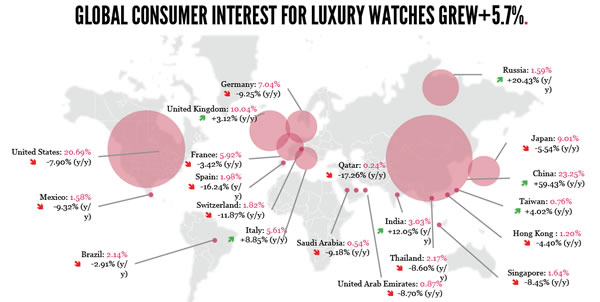

Global demand for luxury watches experienced +5.7% year-to-year growth in 2013, despite a slowdown in sales in Asia, according to the tenth annual World Watch Report (see table below).

The report, which tracks 62 brands across 20 markets, was released by Digital Luxury Group (DLG) to coincide with Baselworld 2014, which runs from 27 March to 3 April in Basel, Switzerland. The release of the full report follows the Haute Horlogerie Preview of 18 luxury watch brands, which was released in January at the Salon International de Haute Horlogerie (SIHH).

|

This year’s report showed BRIC markets dominating global demand once again with the highest year-to-year increases over other markets (see table above). China led the way with +59.4%, followed by Russia at +20.4% and India at +12%.

Mature markets experienced a decline in demand with Germany at -9.2%, the USA at -7.9% and Japan at -5.5%. However, both Italy and the UK saw growth in interest compared to 2012 at +8.8% and +3.1% respectively.

DLG Founder & CEO David Sadigh said: “Our outlook for the Swiss luxury watch industry remains strong. Consumers from around the world are more and more falling in love with fine watches, especially women. The segment currently represents the largest untapped opportunity, both in Asia and the Americas.”

Similar to the findings from the Haute Horlogerie Preview, data from Chinese search engine Baidu showed there is growing demand for high-end watches in the Chinese luxury market despite a slowdown in the home market. Baidu Vice President Liang Zeng said: “Watches are part of the fastest growing luxury segments in China right now.”

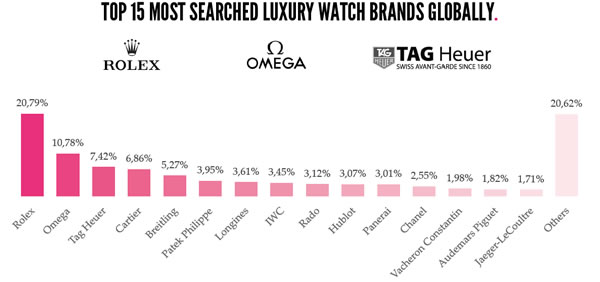

Omega, followed by Cartier and Rolex, were the top three brands among Chinese consumers.

|

The report identified and analysed over 1 billion watch-related search queries typed into major global search engines |

Brazil was the only BRIC country to experience a decline in demand, falling -2.9% compared with the year prior. The decline comes in spite of the country gearing up to host high-profile events such as the FIFA World Cup and the summer 2016 Olympics, which are attracting growing international attention. It is still unclear whether these events will translate into an increase in demand for luxury watches, the report said.

The fastest growing conglomerate was Richemont, with a +13% increase in online demand driven by Haute Horlogerie as well as watch and jewellery brand – both popular with Asian markets and Chinese luxury travellers.

The USA accounted for over one quarter of all demand for ladies’ watches. The category is popular in China with an increase in demand of +145.5%. Brands with the highest year-to-year growth were Omega at +88.3%, Vacheron Constantin at +66.2% and Chopard at +18.9%. Overall, the ladies’ watches segment is dominated by Rolex, which holds 26.5% of the market share.

Instagram proved to be the social media platform of choice for consumers engaging with watch brands, with nearly three times Facebook’s average engagement rate. Data from Baidu showed that Chinese searches for Haute Horlogerie brands using mobile phones increased by +120%.

Digital Luxury Group is a market research firm and has been producing the World Watch Report since 2004. The report covers the watch making industry in partnership with Europa Star and the Fondation de la Haute Horlogerie.

Brands tracked include Audemars Piguet, Greubel Forsey and Vacheron Constantin (Haute Horlogerie); Bulgari, Cartier and Chopard (Watch and Jewellery); Chanel, Dior Watches and Hermès (Couture); Corum, Hublot and Omega (Prestige); and Baume & Mercier, Longines and Rado (High Range).