China Duty Free Group Cruise Services (CDFCS) has its sight set on becoming a major onboard retail force in Asia’s burgeoning cruise line sector. This year is a particularly exciting one for CDFCS, a subsidiary of the world’s number one travel retailer China Duty Free Group, thanks to the impending launch of Adora Magic City, the first China-made large cruise ship.

Passengers are set to experience an unprecedented shopping experience, as Martin Moodie discovered in a recent interview with China Duty Free International General Manager Zhao Feng; China Duty Free International Deputy General Manager Celine Qiu, and China Duty Free International Ltd Director Channel Management and Director & Deputy General Manager China Duty Free Cruise Services Ting Yao.

It’s five years since China Duty Free Group (CDFG) entered the cruise retail business, The group’s dedicated subsidiary China Duty Free Cruise Services Co., Limited (CDFCS) has developed strongly and its prospects are particularly bright.

That’s the message from China Duty Free International (CDFI) General Manager Zhao Feng and China Duty Free International Deputy General Manager Celine Qiu as they look forward to the most exciting development in CDFCS’s history – the early 2024 launch of Adora Magic City, the first China-made large cruise ship.

Speaking to The Moodie Davitt Report at CDFI offices in Hong Kong’s Wan Chai district, they say the launch consolidates an already strong relationship with Adora Cruises (formerly CSSC Carnival Cruise Shipping), with which it runs stores onboard Mediterranean and Costa Atlantica.

CDFCS also manages the retail offer onboard Astro Asia’s Piano Land (named after the Chinese island of Gulangyu, off Xiamen) and has high hopes of expanding its portfolio rapidly in the future.

Creating retail magic at sea

“The Adora Magic City duty free store will be our flagship store at sea,” says Zhao Feng. “We have invited a number of luxury brands onboard, some of which are joining us at sea for the first time.

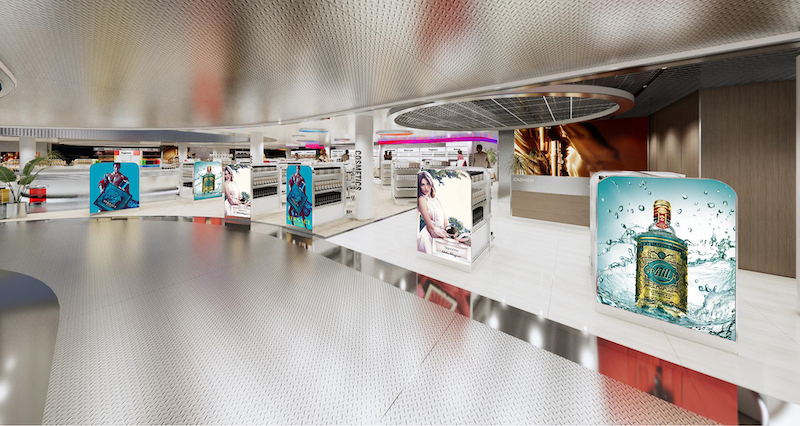

The ship, which was undocked in Shanghai in June, will feature what she calls “a trendy, state-of-the-art” shopping centre of approximately 2,000 sq m, the largest one of its kind at sea in China.

The shopping offer will encompass world-renowned designer brands, fine watches, jewellery, high fashion, beauty products and fragrances. Importantly, too, it will also include a dedicated shopping zone showcasing unique ‘China-chic’ brands as well as popular and creative cultural products.

Strong market rebound

CDFCS is confident of picking up where it led off before the COVID-19 crisis. Before 2020 the Chinese cruise travel market had witnessed an annual average growth rate of +40% in passenger numbers. At that point, China’s annual cruise travel population was expected to reach 10 million in 2030 – making it the world’s biggest cruise market. So how has the sector bounced back since COVID?

“The cruise industry is still in its early days in terms of recovering from the pandemic,” says Qiu. “Major international cruise lines plan to resume full operations in early 2024, while domestic cruise lines are expected to kick start full operations by the fourth quarter of this year.

