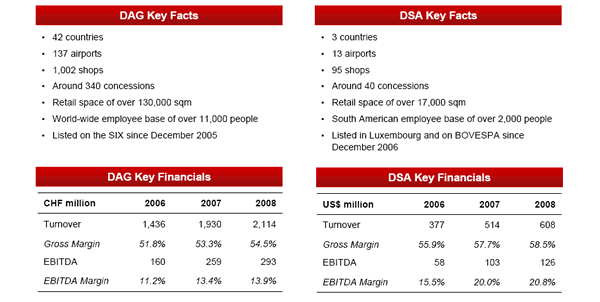

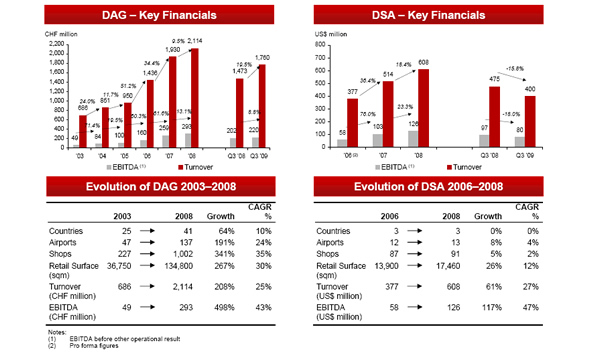

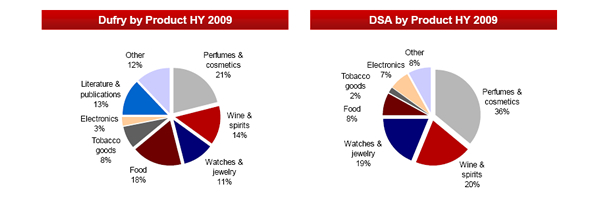

INTERNATIONAL. Dufry Group, a leading global travel retailer with over 1,000 outlets in 42 countries, this morning announced that it proposes to combine Dufry AG (DAG) with Dufry South America Ltd (DSA).

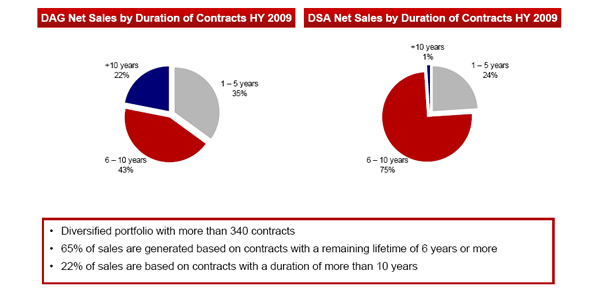

The group said that the rationale for the merger is “to establish a simplified corporate structure of Dufry Group with a unified shareholder base which can participate in a balanced and diversified concession portfolio with an exposure of approximately 60% to emerging markets and a proven track record of delivering growth”.

|

“We want to exploit further growth opportunities and continue to play an active role in the growing consolidation of the fragmented travel retail market“ |

Julián Diaz Chief Executive Officer Dufry Group |

Dufry CEO Julián Díaz commented: “This proposed transaction simplifies the corporate structure and gives us greater strategic flexibility to grow our business globally and also in South America. A unified and broader shareholder base considerably increases the free float for both Dufry AG and Dufry South America shareholders and BDR*-holders.

“We want to exploit further growth opportunities and continue to play an active role in the growing consolidation of the fragmented travel retail market. In recent months Dufry has grown profitably in attractive locations in the duty paid and duty free sectors alike.

“As a global travel retailer with a diversified concession portfolio, it is well positioned to benefit from the renewed growth of the international travel market.”

DETAILS OF THE MERGER

The proposal foresees a merger whereby DSA public shareholders and Brazilian Depositary Receipts (BDRs) holders shall receive 1.00 DAG shares or DAG BDRs in exchange for 4.10 DSA shares or DSA BDRs.

The proposal also includes an extraordinary cash dividend of US$3.92 per DSA share or BDR that will be paid by DSA to DSA shareholders and BDR holders after the approval of the merger.

“The transaction enhances the strategic flexibility of Dufry Group and simplifies the corporate governance of the group,” it commented. “It furthermore combines the free float of both companies and bundles the trading liquidity of DSA and DAG shares and BDRs into one listed company and facilitates Dufry Group’s access to capital markets overall.”

DAG, which is incorporated in Switzerland and listed on the SIX Swiss Exchange, said it proposed yesterday a business combination of DAG with DSA, which is incorporated in Bermuda and is listed on the Luxembourg Stock Exchange and which has BDRs listed on the BM&FBovespa.

The proposal foresees that DAG, which holds 51.04% of the share capital of DSA, will issue new shares in a capital increase and DSA will be absorbed via a merger.

DAG will, at the same time, list its shares in the form of BDRs at the BM&FBovespa in Brazil. The public shareholders and BDR holders of DSA will receive DAG shares or DAG BDRs in exchange for their DSA shares or DSA BDRs. In addition, an extraordinary cash dividend will be paid by DSA to DSA shareholders and BDR holders conditioned upon the merger being approved. Following the completion of the transaction, DAG will own 100% of the business of DSA and the trading of DSA shares and BDRs will be discontinued.

|

|

If the merger is approved, DSA shareholders and DSA BDR holders are expected to receive 1.00 DAG shares in exchange for 4.10 DSA shares or 1.00 DAG BDR in exchange for 4.10 DSA BDRs, respectively.

Furthermore, DSA shareholders and BDR holders will receive an extraordinary cash dividend of US$3.92 per share or BDR. The implied value for each DSA share or BDR – calculated from the exchange ratio plus the extraordinary dividend – is BRL 35.52, which is equivalent to 30-trading day volume weighted average BDR price and +0.3% over the closing price of the BDRs on Friday, January 8, 2010.

|

|

|

|

|

Advertisement |

MORE STORIES ON DUFRY

Dufry grows its global footprint with new deals in Egypt, Honduras, France and the US – 17/12/09

The Moodie Reportfolio: Dufry South America ranks as best performing stock for November – 07/12/09