Brown-Forman Corporation today revealed first-half results for the period ended 31 October, with net sales falling by -5% year-on-year to US$2 billion (flat on an organic basis). Operating income slipped by -7% to US$622 million (-3% organic).

Net sales in the travel retail channel declined by -5% (-3% organic) due to lower volumes of super-premium Jack Daniel’s expressions and Woodford Reserve, as well as the sale of Finlandia vodka last year. The declines in the channel were partially offset by growth of Jack Daniel’s Tennessee Whiskey and Diplomático rum.

Other key regions showed year-on-year net sales declines including the USA (-7%), Developed International (-5%) and Emerging (-3%) amid a soft consumer spending environment.

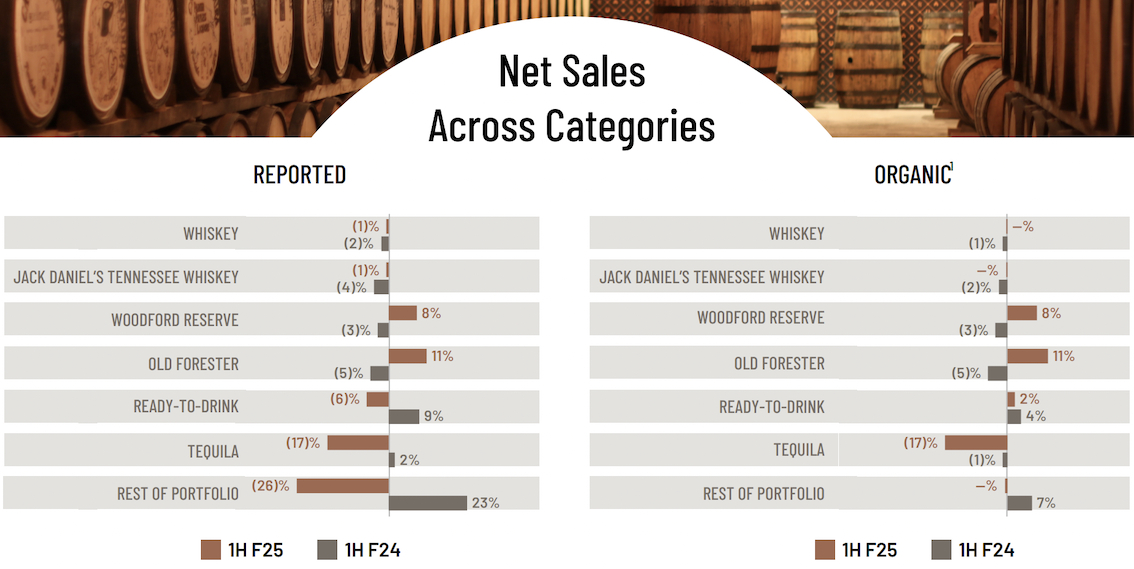

By category, net sales for whiskey products declined -1% (flat organic). Growth from Woodford Reserve and Old Forester in the US was more than offset by declines of the other super-premium Jack Daniel’s expressions, The Glendronach, and Glenglassaugh. Jack Daniel’s Tennessee Whiskey posted a -1% decline (flat organic).

Net sales for the tequila portfolio declined -17% (-17% organic) with ready-to-drink down by -6% and the rest of the portfolio sliding -26%. The latter was driven by the Finlandia and Sonoma-Cutrer divestitures along with lower volumes of Korbel California Champagnes in the USA. The decline was partially offset by a positive contribution from Diplomático.

Second-quarter reported net sales decreased -1% to US$1.1 billion (+3% on an organic basis) compared to the same prior-year period. In the quarter, reported operating income increased +1% to US$341 million (+5% on an organic basis). A +9% rise in Q2 earnings per share to US$0.55 was ahead of analyst expectations and buoyed Brown-Forman stock today.

For the full fiscal year, Brown-Forman said it anticipated a return to growth for organic net sales and organic operating income, driven by gains in international markets and the benefit of normalising inventory trends.

This outlook is tempered by a view that “global macroeconomic and geopolitical uncertainties will continue to create a challenging operating environment”. The company outlined the following expectations for fiscal 2025:

- Organic net sales growth in the +2% to +4% range.

- Organic operating income growth in the +2% to +4% range.

President and Chief Executive Officer Lawson Whiting said, “Despite challenging economic conditions, our results for the first half of the fiscal year were in line with our expectations, and we anticipate a return to growth in fiscal 2025. We continue to expect our performance to accelerate through the second half of the year.” ✈