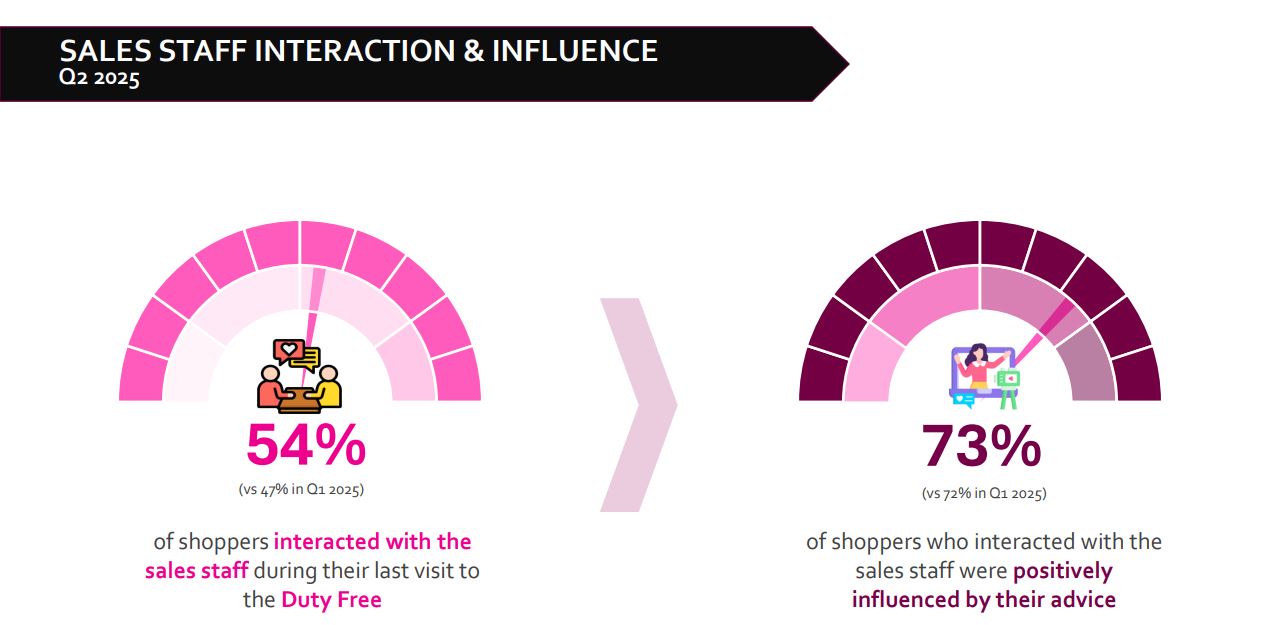

INTERNATIONAL. The Duty Free World Council (DFWC) quarterly KPI Monitor, produced on its behalf by Swiss consumer research agency m1nd-set, reported a +47% rise in in-store shopper interaction throughout Q2 compared to the previous quarter, with 53% of shoppers engaging with sales staff.

Quality of engagement also improved modestly, with 73% of shoppers noting a positive effect on their shopping experience, up one percentage point from Q1.

The study also highlights continued growth in global air travel demand, with 583 million international flights recorded, 113% of the volume in the same period of 2019 and +15% higher than global traffic in Q1.

Europe registered a strong quarter-on-quarter rise in flights of just under +40%, with 284 million recorded, +15% above the level in the same period of 2019.

In Q2, global air traffic in the Middle East and Africa totalled 68 million flights, marking a slight +3% increase from Q1 and a sharp +26% rise compared to pre-pandemic 2019.

In North America, international air travel demand jumped +14% quarter-over-quarter, hitting 65 million departures, a +21% increase compared to the same period in 2019.

Global air traffic in South America fell -13% in Q2, with 34 million international passengers, yet remained +15% above 2019 levels.

Asia Pacific’s air travel growth was the weakest among regions in Q2, rising only +1% from 2019 levels to 132 million departures, but down -6% from the previous quarter.

