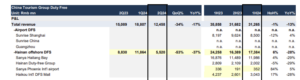

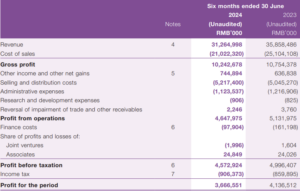

CHINA. China Tourism Group Duty Free Corporation Limited (CTG), parent company of China Duty Free Group (CDFG), posted a -12.81% year-on-year decrease in revenue to RMB31.265 billion (US$4.41 billion) for the six months ended 30 June.

The fall was due mainly to a sharp decline in Hainan offshore duty-free sales. This stemmed from a combination of soft spending and an unflattering comparison with the pre-daigou crackdown months of January-April 2023, which kicked in from May that year.

The results, announced after close of trading on Friday 30 August, were in line with preliminary results released on 12 June.

China Tourism Group Duty Free Corporation Limited is immediately controlled by China Tourism Group Co and ultimately by the State-owned Assets Supervision and Administration Commission of the State Council of the PRC.

First-half profit from operations decreased -9.43% year-on-year to RMB4.648 billion (US$654.6 million).

Gross profit margin of the group’s principal business was 32.94%, up by 2.62 percentage points year-on-year.

Key talking points

Travel sector rebound

Since 2024, China’s inbound and outbound travel market has been recovering rapidly, CTG said. According to National Immigration Administration statistics, 287 million exit-entry travellers were inspected in the first half, a +70.9% increase year-on-year and a recovery to 83% of the same period in pre-pandemic 2019.

According to the Ministry of Culture and Tourism, the number of H1 domestic trips rose +14.3% year-on-year (Q1 +16.7%; Q2 +11.8%) to 2.73 billion with related expenditure climbing +19% to RMB2.73 trillion (US$383 billion).

China Chic

Promoting Chinese products became an intensified focus during the reporting period. The company promoted the overseas expansion of China Chic brands by signing a strategic cooperation agreement with the Jinjiang Municipal People’s Government.

CDFG introduced an array of China Chic brands across multiple categories, including perfume & cosmetics, home appliances, food & beverage, healthcare, and mother & child items during the period.

Hainan challenges

According to the Hainan Provincial Bureau of Statistics, the passenger throughput of Hainan’s ports and airports from January to June 2024 reached 35.68 million, up +9.1% year-on-year. Of these, 18.61 million were passenger departures, a +10.7% increase.

However, Hainan’s tourism market revealed an uneven growth trend whereby the northern part of the island proved more popular than the south. H1 passenger traffic at Sanya Phoenix International Airport fell -3.2% year-on-year to 10.89 million whereas Haikou Meilan International Airport in the north posted a +20.3% gain to 14.49 million.

The offshore duty-free market in Hainan faced pressure on sales during H1, CTG said. According to Haikou Customs, first-half offshore duty-free sales fell -29.9% to RMB18.46 billion (US$2.60 billion). The number of duty-free shoppers declined by a lower -10% to 3.36 million, indicating that spend had softened significantly.

In the second half of 2024, CTG pledged to “stabilise” the Hainan offshore duty-free business.

Potential risks

In a reference to the new pre-departure duty-free shopping policy to be introduced on 1 October, CTG noted new licences on the Mainland will be determined by open bidding while “competitive negotiation” will govern Hainan’s off-shore duty-free sector.

“The duty-free industry in China has entered an orderly competition stage,” CTG said. “In the face of increasingly fierce market competition, the Company will focus on its principal business (i.e. duty-free travel retail), major projects and key markets, strive to improve core business capabilities, strengthen refined management, continuously enhance endogenous and exogenous development momentum, and comprehensively create a new pattern for the development of travel retail.”

Stiffening market competition

“The competition in the industry has become increasingly fierce. Many domestic enterprises have applied for duty-free operation permits, and foreign duty-free giants want to take a share from the duty-free market in China,” CTG commented.

“The intensifying market competition has brought uncertainties to the Company’s sustainable development.”

CTG pledged to deepen its existing advantages to create a competitive edge through online and offline integration, while continuing to promote centralised procurement to enhance bargaining power in buying. It also promised an enhanced development of new product lines. ✈