A -3.5% year-on-year sales decline in the China & Travel Retail business to ¥342.2 billion (US$2.2 billion) weighed on Shiseido Group’s full-year results for 2025.

The downturn reflected subdued consumer spending by Chinese travellers in both domestic and overseas markets, the Japanese beauty products group said in posting the results on 10 February.

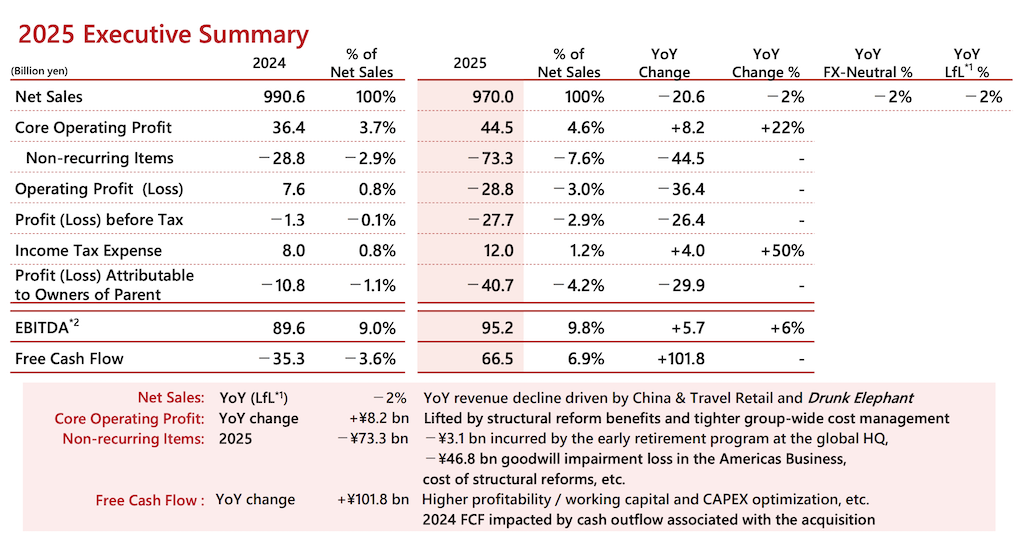

Group net sales slipped -2% year-on-year to ¥970 billion (US$6.25 billion).

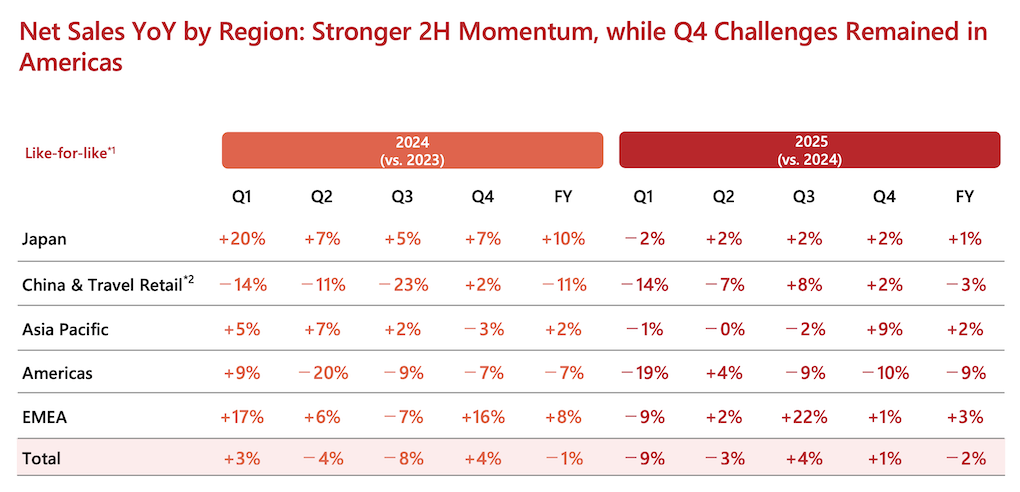

While China & Travel Retail sales fell by ¥15.5 billion (US$99.8 million), the rate of decline narrowed as the year progressed (see table directly below) thanks to prestige brand performance. As reported, Shiseido Group combined its China and Travel Retail business segments in March 2025.

