INDIA. The Centre for Aviation (CAPA) has forecast potential spend of US$3.5 billion from duty free, other retail and food & beverage at Indian airports by 2021. The Moodie Report works closely with CAPA, which provides analysis and research into the global aviation market.

|

CAPA’s India Travel Retail Report, which was released this week, surveyed more than 7,000 passengers across 12 airports, and highlights the huge potential of travel retail in India. The report is published in collaboration with the Asia Pacific Travel Retail Association (APTRA). A special discount of US$2,500 off the official price is available to readers of The Moodie Report (click on icon for details).

CAPA estimates the value of airport-based duty free sales in India in 2010/11 at US$215 million, or less than 1% of the global total, yet India accounts for around 3% of global airport passenger traffic.

CAPA noted: “India’s underperformance in the duty free channel stems from a number of factors including a lack of good airport retail infrastructure, distribution complexities and a previously rigid investment policy.”

But it noted that considerable progress has been made. The growth of retail sales at the end of the past decade was strong, driven by the introduction of private capital for airport development and operations, the building of brand new airports plus terminal revamps, and more international airport operators and duty free retailers entering the market.

Between 2006 (when Delhi and Mumbai were privatised) and 2011 passenger numbers grew by +97%, but non-aeronautical revenue increased by +340%, of which retail was a key driver.

CAPA noted: “The benefits of maintaining the rapid uptake of shopping at airports are potentially large – to airports by way of an expanding revenue stream increasing returns on terminal investment and providing greater operational flexibility; to airlines as a means of limiting the increase in aeronautical charges; and to travellers by way of greater convenience, access to more goods at better prices, and an improved travel experience.”

|

Duty free spending at Indian airports today

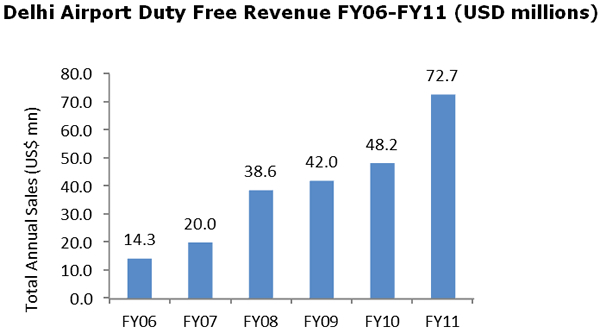

In 2011, duty free stores across India turned over an estimated US$215 million, with Delhi Airport leading the way at US$72.7 million, said CAPA.

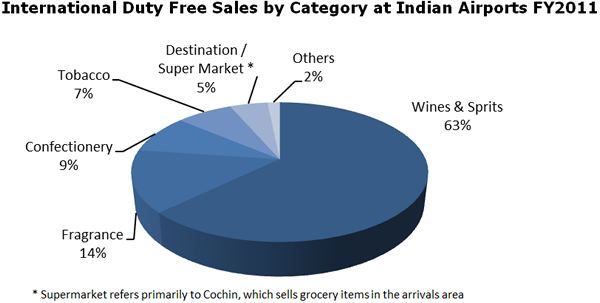

Liquor is the leading duty free category in India, accounting for 63% of sales (source: CAPA), compared with 17% globally (source: Generation Research).

|

At Delhi, duty free spend has increased +400% over the five years to FY2011, while the growth at Mumbai has been even faster off a lower base. Both airports are expected to continue to record growth above +20% to +25% per annum for the next few years.

CAPA said: “Retail represents a major addressable opportunity because more Indians are travelling, they are travelling more often and they have more money to spend when they do. A clear feature of recent duty free spending patterns in India, particularly for liquor, is that the sales of premium brands have outstripped regular products.”

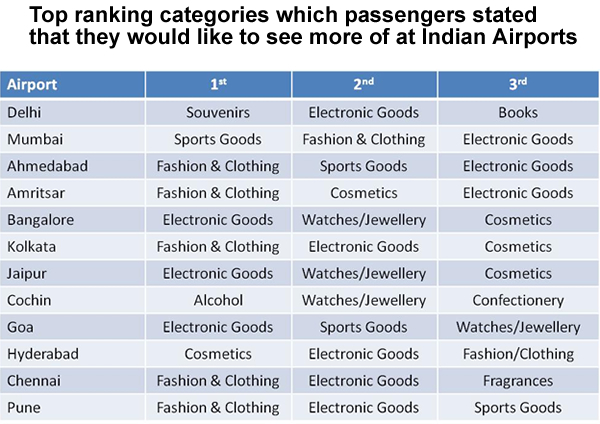

In terms of categories which passengers stated that they would like to see more of at Indian airports, the two most requested were electronic goods (which rated in the top three at eleven out of 12 airports) and fashion/clothing, followed by cosmetics, sports goods and watches/jewellery.

|

Indian nationals represent approximately 70% of international passengers travelling through Indian airports, and slightly less at most of the metro gateways due to the fact that foreign nationals are less likely to travel directly to the smaller cities in India.

Delhi Airport has the highest percentage of foreign nationals (this includes persons of Indian origin) at 43%, as it is the primary entry point for international tourists travelling to Agra and Rajasthan. The airport also serves the Punjab region which receives strong VFR traffic from the UK, US and Canada, a large proportion of whom hold foreign passports.

