In this guest column, industry consultant Jack MacGowan, a former ARI Chief Executive and DAA Chief Commercial Officer, highlights the factors that influence concession bidding for incumbents and challengers, and the common dangers that competitors face in today’s airport commercial tendering marketplace.

Bidding for airport concessions is an art based on incomplete information and over-optimistic bidders have always been an industry issue, writes Jack MacGowan.

Years ago, when margins were ‘fatter’ and legal contracts thinner, over-optimistic winners could mitigate losses by renegotiating terms. But in today’s intense competitive climate, with ‘thinner’ margins and ‘fatter’ legal contracts, a sales forecast which is +30% too high can have a devastating impact and crash a concessionaire’s business.

This can quickly lead to the failure of the concession with significant reputational and financial harm for both bidder and airport company.

The ‘incumbent advantage’

Some years ago, an analysis of more than 70 retail concessions highlighted that ‘incumbent advantage’ in bid situations was real. Despite an average of five bidders, the study showed that about two-thirds of concessions were retained.

Incumbents usually (but not always) know the customer, the airport, the security system, the staff and the space better than other bidders. Crucially they forecast likely sales more accurately and propose a stretching but realistic sales forecast without taking excessive risk (entering the Red Zone).

This begs a key question: What will convince an airport to hand over the concession to a new bidder?

There is great pressure on a bidder to out-do the incumbent both financially and on other measures of success. They must have a great reputation, a track record of success elsewhere, demonstrate they know their stuff and propose a credible business plan. It helps if they have a couple of powerful, genuinely innovative ideas to drive sales, excite passengers and survive the intensive challenge by the airport evaluation team.

Ah yes, you say, but it’s all about the percentage rent – put simply, you need to be the highest bidder.

Of course, it’s no harm to be the highest bid. If your bid is not the highest, then it does need to be close to the highest credible bid. For example, if you bid a rental percentage of say 35% on a concession with US$100 million annual sales over a ten-year term, and your bid is -3% lower than the highest credible bid, you are making it very hard for the airport to choose your bid.

To choose your bid, the airport team must argue to their board directors why they are foregoing US$30 million in rent. Any difference greater than 3% and you are most likely heading to Losers’ Alley.

Losers’ Alley, The Sweet Spot & The Red Zone

The ‘Sweet Spot’ for all bidders is a sales forecast at the top end of the range that meets airport expectations and, crucially, doesn’t take excessive risk. Airports often see a wide variation in sales forecasts from five to ten bids for the same opportunity.

They quickly discard the lowest bids (Losers’ Alley) and then proceed to shortlist the higher bids, trying to ensure the chosen bid is well thought through and NOT in the Red Zone. But, after the new stores are open, if actual sales do end up significantly (-30% or more) below the forecast bid, then both bidder and airport are in the Red Zone. And you don’t want to be in the Red Zone.

But, after the new stores are open, if actual sales do end up significantly (-30% or more) below the forecast bid, then both bidder and airport are in the Red Zone. And you don’t want to be in the Red Zone.

Prudent airport evaluations

Even though airports give all bidders the same data, airport evaluation teams often see a wide variety of forecasts and need to focus on which bids are credible.

During my seven years as daa Commercial Director, we oversaw 100+ bidding competitions, typically with five to ten bidders for retail & F&B opportunities. It was not unusual to have a 50-100% difference in sales forecasts from the lowest to highest bidders.

It is important to identify the highest credible bid early. But how do you challenge each bidder’s sales forecasts when you’re not a retailer? It is not easy.

One simple way is to ask bidders explicitly to back up their sales forecasts with consumer data, then use the shortlist bid interviews to challenge the bidder rationale. If it doesn’t ring true, then watch out!

Prudent bidding

Aside from death and taxes, nothing is certain in the future so a prudent bidder needs a well-supported, grounded sales forecast to reduce forecasting error. Forecasting error can be introduced by many assumptions in the bidder’s P&L but internal estimates such as payroll and capex are relatively well known and can be estimated accurately in advance. Much more likely to be wildly wrong are external factors such as passenger demand. If the bid ends up as one of the lowest bids, in Losers’ Alley, then the bid will rarely be awarded the concession, but will live to fight another day.

If the bid ends up as one of the lowest bids, in Losers’ Alley, then the bid will rarely be awarded the concession, but will live to fight another day.

