SOUTH KOREA. Bidding closes tomorrow (28 February) for the duty free contracts on offer at Incheon International Airport Terminals 1 and 2.

Pre-pandemic, Incheon International Airport historically ranked as one of the world’s two biggest airport duty free sales locations, alongside Dubai International Airport.

Sales were devastated, however, by the COVID-19 crisis. The total Korean duty free market reached just US$13.8 billion last year, down by -11.5% year-on-year (largely due to a decline in downtown sales) and representing a -35.4% slump compared with record revenues in 2019 of US$21.3 billion.

As reported, China Duty Free Group (CDFG), the world’s number one travel retailer according to The Moodie Davitt Report’s annual sector rankings, is among the contenders.

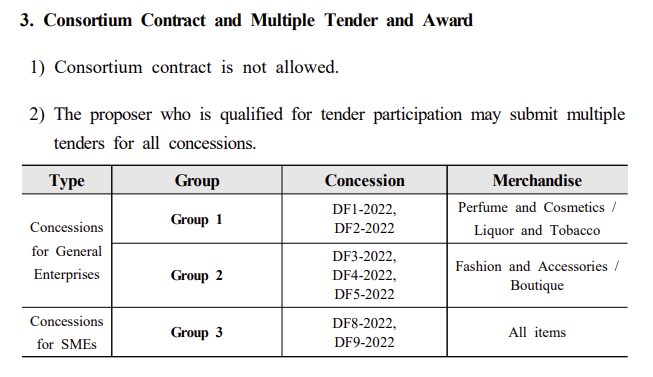

The Moodie Davitt Report understands that CDFG will bid on at least two of the concessions – one covering cosmetics, perfumes, liquor and tobacco, another featuring fashion and luxury boutiques.

CDFG will face strong local rivalry for the contracts set aside for big corporations from Korean giants Lotte Duty Free and The Shilla Duty Free. The Republic’s next biggest players, Shinsegae Duty Free and Hyundai Duty Free, may also bid though both (in common with Lotte and Shilla) are under much financial pressure due to tough market conditions {look out for our report on the dramatic upheaval in the all-important daigou channel, coming soon} and onerous existing contracts at Incheon Airport.

CDFG’s deep pockets and unrivalled knowledge of the Chinese consumer – historically the most important spending group in Korean duty free – makes it a formidable adversary for the local giants.

CDFG’s deep pockets and unrivalled knowledge of the Chinese consumer – historically the most important spending group in Korean duty free – makes it a formidable adversary for the local giants.

If successful, CDFG would become the first foreign retailer to hold a duty free contract at Incheon International Airport since incumbent DFS Group was ousted in the 2007 tender. DFS had won a five-year concession with a two-year extension, operating from when Incheon opened in 2001.

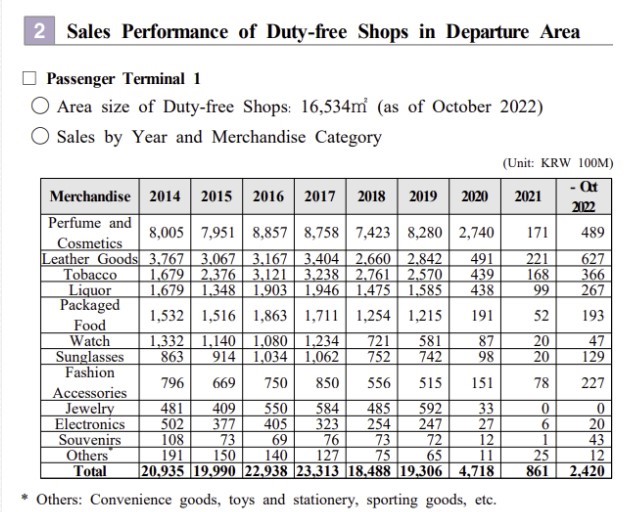

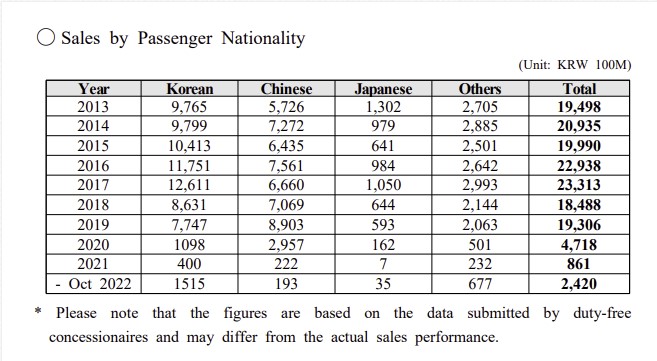

Chinese shoppers overtook Koreans as Incheon International Airport Terminal 1’s leading spenders by total sales in pre-pandemic 2019, representing more than 46% of revenues, ahead of Koreans with 40%.

