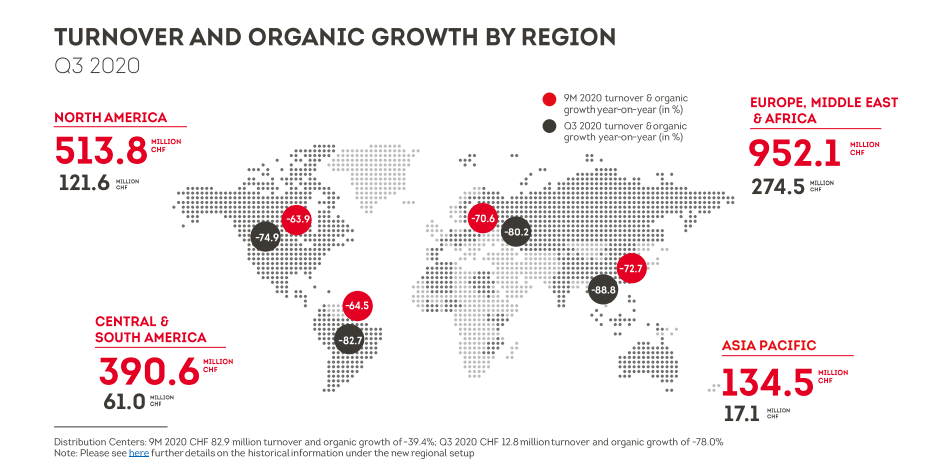

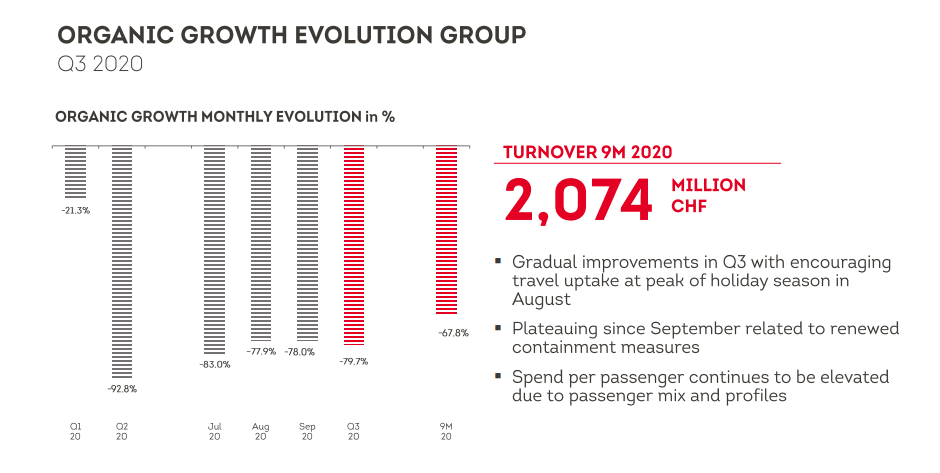

INTERNATIONAL. Dufry Group today reported on its third-quarter and nine-month performance, with turnover reaching CHF2,073.9 million (US$2,259 million), down by -69% year-on-year (-67.8% organic and at constant exchange rates).

The third quarter saw turnover fall by -79.7% at constant exchange rates compared to a year ago, reaching CHF487 million (US$530.5 million).