However, if the bid wins and forecast sales end up more than +30% too high, then we may well be in the Red Zone.

Long ago, when concessions were less competitive, a Red Zone sales forecast would cause issues but with ‘fat’ margins and thin legal contracts, bidders could wriggle out of the bad situation. Today, intense competition is driving thin margins and fatter legal contracts, and a Red Zone sales forecast is very likely to result in very substantial losses for the entire term of the concession, if not worse consequences. So the mantra is, bid competitively, but at all costs avoid overbidding by over 30%.

A model to help bidders (and airports) avoid the Red Zone

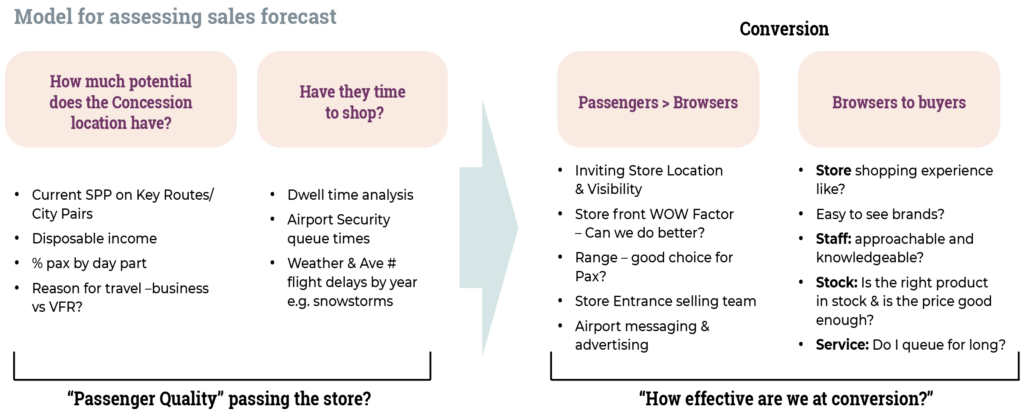

Bidders can improve their chances of not landing in the Red Zone by adopting a structured approach to sales forecasting and by having a model to ensure they consider all factors influencing future sales. That also means properly benchmarking their forecasts versus other airports and historical sales.

Assessing passenger quality: This is a critical step in the process and drives most of the variation in spend per passenger (SPP). So a Lebanese passenger departing Beirut to Paris with two hours of dwell time will spend on average ten times what an Irish passenger on a short business trip from Dublin to Bristol will spend.

Despite having local knowledge and deep retailing experience, bidders often manage to get it wrong, so a structured approach is useful to reduce the risk of serious errors and ending up in The Red Zone.

Customer experience: At Dublin Airport, a typical passenger might have less than ten minutes browsing time before heading to the gate. When the passenger walks into the store, immediately meets an expert whiskey ambassador and is walking to the till with product in hand in under three minutes, then sales per pax will be good.

However, if the passenger walks into a store with no staff visible, and it takes five minutes to find a free assistant (perhaps a student working holidays), and then another five to find the product, there may be a substantial deterioration in sales per pax.

Dwell time: A passenger flying from Rio to New York lands at Miami Airport en route only to encounter long queues transiting the airport. Instead of the planned three hours leisurely browsing the retail stores for a gift for his wife, he now has 30 minutes to make his way to the gate and regrettably, has to rush past the store. Another factor that has a negative impact on sales per pax.

Passenger profile: Some of the worst bidding mistakes we saw over the years were from bidders treating all passengers on an average basis. Astute bidders with deep experience know that an American passenger flying early afternoon from Dublin to New York is not the same opportunity as an Irish passenger flying early morning from Dublin to Warsaw. A family flying from Dubai to Madras is not the same as a Chinese family flying from Dubai to Beijing.

Deep regional experience can often help prevent these mistakes. Knowing average sector lengths by day part, reasons for flying and expected dwell times can give one bidder a big advantage over the others.

Likewise, knowing disposable income, spending habits and categories to promote on specific holidays are the bread and butter of getting the bid right.

*This article first appeared in our October Magazine. Click here for access. A related column from Jack MacGowan on airport tenders appeared in our April Magazine edition and online, and is available as an archived article. Contact Jack MacGowan at jackmacgowan@castlepole.com ✈