SOUTH KOREA. Daigou resellers are adapting fast and creatively to the challenges posted by China’s new ecommerce law introduced on 1 January, according to exclusive new research from The Moodie Davitt Report.

As reported, the law is designed in part to curb excessive buying abroad by daigou buyers (or shuttle traders as they are often called in Korea). Many in the travel retail and investment communities had predicted a slump in the daigou trade that has propelled Korean duty free sales to new heights over the past two years, but the early evidence suggests there has been minimal impact, at least for the key beauty sector.

First-quarter projections proven incorrect

Analysts and duty free retailers alike have been pleasantly surprised by the 2019 market performance. At the end of 2018, Hotel Shilla (parent of The Shilla Duty Free) and Shinsegae adopted a cautious tone and warned that duty free sales would most likely drop in the first quarter of 2019. CLSA’s tourism analyst was more downbeat, outlining a bear case scenario showing reseller sales declining 60%, 50% and 40% in the first three months of the year.

In fact, duty free sales grew by 11%, 31% and 23% in US Dollar terms in those months with Chinese resellers continuing to drive the growth.

Daigou evolving to stay in the game

Korea Duty Free Association data suggests little has changed with the way daigou are conducting their business. However, both duty free retailers and corporate daigou talk of turbulent changes beneath a seemingly calm market surface.

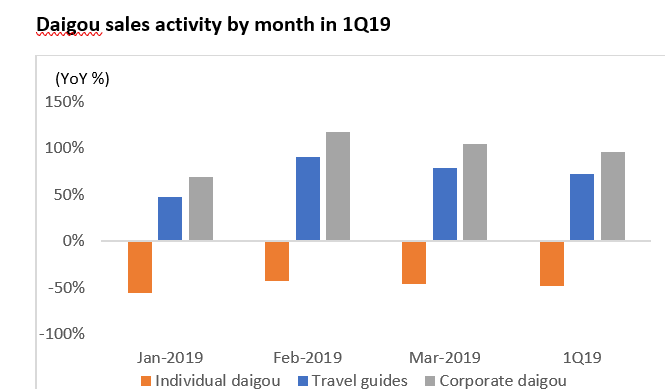

Afraid of prosecution and tightening customs crackdowns, many individual daigou have refrained from making new purchases but larger corporate daigou have offset that decline by increasing purchasing volumes

Moodie Davitt Research proprietary analysis of daigou activity in Korea suggests that corporate daigou have this year outstripped the market growth rate. As a result, their portion of reseller sales rose from 40% in 2018 to 60% in Q1 2019. The implied year-on-year growth rate of the corporate daigou the first quarter is close to 100% compared to a decline of 48% in individual daigou.

Daigou in their third generation

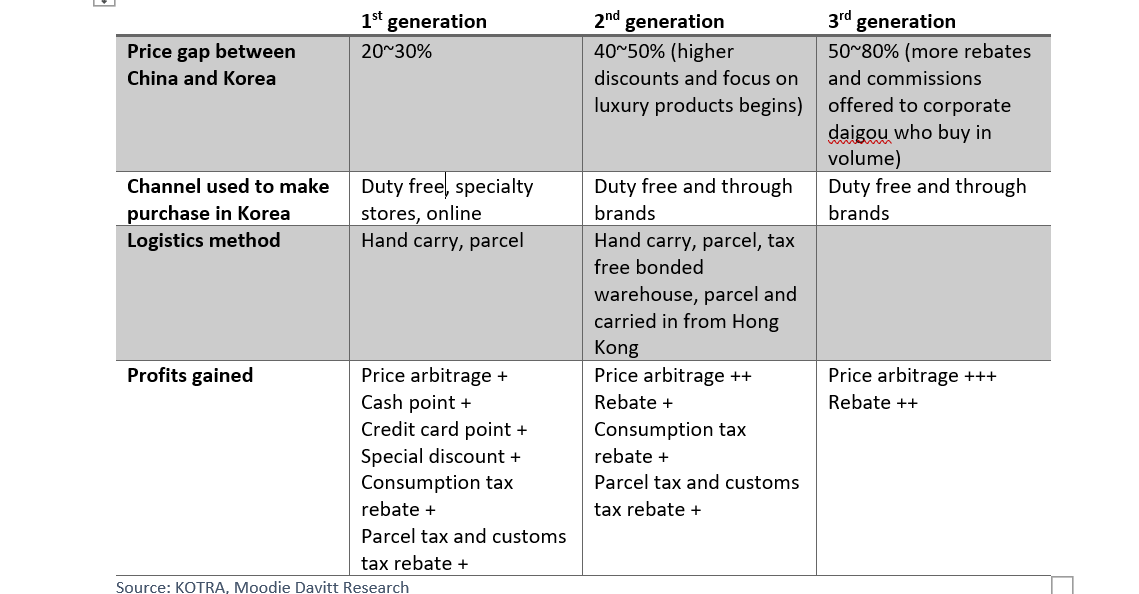

The pattern is clear – Chinese daigou have entered a new phase with larger corporate daigou growing in volume and small individual daigous losing out.

Local duty free retailers have had to adapt to step up commissions and other benefits such as offering best-selling products and arranging for delivery of products to basement car parks so that daigou no longer have to wait in line.

Key changes in daigou behaviour witnessed from the beginning of the year

– Large corporate resellers have increased their volumes to make up for the shortfall from having to pay taxes and duties.

– Mass queues in stores have been largely eliminated with the number of people employed by travel guides and corporate daigou reduced.

– Instead of lining up for the best products, large corporate daigou call duty free operators from their offices and ask for products they have orders from in China.

– Some of the smaller scale daigou are banding together to enhance purchasing power and pay for costs associated with registering their businesses.

– The larger resellers are taking advantage of the price competitiveness of Korean duty free to purchase at prices that allow them to make returns even after paying taxes in China.

– Growing popularity in China for high-end luxury makeup and the need to buy smaller portable products increases demand for smaller makeup products in duty free stores.

– Fewer individual daigou traders employed means that the time spent purchasing products daily has grown in importance. With time management critical and daigou employees sometimes staying up to 3am or 4am repackaging their purchases, it becomes increasingly difficult to visit stores in Gangnam that are far away from key locations such as Lotte Duty Free in Myeong-dong.

What to expect next?

Reports suggest that the Chinese government has recently stepped up efforts to enhance customs inspections (particularly at Shanghai Pudong Airport), crack down on illegal imports and make examples of those who have clearly violated the new ecommerce law. Despite that, Chinese official policing of the new law has been much more muted than expected, prompting daigou traders and industry experts to speculate that Beijing is allowing time for market participants and smaller-scale individual businesses to adapt to the law change.

The early 2019 performance has surprised and encouraged Korean duty free retailers, but more stringent enforcement and heightened regulation may yet depress the country’s badly overcrowded Korean travel retail sector.