|

“Still 53% of sales are generated by smaller operators, so there is significant room for consolidation in the fragmented travel retail industry“ |

Julián Díaz Chief Executive Officer Dufry Group |

SWITZERLAND. Dufry Group is targeting greater cash generation and improved efficiency, as well as eyeing organic growth and acquisition opportunities in 2010, according to CEO Julián Díaz.

Speaking to analysts after the publication of the company’s annual results for 2009 last Friday, Díaz noted that 2009 was a “challenging year” but one that “demonstrated the resilience of the travel retail business and of Dufry’s business model,” he said.

As reported, Dufry turnover grew by +12.5% year-on-year in 2009 to CHF2,378.7 million (US$2,255 million). EBITDA (before other operational result) increased by +2.6% to CHF301.1 million (US$280 million) from CHF293.4 million in 2008, resulting in an EBITDA margin of 12.7%.

Díaz said the year was dominated by the impact of the economic crisis, which reduced international passenger numbers worldwide by -4%, or around 60 million. He said the swine flu outbreak had hit Dufry’s business especially in Mexico and Brazil, while the Alitalia crisis in Italy had slashed around 1.2 million passengers from its potential customer base, he noted.

“The first six months were very difficult, mainly due to the economic crisis, but then we saw a gradual improvement in the second semester,” said Díaz. “In the first two months of 2010 we have seen a better performance from all regions, including in the British Caribbean since the beginning of March [with single-digit growth in early 2010-Ed]. For the period to the end of February, Dufry has returned to growth, including significant double-digit sales growth in total sales, and also very significant growth in organic.”

|

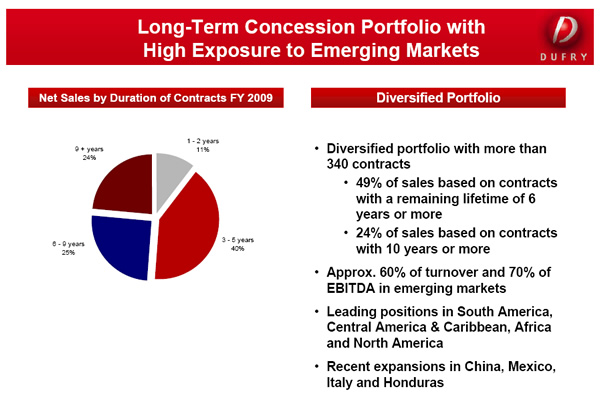

Díaz said the group was poised to benefit from a long-term concession portfolio with an emphasis on emerging markets. Some 49% of sales are in contracts with a remaining lifetime of six years or more (as of the end of 2009), and 24% of sales are in contracts with ten years or more. Around 60% of turnover and 70% of EBITDA come from emerging markets. “We are focused on developing the company in Eurasia & Asia and in Latin America & Caribbean,” noted Díaz.

The group has 52 projects “in the pipeline” added Díaz, comprising 28,700sq m of space, with 40% of this in North America, and 30% in Eurasia & Asia. Dufry has already opened 26 stores under the Hudson brand name outside North America, he added, including 1,900sq m of space. New Hudson stores will shortly open in Moscow and in Belgrade, and the company plans to open 40 new Hudson stores in 2010.

|

Díaz also said the company was eyeing retail opportunities on motorways, notably in South America. Asked by one analyst whether the company was targeting inflight retail opportunities in South America, he said: “Airport retail, convenience store retail and border shops are part of the travel retail business in South America. It is also our intention to develop motorway retailing in the near future.”

|

Acquisitions remain firmly on the agenda, added Díaz. He noted that Dufry accounted for 6% of global travel retail sales in 2009, with an estimated 41% of sales through other leading (top ten) retailers and the balance from small to medium sized retailers.

“Still 53% of sales are generated by smaller operators, so there is significant room for consolidation in the fragmented travel retail industry,” he said. “We will continue to lead this process. And we should be able to consolidate small to medium-sized companies within our existing structure.”

Among the product categories, Díaz underlined the struggles the company had faced in electronics and jewellery & watches during 2009. Electronics sales fell by around -26% year-on-year in 2009, while jewellery & watches sales fell by -18%. But he noted that core categories had performed well, with food & confectionery sales rising by +50%, aided by the performance of the category through Hudson stores. He said that food & confectionery, fragrances & cosmetics and convenience store items (through Hudson) would prove key categories in the future.

In 2009, 63% of sales were achieved through duty free, with the balance in duty paid. Díaz said that with the expansion of the group, he expected this ratio to hit 50:50 in the future.

Díaz concluded: “We want to remain strong in the area of organic growth and to pursue new opportunities, including new concessions; and we can also perform better in terms of gross profit margin and improve our net working capital.

“This is not a year for long-term decisions, it is a time to act month by month. If the performance each month is robust then let’s take a step forward. But we will perform on the basis of credibility and reality.”

|

To donate please visit www.HandinHandforHaiti.com |