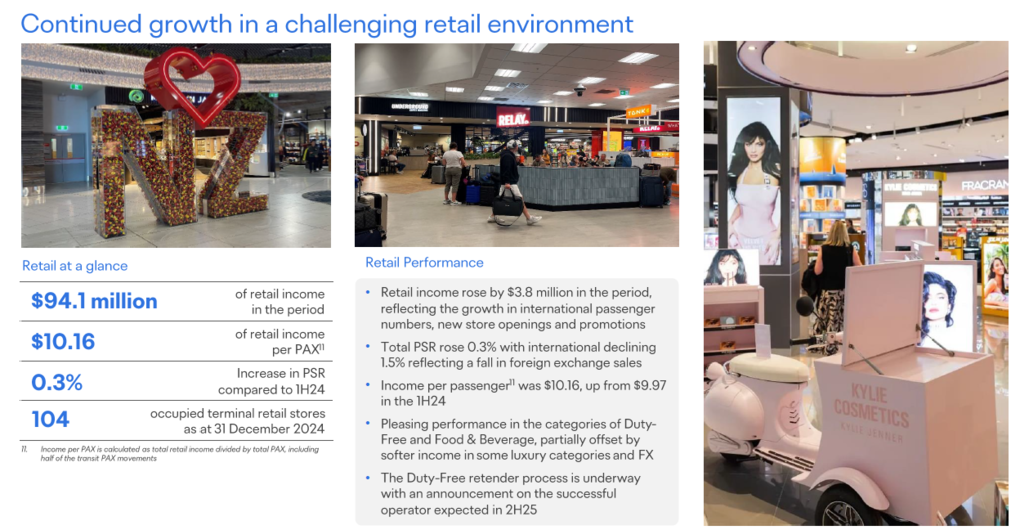

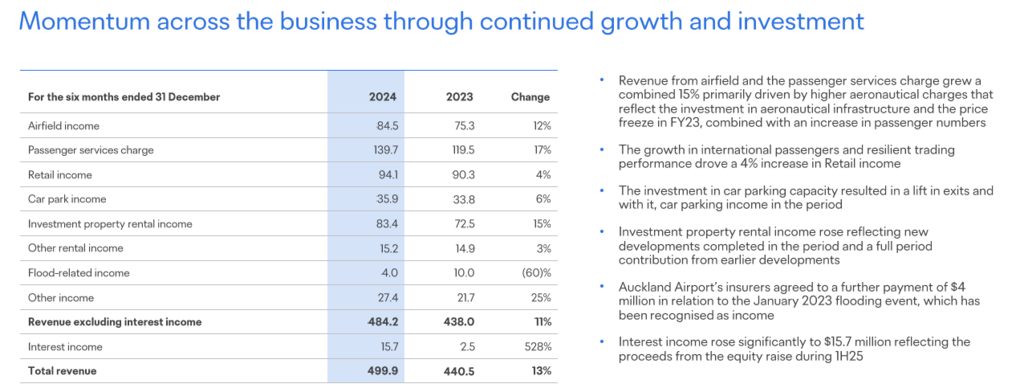

NEW ZEALAND. Retail income grew by +4.2% year-on-year at Auckland Airport during the company’s first half year ended 31 December 2024 to NZ$94.1 million (US$53.8 million).

Income per passenger rose +1.9% to NZ10.16 (US$5.81) with the passenger spend rate (PSR) nudging ahead by +0.3% year-on-year. However, international PSR was down -1.5%. Collectively this indicated slightly higher average concession yields, according to a note from New Zealand investment firm Forsyth Barr’s Head of Research Andy Bowley.

