UK. BAA today announced a £51 million operating loss for the first quarter ended 31 March. This compares with a profit of £107 million for the same period a year earlier. Net retail income fell marginally, driven by a decline in per passenger income and a slump in car parking revenue.

The Ferrovial-controlled airport group said that results had been negatively impacted by costs related to the new Terminal 5, and increased security and maintenance costs in relation to programmes implemented to meet higher service standards.

Revenue from continuing operations was up +8.8% to £506 million. UK airports’ passenger traffic rose +0.9% to 32.3 million for the quarter while in Italy traffic at Naples rose +11.7% to 1.1 million.

|

Heavy competition for BAA’s car parking services hit net income in this key sector |

Encouragingly from a travel retail perspective long-haul traffic continued to outperform most other routes out of the UK, with Asian sectors some of the strongest. Traffic to and from China (including Hong Kong) was up by +12% year-on-year.

Net retail income per passenger slips

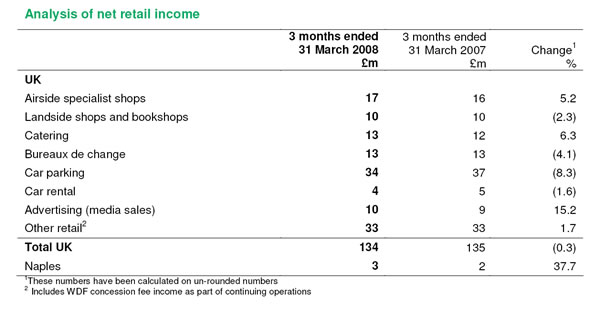

Underlying revenue for the period was affected by a number of factors, including the UK passenger increase, a +13.9% rise in average aeronautical charges per passenger and a -1.1% year-on-year decrease in UK airports’ net retail income per passenger to £4.18.

|

“Our operating profit was clearly affected by higher security and maintenance costs“ |

Colin Matthews Chief Executive BAA |

That drove a marginal decline in UK airports’ net retail income for the period to £134 million, down from £135 million a year earlier. The figure includes the World Duty Free concession fee income as part of continuing operations. The sale of World Duty Free Europe (formerly an in-house retail operation) to Autogrill was completed on 21 May.

BAA noted: “Overall net retail income, after adjusting for the revised treatment of the World Duty Free concession fee, remained consistent compared with the same time last year with a slight deterioration in net retail income per passenger.

“Enhanced brand offerings coupled with improved passenger service delivery combined to deliver growth for key in-terminal product categories. This helped to mitigate car parking performance which was impacted by increased competition at Heathrow.”

Net profit from discontinued operations of £523 million included the gain on disposal of World Duty Free Europe of £517 million.

Net debt stood at £7,418 million (31 December 2007: £6,955 million) with a gearing of 93%.

BAA Chief Executive Colin Matthews said: “BAA today reports good revenue growth for the quarter, driven by increased passenger traffic through our airports. Our operating profit was clearly affected by higher security and maintenance costs, reflecting the importance we place on delivering a safe and convenient service to passengers, through higher standards and better facilities.”

[comments]

Your post will appear – once approved – in The Moodie Forum on our home page

MORE STORIES ON BAA

Civil Aviation Authority calls for break-up of BAA airport portfolio – 26/05/08

World Duty Free becomes part of Autogrill as £546.6 million acquisition is closed – 22/05/08