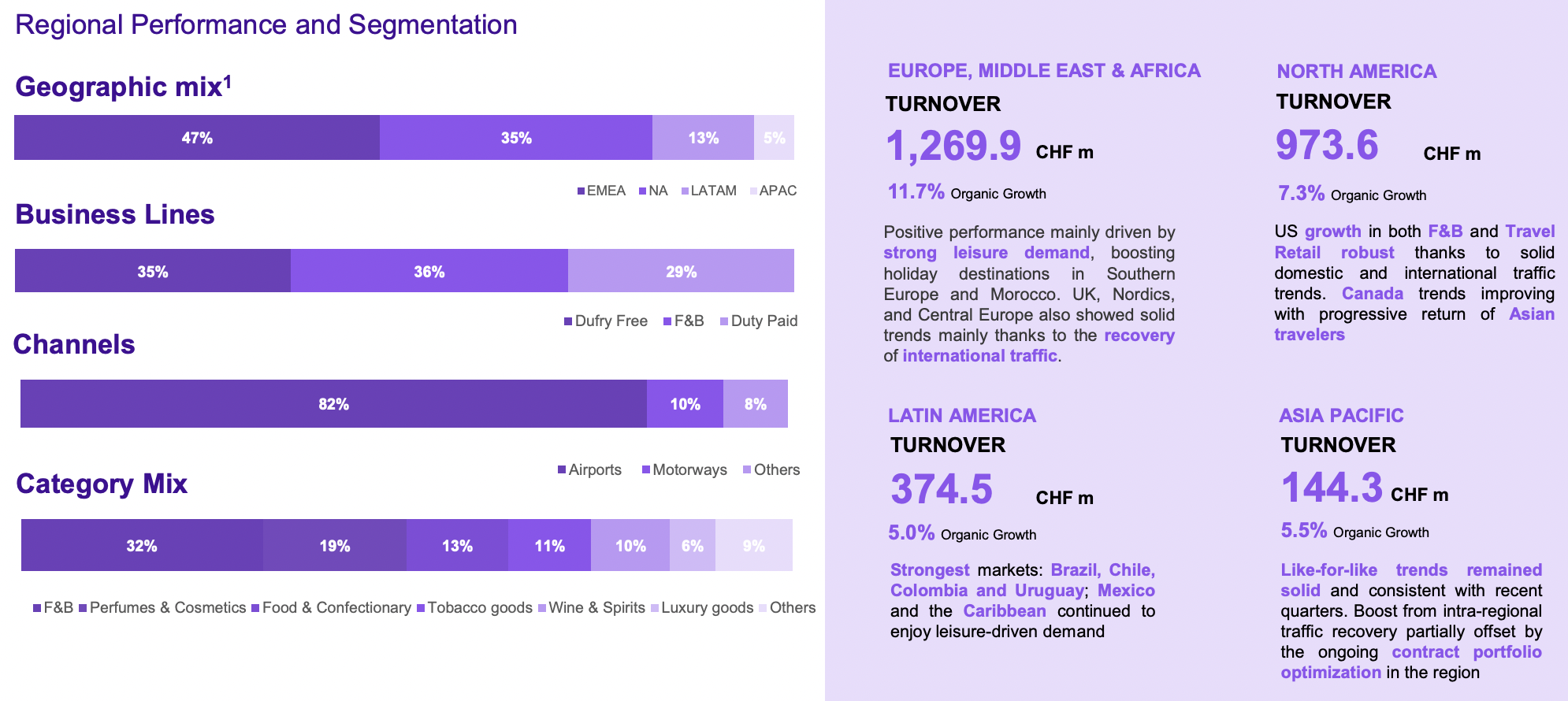

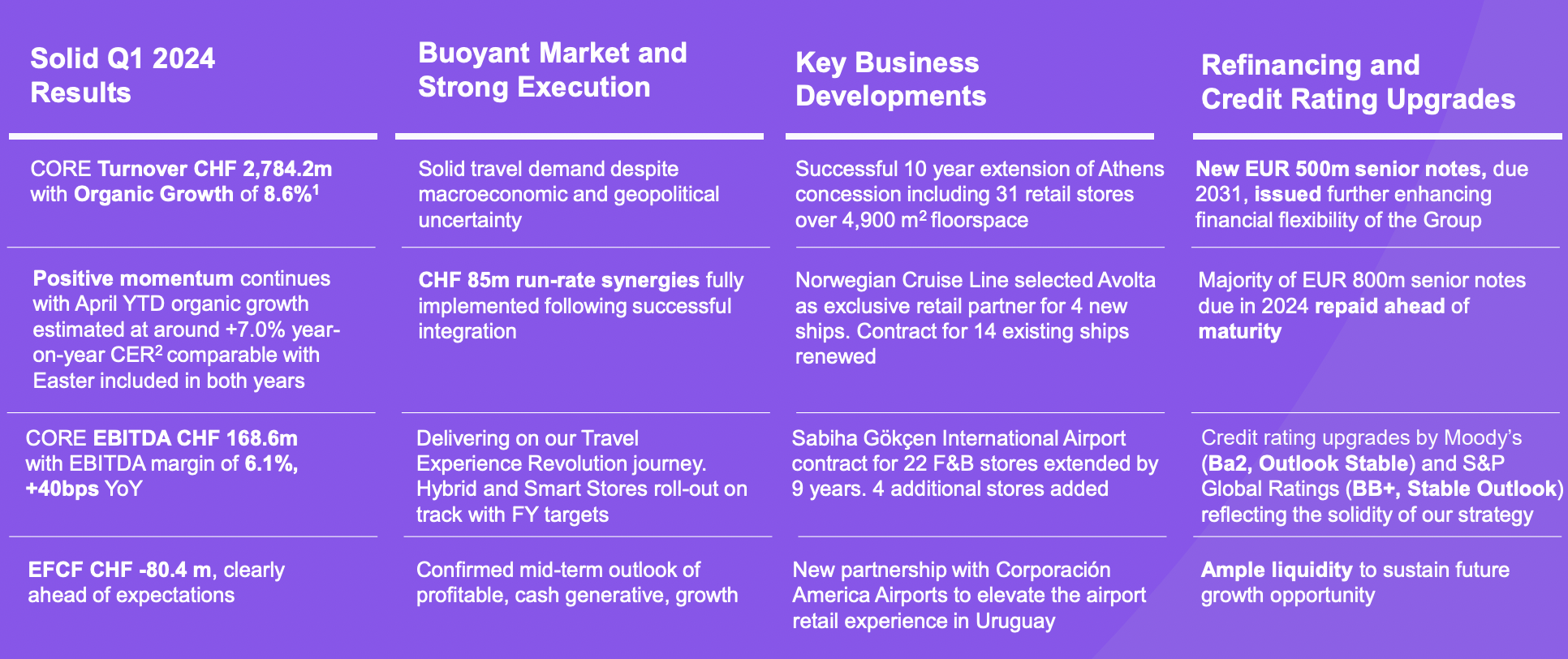

INTERNATIONAL. Travel experience player Avolta today reported first-quarter results to the end of March, with consolidated turnover reaching CHF2,838.4 million (US$3,149 million) and core turnover of CHF2,784.2 million (US$3,090 million), up by +18% on a reported basis and reflecting +8.6% organic growth. (Core turnover excludes fuel sales from the motorway business.)

All regions contributed positively, with the company saying that “underlying demand for travel retail, convenience and F&B across the quarter continued to be strong”.

The organic growth trend has continued through April, with the company estimating April organic growth at around +7% year-on-year at constant exchange rates.

Core EBITDA in the quarter reached CHF168.6 million (US$187 million) with an EBITDA margin of 6.1%, up by 40 basis points year-on-year.

Equity Free Cash Flow amounted to a negative CHF80.4 million (US$89.2 million) in the first quarter of 2024, reflecting seasonality and some timing shift in capex.

CEO Xavier Rossinyol said: “The first quarter of 2024 not only marks a strong beginning of our first full calendar year as Avolta but supports our outlook for 2024 and beyond. We are pleased to report that our strong trajectory continues into Q1 2024, underlining our confidence as we head into the summer season, with KPIs including an organic growth rate of +8.6%, an EBITDA margin of 6.1% and uninterrupted growth trends across the remainder of 2024 and beyond.

