INTERNATIONAL. Yesterday’s report from the Wall Street Journal claiming that China’s HNA Group is seeking to buy a stake in Dufry caught the world’s largest travel retailer by surprise just as much as it did the industry.

While the two parties are understood to have held informal dialogue in the past, Dufry has received no approach from the fast-growing, profoundly ambitious Chinese travel-to-leisure conglomerate this time around. Nor was it aware prior to the as-yet unverified newspaper report of any communication with minority shareholders.

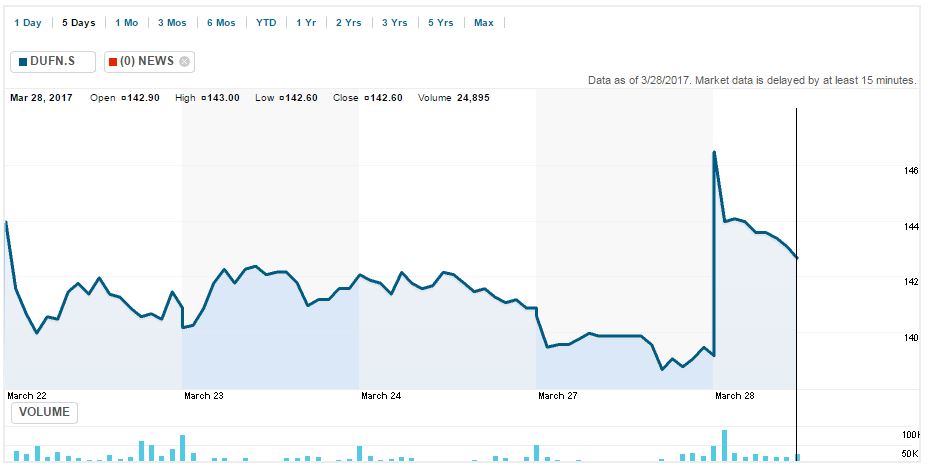

Dufry’s stock rose +3.52% yesterday to CHF144.00 on claims that Dufry investors, including Singaporean sovereign wealth funds GIC and Temasek of Singapore, had been approached by HNA (see table of shareholders below). The reports also cited the Qatar Investment Authority’s 6.92% stake. By 15.40 Swiss time today (Wednesday) the stock was trading at CHF144.70, up +0.49%.

HNA would become Dufry’s largest individual shareholder if it managed to buy the stakes of each of the three funds.

The Moodie Davitt Report has approached HNA for comment and will bring you any response.

While Dufry was unaware of any such approach, the newspaper claim – probably leaked by an interested party – is, if true, positive news for the company. HNA is a hugely ambitious, powerful and growing force in the aviation and leisure sectors and any partnership would greatly enhance Dufry’s position both within China and with the Chinese traveller abroad. Dufry’s relatively weak Asian profile and modest Mainland China presence would also be improved by HNA participation.

While the two Singaporean funds are relative newcomers to Dufry stock (buying in at less than CHF130), either or both might see the merit in cashing out now (depending on the price) given broad global uncertainties in the travel retail sector. Alternatively, and perhaps likelier, they could decide to wait for one or more quarters to benefit from Dufry’s improving trading performance (and therefore an enhanced share price/valuation) as the market continues to recover from the travails of 2016.

In Switzerland, the take-over code does not trigger a mandatory offer for the whole company unless a stake larger than 33.33% changes hands, according to a reliable investment community source. This would almost certainly not be the case here, creating flexibility on pricing in an off-market purchase – i.e. individual negotiation between the parties. Importantly, HNA will be obliged to make a public disclosure within 24 hours if it acquires a holding of above 3.0%.

Source: Reuters

Click on image to enlarge

Click on image to enlarge

CONTROL UNLIKELY

Taking a stake in Dufry is one thing. Getting control though would be “very difficult” according to reliable sources. The enterprise value of Dufry today, said one party, is around CHF11.7 billion (US$11.75 billion). “You would need a very big pocket for that,” he said. However, as emphasised by HNA’s impressive recent acquisition spree (see table below), its pocket is indeed deep.