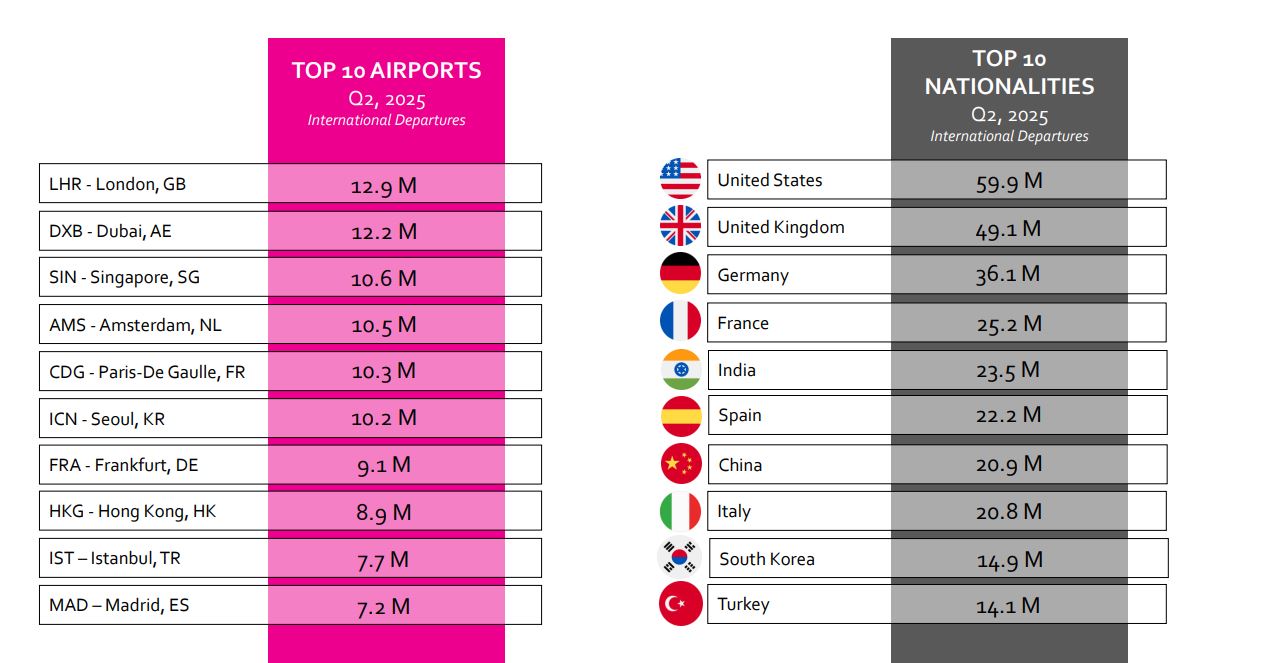

In terms of passenger nationalities, the top ten were largely unchanged from the previous quarter, with Türkiye the only newcomer the tenth spot.

The USA, UK and Germany retained the top three positions, posting quarter-on-quarter growth of +19%, +42% and +35%, respectively. France advanced to fourth, moving China to sixth, with India in fifth. Spain, Italy, South Korea and Türkiye completed the top ten.

All top ten nationalities posted growth in Q2 international departures compared with Q1, except China and South Korea, which experienced a decline.

In addition to tracking traffic trends, the DFWC’s quarterly KPI Monitor provides insights into evolving shopper behaviours, highlighting shifts in the factors that motivate purchases in duty-free stores.

Key observations from Q2 show largely stable purchase drivers. Leading the list are ‘good value for money’ (27%), ‘convenience’ (21%) and ‘suitability as a self-treat’ (17%) at the top. ‘Brand loyalty’ (16%) climbed to fourth place, while ‘having enough time to choose’ (15%) dropped to fifth.