“Looking ahead, market conditions remain promising, supporting our commitment to deliver best-in-class execution and performance. Collectively, the commitment to and execution of our Destination 2027 strategy continues to deliver attractive growth in combination with resilience. Our industry offers prime exposure to travel and long-term consumption trends. Avolta stands out with a uniquely stable and global platform with more than 5,100 points-of-sale across 73 countries.

“The strength of our platform has also been recognised with Moody’s upgrading Avolta’s credit rating from Ba3 to Ba2 and Stable Outlook and S&P’s ratings increase in Q2 from BB to BB+ with a Stable Outlook. Both agencies acknowledged the strength of our business model and sustainable competitive edge in travel retail and F&B, as well as our successful deleveraging efforts of recent months.

“With a strong start in the first quarter and continued positive trends in the second, we confidently prepare for the upcoming summer season. 2024 holds great prospects, underpinned by highly attractive long-term global air passenger traffic trends, expected to double by 2042. The Avolta management team remains confident to deliver on 2024 and beyond. Journey On!”

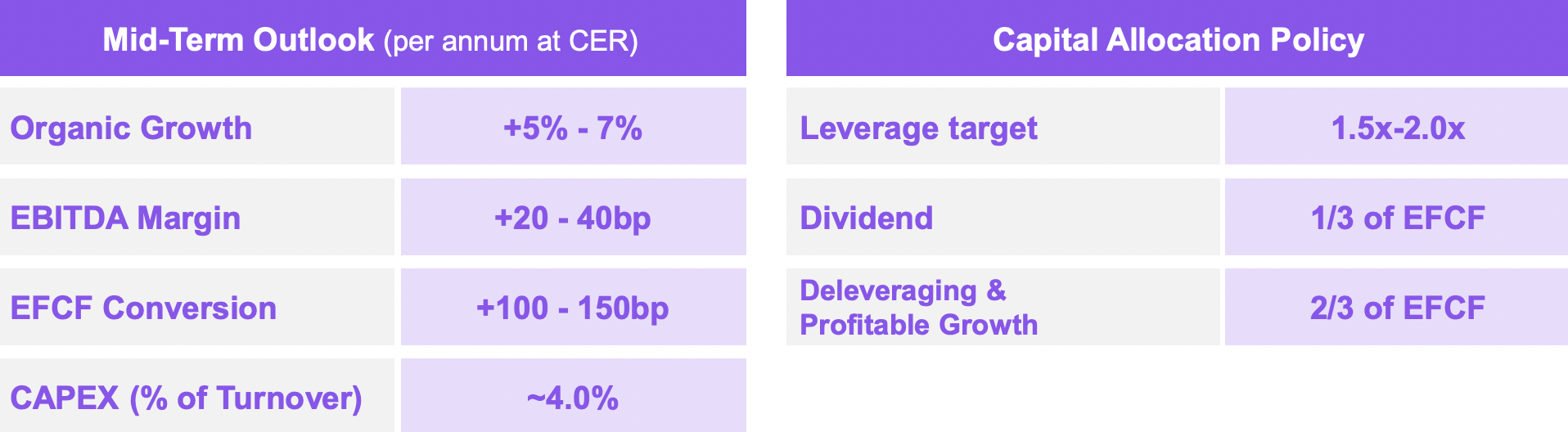

Over the medium-term, the company confirmed its previously announced core turnover growth target of +5% to +7% per year on average at constant exchange rates, and underpinned by Avolta’s global diversification. Beyond, Avolta is committed to deliver +20-40bps of core EBITDA margin improvement per year, and +100bps-150bps Equity Free Cash Flow conversion, with around 4% capex on core turnover a year.

As part of the Dufry-Autogrill business combination, Avolta reconfirmed its target of achieving full run rate synergies of CHF85 million in 2024, and integration related costs to reach CHF25 million during the year.

Assuming current exchange rates remain stable for the remaining part of 2024, Avolta said it expects 2024 currency translation to be at the lower-end of the previously communicated -2% to -3% range.