Japan’s domestic and travel retail performances were hit in December by the escalating row between the Japanese and Chinese governments prompted by Prime Minister of Japan Sanae Takaichi’s inflammatory comments on Taiwan (see panel below). Beijing has since applied a series of retaliatory measures, including restricting travel to Japan.

Escalating Japan v China political row to have “inevitable” 2026 travel retail impactAsked on an earnings call about the ongoing negative effect of recently soured relationships between Japan and China, Shiseido Group President and CEO Kentaro Fujiwara responded: “The impact began in December last year. For Mainland China, in terms of last year’s result, there was a little impact on the results in December as Double 11 had just ended, but since the sales in December are normally rather small, there’s not really a significant impact on FY2025 sales. “As for January, naturally, the inbound tourists are declining, so the travel retail Japan impact is inevitable. However, if we take a look at the details, the drop in sales from Chinese tourists is not purely reflected in sales. On the contrary, we are offsetting that impact by shifting our investments towards non-Chinese tourists.” According to an article in The Japan Times yesterday (19 February – see below), the decline in Chinese visitors to Japan accelerated sharply in January, fuelling the first monthly drop since COVID-19 restrictions were lifted. The publication noted that Chinese tourists have been the backbone of Japan’s post-pandemic recovery, accounting for about a fifth of tourism revenue in 2025. Yesterday’s report, quoting Japan National Tourism Organization figures, said arrivals from China shrank -61% year-on-year compared with a -45% decline in December, noting a shift in the timing of the Lunar New Year holiday and Chinese warnings against travel to Japan. “Another point is that since more travellers are visiting Hainan island, the market environment there is actually improving. So, it depends on where the travellers are going, and we need to steadily capture that opportunity. By doing so, we will be able to mitigate the impact to some extent.” Healthy inventory levels in Hainan; need to reduce unauthorised salesFujiwara added: “While the travel retail market remains challenging, signs of recovery are emerging in Hainan island. Our customer purchases fell in the mid-teens, but the year-on-year decline narrowed. Meanwhile, net sales remained positive in Q4 for the two consecutive quarters. Healthy inventory levels are maintained and we will continue to manage them appropriately.” In order to continue to pursue what he called “quality growth”, Fujiwara said the group needs to reduce inventory for unauthorised sales. “For China, we will control unofficial or irregular sales, so we have to put more effort for that, while at the same time pursuing high growth. “So we will be aiming to deliver higher growth in other regions and that will offset the situation in the travel retail market, landing at about +3% growth overall which seems to be achievable as a target.” |

Group-wide momentum improved in the second half, with H2 sales rising +2% year-on-year.

Group-wide momentum improved in the second half, with H2 sales rising +2% year-on-year.

Core operating profit reached ¥44.5 billion (US$286.8 million), exceeding the company’s initial plan of ¥36.5 billion (US$235.2 million) and marking the first time in four years that Shiseido has met its original full-year target.

Profit attributable to owners of the parent company declined to a net loss of ¥40.7 billion (US$262.2 million). This was primarily due to a ¥46.8 billion (US$301.5 million) goodwill impairment in the Americas business. The EBITDA margin was 9.8%.

“Our excessive reliance on the Chinese market has been steadily and irreversibly corrected, as intended,” commented Shiseido Group President and CEO Kentaro Fujiwara.

“Despite challenging conditions, our China & Travel Retail Business has steadily strengthened its profitability through cost structure reforms, maintaining high margins. We are now positioned to translate future market recovery into sustained profit growth.

“Furthermore, in Japan, EMEA, Americas, Asia Pacific and at the global headquarters, we have significantly improved profitability through the correction of a high fixed-cost structure and through cost efficiency. As a result, we are now transitioning to a more globally balanced structure in terms of both sales and profits.”

He added: “In 2025, despite reduced profits in China & Travel Retail, we achieved robust profit growth for the entire group, driven by increased profits in other regions, particularly Japan. We view this as clear evidence that our regional diversification has begun functioning not merely as a risk mitigation, but as a device for stable profit grow.”

Shiseido Group Chief Financial Officer Ayako Hirofuji commented: “Throughout this past year, our business has focused on improving both our revenue structure and capital discipline, establishing a solid financial foundation capable of consistently generating profits. The numerous initiatives we have implemented are now yielding results. While we remain on an improvement trajectory, tangible changes in the quality of our business are evident.