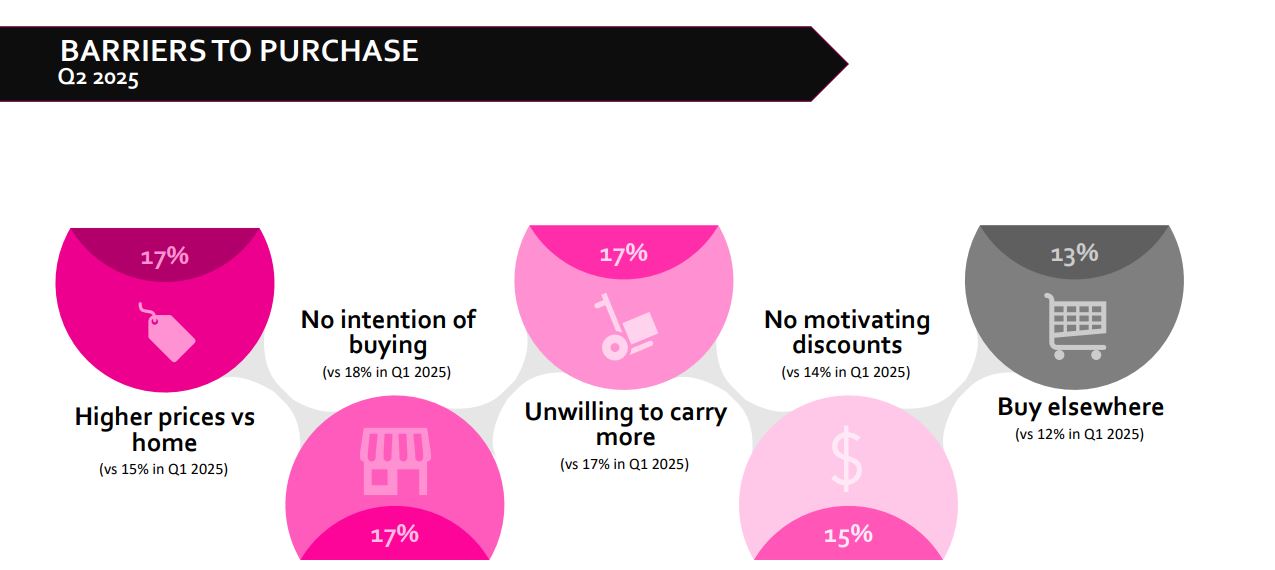

The top reasons cited for not buying are ‘higher prices than at home’, ‘no intention to buy’, and ‘unwillingness to carry more items’ (17% each), followed by ‘lack of motivating discounts’ (15%) and ‘buy elsewhere’ (13%).

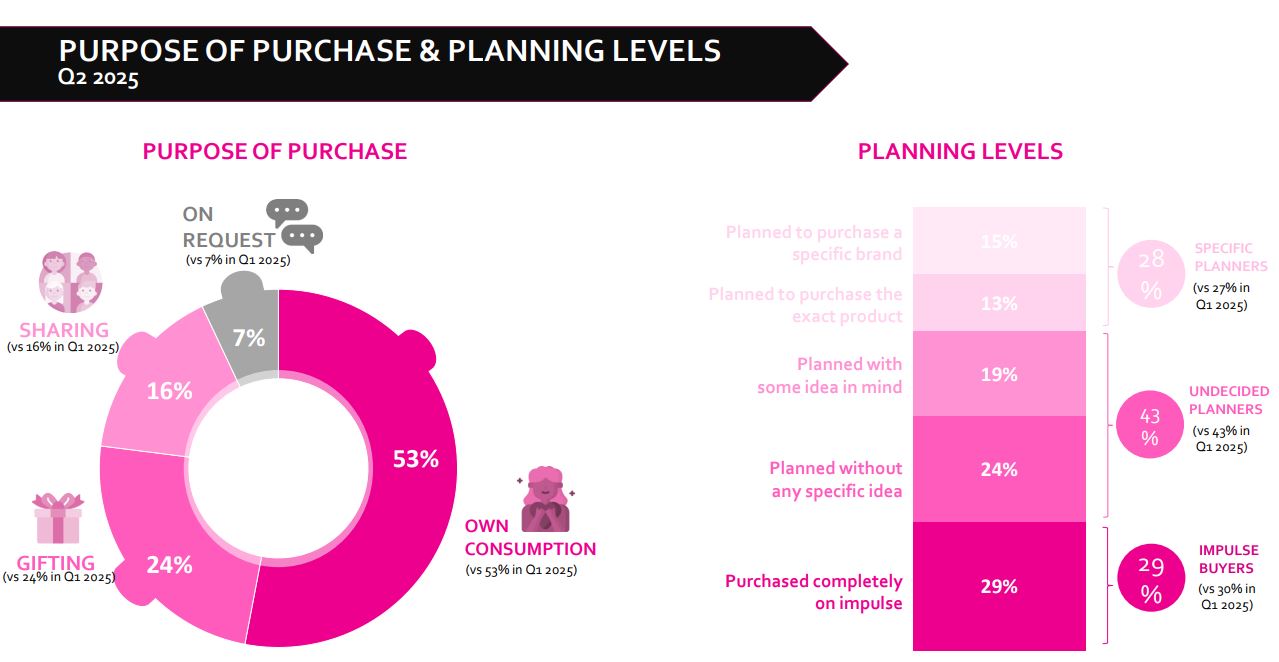

The buying intentions of global travel retail shoppers remained largely stable between Q1 and Q2, with 53% buying for themselves, 24% for gifting, 16% for sharing and 7% on request.

The study found minor shifts in purchase patterns between the first two quarters of the year. In Q2, 71% of shoppers planned their purchases, with specific planners rising slightly from 27% to 28%, while the number of those buying on impulse dropped from 30% to 29%.

