GERMANY. Frankfurt Airport parent company Fraport has said that the long path to industry recovery has begun, despite posting sharp falls in revenue and profit in the first quarter of 2021.

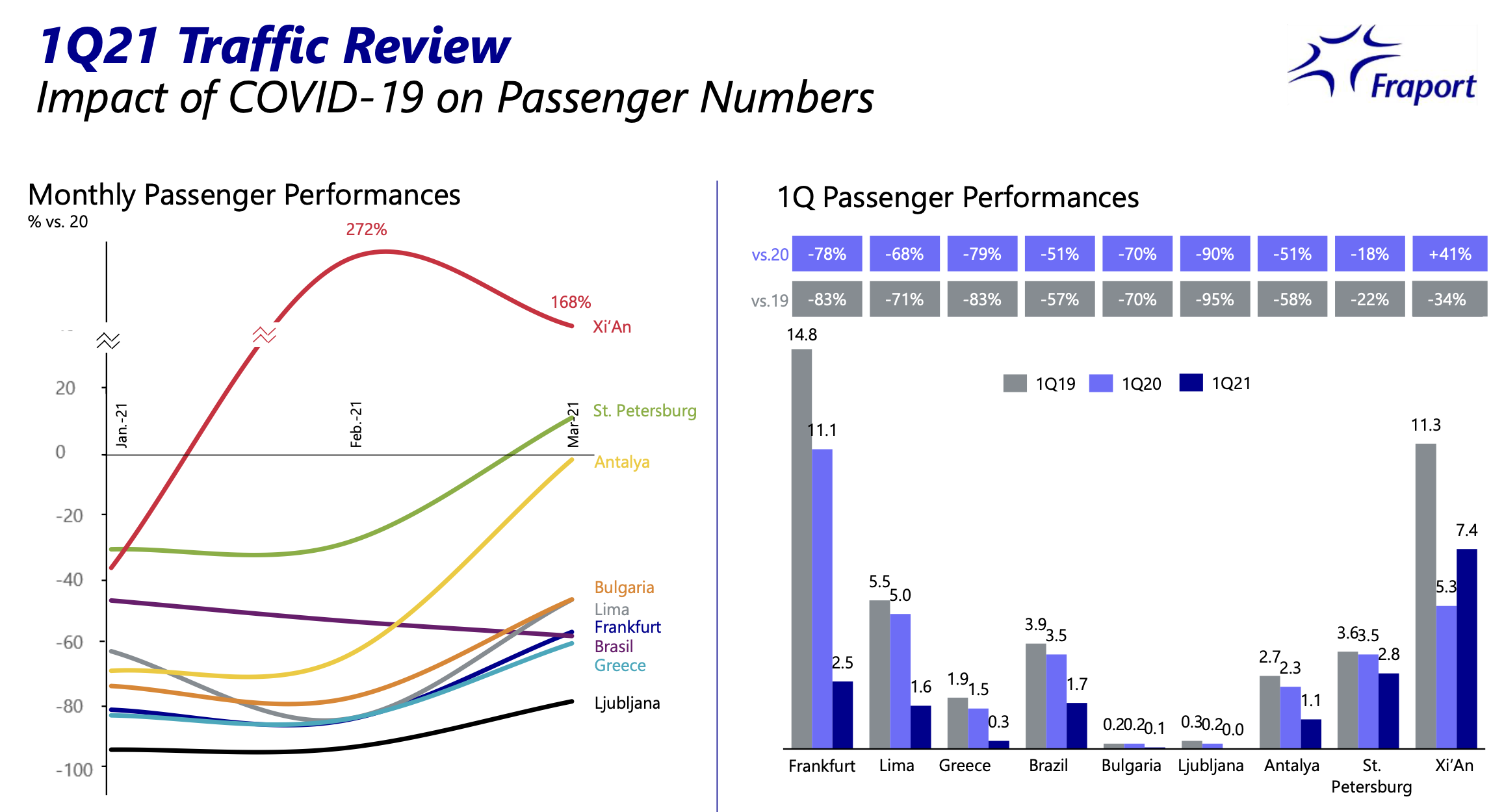

With passenger traffic falling by -77.6% in Q1 at Frankfurt Airport, and down by -50% to -90% across its airports worldwide, Fraport Group revenue declined by more than -40% year-on-year to €385.0 million in the period. The airport company posted a net loss of €77.5 million.