“Our key brands led overall growth with a+4% growth in H2. Market share expansion is progressing in Japan local, China and Asia Pacific. While the Americas business faced challenges in Q4, the China & Travel Retail business is showing steady recovery trends.”

Performance by region

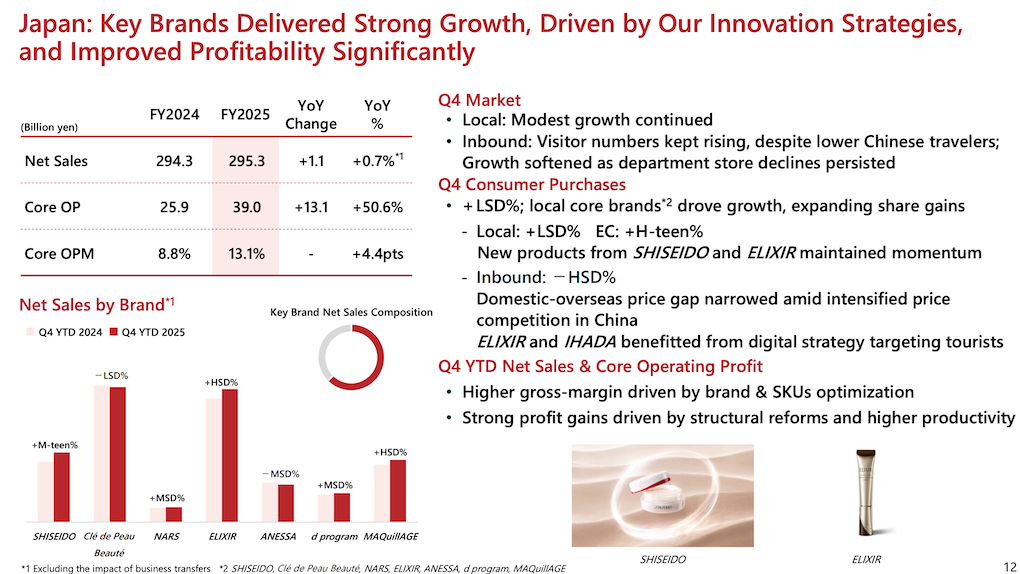

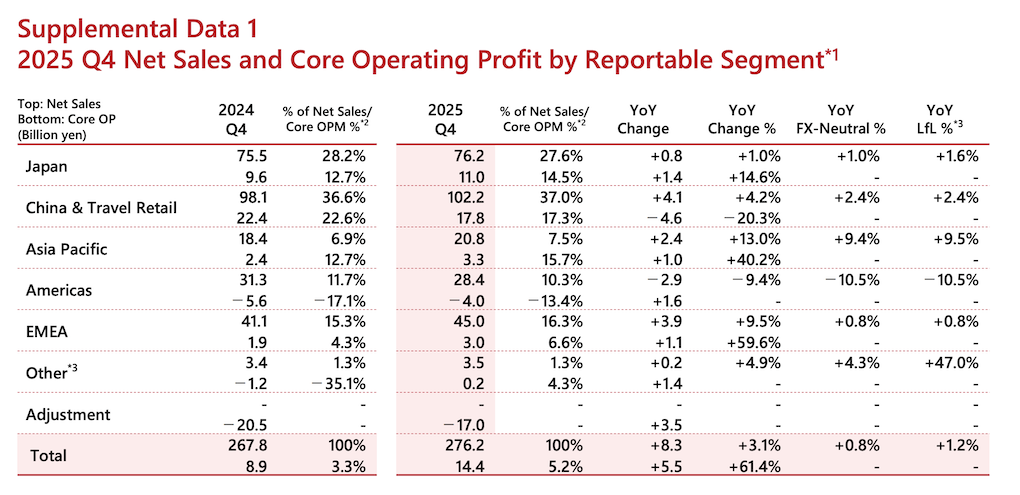

Net sales in Japan rose +0.7% year-on-year to ¥295.3 billion (US$1.9 billion). Core operating profit increased +50.6% to ¥39 billion (US$251.3 million), with margin improving 4.4 points to 13.1%.

Although inbound sales softened amid changing Chinese tourist behaviour, local demand remained resilient. Market share expanded for three consecutive years, supported by new product launches, including Shiseido’s New Ultimune relaunch and Elixir’s wrinkle cream update.

