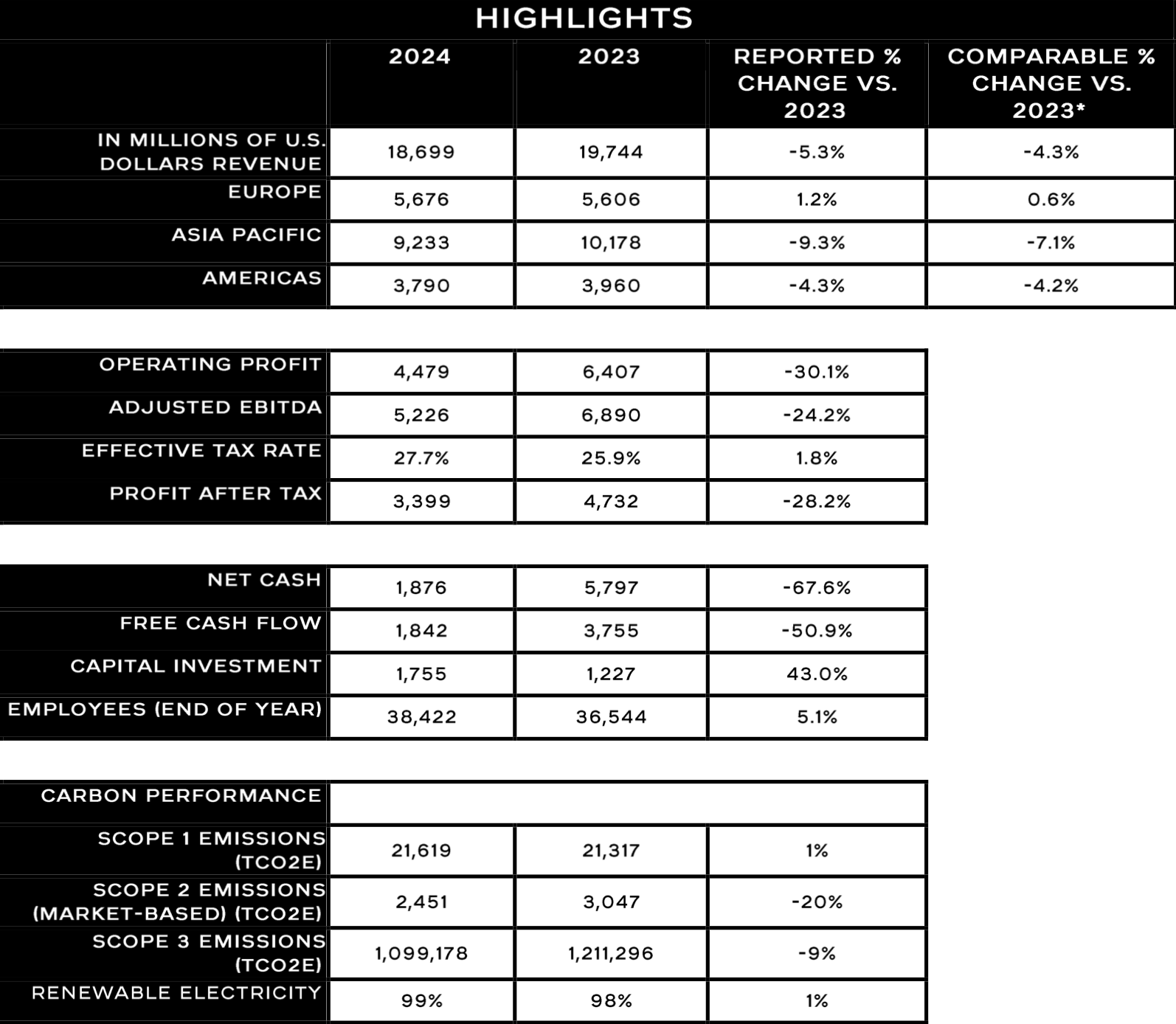

French luxury to beauty house Chanel today reported annual results for 2024, with sales declining by -4.3% year-on-year to US$18.7 billion.

The key regional dynamic was the performance of Asia, where sales slipped by -7.1% to US$9.2 billion amid a slowdown in the luxury business in China. Europe tracked ahead of trend, with +0.6% growth in sales, while sales in the Americas fell by -4.2%.

Notably, the Fragrance & Beauty division was driven by makeup and skincare, with the company citing a “strong performance in travel retail”.

The fashion category “experienced a more challenging context in Mainland China, but this was partially offset by strong performance in Japan and Europe,” said a statement.

The Watches and Fine Jewellery arm delivered “dynamic growth,” said Chanel.

Operating profit fell by -30% year-on-year to US$4.48 billion, with profit after tax down by -28.2% to US$3,399 billion.

Chanel increased capital expenditure by +43% to a record US$1.76 billion in 2024 and plans a similar level of investment in 2025. In a statement, Chanel also highlighted its free cash flow of US$1,842 million, combined with a strong balance sheet.

Global CEO Leena Nair said: “Following a period of exponential growth, in 2024 we saw challenging macroeconomic conditions which had an impact on sales in some markets. As a 100-year brand, we expect ebbs and flows. Our philosophy has always been to act with a long-term view, propelled by the singularity of the Chanel brand.

“Last year, we invested record high levels in our boutique expansion, client experience and creative ecosystem and savoir-faire. 2024 was another year of exceptional creation across the House, from the spellbinding Métiers d’art show at Hangzhou’s West Lake – our most viewed show ever – to our first Maison de Beauté in Passy, Paris and new dedicated Watches and Fine Jewellery flagship boutiques in New York and Taipei.”

Global Chief Financial Officer Philippe Blondiaux said: “Last year was a period of record investment, where we prioritised real-estate acquisition, enhanced client experience and savoir-faire, and advanced our sustainability ambition.

“While increasing investment by over +40% to US$1.8 billion, maintaining high levels of brand support activities at more than US$2.4 billion and investing continuously in our people had a direct impact on profitability, at Chanel we take a long-term view in everything we do.

“Aligned with this approach, we have maintained a very solid financial structure and balance sheet, key to underpinning Chanel’s strong brand equity for the future.

“In 2024, we expanded our global footprint with new boutique openings in prime locations, including the iconic Fifth Avenue in New York, Nanjing, Chengdu, and Tokyo. In 2025, and beyond, we will maintain the momentum to invest significantly in our worldwide distribution network. This will mean further expansion into markets such as India and Mexico, as well as new boutiques in Mainland China, Japan and Canada, to continue to deliver the ultimate client experience.”