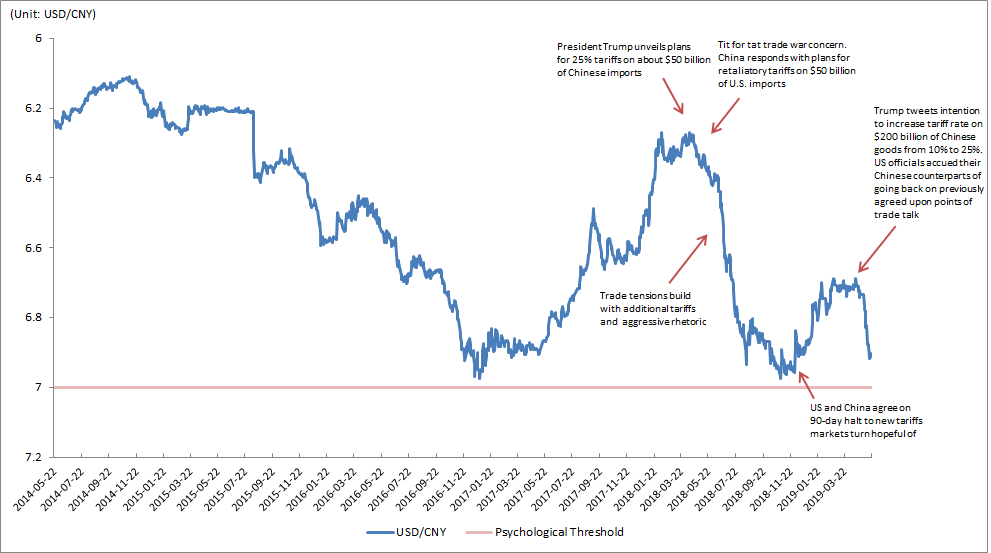

ASIA PACIFIC. The recent sharp fall in the value of the Chinese Yuan, amid an increasingly hostile trade standoff between the USA and China, threatens to dampen Chinese travel and duty free spending if it continues, according to Moodie Davitt Research.

Since President Trump first tweeted about introducing new tariffs on Chinese imports on 5 May, the Chinese Yuan has weakened 2.5% against the US Dollar and inched ever closer to the key psychological threshold of RMB7 to US$1, a level not seen since the 2008 global financial crisis.

Crossing this threshold risks further selloffs, boosts inflation and lessens the purchasing power of Chinese travellers and daigou abroad. China seems intent on keeping the Yuan above this key psychological level but duty free industry experts, notably in South Korea, are concerned about the recent sell-off and remain wary about the prospect for Chinese travel and spending.

China appears determined to continue its interventionist role with Pan Gongsheng, Chief of the State Administration of Foreign Exchange, stating in an interview with China’s Financial News: “We absolutely have the fundamentals, the confidence and the ability to keep China’s foreign exchange market stable and keep the yuan exchange rate at a reasonable and balanced level”.

The confidence boost by a key Chinese official along with the People’s Bank of China’s monetary policy report has seen the Yuan gain some ground in recent days following a peak of 6.92 to the dollar on 17 May.

Despite the weakness in the Yuan, Korea’s duty free market continues to surge ahead and recorded the second-highest monthly result ever in April, as reported. Duty free retailers in Korea are heavily dependent on Chinese resellers and tourists (84% of downtown duty free sales) and often increase rebates and discounts to make up for the shortfall from sharp currency movements.

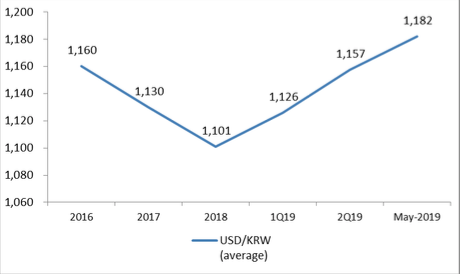

The recent strength of duty free sales has had little to do with discounts and rebates; however, any prolonged weakness in the Yuan may see retailers take steps to incentivise spending. There is room for them to provide some assistance given the weakness in the Korean Won, which means retailers not only benefit from foreign exchange translation upside but also from inventory gain. Products purchased from local suppliers are paid for in Won but sold in US Dollars and sharp movements in exchange rates often result in additional gains.

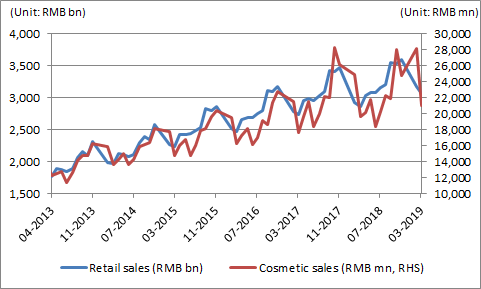

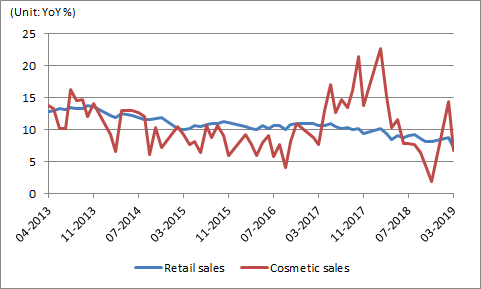

Despite China’s rigid stance on defending the RMB7 psychological threshold and the recent strong growth rates recorded, duty free experts in Korea remain wary. Crossing the RMB 7 threshold may see a degree of panic with Chinese households reducing their overall consumption and travel-related expenses. Industry experts have commented that the decline in consumer sentiment and sales is already underway in China with retail sales and cosmetics sales growth rate slowing in H2 2018 and up to April.

Duty free retailers and luxury brands have so far remained largely unaffected by the slowdown. The Chinese luxury market has outperformed mass brands that are negatively affected by the slowing economic growth and the lower consumer sentiment as a result of heightening trade tensions.

Korean duty free retailers see no immediate reason to fret with Q2 2019 so far maintaining the strong start to the year in Q1. But all eyes are fixed on how Chinese consumers react in a scenario if and when trade tensions boil over and the Yuan crosses the crucial RMB7 psychological threshold.