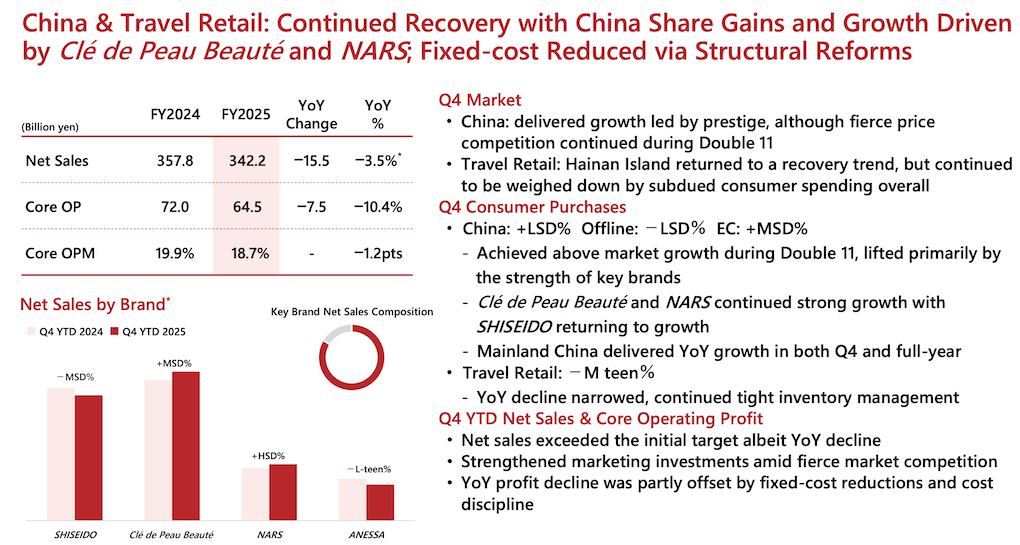

China and Travel Retail Core operating profit declined to ¥64.5 billion (US$415.6 million), representing a high 18.7% margin, supported by fixed cost reductions and structural reforms.

Travel retail remained pressured by reduced Chinese traveller spending in China and South Korea. However, Hainan showed signs of stabilisation, with narrowing mid-teen declines in customer purchases and two consecutive quarters of positive net sales in H2. Inventory levels were described as healthy.

In Mainland China, growth turned positive in Q4 and for the full year.

Despite intensified discounting during Double 11 and geopolitical tensions affecting December sentiment, full-year performance exceeded internal plans. Notably, Clé de Peau Beauté and NARS outperformed during the Double 11 shopping holiday.

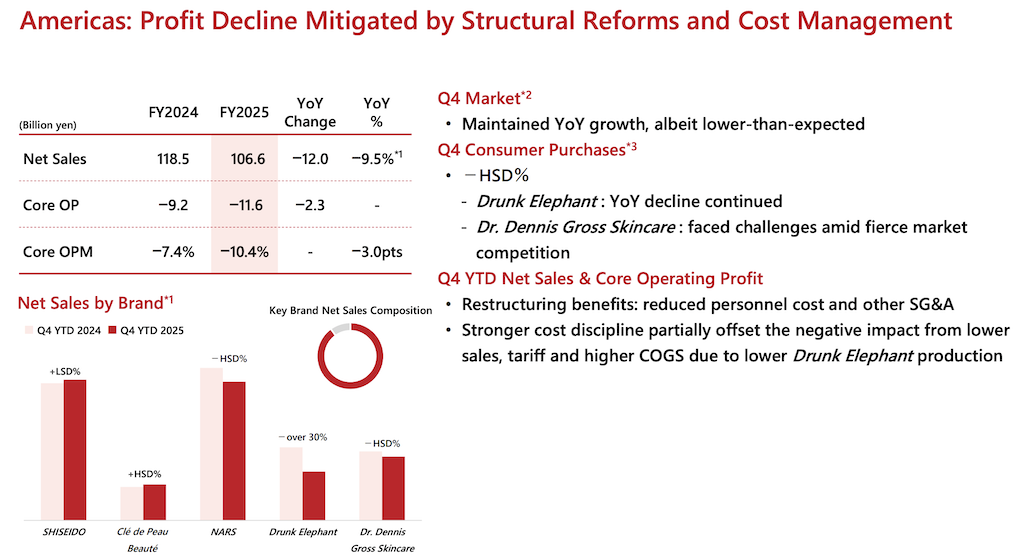

Net sales in the Americas fell -9.5% like-for-like to ¥106.6 billion (US$687 million). The core operating loss widened by ¥2.3 billion (US$14.8 million) to ¥11.6 billion (US$74.7 million).

