UK. A strong retail performance buoyed revenues in Q1 at BAA (SP) Limited, the company that owns London Heathrow and Stansted airports.

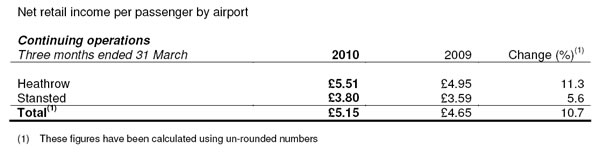

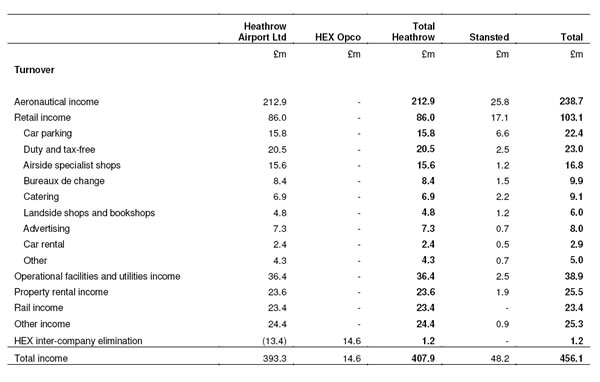

Gross retail income from continuing operations (excluding Gatwick) grew by +5.6% to £103.1 million. Duty and tax free revenues contributed £23 million, airside specialist shops £16.8 million and catering £9.1 million. Net retail income per passenger rose sharply (+10.7%), from £4.65 in the same period last year to £5.15 in Q1 2010.

Net retail income (NRI) per passenger at Heathrow rose by +11.3% to £5.51 while at Stansted the figure rose by +5.6% to £3.80.

|

Total revenue from continuing operations (i.e. excluding Gatwick Airport) climbed by +5.5% to £456.1 million, with passenger numbers increasing by +0.2% to 18.6 million across Heathrow and Stansted combined. Adjusted EBITDA (again, excluding Gatwick) rose by +3.3% to £174.1 million. Overall pre-tax losses narrowed from £316.2 million a year ago to £195.5 million in 2010.

At Heathrow, gross retail income increased +11.0% to £86.0 million (2009: £77.5 million) and NRI per passenger increased +11.3% to £5.51 (2009: £4.95).

|

BAA (SP) noted: “Most areas of the retail business performed well, with the main growth drivers being duty and tax-free shopping, airside specialist shops, catering and bureaux de change. Car parking showed increased stability following the recent period of weakness.

“Heathrow’s continued strong retail performance reflects the increase in the proportion of higher spending origin and destination passengers. This benefits both the in-terminal and car parking elements of retail income. The performance also reflects the greater numbers of passengers utilizing Terminal 4 following relocation of airlines prior to Terminal 2’s recent closure who are benefiting from its upgraded retail facilities completed as part of the terminal’s recent refurbishment.

“Further, growth in passenger spend has been particularly strong in the luxury segment of Heathrow’s airside retail outlets. In March 2010, Heathrow received a significant independent endorsement of the quality of its retail offering when it was the global winner of the Best Airport Shopping Award in the annual Skytrax World Airport Awards.”

Stansted’s gross retail income declined -0.6% to £17.1 million (2009: £17.2 million), which the company said was “a resilient performance given passenger trends which, in combination with lower retail expenditure, meant that NRI per passenger increased +5.6% to £3.80 (2009: £3.59).”

It added: “Car parking income continues to be affected by increased lower yielding advance bookings whilst other retail income has increased overall, driven by increased catering income benefiting from flight delays caused by severe winter weather in January.”

|

Click here to view the enlarged image (then hover over graphs with your cursor and click for full detail) |

BAA Chief Executive Colin Matthews said: “Heathrow and Stansted delivered a resilient financial performance during the first quarter. Operational performance in the quarter was robust despite enhanced security procedures, extreme winter weather and industrial action at our biggest airline customer. Heathrow’s traffic continues to perform well and the group achieved strong growth in net retail income per passenger.

“The rest of 2010 continues to present significant financial challenges for the industry as a whole. We currently estimate that the closure of Heathrow and Stansted due to volcanic ash will have a total impact on 2010 Adjusted EBITDA of £28 million. Our priority for the rest of 2010 remains the improvement of customer service and efficiency.”