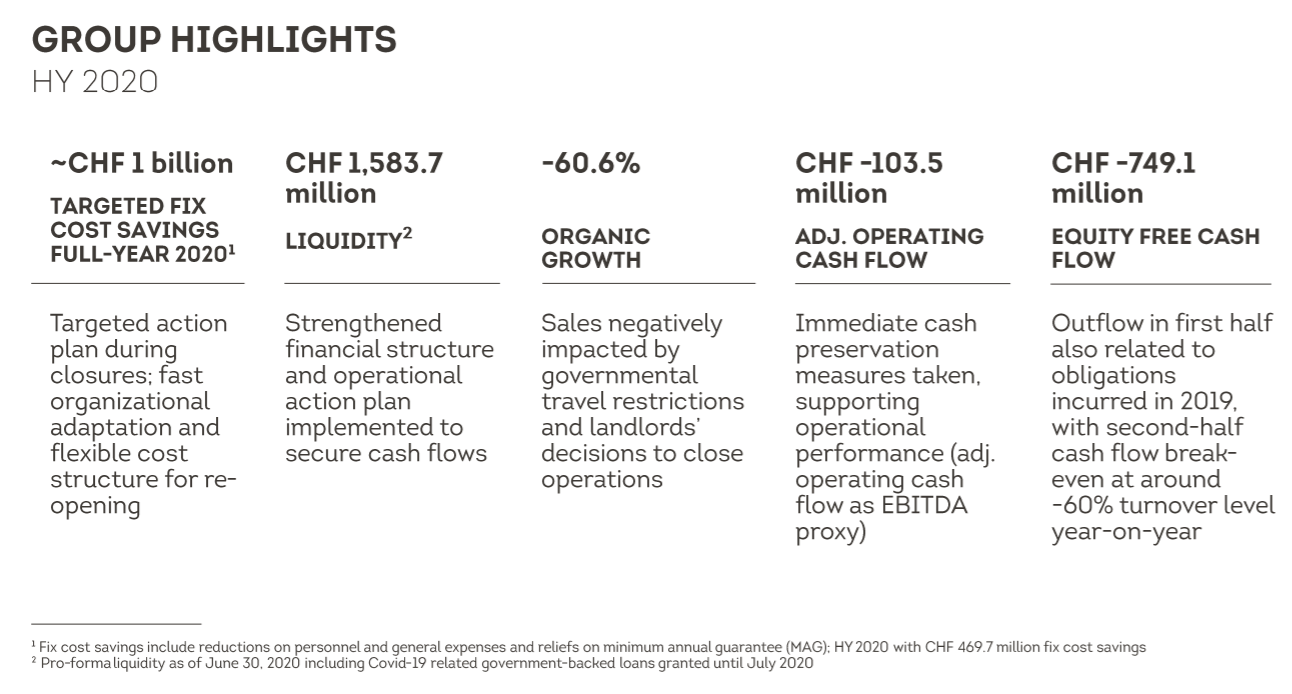

INTERNATIONAL. Travel retail giant Dufry today put a brave face on the most difficult six months in its history, a first half that saw turnover plunge -62% (-60.6% organic) to CHF1,586.9 million (US$1,733.93 million).

Despite the gravity of the coronavirus-driven crisis, the company offered room for optimism by pointing to an accelerating store reopening schedule (see sidebar below). It also highlighted its extensive cost-reduction programme, a strengthened financial framework, and the implementation of a new simplified organisation.

Organic growth was -60.6%, with like-for-like performance reaching -57.6% due to lower passenger traffic across most airports globally and contributions from net new concessions amounting to -3.0%. The translational FX effect in the period was -1.4% as a result of the strengthening of the Swiss Franc versus the main currencies of the US Dollar, Euro and Pounds Sterling

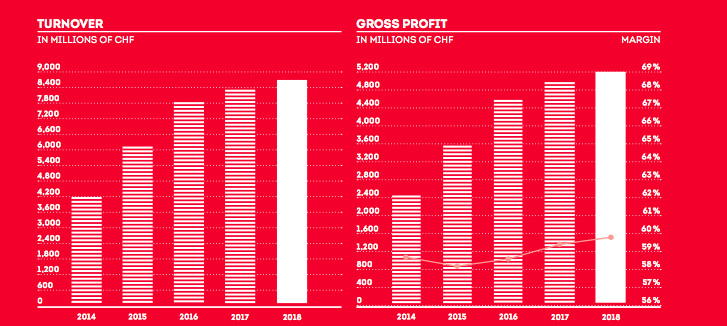

Gross profit slumped -63.3% to CHF920.5 million (US$1,005.8 million) in the first six months. Gross profit margin remained “resilient” supported by the collaboration between Dufry and its suppliers and is expected to normalise with business recovery, the company claimed.

