INDIA. Airport Dimensions’ AX24: The Age of the Airport Experience study has revealed that Indian travellers expect +16% growth in travel frequency over the next 12 months, compared to a global average of +8%.

The 9,000-participant survey indicates that growth is being driven by higher expectations for business travel, which is increasing at a rate of +22% in the Indian market compared to a global average of +11%.

Additionally, international travel is growing at a rate of +35% in India, compared to the global average of +16%. India mirrors the wider global trend for travel frequency being driven primarily by Millenial and Gen Z travellers.

India is planning to invest approximately INR980 billion (US$12 billion) between 2023 and 2025 on airports to ease the pressure on existing infrastructure. By 2025, there will be 220 airports in the country – up from 148 at the start of 2023.

According to Airport Dimensions, Indian travellers have an ever-growing appetite for an elevated airport experience that positions the region as a contender to overtake current experience leaders such as Singapore and China.

Given the rapid pace of sector expansion in this market, AX24: The Age of the Airport Experience identifies several areas for airport operators and concessionaires to focus and improve their offerings to deliver revenue growth and be better placed to meet customer expectations.

Affinity for experiential retail

Indian travellers show continued interest in traditional airport retail, more so than their global counterparts. This is likely fuelled by the recent surge in modern airport infrastructure featuring a wider variety of shops and brands.

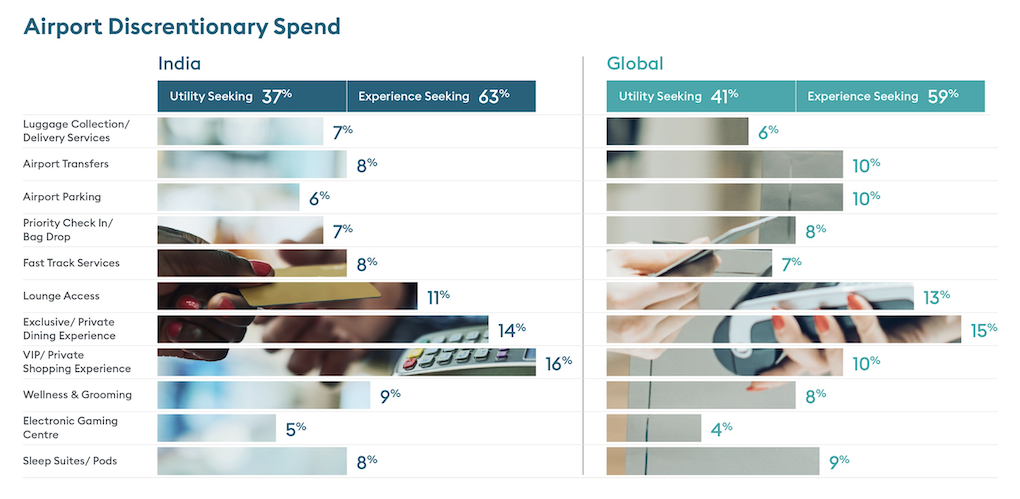

However, the AX24 data also outlines a growing desire for experiences that offer greater value than just traditional shopping – 63% of Indian travellers identify as ‘experience seeking’.

Personalised shopping, interactive elements and pop-up concepts are more appealing for travellers and they’re willing to pay for this added value.

Indian travellers are also over-index on desire for wellness and grooming and gaming services versus the global average.

Prioritising lounge access

According to the survey, 84% of Indian travellers believe that more lounge access options would significantly enhance their airport experience.

According to the survey, 84% of Indian travellers believe that more lounge access options would significantly enhance their airport experience.

When the amenities are available, they are some of the most enthusiastic global lounge users, with three-quarters (76%) suggesting that they use airport lounges, compared to 50% worldwide.

Increased lounge access options can also help manage passenger flow and address overcrowding at lounge check-in counters.

The AX24 report emphasises that the food & beverage offering is the most important factor for Indian travellers in deciding to purchase lounge access – even more than their wait time at the airport.

They rank provisions for family a close second (85%), while leisure facilities rank at 76% when it comes to purchasing intent, reflecting a pivot away from a business focus to lounges supporting leisure and lifestyle aspirations.

Indian travellers rely less on their airline – such as class of travel and frequent flyer programme (FFP) status – for lounge access and instead use either network programmes such as Priority Pass or lounge benefits provided through banks or credit cards.

With lower levels of FFP participation, 35% in India, versus a global average of 51%, they are seeking rewards, recognition and benefits from alternative sources. They appreciate the flexibility of travel benefits, such as lounge access, that are not tied to a particular airline.

This opens opportunities for airports to influence travellers’ loyalty. Airport Dimensions notes that this is a trend that will likely be mirrored around the world over time as lounge propositions and access options continue to evolve.

Digital natives

Indian travellers are among the most digitally engaged in the world, actively using mobile apps and other digital tools to enhance their airport journey. Only 15% of Indian travellers report never interacting with airport digital assets, compared to a global average of 21%.

This demand for digital services extends into the lounge. Of the AX24 survey respondents, 90% said that they would prefer accessing flight information from their phone in-lounge, closely followed by the ability to place food & beverage orders via their own device (86%).

This presents an opportunity for airports to leverage mobile applications and develop robust digital platforms to build stronger relationships with travellers, particularly to fill the vacancy created by the declining role of FFPs.

Airport Dimensions President EMEA & APAC Errol McGlothan said: “As one might expect from the fastest-growing aviation market in the world, the Indian travel sector is redefining modern travellers’ expectations for airport experiences. These evolving expectations and behaviours will significantly influence the global airport landscape.

“Airport Dimensions is excited to support this transformation by developing innovative experiences tailored to the needs of these forward-thinking travellers, helping airport decision-makers to ensure their offerings are best in class.” ✈

All infographics courtesy of Airport Dimensions

Note: The Moodie Davitt Report is the leading international information source on India’s travel retail and airport non-aeronautical revenue sectors. All stories are archived permanently in our India newsroom (accessed via the regional section on our home page drop-down menu).