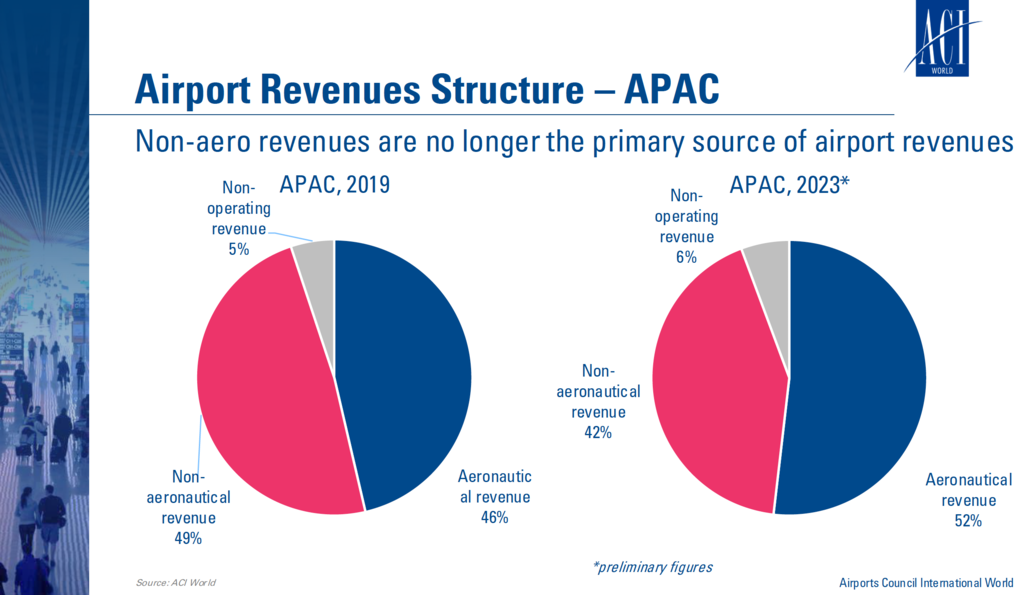

And notably, in Asia Pacific, non-aeronautical revenues are no longer the primary source of airport revenues. They stood at 49% of total revenues in 2019, ahead of aeronautical revenues (46%) and non-operating revenues (5%) but for 2023 fell to 42%, trumped by aeronautical revenues at 52%.