One of those acquisitions was Gate Group, the Swiss inflight services provider. Gate Group CEO Xavier Rossinyol knows Dufry better than most having been its Chief Financial Officer from 2004 to mid-2012 and Chief Operating Officer EMEA and Asia from 2012 to 2015. He led over ten post-merger integrations across several continents as well as M&A activities across Europe, the U.S., Latin America and Asia.

The biggest block to control is the group of shareholders comprising Andrés Holzer Neumann; Juan Carlos Torres Carretero; Julián Díaz González; James Cohen; James Cohen Family Dynasty Trust; Dimitros Koutsolioutsos; and Nucleo Capital Co-Investment Fund 1 Limited. Given the upturn in Dufry’s performance, the certain benefits at EBITDA level of its own acquisition spree (The Nuance Group and World Duty Free Group), this group of stakeholders would be highly unlikely to sell for anywhere near the current valuation.

Reports like the one in such a respected media as the Wall Street Journal do not happen by chance. The market is rumbling. Watch this space.

Another limiting factor is the Chinese Government’s late 2016 introduction of strict conditions on outbound foreign investment to curb capital outflows. Last November, officials of four government agencies – the National Development and Reform Commission, the MOC, the People’s Bank of China (PBOC) and the State Administration of Foreign Exchange – imposed the restrictions in response to the Yuan’s slump against the Dollar and the PBOC’s falling foreign exchange reserves.

According to the FT, China’s State Council is most concerned about outbound mergers and acquisitions worth more than US$10 billion while purchases of over US$1 billion will be scrutinised if outside the investor’s core business.

However, a Dufry stakeholding of whatever scale would appear to make real sense for HNA, which wants to enhance its status as a diverse aviation services provider. Reports like the one in the Wall Street Journal do not happen by chance. The market is rumbling. Watch this space.

ABOUT HNA GROUP

HNA Group is a privately owned Fortune Global 500 Corporation headquartered in Haikou, Hainan Island, China with operations in the aviation sector, infrastructure and real estate, financial services, tourism (including duty free retailing) and logistics.

It controls Haikou Meilan Airport Duty Free Shop, which offers highly successful offshore duty free shopping to Chinese travellers at Haikou Meilan International Airport on Hainan Island.

Intriguingly, and as reported, Hainan Duty Free is set to form a joint venture with China Duty Free Group in what would be a blockbuster alliance. The registered share capital will be RMB100 million (US$14 million), with Hainan Duty Free contributing RMB51 million for a 51% share, and China Duty Free Group investing RMB49 million for the remaining 49% holding.

HNA Group was founded in 1993 and has nearly 180,000 employees worldwide.

On the acquisition trail

Chinese conglomerate HNA Group has been very active in recent times in making acquisitions across its fields of interest with aviation and aviation-related services central to the expansion. Here is a selected timeline of some of its main deals:

- December 2016: As reported, HNA completes acquisition of gategroup, the Swiss inflight services provider, in a transaction valued at CHF1.4 billion (US$1.47 billion).

- December 2016: Completes acquisition of IT products and services company Ingram Micro through subsidiary Tianjin Tianhai Investment Company. The all-cash transaction is for US$38.90 per share with an equity value of approximately US$6 billion.

- December 2016: Closes deal to acquire Carlson Hotels through subsidiary HNA Tourism Group. Also acquires Carlson’s 51.3% stake in Brussels-based Rezidor Hotel Group.

- October 2016: China Duty Free Group parent company China International Travel Service votes at its board meeting on 28 October to create a joint venturewith Hainan Duty Free.

- October 2016: Announces intention to purchase a quarter of Hilton Worldwide Holdings Inc. for US$6.5 billion.

- October 2016: Buys CIT Group’s aircraft leasing business for US$10 billion.

- May 2016: Agrees to purchase 13% of Virgin Australia for US$114 million, with plans to raise that stake to about 20%.

- March 2016: Increases stake in Deutsche Bank from 3.04% to 4.76%.

- March 2016: Acquires Manhattan’s 245 Park Avenue skyscraper for US$2.21 billion.

- November 2015: Agrees to buy 23.7% stake in Azul Brazilian Airlines for US$450 million through subsidiary Hainan Airlines.

- July 2015: Agrees to buy airport luggage handler Swissport International from PAI Partners for US$2.81 billion.