EUROPE. The European Travel Retail Confederation (ETRC) has said that a new window of opportunity could open for arrivals duty free in the European Union (EU) as part of a wider programme for tourism in the region.

That’s according to ETRC President Dr. Jennifer Cords and ETRC Secretary General Julie Lassaigne, who updated The Moodie Davitt Report this week on its latest efforts to introduce a new channel of trading in the EU. That update followed a gathering of the ETRC Board and Supervisory Board in Hamburg this week, hosted by Gebr. Heinemann.

Consultants to the EU Commission have begun studying how governments can support regional tourism infrastructure post-pandemic – and are approaching travel retail industry stakeholders about the issues at stake.

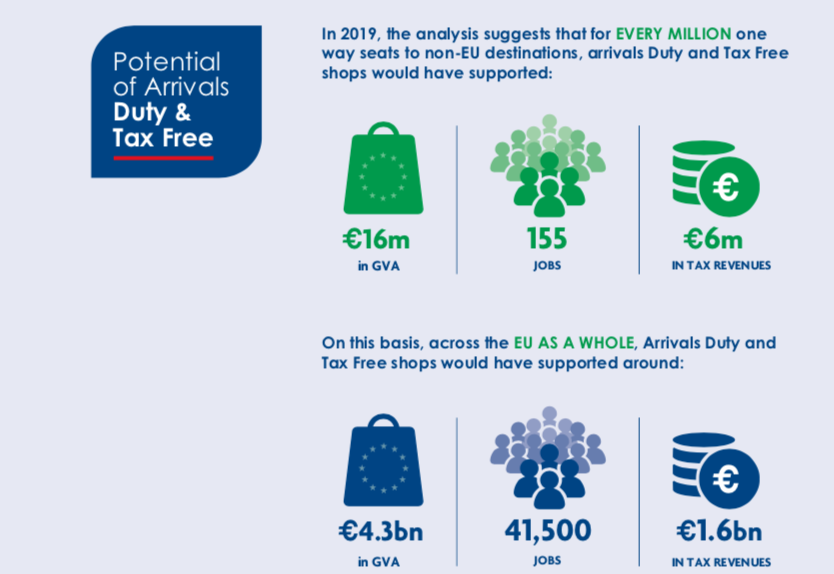

A study is expected to be produced by January 2023, which will feed into an impact assessment by the EU Commission which will consider several policy options, hopefully by Q2 next year. This will cover areas such as VAT relief for tourism, but industry campaigners are optimistic that it can also include a proposal to amend EU excise duty and VAT directives to allow duty free sales for inbound passengers to the EU, as part of a new tourism framework.

The ETRC has been lobbying for the introduction of arrivals duty free since 2020. It accelerated these efforts in late 2021 against the backdrop of new legislation that was proposed to formally permit the French Eurotunnel rail terminal at Coquelles to sell duty free goods.

The ETRC supported this move and as part of its consultation asked the EU Commission to consider amendments to its Excise Directive to allow arrivals duty free. Ultimately the ‘technical amendment’ to allow Coquelles to sell duty free was passed in March but without further amendment to include arrivals duty free.

Julie Lassaigne explained: “We had been working hard last year to convince the Commission and member states about the benefits of arrivals duty free. That accelerated after the Commission published a proposal [on 16 December -Ed] to formally allow duty free sales in the French Eurotunnel rail terminal at Coquelles. Duty free sales between EU states and the UK returned post-Brexit. France however decided not to allow rail duty free sales in general but it did allow a duty free shop to open at Coquelles.

“When the European Commission published a proposal to enshrine this into EU legislation, we saw this as an opportunity as it dealt with the same piece of EU legislation as governed arrivals, namely the Excise Directive.

“We had an intense campaign through the next few months where we were talking to the Commission, various relevant departments plus member states to try to get an additional amendment adopted to permit arrivals duty free.

“The EU Council [representing member states] decided to adopt the technical amendment to allow duty free in Coquelles but without any other amendments. That Eurotunnel shop now has proper recognition and is in line with EU legislation.