Gross profit margin declined by 220 base points from 62.0% to 58.0%, being mainly affected by the turnover mix from the retail and wholesale business. Retail-related gross profit margin was only 60 base points lower compared to full-year 2019 despite the Q2 sales decline.

Adjusted operating profit (adjusted EBIT) fell from CHF277.0 (US$302.3 million) in the first half of 2019 to a loss of -CHF464.6 million (US$507.7 million) this time.

Personnel expenses were reduced by -31.6% to CHF423.0 million (US$462.2 million) driven by an efficiency programme, which includes reducing costs at all levels, making use of government support schemes, and the implementation of voluntary salary reduction schemes, also supported by Dufry’s Global Executive Committee and Board of Directors.

| MAG adjustments help ease expenses Lease expenses fell by -88.1% to CHF75.7 million (US$82.8 million) in the first half, driven by lower sales and various COVID-19-related minimum annual guarantees (MAG) relief programmes negotiated with landlords in the period. Such relief included the waiving of fixed rent components and implementing variable concession schemes instead. Another formula was the adjustment of fixed MAGs to lower passenger numbers, scheduled flights and operating hours. Up to 30 June, Dufry was able to close several agreements releasing partially or totally about CHF161.8 million (US$176.8 million) of MAG obligations. Management remains in negotiations with other lessors reviewing the lease terms in response to the crisis-driven market circumstances beyond 30 June. In relation to these ongoing negotiations, Dufry has already received offers granting further MAG relief in relation to the first half of 2020 for CHF137.0 million (US$150 million), which, if and when such rent concessions are signed, will result in a de-recognition of lease obligations to the same amount. |

Dufry Group CEO Julián Díaz commented: “This is certainly a difficult time for both the travel retail industry and our company. However, since mid-June we have started to see first signs towards a recovery, with travel resuming gradually and more than 1,000 of our shops globally in operation again at the end of July, based on our shop-by-shop re-opening plan.

“In the first half-year 2020, we have implemented a whole array of initiatives to adapt the company to the new market environment and safeguard its resilience going forward. These include measures to reduce costs at all levels, several activities to strengthen Dufry’s financial structure, as well as a restructuring of the company and the implementation of a new simplified organisation as per September 1, 2020.

“I am confident that we have taken the right initiatives and that they will help us to emerge from the crisis with a solid position. During the recovery and going forward the increased agility and faster decision-making processes will allow us to adapt swiftly to the new and changing market requirements, drive sales and accelerate growth.

“By taking out one organisational level, the teams covering our global functions and the countries will increase efficiency and get closer to the market and our customers.”

Díaz expressed his personal gratitude to Dufry employees for their commitment during such difficult times, noting, “Without their strong support and dedication, the fast adaptation of the company and the changes applied would not have been possible.”

He continued: “I also want to remember the colleagues we lost as a consequence of the pandemic and I wish a full recovery to our employees who were infected.”

Commenting on trading in reopened locations, Díaz said: “We have taken all necessary steps to provide our employees with a safe working environment. Our health and safety protocols are an integral part of our stores globally to also protect our customers, while we continue to provide them with a first-class shopping experience.

“We see that passengers want to engage in travel retail as soon as airports and other locations are re-opening. We are looking forward to serving our customers globally with great service and attractive promotions.”

Díaz also expressed Dufry’s gratitude to shareholders, business partners and stakeholders for their support during the crisis.

Personnel expenses were reduced by -31.6% to CHF423.0 million (US$462.2 million) driven by an efficiency programme, which includes reducing costs at all levels, making use of government support schemes, and the implementation of voluntary salary reduction schemes, also supported by Dufry’s Global Executive Committee and Board of Directors.

The Dufry share price, which was just over CHF96 at the beginning of January, stood at CHF21.77 at 13.45 CET, down almost -6% in the day.

| Outlook tough but improving Looking forward, Dufry noted that in the current crisis context and given the resultant low visibility to provide business forecasts, the company had already withdrawn guidance for full-year 2020 in its Q1 Trading Update in May.

As reported, Dufry has defined cost containment measures for different scenarios based on turnover development in 2020 and information made available by different trade associations and independent data providers of the travel retail and airline industry. The scenarios consider a -40%, -55%, and -70% turnover decline for full-year 2020 compared to 2019. They are used to steer the company through a time of uncertainty and implement necessary action plans to reach required cost reductions, safeguard liquidity and re-open the business in a cash-preserving way, Dufry said.