Regional performance: Europe, Middle East and Africa

Reported turnover reached CHF1,324.1 million, with core turnover of CHF1,269.9 million (US$1,410 million) representing organic growth of +11.7% year-on-year. The performance was mainly driven by the persistence of strong leisure demand, benefitting holiday destinations in Southern Europe (with Italy and Greece as stand outs) and Morocco. In addition, performances in the UK, Nordics and Central Europe were solid mainly thanks to the continued recovery of international traffic.

Avolta secured new wins and extensions in the region in Q1 2024 including a nine-year contract for 26 F&B stores at Sabiha Gökçen International Airport (Türkiye), a seven-year contract extension at Edinburgh Airport (UK) including +30% additional commercial space, and a new ten-year partnership with Cologne-Bonn Airport (Germany) with the award of 17 new F&B stores.

Avolta also expanded its presence in Bulgaria with an eight-year contract extension as Master Retail Concessionaire airside, including an additional six new stores at Burgas and Varna airports (Bulgaria), corresponding to 2,707sq m of retail space, as well as securing a seven-year concession at Belgrade Nikola Tesla Airport (Serbia).

New openings and significant store upgrades in the region included the following highlights; the opening of eight F&B stores in Helsinki (Finland), the launch of 12Oz store in Milan (Italy), the addition of proprietary brand Burger Federation in Düsseldorf (Germany), Yardbird’s opening in Zurich (Switzerland), the newest Jones the Grocer opening in Abu Dhabi’s Zayed International Airport (UAE), as well as the inauguration of Eataly at the Autogrill Motorway in Dorno (Italy).

North America

Turnover reached CHF973.6 million (US$1,080 million) with organic growth of +7.3% year-on-year. In the USA, growth across both travel retail and F&B was robust, underpinned by solid traffic trends and strong demand for the duty-free segment. Canada continued to benefit from the recovery of international traffic volumes.

Hudson opened its first duty-free store in Halifax Stanfield International Airport and a Hermès boutique at Vancouver International Airport in Q1, as well as introducing the locally inspired Bryant Park Market by Hudson to Terminal 5 at John F. Kennedy International Airport and numerous travel convenience and retail stores to Dulles International Airport.

In F&B, HMSHost opened Angie’s Subs at Jacksonville International Airport and Summit House at Calgary International Airport, and introduced a unique Chick-fil-A quick-service restaurant that serves both landside and airside travellers at Charleston International Airport.

Latin America

Turnover came in at CHF374.5 million (US$415.7 million) with year-on-year organic growth of +5%. Growth in Brazil, Chile, Colombia and Uruguay was solid thanks to international traffic recovery. This went someway to offsetting the negative trend in Argentina as a result of the unfavourable macroeconomic scenario. Mexico and Caribbean continued to experience strong leisure-driven demand.

Avolta grew its presence in the region in the first quarter, with the award of a new six-year duty-paid contract at Maceió-Zumbi dos Palmares International Airport (Brazil), as well as establishing an innovative collaboration agreement with Corporación America Airports, to elevate the airport retail experience in Uruguay.

Asia Pacific

Turnover reached CHF144.3 million (US$160 million) with year-on-year organic growth at +5.5%. Like-for-like trends remained solid, said Avolta, benefitting from the intra-regional traffic recovery (COVID-related travel restrictions were still in place in Q1 2023), and sustained leisure traffic towards main holiday destinations during the quarter. This like-for-like was partially offset by the ongoing contract portfolio optimisation in the region, it said.

During the quarter, Avolta expanded the company’s footprint in India to more than 100 stores with the award of a ten-year contract at the soon-to-be-opened Noida International Airport, adding eight new F&B stores to its portfolio.

Newly opened or refreshed stores in the quarter include the opening of a premium Bangalore Duty Free shopping experience, as well as Jones the Grocer and Royal Challengers Bangalore Sports Bar at Bangalore International Airport (India), the addition of a Diptyque boutique as well as a Wolfgang Puck restaurant and four Hudson stores at Shanghai Pudong Airport (China), Chongqing’s Chanel boutique (China), the opening of Hungry Jacks at Gold Coast Airport (Australia), as well as the opening of a Pizza Hut and two Ahh Yum stores, a local favourite, at Kuala Lumpur International Airport (Malaysia).