“However, all of the engagement has resulted in the Commission agreeing to look into the possibility for arrivals shops as part of the VAT package for tourism. This also arguably takes the light away from [arrivals] being a fiscal question only, and allows us to build our rationale around the benefits of travel retail for the transport and tourism sector in the EU, and the need to support its recovery and future growth.”

Lassaigne added that the Commission is set to now “give proper consideration to the introduction of duty free for inbound passengers and also potentially railway passengers, which is still not part of legislation currently.

“The subject therefore remains very much on the table thanks to the work of the past two years, and we see a pathway to the introduction of arrivals duty free.”

Dr. Jennifer Cords added: “The big outtake from what we have done so far on arrivals duty free is that we have created a lot of buzz around the industry that was not there before. We have stressed the importance of non-aeronautical revenues to airports, the fact that we are proposing something that does not cost the states to support it, and that is self-financing. We were able to shine a light on our place in the business that was not clear to legislators who were fixated on airlines first and airports second.

“Now the EU Commission is undertaking a huge research work to look into how it supports tourism. VAT relief for that sector is one element, but travel retail is also part of the conversation.

“Without the amendment to the Excise Directive that came about because of the Coquelles question, that phase of the campaign is closed. But now the EU has come to us to ask what arrivals should play, what role should duty free in rail stations play? And this is potentially a better window of opportunity. The EU is driving this process now, and our role is to be a navigator.”

The EU Commission taxation department approached the ETRC in March to say it was looking into a new VAT package to support tourism from 2023. As noted, it has appointed consultants that are interviewing stakeholders in the industry about a range of topics and how they contribute to tourism in the EU.

Lassaigne said: “We have already spoken to the EU consultants, and they were well informed, which confirms that we have been addressing the right messages in our campaign. We are seen as an economic contributor to the tourism industry, and they are looking at spending that is related to tourism.

“What we have done recently is show the importance of travel retail in terms of revenues and how this helps airports for their funding and financing. Looking at the future, airports have undergone huge losses so now the question is, where will the money come from for that funding? It’s important to see that we can create our own commercial opportunities to bring even more money into that tourism ecosystem.

“With the study, our main aim is to ensure that a recommendation to legislate for arrivals duty free is introduced.

“We had initiated the engagement with member states, and that needs to continue. Any proposal will need to go through the EU legislative systems but also that of member states; any taxation matter at EU level needs to have the agreement of the 27 states. We also need to add more data to support our arguments and here the industry’s role will be important.

“We are optimistic. We see that the way this is presented could be a huge boost for the tourism sector. The EU is looking at it from a growth perspective. It is up to us to make sure it becomes an opportunity.”

Other issues the ETRC is addressing today include sustainability. “This is very much top of mind today, not least because of the recent Toulouse Declaration [about the future sustainability and decarbonisation of aviation -Ed],” said Cords. “We are still working through what sustainability means in our area of the business. We aim to work with our members to advance this topic in our business.

“In terms of specific initiatives, digital labelling is one closely related. That affects B2B and B2C packaging reduction in what we believe will be a big way, and we continue to work on this, especially now that we are past the crisis management phase.”

Lassaigne added: “We are reigniting the ETRC taskforce dedicated to digital labelling. Maybe because of COVID, the idea of bar codes has gained currency and policy makers realise this. Some product label legislation is being amended. For example on wine, digital labelling may be used from next year in the EU. We are having similar conversations about other categories as part of the revision of the food information to consumer regulations.

“There are threats such as front-of-pack nutrition detail for food and confectionery. We have seen that in South America, where it applies to travel retail, and has an impact on packaging, sales and supply chain. So here, we will really try to use our duty free label project as an enabler to secure an exemption from any on-pack requirements that might arise in the EU in future.”

The alignment of travel rules in the EU remains a concern, with discrepancies in how vaccine certificates are employed, and which vaccines are permitted across states.

Cords noted: “Our concern is that you have national laws on one hand, and rules introduced by airlines on the other, and that can cause customer confusion. People want to travel but any bad experiences can also have an influence. The range of policies that consumers face is a worry still as travel returns.”

Broadly though, Cords noted, the outlook for members across the sector in the region is positive. “The picture is bright for travel bookings and spending is good. We are refocusing now on the potential of travel retail and on unlocking that potential.”