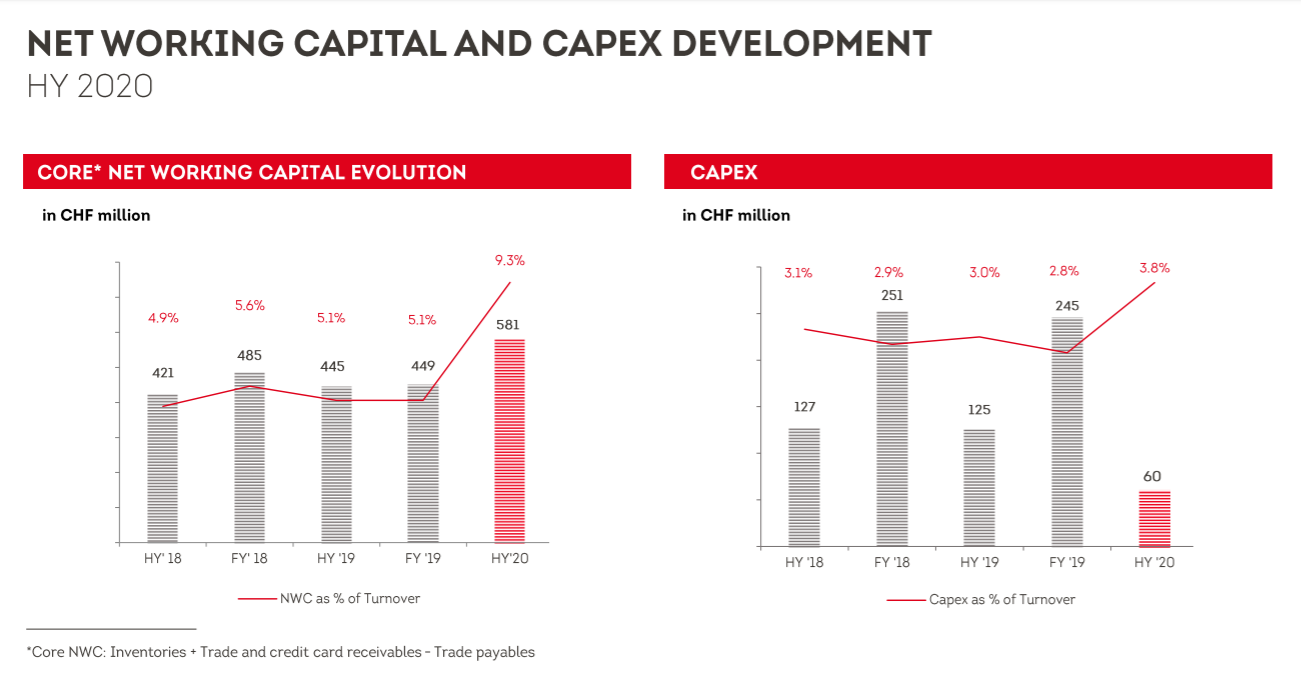

As of today, Dufry expects to generate around CHF1 billion (US$ 1.1 billion) in fixed cost savings in full-year 2020, of which CHF299 million (US$326.7 million) will come in MAG relief. In addition, actions taken at Capex and working capital level will generate cash savings of around CHF160 million (US$174.8 million) in the full-year 2020. During the H2 re-openings and depending on the recovery trajectory, Dufry expects positive average monthly cash flow of around CHF60 million (US$65.6 million) in a -40% scenario and around CHF10 million (US$10.9 million) in a -55% scenario, and cash consumption of around negative CHF60 million (US$65.6 million) in a -70% scenario.

Since mid-June, travel restrictions have been increasingly lifted and domestic and international travel started to resume, especially in Asia, Europe, and the US, Dufry said. The company has started to reopen its retail operations gradually, based on single-location productivity scenarios and in close cooperation with airport authorities and landlords. More than 1,000 of Dufry’s 2,400 shops globally have opened again, representing around 60% in sales capacity compared to full-year 2019. The reopened stores include key locations such as the UK, Spain, Switzerland, Mexico, US, Turkey, Russia, Hong Kong, India, Cambodia, South Korea and Kuwait. In the first four weeks of July (until 26 July), organic growth reached -82.3% compared to the same period last year. At the end of August, Dufry expects to be operating around 50% of shops, representing 70% of sales capacity. “Based on sales progression and customer insights Dufry expects to be well positioned for the reopening and business recovery both from a commercial and operational perspective. Current reorganisation initiatives are further strengthening the airport travel retail business and other channels, thus driving the company’s profitability and preparing growth acceleration,” the company concluded. |