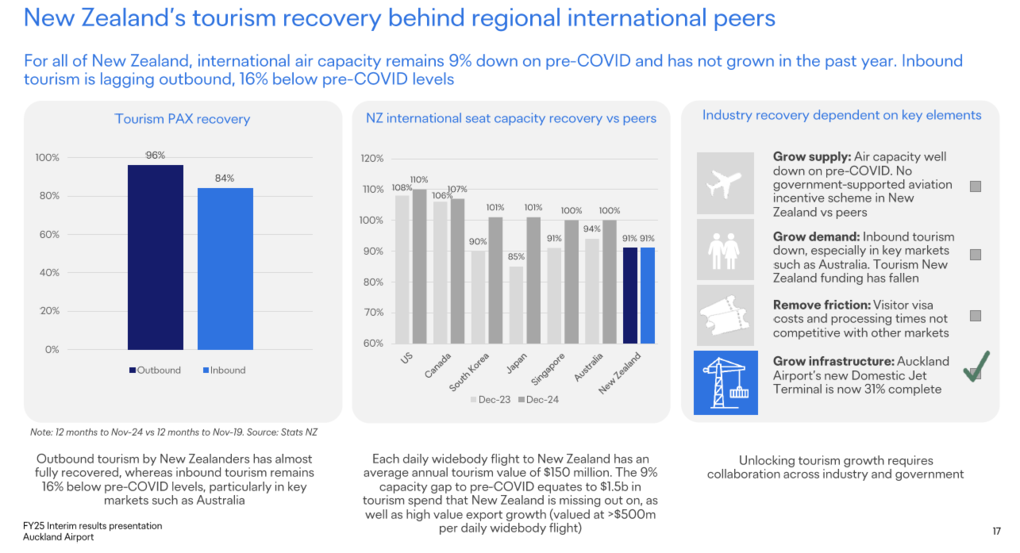

Total passenger numbers of increased +2.3% to 9.46 million with domestic traffic flat at +0.1% to 4.27 million, and international traffic (including transits) ahead +4.1% to 5.19 million.

Speaking on an earnings call yesterday, Chief Financial Officer Stewart Reynolds attributed the retail income growth to an increase in international travellers combined with improvements to the international retail offering and promotional activity resulting in increased shopping engagement.

“Improvements were seen in retail performance across a number of our categories in the terminal, including duty-free, specialty and destination,” he said.

“These resulted in a slight lift in PSR and a 2% lift in income per passenger to NZ$10.16 for the period. Notwithstanding this, we saw weakness in some of the luxury segments as consumer patterns changed in the period, reflecting the current economic climate.”

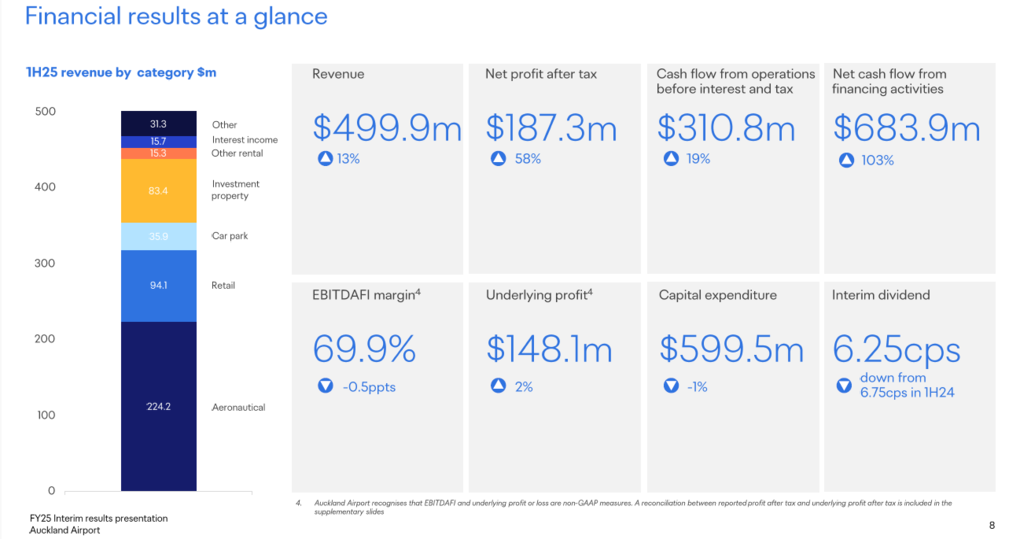

Total revenue was up +13% to NZ$499.9 million (US$286 million) with post-tax profit ahead by +58% to NZ$187.3 million (US$107.1 million).