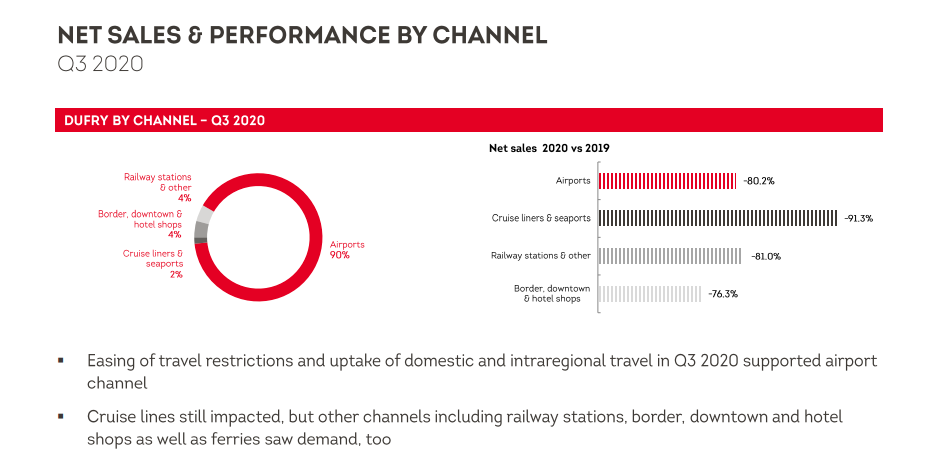

The Q3 like-for-like performance was down by -76.9% due to reduced passenger traffic across most airports and other travel-related channels globally. Contributions from net new concessions amounted to -2.8%. The translational FX effect in the period was -0.8%, mainly as a result of the US Dollar weakness, only partly offset by other main currencies.

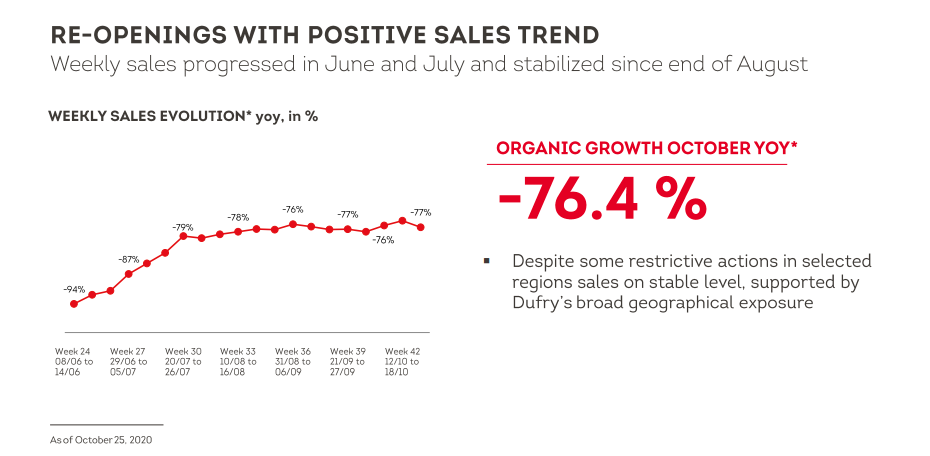

In October (until 25 October), Dufry estimates organic growth to have reached -76.4% compared to the same month last year. By region, estimates for Europe, Middle East and Africa are -78.4%, for Asia Pacific -84.8%, Central and South America -75.7% and for North America -71.6%.

As of the end of October, almost 55% of Dufry shops were open, representing 72% of sales capacity. By the end of this month, the target is to open 60% of stores, or 73% of sales capacity.

In response to the COVID-19 crisis, Dufry delivered further cost savings in Q3 for a total of CHF760 million in the first nine months, with a savings target of CHF1 billion for the full year.

As reported, the company announced a restructure that will save at least CHF400 million, one element of which is to acquire the remaining equity interest in Hudson (for around CHF295 million) and delist the company from the New York Stock Exchange. That process is expected to be completed in Q4.

Among other key initiatives, Dufry also recently announced a joint venture with Alibaba Group to jointly explore and invest in opportunities in China and to enhance Dufry’s digital transformation. The JV will be set up by the end of 2020 as a Chinese incorporated entity with Alibaba Group holding ownership of 51% and Dufry at 49%.

Dufry noted: “Alibaba will bring in its established network in China and its digital capabilities while Dufry will contribute to the JV its existing travel retail business in China, and will support the JV with its supply chain and strong operational skills. The governance structure and initial projects will be announced in due course. First operations are expected to start in H1 2021.”

Following a rights issue and capital increase concluded on 22 October, Alibaba Group held a 6.1% stake in Dufry (with Advent International at 11.4%). Advent International and Alibaba Group have agreed to a lock-up period of six months following the first day of trading of the new shares.

Dufry Group CEO Julián Díaz said: “Today, we are standing as a stronger and more resilient company than three months ago for three specific reasons. First, we have reached final stages in the implementation of our restructuring initiatives and group-wide reorganisation, which include the full reintegration and delisting of our Hudson business in North America, which we expect to close in the fourth quarter of this year.

