CHINA. China Tourism Group Duty Free (CTGDF), the parent company of world number one travel retailer China Duty Free Group (CDFG) announced solid financial results for Q1 2022 and full-year 2021 on Friday after the market closed.

However, March’s performance was hit hard by the Omicron-variant COVID breakout in China with Q2 certain to be heavily influenced by concerted efforts to curb infections in key Hainan traveller-source destinations such as Shanghai and Beijing.

The full-year performance confirms the strong preliminary results announced in January. Most interest therefore centres on the Q1 showing and the impact of the travel restrictions that affected Hainan from March.

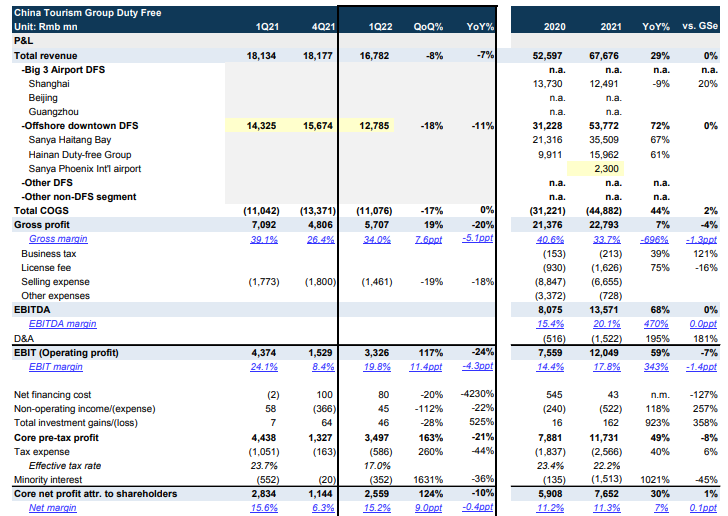

Net profit for the quarter reached RMB2.56 billion (US$393.8 million). That indicated a March profit of just RMB163 million (US$25.1 million) Goldman Sachs Equity Research pointed out in a note, based on January-February’s RMB2.4 billion (US$369.2 million result).

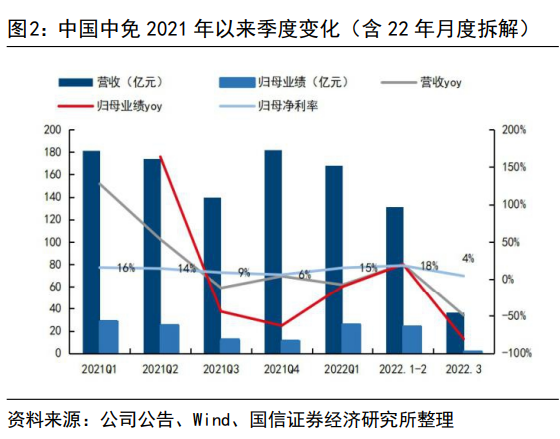

Group revenue dropped sharply from RMB13.1 billion (US$2.0 billion) in January and February combined to just RMB3.7 billion (US$569.1 million) in March.

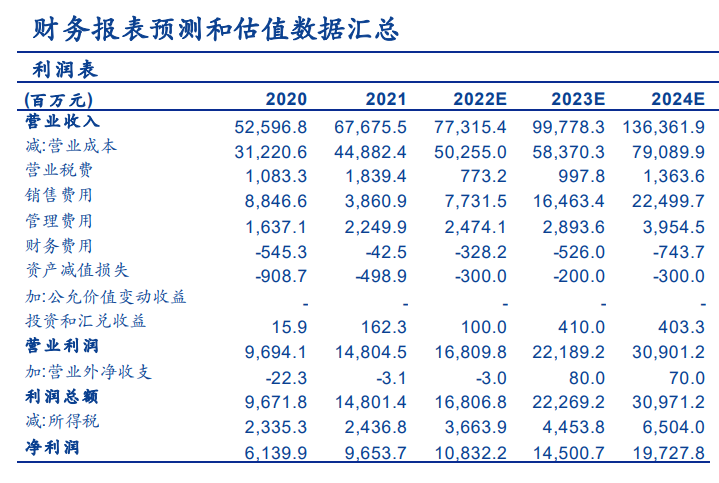

Analyst reaction was widely favourable with multiple reports highlighting a likely second-half improvement and a rapid strengthening of the group’s online operations.

Chinese state-owned financial services company Guosen Securities commented: “The operation in 2022 Q1 had its ups and downs. It recovered well from January to February, but it was obviously under pressure from the pandemic in March.

“The short-term epidemic still affects company owners’ business operations. The Sanya store was closed for several days in April due to the impact… and short-term revenue and profit pressures exist. However, in the second half of this year the pressure on the base is expected to gradually ease.”

The agency maintained its Buy rating.

Chinese investment bank BOCI said: “The uncertainty of the short-term epidemic is still there, but the company actively responds with flexibility supplemented by online business, relying on policy support, and building new stores…. after the current weakening, the company’s medium and long-term operation is still expected to be optimistic.”

