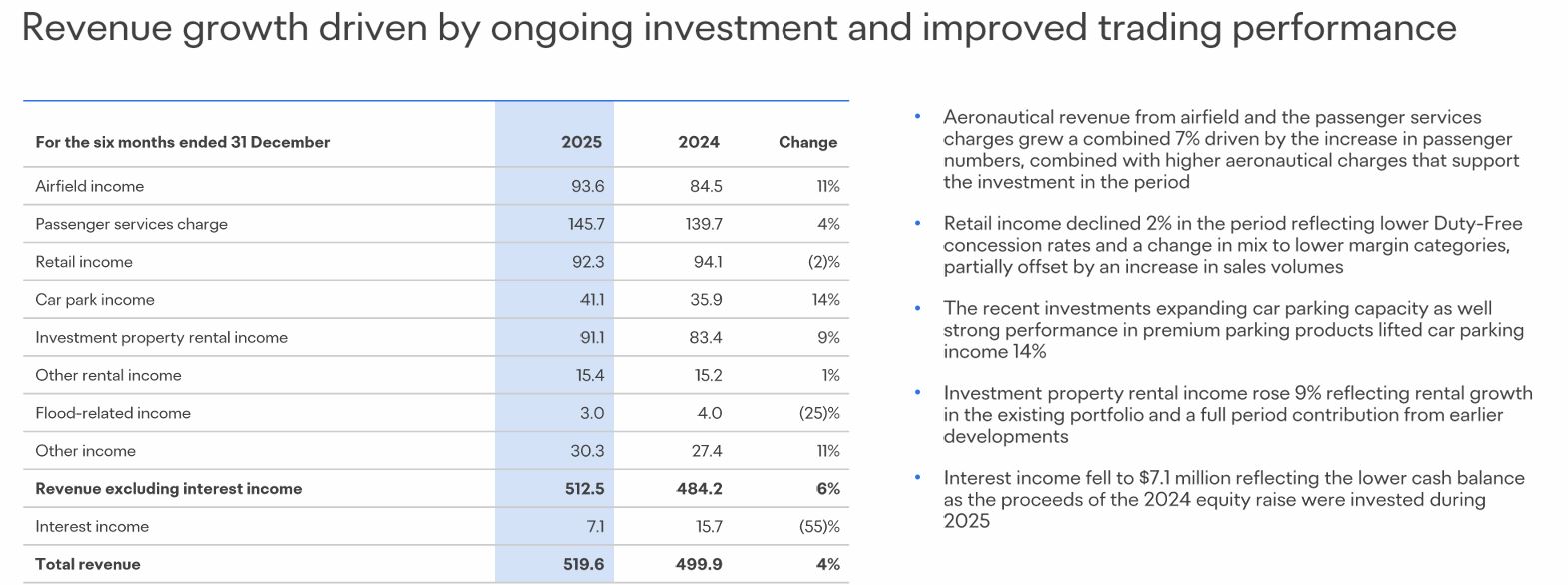

NEW ZEALAND/AOTEAROA. Auckland Airport has reported a -2% year-on-year decline in retail revenues to NZ$92.3 million (US$55.1 million) for the six months ended 31 December 2025.

Data released today (19 February) shows income per passenger (IPP) falling -4% year-on-year to NZ$9.76 (US$5.83), although passenger spend rate (PSR) increased +2% over the prior-year period. Excluding foreign exchange impacts, PSR rose +5%.

This slight dip in retail performance came despite positive sales momentum across core categories, driven by a shift in sales mix. Growth in electronics and cosmetics was partially offset by softer alcohol sales.

The decline in IPP was attributed to lower average duty-free concession rates. However, these lower rates strengthened the customer value proposition, driving higher conversion and boosting PSR, said Auckland Airport in its H1 presentation.

Targeted promotional activity and bundling initiatives also contributed to higher average basket sizes.

Total passenger numbers reached 9.64 million, marking a +2% year-on-year increase. International traffic, highlighted as an “essential driver” of the economy, accounted for 5.27 million passengers, up +2%, while domestic volumes also rose +2% to 4.37 million.

Speaking on the earnings call, Chief Financial Officer Stewart Reynolds credited the growth in retail income to stronger international traveller traffic.

He said, “The increase in passenger activity was a key driver to the improved performance across most of our commercial lines of business with improved performance in car parking and the airport hotels, whilst also supporting our retail business in what has been a more challenging market for travel retail.”

Chief Executive Carrie Hurihanganui added, “In a sluggish retail environment, both on the high street here in New Zealand and in travel retail more broadly, to be able to grow basket size and PSR is a pleasing outcome with the duty-free business outperforming most regional peers.”