“Besides adding agility and simplifying the daily operational management of the company, these initiatives will allow us to reach significant cost reductions of CHF 1 billion in 2020, of which at least CHF 400 million are resilient structural savings also enduring in 2021 and beyond.

“Second, with the total gross proceeds of CHF890 million we have raised through the rights issue process, we have considerably strengthened our financial position and increased our flexibility to act on growth opportunities including new concession contracts and strategic partnerships. I would like to thank our existing shareholders and our new partners Advent International and Alibaba Group for their trust and support of the company’s long-term strategy and path towards recovery to emerge as a more efficient travel retail company.

“Third, the collaboration with Alibaba Group, for which we are currently setting up a Joint-Venture company in China, will not only allow us to further develop travel retail in China but also to accelerate Dufry’s digital transformation globally. This is a considerable contribution in driving our e-motion strategy to increase customer touch-points and engagement along their journey. We will keep you informed on the progress of the collaboration and the opportunities identified.

“With respect to the current performance, our business and the travel retail industry remain particularly exposed to the dynamic macroeconomic situation and the travel restrictions. We have seen an encouraging travel uptake in July and August, with a plateauing in September caused by the increased quarantines imposed by certain countries. Nevertheless, the comprehensive set of actions implemented in 2020 in close alignment with our landlords, suppliers and other business partners as well as our current liquidity position will allow Dufry to comfortably endure even a prolonged recovery.

“I would like to express again my personal gratitude to our employees, who continue to support the company through this challenging time and are embracing the new organisation and ways of working with a high motivation. Their resilience and commitment have allowed us to quickly adapt the company to the new environment while also engaging in opportunities and new partnerships. Sadly, we have colleagues who were infected and I want to remember them and their families globally. We will continue to take all necessary steps to provide our employees with a safe working environment.”

Regional performance: Europe, Middle East and Africa

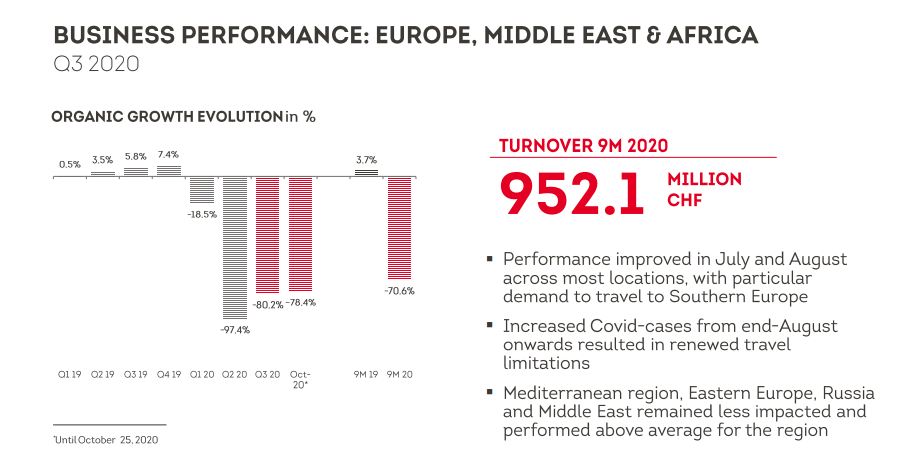

The third quarter saw organic growth slide by -80.2% versus Q3 2019, reaching CHF274.5 million (US$299 million). Performance improved in July and August across most locations in Europe, especially in Southern Europe at the beginning of August with the peak of the summer holidays and supported by the lifting of travel restrictions.

From the end of August, some countries such as Spain, France, and UK saw increased Covid-19 cases, resulting in renewed travel limitations, which were more broadly put in place across Europe starting in late September. The Mediterranean region, but also Eastern Europe, Russia and the Middle East remained less affected and performed above average for the region.