Essence Securities commented: “Looking ahead to Q2, the impact of the epidemic still needs to be tracked as since April the national epidemic situation is still at a high level. It is serious in Sanya’s traditional source areas of passenger flow such as Shanghai and Jilin, and other areas are also affected. There are sporadic cases and the national epidemic prevention and control measures are still relatively strict, which will inevitably affect the flow of passengers to Hainan.”

Net margin recovered strongly in Q1 adding +9 points quarter-on-quarter to 15.2% (vs. 8.9%/6.3% in Q3 and Q4 2021) – back to the levels of H1 2021. Gross margin also rebounded by +7.6 points quarter-on-quarter to 34% (vs. 26.4% in Q4 2021).

Goldman Sachs said that effect was consistent with management’s earlier comments that margin should have bottomed last year due to a new focus on profitability. This has been achieved by scaling back promotional activities and “irrational” competition in consensus with other Hainan duty free retailers.

Maintaining a ‘Buy’ recommendation, key Goldman Sachs takeaways included:

• Duty free sales weakness likely to persist in April due to store closures (nine days in April).

• Sunrise Shanghai’s online sales also affected since mid-March due to city lockdown and supply chain disruptions.

• Ongoing focus to drive more online sales to compensate the impact of COVID-19 outbreak on Hainan, including advertising partnerships with social media platforms such as Douyin to boost consumer awareness of CDFG’s product offerings and prices. Enhanced online range.

• Haikou International Duty Free City on course for September 2022 opening; Haitang Bay phase 2 for late 2023

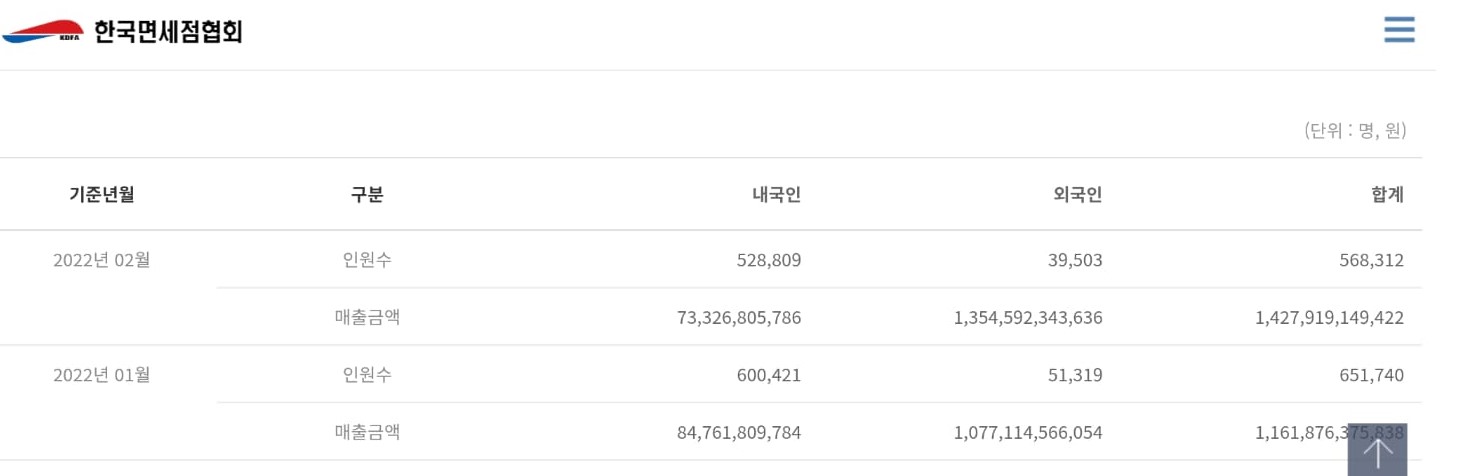

• Hainan duty free prices more competitive vs. South Korea as brand owners are allocating more products to China. This has resulted in sales gains vs. Korea. According to the Korea Duty Free Association, duty free sales to foreigners fell -9% year-on-year to just over US$2.0 billion in the first two months of 2022 while Hainan’s duty free sales rose +33% year-on-year in the same period to RMB12.9 billion – again, circa US$2.0 billion.

Coming soonThe Moodie Davitt Report is delighted to announce the launch of 穆迪达维特中国旅游零售报告 – The Moodie Davitt China Travel Retail Report, a digital magazine dedicated to our industry’s hottest market. The new digital title, to be launched in April, will be published in Mandarin and English four times a year across multiple platforms.  This exciting new digital magazine from the world’s leading travel retail publisher will focus on all aspects of China’s travel-related ecosystem, including:

To subscribe, please email Kristyn Branisel at Kristyn@MoodieDavittReport.com For advertising and sponsorship enquiries please contact Irene@MoodieDavittReport.com or Sarah@MoodieDavittReport.com. For all editorial enquiries please contact Martin Moodie at Martin@MoodieDavittReport.com |