Decision time nears on duty-free tender

The results will be closely watched by contestants in the current Auckland Airport duty-free tender, now understood to be down to a small shortlist.

The incumbent is the Lagardere Travel Retail AWPL joint venture, though we understand Lagardere Travel Retail will bid alone in defending its contract. The new concession starts in the second half of calendar year 2025 so the clock is ticking.

Asked on the earnings call about the tender, Auckland Airport CEO Carrie Hurihanganui said: “We are still going through with the shortlist and haven’t concluded those go-rounds. So unfortunately, we’re not in a position yet to comment on that.”

Hurihanganui said an announcement will be made in the last [financial] quarter. “We’ve been engaging in terms of kicking off in the new financial year as the targeted time frame. But again, as we get into the pointy end of those elements, there will be considerations around transitions and anything else that may be required. But we’re aiming for the new financial year.”

Responding to a question about how leveraged retail revenue is to the PSE relative to trading on a minimum annual guarantee (MAG), Reynolds commented: “It’s a lot more leveraged than what it used to be. So you’ll recall, obviously, back when we last did a duty-free tender pre-COVID, airports were used to essentially receiving quite high MAGs from retailers.

’I think COVID has really changed the structure of that. So airports are taking on much more volume risk and, with that, retailing risk in terms of the effectiveness of retail in terms of providing those right products and services to the travelling public.”

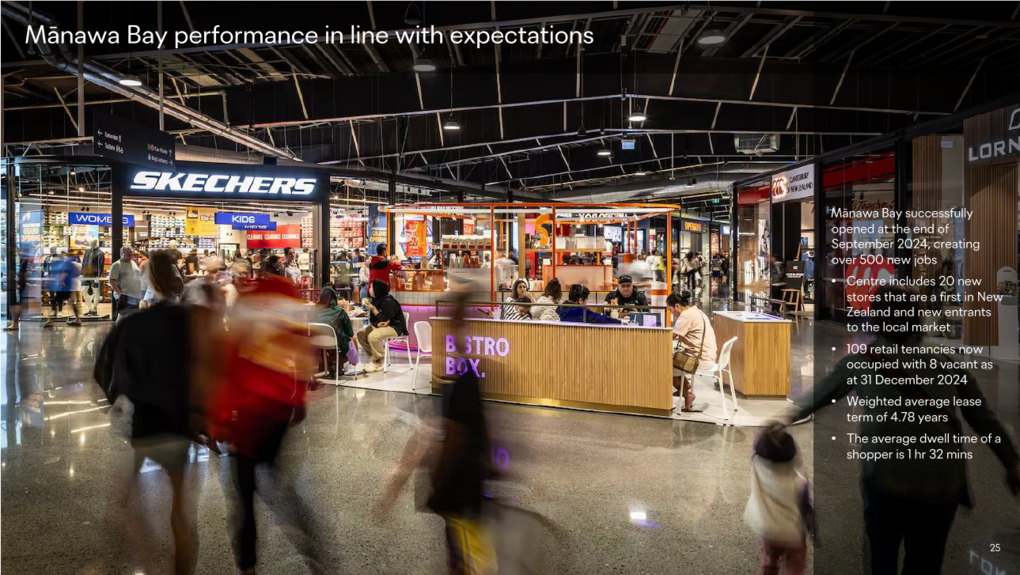

Commenting on the airport-owned Mānawa Bay shopping centre opened last September, Hurihanganui said: “Mānawa Bay is now home to 109 retail tenancies with a weighted average lease term of just under five years at 4.8 years and includes 20 new stores that are first in New Zealand and new entrants to the local market, which is something that we are incredibly proud of.

“The shopping centre has created employment for more than 500 people across a range of retail and hospitality roles and is providing shopping amenities for the around 75,000 people who engage with the airport every single day, including airport workers and the Auckland community.” ✈