Asia Pacific

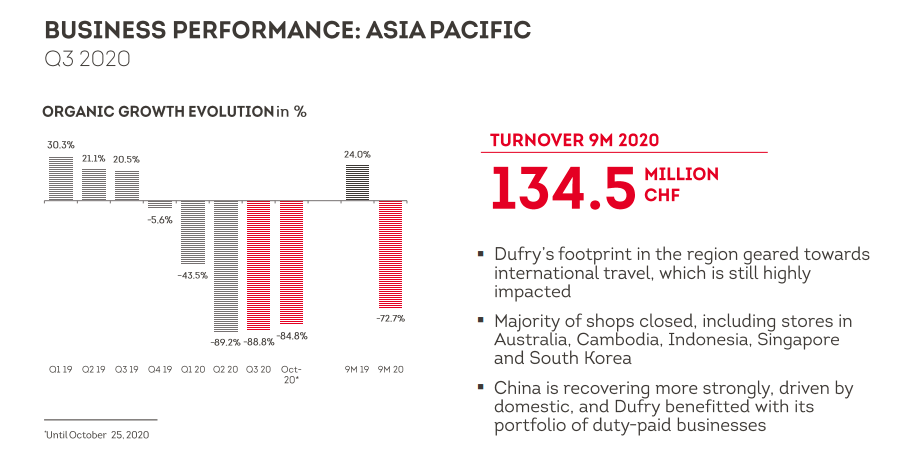

Turnover amounted to CHF17.1 million (US$18.6 million) in Q3 2020, with organic growth falling -88.8% year-on-year. Dufry’s footprint in the region is geared towards international travel, which is still highly impacted. The majority of shops in Dufry’s Asia Pacific locations remained closed, including those in Australia, Cambodia, Indonesia, Singapore and South Korea. China is recovering more strongly in the region and globally, driven by the significantly increasing demand in domestic travel since Q2, and Dufry benefited with its portfolio of duty paid businesses.

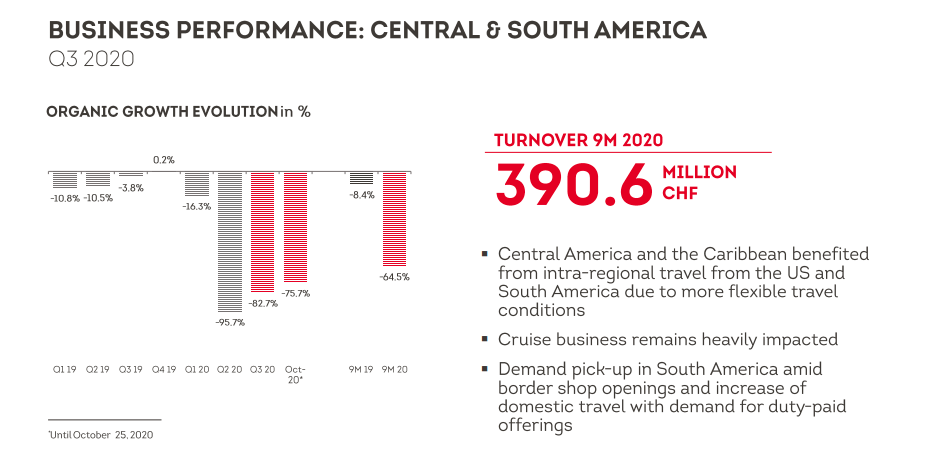

Central & South America

Turnover was CHF61 million (US$66.5 million) in Q3 2020 (organic growth -82.7%). Central America and Caribbean, including Mexico, Dominican Republic and the Caribbean Islands are performing more robustly compared to all other regions, driven by intra-regional travel from the US and South America, especially during the summer months, and continued demand due to more flexible travel conditions.

The cruise business remains heavily affected. South America saw demand pick-up amid border shop openings and increase of domestic travel with duty paid businesses performing better compared to duty free operations, and airports lagging behind other channels.