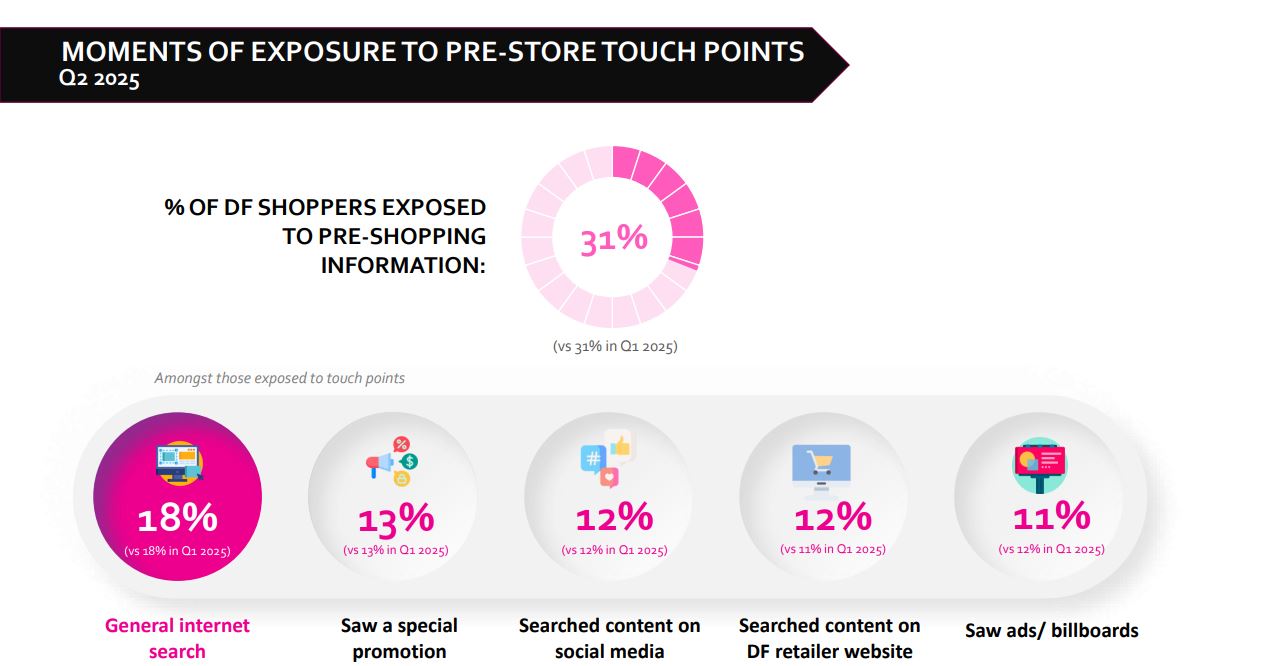

The share of global shoppers exposed to pre-shopping touchpoints remained at 31%, with 18% citing general internet searches as their primary touchpoint. Special promotions followed at 13%, with proactive searches on social media and duty-free retailers’ websites, both at 12%, and billboard advertising at 11%.

DFWC President Sarah Branquinho said, “The Q2 2025 KPI Monitor confirms encouraging signs for our industry, particularly the marked improvement in staff engagement, both in frequency and quality.

“With over half of global shoppers now interacting with sales staff, and the majority reporting a positive impact, this reinforces the value of human connection in the travel retail experience.

“However, as most shopper behaviours and purchase motivations remain relatively stable, it is clear that more needs to be done to convert traffic growth into sales.

“We encourage retailers and brands to invest further in staff training and to enhance promotional visibility, especially through digital and in-store channels, to overcome persistent purchase barriers and better capture the attention of today’s travel retail consumers.”

Branquinho added, “The quarterly DFWC KPI Monitor is possible thanks to our partnership with m1nd-set. By capturing quarterly feedback across all major nationalities, regions and product categories, and changes in flight and passenger traffic, the DFWC monitor provides the travel retail industry with timely, in-depth insights that reflect real-world traveller behaviour and seasonal trends.”

m1nd-set CEO & Owner Peter Mohn commented, “The B1S tracking survey has been the industry’s most consistent and comprehensive source of shopper insights since its launch in 2016, with over 200,000 international travel retail shoppers surveyed to date.

“B1S compiles data using nationality quotas that are defined based on international traffic data provided by IATA exclusively to m1nd-set, that is representative of the key nationalities that have been travelling internationally during the relevant period of time.”

Mohn concluded, “Even through the disruption of COVID-19, we were able to maintain data quality and representativeness thanks to our exclusive partnership with IATA and our global traveller and shopper panel. We are delighted to service so many industry partners with our shopper analysis and the DFWC through the quarterly monitor.” ✈