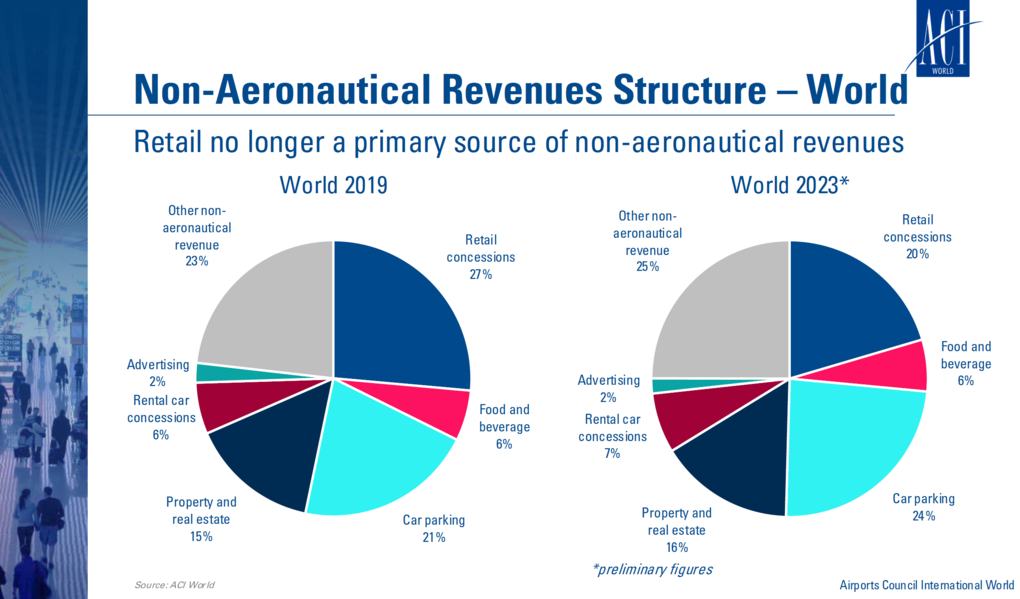

Retail concessions are no longer the primary source of non-aeronautical revenues globally, falling from a 27% share in 2019 to a 20% share in 2023. Food & beverage remained static with a 6% share in the two highlighted years.

Once again, the disparity between global figures and Asia Pacific was pronounced, with retail concessions falling from 44% of airport non-aeronautical revenues in 2019 to 33% in 2023.