Performance was impacted by high single-digit declines in customer purchases, inventory optimisation at Drunk Elephant ahead of its 2026 rebranding, tariff effects and increased competition in skincare. Workforce reductions and procurement efficiencies partially offset profit pressures.

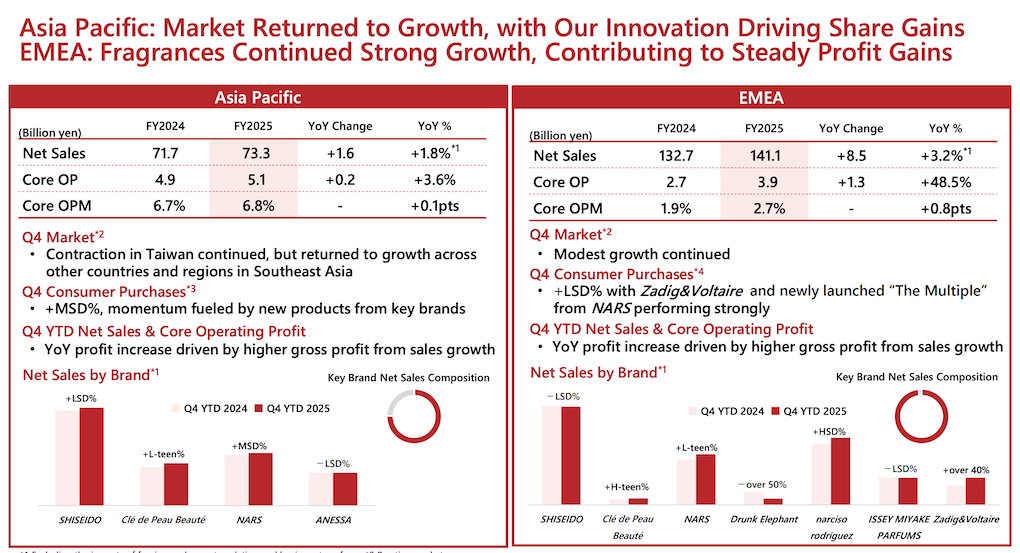

Asia Pacific net sales rose +1.8% like-for-like to ¥73.3 billion (US$472.3 million). Core operating profit increased by ¥200 million (US$1.3 million) to ¥5.1 billion (US$32.9 million). While Taiwan remained weak, other Southeast Asian countries delivered growth.

Net sales in EMEA increased +3.2% like-for-like to ¥141.1 billion (US$909.2 million). Core operating profit rose +48.5% to ¥3.9 billion (US$25.0 million).

Growth was driven by fragrances, particularly Zadig&Voltaire, alongside new Nars launches. Marketing investment increased to support expansion.