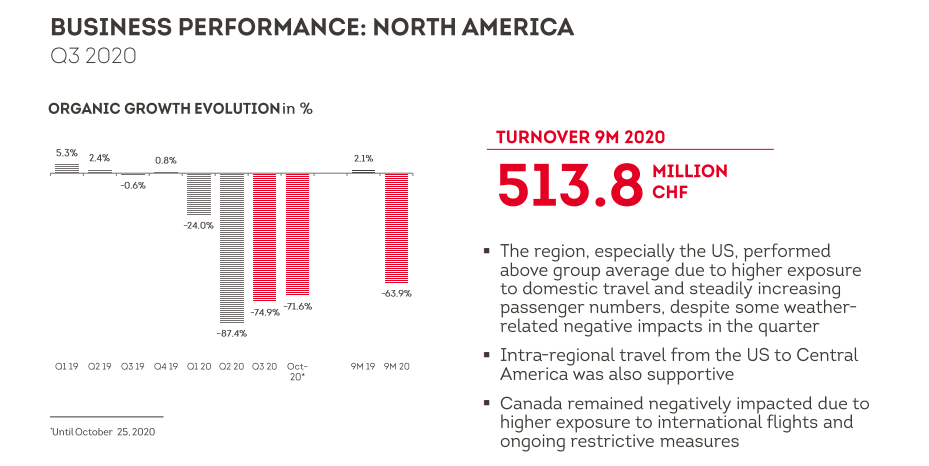

North America

Turnover reached CHF 121.6 million (US$132.5 million) in Q3 2020 with organic growth down -74.9% in the period. The region, especially the US, performed above the group average due to higher exposure to domestic travel and steadily increasing passenger numbers, despite some weather-related negative impacts in the quarter. Intra-regional travel from the US to Central America was also supportive. Canada remained negatively impacted due to a higher exposure to international flights and restrictive measures. The performance was driven by Hudson convenience stores, food & beverage and other duty paid offerings. (See Hudson performance below.)

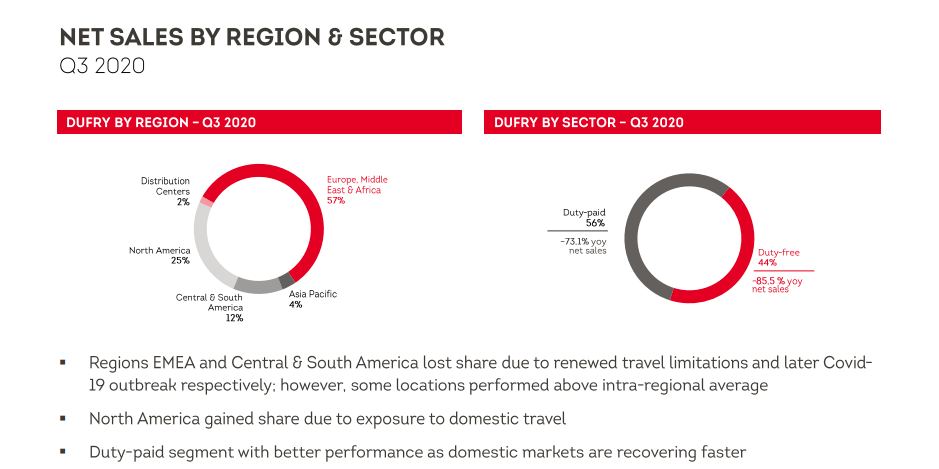

The regional net sales split saw Europe, Middle East and Africa contributing 57%, Asia Pacific 4%, Central & South America 12% and North America 25%. Global distribution centres accounted for 2% of Q3 2020 net sales.

Business development

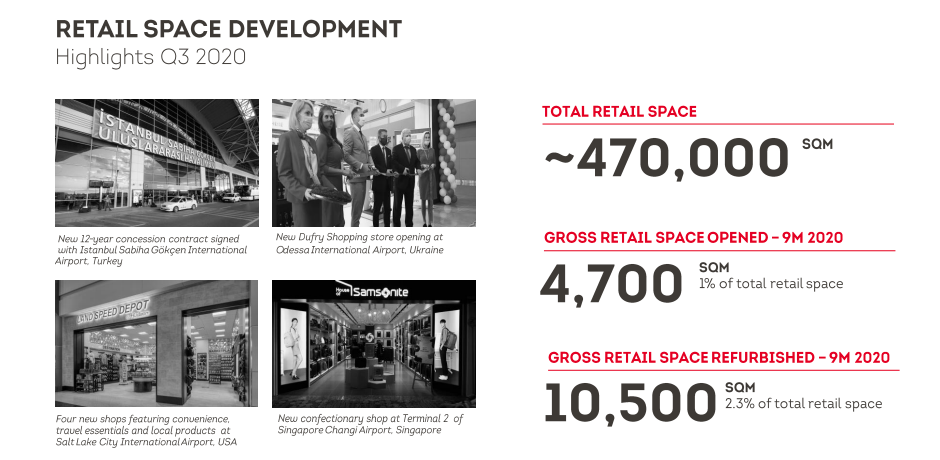

The total gross retail space opened during the first nine months was 4,700sq m or 1% of overall retail space operated by Dufry. New shops were opened, among others, in Odessa, Singapore, Salt Lake City, and Boston. Shops in Corfu, Mykonos, Thessaloniki, Antalya, Belgrade and Nashville, among others, were refurbished, accounting for 10,500sq m or 2.3% of overall retail space.

