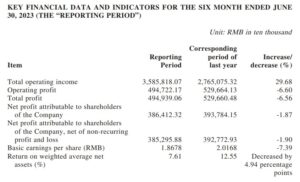

CHINA. China Tourism Group Duty Free Corporation Limited (CTG), the parent company of the world’s largest travel retailer China Duty Free Group (CDFG), has posted a +29.68% year-on-year increase in revenues to RMB35.858 billion (US$4,965,656,359) for the six months ended 30 June.

Operating profit fell -6.6% to RMB4.947 billion (US$685.1 million) while net profit eased -1.87% to RMB3.864 billion (US$535.1 million), CTG said in revealing its preliminary results for the period.

CTG said it had “seized the opportunities arising from the full recovery of consumption and the relaxed entry and exit policies” in delivering the performance.

Other driving factors were adhering to the philosophy of “trusted business operation and excellent services”; further optimisation of store layouts; and concentrating of resources in principal businesses.

“The core competitiveness of the company continued to increase, the overall development trend of the company improved, and the principal business developed steadily,” said CTG.

The company said it paid more attention to the balance between profit and scale, driving a steady improvement in gross profit margin. This increased by 7.81 percentage points quarter-on-quarter as compared with the second half of last year, CTG noted.

Of that figure, the second quarter increased by 3.67 percentage points quarter-on-quarter compared with the first quarter in 2023.

While detailed performance breakdown will not be available until the publication of full results in August, Goldman Sachs Equity Research surmised in a note (based on industry data and company commentaries) that CTG’s Hainan duty free revenues had dropped ~40% quarter-on-quarter.

This was due to the recent enhanced crackdown on daigou trading rather than any diversion of travellers to overseas countries since outbound travel restrictions were lifted, the firm said.

More positively, the report estimated CTGDF’s other revenues might have increased by +30% quarter-on-quarter, driven by accelerating duty free sales recovery at airports along with continued international travel recovery tracking at ~40% of pre-COVID19 levels.

CDFG’s three main airport locations – Shanghai Pudong, Beijing Capital and Guangzhou Baiyun saw their international traffic improve to 35%/19%/42% of FY19 levels respectively in May, compared to only 18%/8%/18% in 1Q23, Goldman Sachs noted.

“We suspect this might have made up for slower online sales amid macro slowdown and cannibalisation risk from the physical airport sales,” the note said.

“As far as shopper spending is concerned, we gather that average duty free spending per passenger at Guangzhou/Shanghai airports is back to 80-90% of pre-pandemic levels in 2Q23 (i.e., RMB81/Rmb350 vs. Rmb103/Rmb363 in FY19), which might have been affected by the heightened air ticket prices, although those traveling at this stage are generally higher-spending customers.”

The firm maintained its ‘Buy’ rating on CTG stock. ✈