The relative proportion of Indian and foreign nationals has implications for the optimal retail product mix at airports, and the relative size of departures and arrivals stores, noted CAPA. Foreign visitors for example tend to seek more unique destination products and are more likely to shop on departure. In the survey, Delhi was the one airport where Souvenirs ranked strongly as a category that passengers would like to see better represented.

Even within the category of foreign passengers there are significant differences between the mix of nationalities, and there is a need to carefully research their respective preferences when deciding on the appropriate product offer, said CAPA. The mix is also evolving as visitors from Asian and other emerging nations are growing faster than the traditional markets.

Western Europe and North America are the two largest source regions for inbound visitors, but they are also the slowest growing with a CAGR of 6-8% over the five years from 2005 to 2010. Meanwhile arrivals from Asia are growing at almost twice the rate. Other markets such as Eastern Europe, the Middle East and Latin America are also showing strong growth but are much smaller in absolute terms.

|

Delhi Airport has a high percentage of passengers from Western Europe, followed by North America, whereas in the case of Chennai, the largest foreign passenger numbers come from South Asia (predominantly Sri Lanka) as well as there being a relatively higher percentage from Southeast Asia than at other metro airports.

|

Strong passenger traffic to drive retail expansion

CAPA projects strong continuing growth in Indian aviation and across virtually all Indian airports. International traffic is expected to achieve a CAGR of +9.9% over the ten years to 2021 to reach 96 million passengers, while domestic airport traffic is projected to grow even faster at +13.0% per annum to 356 million. By that stage India would be the third largest aviation market in the world behind the US and China. The Indian aviation sector is facing some short term challenges at present, but the underlying fundamentals remain strong, CAPA noted.

“Positive air traffic forecasts in turn raise the prospect of rapid growth in the retail sector resulting simply from increased passenger flows, even if there were to be no change in the share of passengers shopping on-airport or in the average value of transactions. But current spending levels are low by international standards.

“The real gains in airport retailing will be made when more passengers are encouraged to spend, and when the value of individual transactions increases. With per capita incomes in India expected to more than triple over the next 10 years, and McKinsey forecasting a far greater increase in the proportion of the population defined as being in middle or upper income classes, such a hypothesis seems highly likely.”

The Government of India is targeting sustained GDP growth of 8-9% per annum for the next two decades which would be transformational. In addition, the existence of a substantial grey and cash economy which is not captured in official data means that actual growth is higher than reported.

|

Potential for US$3.5 billion in airport spend

CAPA developed a model combining the passenger traffic projections, per capita incomes in different cities, the projected growth rate of their local economies and qualitative analysis of drivers of consumption to arrive at revenue projections for traditional duty free, domestic duty paid, general retail and food and beverage. Total passenger spend is estimated to have the potential to reach US$3.5 billion by 2021, of which traditional duty free could grow to US$1.55 billion, up from US$215 million in 2011.

Within the traditional duty free segment, liquor is projected to remain the largest single category, although its share is expected to decline to 43% (down from 63% today). Combined with a large share of the duty paid revenue, Indian airports could see liquor sales of over US$800 million per annum by 2021. Beauty products and fragrances are projected to see growth of 16 times.

It should be noted that of the US$3.5 billion forecast, close to 70% is projected to be generated at the Public-Private-Partnership (PPP) airports of Delhi, Mumbai, Bangalore, Hyderabad and Cochin. These airports already have a strong demonstrated commercial orientation which increases the likelihood of them achieving their potential, said CAPA.

Delhi Airport has the greatest prospects to establish itself as a hub airport attracting large flows of transfer traffic, in which case it could even exceed the projected spends. However, this will be highly dependent upon the ability of Indian carriers to develop effective global networks.

CAPA added: “Whether the rest of the airports in the country, which are operated by the state-owned Airports Authority of India (AAI), can achieve their unconstrained potential is less clear and is subject to a number of factors such as the ability to introduce a stronger commercial focus at the management level of the airports; construction of sufficient capacity to meet demand and the allocation of bilaterals for services to non-metro airports. The AAI’s track record in retail development lags the PPP airports, with average duty free spend per passenger of US$3.05, compared with US$7.08 at PPP airports. It therefore faces a challenging task if it is to catch-up.”

The downside risks are less in the case of Chennai and Kolkata than at the smaller non-metro airports, but even here CAPA said a more aggressive commercial approach by the AAI was required.

“The projection of US$1.1 billion for the AAI airports could therefore be considered to be an optimistic scenario if a number of factors align as described above. However, if the AAI is able to leverage this potential it stands to be one of the greatest beneficiaries of the travel retail phenomenon. The net income generated from a possible US$1.1 billion in gross retail spend could transform the financial status the authority and help to fund its massive capex requirements.”

Conclusion

There are exciting opportunities for growth in the airport retail sector in India, concluded CAPA. Provided the regulatory environment is right and the necessary airport and airline investment take place, growth in Indian aviation is “inevitable” it said. Accompanying that with profitable, sustainable retail growth offers the opportunity for increasing the commercial viability of the sector and enhancing the travel experience. But this requires an informed and considered approach if travellers are to be converted to shoppers.

The CAPA study found that the key challenge for retailers and brands will be to understand that the Indian consumer is diverse in terms of income levels, travel experience and tastes, and that this is further complicated by rapidly changing socio-economic influences. Detailed research about the consumer must be central to the planning, design and development of retail formats, it noted.