INTERNATIONAL. The Duty Free World Council (DFWC) has reported significant changes in both purchase drivers and barriers, according to its Q3 global shopping monitor.

The research, commissioned by DFWC from Swiss research agency m1nd-set, was conducted over three months from July to September and compares the findings with pre-COVID shopper behaviour during the same period in 2019.

Special editions and duty free exclusives continue to increase in importance as purchase drivers. Meanwhile shoppers have become more self-indulgent since the pandemic began, purchasing products for themselves more often, the research claimed.

The number of global shoppers who have a clear idea of what they want to buy and plan their airport shopping accordingly has also increased.

DFWC President Sarah Branquinho said: “We are delighted to see the return of the DFWC shopping monitor in partnership with m1nd-set. Shopping behaviour today is quite significantly different from pre-pandemic times and the research highlights the importance of frontline customer-facing staff.

“The monitor shows how the percentage of shoppers engaging with sales staff has increased from 49% to 71% over the past three years. This demonstrates the importance of staff training, which is why the Duty Free World Council has invested in the DFWC Academy.

“The success rate of staff interactions has also increased significantly, up from 51% in 2019 to 78% this year. We cannot emphasise enough the importance of training programmes, such as those offered by the DFWC Academy to ensure staff have all the necessary tools at their disposal to engage successfully with shoppers and potential shoppers in the travel retail environment.”

The findings show value for money and price advantage, the top two purchase drivers, have declined from 32% and 30% of shoppers citing these factors in Q3 2019 to 18% and 17% respectively in Q3 this year.

Convenience as a reason to purchase was quoted by over a quarter of shoppers in Q3 2019 but by only 16% during the same period this year.

15% of shoppers quoted both dwell time and brand loyalty in Q3 this year according to the DFWC monitor, down from 20% and 18% in 2019.

The only purchase driver which has seen an increase among shoppers over the three-year period is special editions/duty free exclusives, up from 12% in 2019 to 15% in 2022.

It found while shopping barriers have consistently increased, such as long queues to pay and higher prices versus what consumers pay at home, had dropped over the three years from 31% in Q3 2019 to 17% in Q3 this year.

Long queues, insufficient time, uncertainty over custom regulations and higher prices compared to other airports all saw an increase in consumers quoting these as reasons for not purchasing at an airport.

The percentage of global shoppers planning their airport shopping with a clear idea of what they want has increased significantly from the pre- to post-COVID period, according to the DFWC shopping monitor.

35% of shoppers planned to purchase either a specific product or brand this year, compared to 22% in 2019. Undecided planning has decreased over the three years on the other hand, down from 55% in 2019 to 44% in Q3 2022. The percentage of shoppers purchasing on impulse has decreased only slightly from 23% to 21%.

Shoppers have become more self-indulgent since COVID, the research reveals, with 50% of shoppers purchasing products for themselves in Q3 2022, up from 45% in 2019; while gift shopping has declined from 41% to 29% over the three-year period.

Shoppers noticing touchpoints has increased significantly from Q3 2019 to 2022, with 50% of shoppers noticing touchpoints in Q3 2022, compared to 22% in Q3 2019.

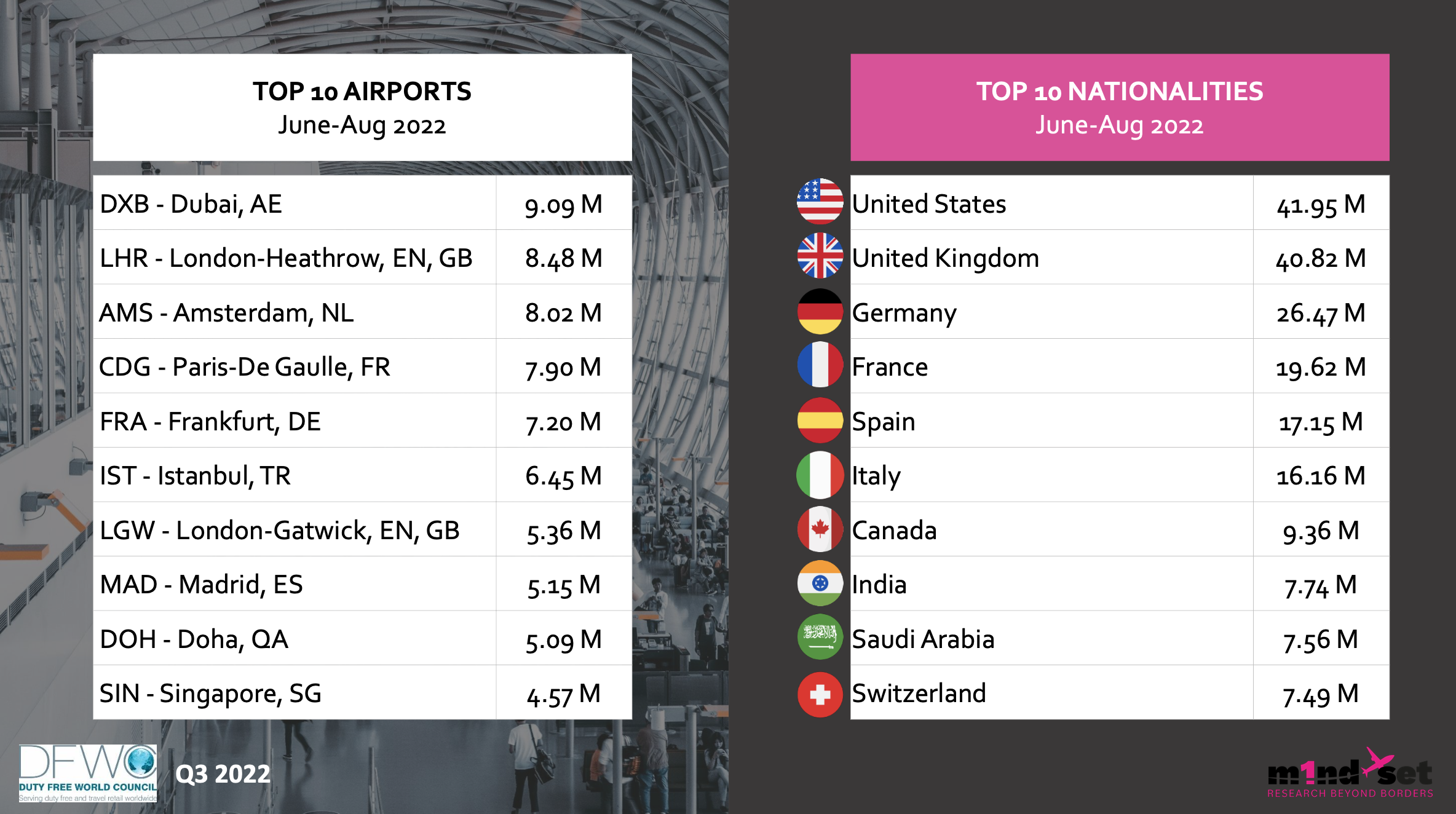

The quarterly monitor also provides a global and regional air traffic overview, based on data from IATA, which reveals global as well as regional traffic, the top ten airports and the top ten travelling nationalities.

While global recovery is at 70% of the 2019 levels over the 2022 summer months, recovery across almost all regions surpassed 80%. Only Asia Pacific shows a below average recovery rate with just over 30% of the 2019 traffic levels in the summer of 2022, according to the DFWC monitor.