As reported, Dufry was awarded a 12-year duty free concession at Istanbul Sabiha Gökçen International Airport, the second busiest airport in Turkey and the closest to Istanbul city centre. From Q4 2020 onwards, Dufry will operate 3,900sq m of duty free and speciality shops.

For full-year 2020, Dufry expects to deliver around 23,000sq m of new and refurbished space, consisting of around 90 shops. This represents growth of around +5% compared to existing retail space. Current status of the delivery plan for new retail space is as follows:

- 11,750sq m of new space with 4,700sq m executed by Q3 2020

- 11,250sq m of refurbished space with 10,500sq m executed by Q3 2020

- Current pipeline opportunities stands at 29,035sq m as of October 2020.

Financial position

Dufry noted that it concluded a comprehensive set of initiatives to strengthen its capital structure and liquidity position earlier this year. As of 30 September, net debt amounted to CHF3,735 million compared to CHF3,659.4 million compared as of June 30, 2020, and CHF3,101.9 million at the end of December 2019.

Dufry’s liquidity position amounted to CHF2,065 million as of 30 September pro-forma, including:

- Net proceeds from rights issue and mandatory convertible note of CHF867 million

- Cash outflow related to Hudson transaction of CHF295 million

- Cash and cash equivalents of CHF748 million

- Available credit lines of CHF 745 million

Cash consumption, defined as equity free cash flow, stood at CHF51 million in Q3 2020. Including the above-mentioned proceeds related to the capital increase and the cash outflow for finalising the Hudson transaction, pro-forma net debt as of 30 September stood at CHF3,171 million.

Outlook

As noted above, Dufry expects to generate around CHF1 billion in cost savings in 2020, Around CHF500 million of these are expected to be in the form of MAG reliefs related to the year ending 31 December.

Dufry expects personnel expenses reductions of around CHF450 million in 2020, and around CHF300 million cost reductions in 2021 due to a permanent restructuring, a decrease of around -35% and -25% compared to 2019 respectively. Dufry has recognised a provision in the amount CHF62.7 million for restructuring related expenses as of 30 September.

Other expenses-related cost reductions for 2020 are expected to account for around CHF230 million, for 2021 for at least CHF100 million, a decrease of around -40% on 2020 and -20% compared to 2019 respectively. In addition, Dufry has taken action with respect to capital expenditures, with expected cash savings of around CHF145 million in full year 2020.

Dufry confirmed cash flow scenarios for H2 2020, in particular:

*Average monthly cash outflow in the second half of the year of approximately CHF60 million if full-year 2020 turnover decreases -70% compared to full year 2019 turnover;

*Average monthly cash flow break-even in the second half of the year if full-year 2020 turnover decreases -60% compared to full-year 2019 turnover.

Those scenarios include changes in trade payables, trade receivables and inventory, but no other working capital changes.

Duty paid sales lift Hudson

In related news, Hudson reported growth in Q3 relative to Q2 as duty paid sales improved and domestic travel climbed in the US market. Turnover for the three months ended 30 September 30 fell by -74.1% year-on-year to US$135.4 million, and turnover for the nine months dipped by -63.6% to US$538.6 million.

After having temporarily closed over 700 of its approximately 1,000 stores at the height of the pandemic, Hudson has now reopened over 300 stores as of 31 October.

The company noted that US airport passenger levels were down approximately -65% year-over-year in October, compared to -95% down at the height of the COVID-19 pandemic in April 2020.

CEO Roger Fordyce said: “While the past seven months have been challenging, we’re continuing to position the company for a strong recovery both in the immediate and long-term by minimising our cash spend, optimising our operational efficiency, advancing our digital initiatives, and above all, prioritising the health and safety of our teams and customers.”