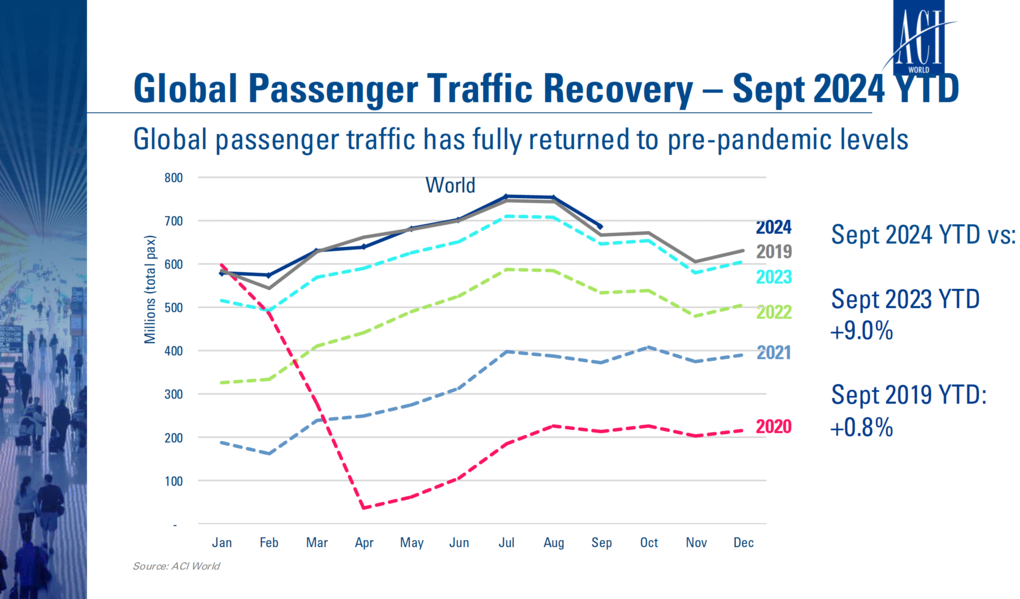

Passenger traffic recovery

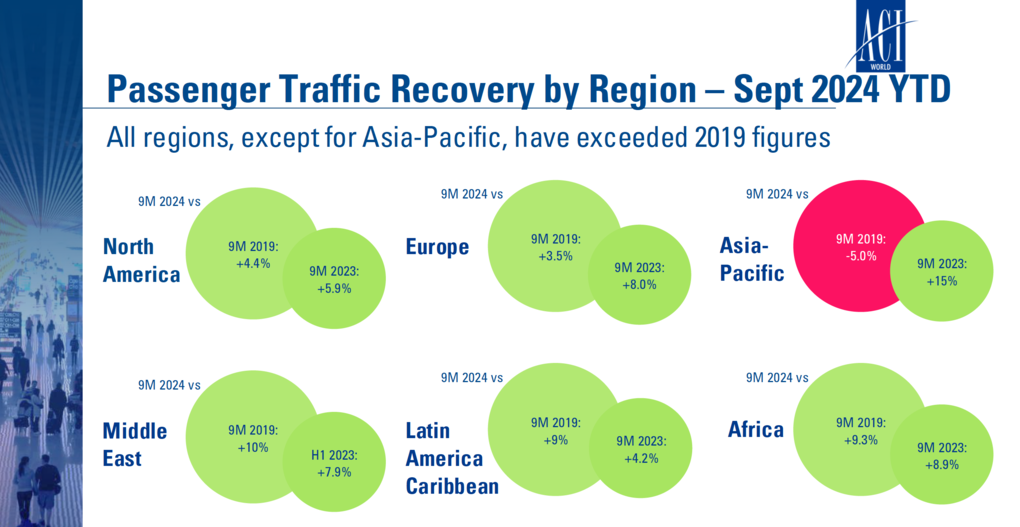

On a more positive note, ACI World’s data showed global passenger traffic from January-September 2024 exceeded the comparable year-to-date number in 2019 by +0.8% and rose +9% against the equivalent period of 2023.