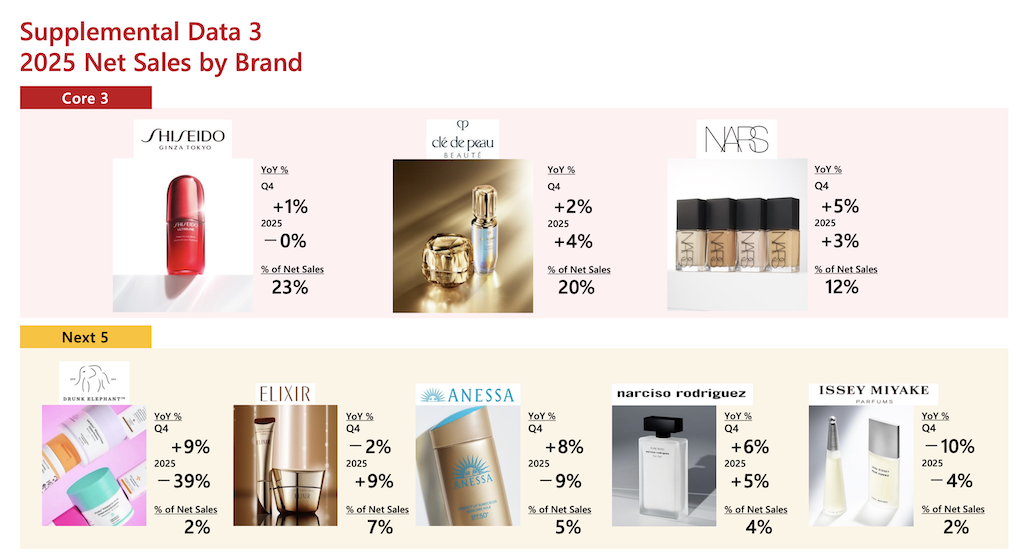

Performance by brand

Key brands delivered double-digit H2 growth in several regions. Shiseido recorded approximately +20% sales growth in Japan, while Clé de Peau Beauté demonstrated a double-digit sales increase in China & Travel Retail, Asia Pacific, and EMEA. Nars achieved a +3% sales increase in FY2025, with double-digit H2 gains in China & Travel Retail and EMEA.

Elixir retained its number one skincare ranking in Japan for the 19th consecutive year and posted a +30% sales in the Asia Pacific and double-digit growth in the China & Travel Retail. Anessa and fragrance brands are positioned for expansion, while Drunk Elephant’s rebranding and new campaign strategy aim to restore momentum in the Americas.

Outlook

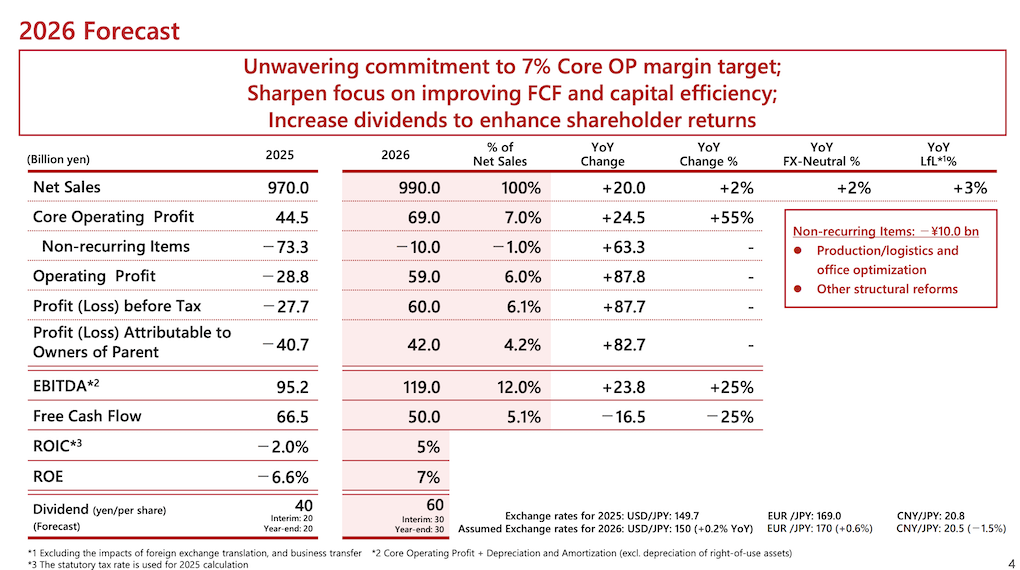

For FY2026, Shiseido forecasts consolidated net sales of ¥990 billion (US$6.37 billion), representing +3% like-for-like growth. Core operating profit is projected at ¥69 billion (US$444.6 million), implying a 7% core operating margin.

A non-recurring loss of ¥10 billion (US$64.4 million) is expected, primarily related to structural reforms. Profit attributable to owners of parent is forecast at ¥42 billion (US$270.6 million).

Management described FY2026 as a pivotal year in advancing towards its 2030 Medium-Term Strategy, with a focus on innovation-led sales growth, margin expansion and further enhancement of capital efficiency in a volatile global market environment.

Hirofuji added: “The business environment surrounding our company continues to be characterised by numerous volatile factors, including geopolitics, market trends and exchange rates. Amid this, we will continue to focus investments in key areas, firmly capture recovery in momentum seen since H2 last year, and achieve sales growth.”

Fujiwara commented: “2026 marks the first year of the 2030 medium-term management strategy. Despite the uncertain external environment, our reforms have made our regional and brand portfolio stronger and more balanced, and our management foundation more efficient and flexible.

“Based on our enhanced financial discipline, agility and accountability, we will solidly achieve our FY2026 performance targets and move forward toward 2030 goals.” ✈