“While we do not have any concrete figures at the moment, we are very optimistic. Once we resume full operations, the market is expected to rebound quickly and grow robustly.

“We believe the long-term outlook for the cruise business in China remains very promising, despite the challenges posed by the pandemic and the restrictions on international travel. We see customers from different generations wanting to come onboard to experience cruise journeys.

“Apart from the traditional sector, like families and senior people, now we see more Generation Z consumers seeking the cruise experience. We are seeing a lot of repeat customers, just as you do in the States and in Europe.

“Once people have this experience they become addicted to it, and they will just keep on trying different itineraries with different cruise lines. That’s why I think the future is very optimistic, and we believe the growth will remain very strong and the bounce will be robust.”

The growing diversity of the customer base is borne out by the numbers, which show 0-24 years old representing 14% of total passengers; 25-44 30%; 45-64 37% and over 65 19%. “So the majority will be 25 to 64 with the middle-age group, between 45 and 64, the most popular group for us,” says Ting Yao, China Duty Free International Ltd Director Channel Management and Director & Deputy General Manager China Duty Free Cruise Services.

Zhao Feng points out that China is already the world’s second-largest cruising nation after the US, and has been developing its domestic cruise industry for 15 years. Major domestic cruise companies are investing heavily in building new ships and are striving to create attractive itineraries, she says.

Asked to describe CDFSC’s mission and vision, she replies: “In our duty free business, we are committed to providing cruise passengers with a unique and memorable shopping experience onboard. We see that as an essential part of the wider cruise experience. We also want to make our contribution to the ecosystem of the cruise industry.”

Given that the Chinese cruise sector is still relatively young, consumer trends in terms of shopping onboard are evolving constantly. So how do Chinese cruise passengers view shopping in terms of the overall cruise programme?

“Chinese consumers are often looking for a unique shopping experience on a cruise, buying not only the product but also the memory or the emotional value that the products bring,” Qiu responds.

“I think shopping is actually one of the most crucial parts of their cruise journey. Normally the cruise lines are homeported in the eastern part of China, so wherever they go, there will definitely be one or two days out on the high seas.

“During those times the crews offer a lot of entertainment, food & beverages and so on but as you know the Chinese have a very strong gifting culture. They can also enjoy attractive savings on shopping. And with up to four days onboard, the dwell time means they have many chances to enter our shops.”

Seniors, such a key consumer segment, are particularly consistent buyers, Qiu observes. “They always want to bring something home as a gift to their family so the shopping onboard is extremely important to them. They are looking for something unique – not just the product but also the memory and the experience.

“That’s why we offer not only the merchandise but also a lot of interactive activities. For example, wine tasting, watch and jewellery workshop, beauty consultation and makeup demonstration.”

While not revealing numeric details, Qiu says CDFCS is deeply committed to developing its cruise business. “The partnership with Adora Cruises is the best example of our expansion of our maritime network and duty free portfolio,” she says. “We will keep expanding our cruise retail horizon as Chinese consumers continue to have a strong appetite for both high-quality travel and products.”

The group benefits from a deep understanding of multiple Chinese consumer demographics thanks to the constant studies it conducts in heavy-traffic locations such as Sanya and Haikou. This produces crucial information on category and brand preference by province of origin, age group, gender and so on.

Discussing the differing mix onboard relative to downtown and airport stores, Zhao observes: “As cruise passengers tend to have plenty of time on their hands, we take an experiential approach to the services we offer our customers. For example, we offer more jewellery and watches than FMCG compared to airport and downtown duty free stores.”

Asked if she has any closing message for brand or cruise line partners, Zhao says: “We believe there are broad development prospects as the market shifts from traditional tourism to high-end holiday tourism and cruise tourism. We invite all world-renowned designer brands to join us in creating an inspiring cruise holiday experience for our customers.” ✈

This article first appeared in The Moodie Davitt China Travel Retail Report, click here for access.