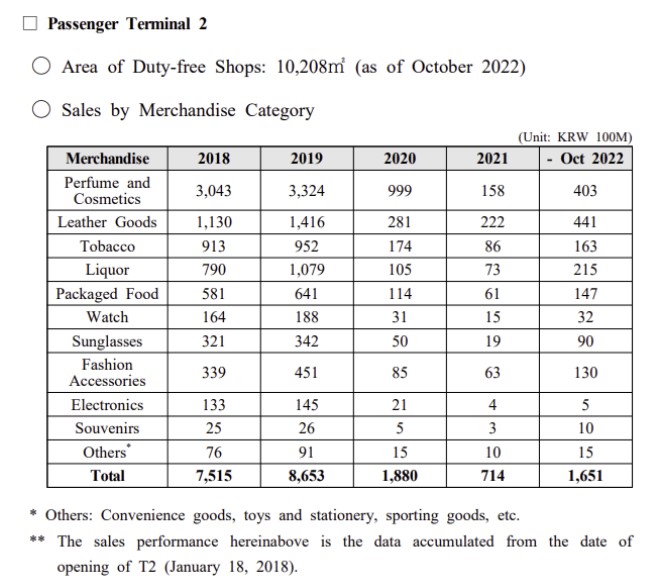

In Terminal 2, home to national carrier Korean Air, Chinese customers generated 31.7% of sales in 2019 compared with 53.2% by Koreans.

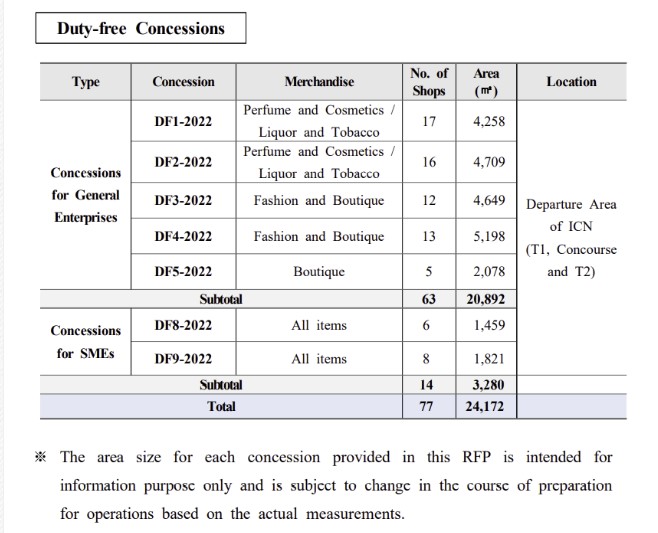

Incheon International Airport Corporation is offering seven business licences (five general licences covering 63 stores, and 20,842sq m of space) to big companies and two small and medium-sized licences (embracing 14 stores and 3,280sq m). ✈

Note: The Moodie Davitt Report is the industry’s most popular channel for launching commercial proposals and for publishing the results. If you wish to promote an Expression of Interest, Request for Proposals or full tender process for any sector of airport or other travel-related infrastructure revenues, simply e-mail Martin Moodie at Martin@MoodieDavittReport.com.

We have a variety of options that will ensure you reach the widest, most high-quality concessionaire/retailer/operator base in the industry – globally and immediately.

The Moodie Davitt Report is the only international business media to cover all airport or other travel-related consumer services, revenue-generating and otherwise. Our reporting includes duty free and other retail, food & beverage, property, passenger lounges, art and culture, hotels, car parking, medical facilities, the Internet, advertising and related revenue streams.

Please send relevant material, including images, to Martin Moodie at Martin@MoodieDavittReport.com for instant, quality global coverage.