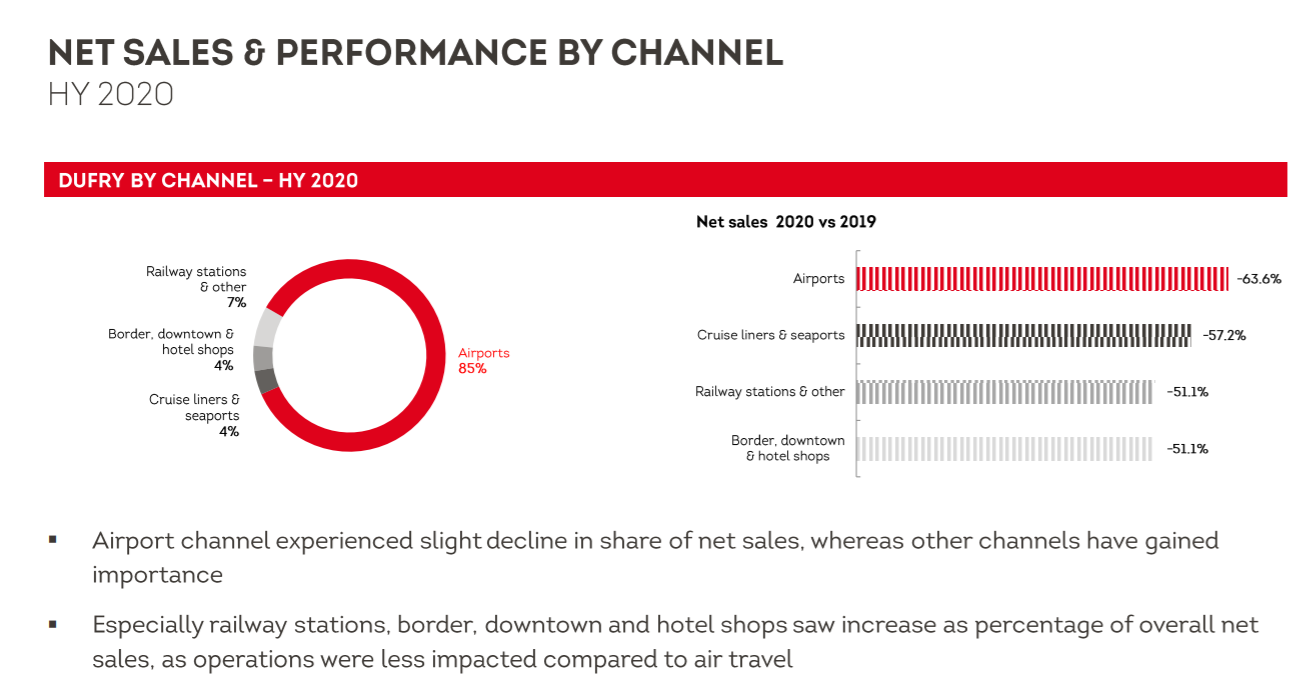

| Regional analysis underlines global nature of crisis The divisional turnover split saw Europe & Africa contributing 36% of revenues, North America 25%, Central & South America 21%, and Asia Pacific & Middle East 15%. Global distribution centres accounted for 3% of HY 2020 net sales. Europe & Africa Turnover fell CHF558.9 million (US$608.76 million) in the first six months from CHF1,725.5 million one year ago. Organic growth plunged -66.1%. Performance was negative across most locations though less so in Africa. From mid-June 2020 onwards, travel restrictions were lifted or eased and intra-European travel, especially in Southern and Central Europe as well as the UK, started to resume. Asia Pacific & Middle East Turnover reached CHF236.0 million (US$257.06 million) versus CHF623.8 million (US$623.8 million) in the same period last year. Organic growth reached -60.4% with China and South Korea being especially impacted especially during Q1 2020 but resuming some domestic and bilateral travel in Q2. Other parts of Asia Pacific and especially in the Middle East were impacted mainly in the second quarter and are still continuing to be affected with a low level of open shops. North America Turnover in the half reached CHF392.2 million (US$427.19 million) compared to CHF954.5 million (US$1,039.66 million) in H1 2019. Organic growth was -57.9% in the period with a slowdown in both duty free and duty paid, but especially in the former, which is exposed to international flight schedules. Domestic travel, which accounts for around 85% of US flight movements, started to resume, while the Canadian business was still impacted by international travel restrictions. The North American business started an initiative through its Hudson brand to roll out vending machines featuring health and safety products across 27 leading airports. For more on the Q2 performance at Hudson, click here. Central & South America Turnover was CHF329.6 million (US$359.01 million) in the first half of 2020 compared to CHF761.8 million (US$829.77 million) one year. Organic growth was negative -55.6%. The division was the least impacted during the first semester, as most restrictions in the region only started in the second quarter. The cruise business, mainly part of the Central & South America operation, performed in line with the overall division. This was despite the cancellation of cruise itineraries as staff were still based on ships and high season would only have started later in the year. Domestic travel, as well as border shopping and international flights within the region remained possible at limited levels, whereas most extra-regional international travel was restricted. |