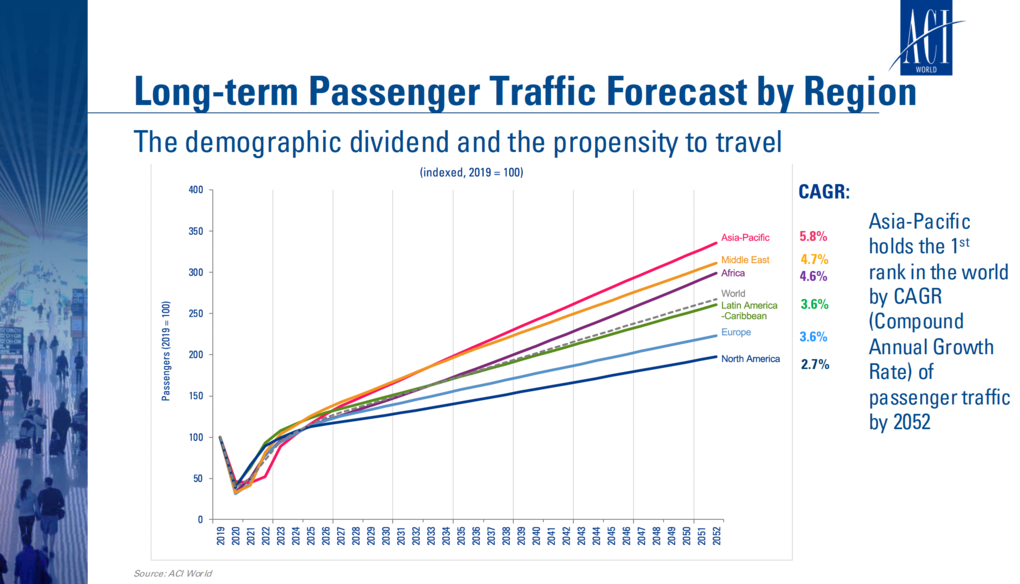

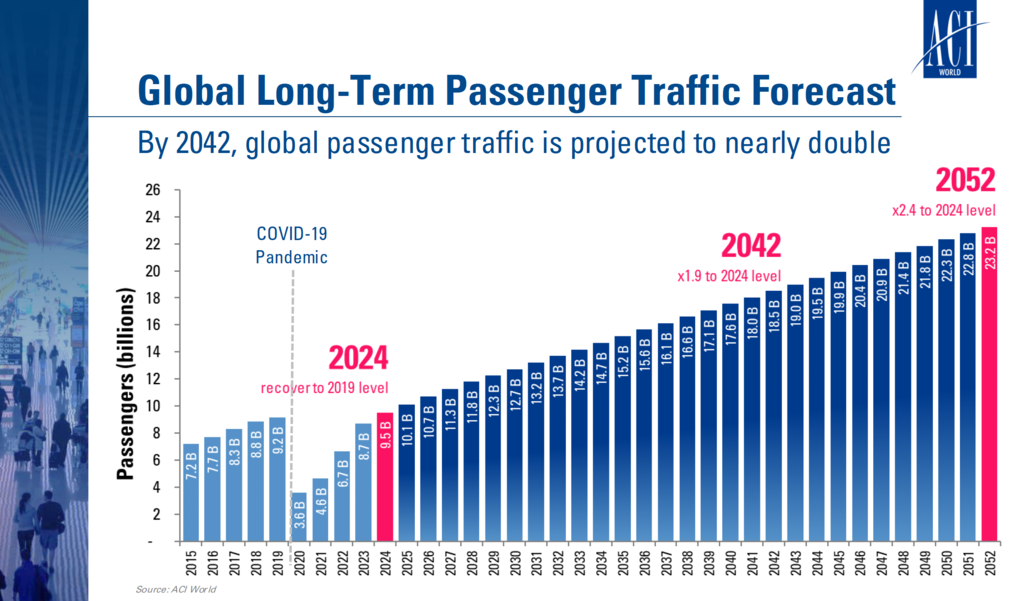

The data also showed a strong long-term outlook for global air passenger growth, with numbers projected to reach 23.2 billion by 2052, some 2.4 times more passengers than are projected to be recorded in 2024 (9.5 billion).

Asia Pacific leads projected air passenger CAGR (Compound Annual Growth Rate) for 2024-2052, at +5.8%. The equivalent figures for the other regions are the Middle East +4.7%, Africa +4.6%, Latin America/Caribbean +3.6%, Europe +3.6% and North America +2.7%.

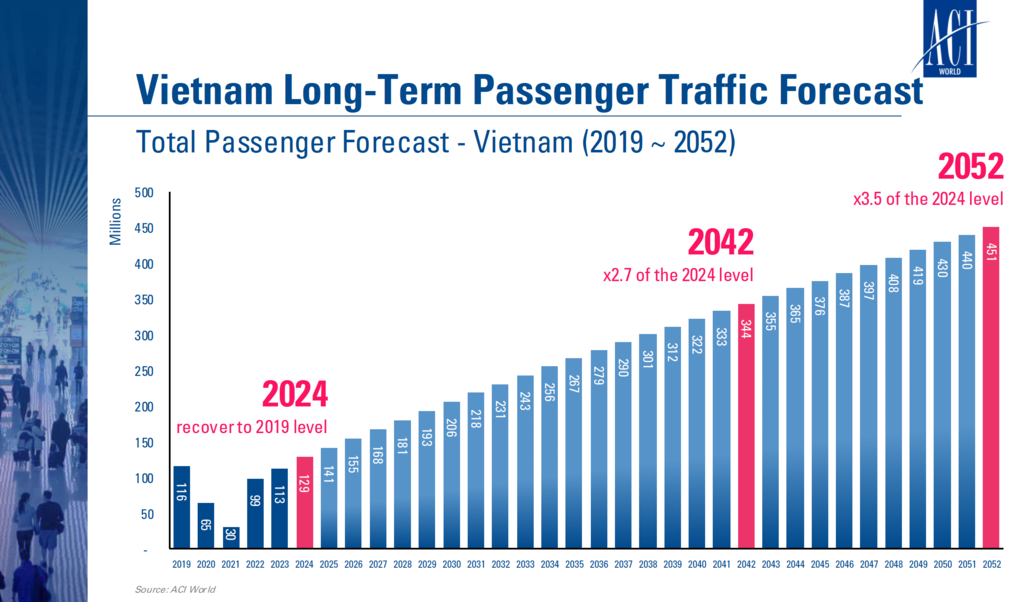

ACI World also highlighted a very positive outlook for Vietnam, with passenger numbers expected to reach 451 million annually in 2052, some 3.5 times the 2024 level. The airport trade body predicts that Vietnam will soar from 20th place for total passenger traffic volume in 2023 to 10th place in 2052.

*ACI World has published a guide to airports outlining key strategies to elevate the passenger experience and unlock commercial opportunities amid fast-paced digital change. The Airport Commercial Digital Transformation Best Practices was unveiled during The Trinity Forum. Access it via this link. ✈