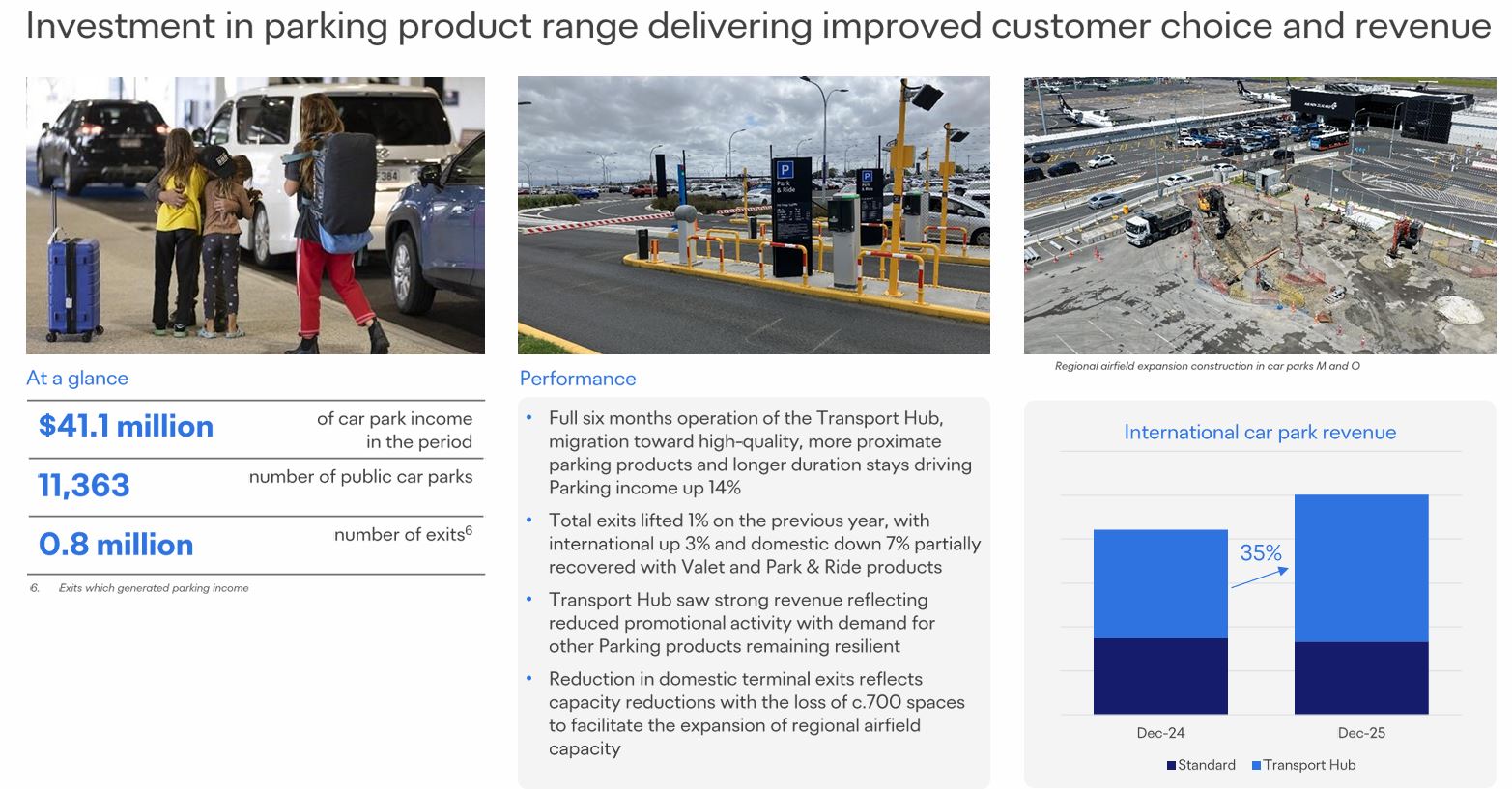

Car parking income grew +14%, fuelled by a +35% surge in revenue from the Transport Hub. Total car park exits were slightly up +1%, with international departures rising +3% while domestic exits declined -7%.

Auckland Airport’s commercial property assets continued to deliver steady growth, supported by an annualised rent roll of NZ$195.4 million (US$116.7 million), 99% occupancy, and a weighted average lease term of 8.7 years.

Overall performance remained positive, with total revenue rising +4% to NZ$519.6 million (US$310.4 million). Excluding interest income, revenue grew +6% year-on-year to NZ$512.5 million (US$306.4 million).

Duty-free drives retail growth

Reynolds highlighted well-performing duty-free sales despite a difficult travel retail environment.

He said: “On a category basis, duty free traded well with sales up on the prior period. And as indicated at the full-year results, the new contract has evolved with industry trends to support more flexibility to drive greater basket size and with it, customer value.

“In addition, food & beverage, destination, news and books categories also traded well in the half, reflecting the attractiveness of the retail proposition.

“However, also reflecting the difficult New Zealand retail environment, luxury and foreign exchange continued to underperform in the period, with the latter remaining challenged as the industry continued its migration to new technologies.”

Hurihanganui meanwhile saluted the company’s partnership with Lagardère Travel Retail, which secured an eight-year duty-free contract last year.

She said, “The new offering is already proving popular with travellers as Lagardère starts to significantly upgrade the store experience for customers, offering new brands and more choice.

“And while travellers will notice construction activity in the duty-free stores, the work is being undertaken in a very carefully staged manner throughout the 2026 calendar year to minimise the disruption, and travellers will continue to be able to access and buy their favourite brands.”

Reynolds highlighted the collaborative approach behind choosing Lagardère. He said, “In working together and alignment around effectively ensuring that the retail environment is one where customers want to stop, dwell and with that, potentially spend, ensures a greater outcome for all concerned.

“And so we work with them around promotional activity. We work with them around bundling as an example.”

When asked about trends in retail categories and whether there are structural pressures on retail concession yields, Hurihanganui declined to comment on commercially confidential contract terms. She noted, however, that there are observable patterns over the past couple of years.

Hurihanganui said, “We were seeing elements around trends in both regional and global travel retail evolving.

“You were seeing it moving away from liquor in some instances towards fragrance, beauty and technology. That trend continues. And so that’s certainly in the sales mix and what you see there.”

Although the half-year results were impacted by softer market conditions for new commercial developments, tenant demand remained positive.

The airport-owned Mānawa Bay shopping centre, opened in September 2024, delivered strong performance, maintaining 99% occupancy as at 31 December 2025.

The shopping centre delivered strong year-on-year growth for the November-December period, with footfall up +6% and sales rising +18%, reinforcing its role as a daily shopping destination for approximately 75,000 people, including airport workers and local residents.

Looking ahead, Hurihanganui highlighted the potential for continued positive performance across both aeronautical and commercial activities for the remainder of the financial year. ✈