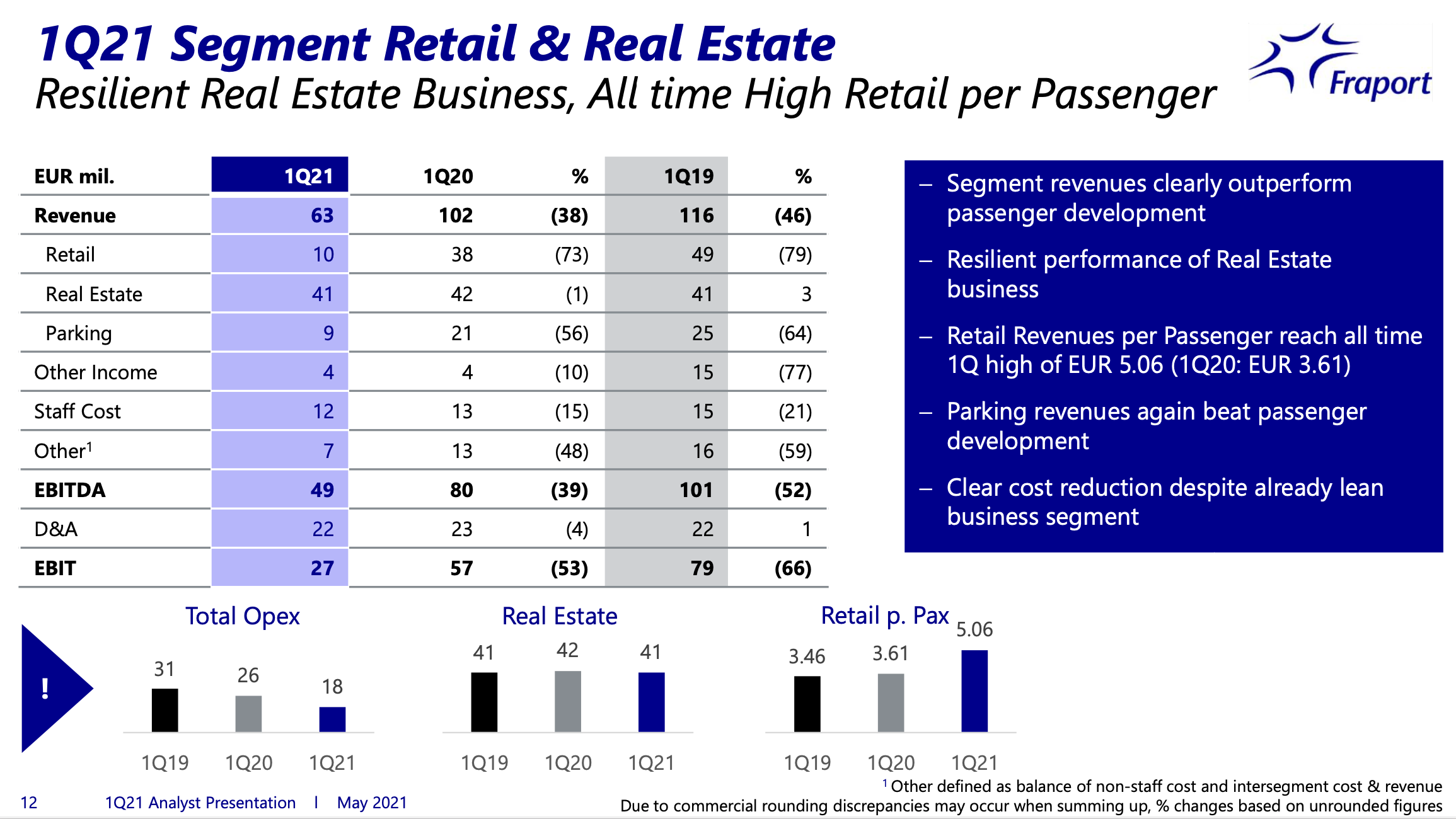

Revenue in the Retail & Real Estate segment fell by -37.9% year-on-year to €63.2 million. This was due to lower retail and parking revenue as a result of the severe drop in passengers at Frankfurt Airport. Real Estate revenue was roughly at the previous year’s level. Net retail revenue per passenger increased from €3.61 to €5.06 though this was skewed by the far lower passenger base. EBITDA amounted to €48.9 million (–38.9%). Due to a slight decline in depreciation and amortization (–€ 0.9 million), segment EBIT decreased to €26.6 million, a fall of –53.2%). Fraport Executive Board Chairman Dr. Stefan Schulte said: “The aviation industry still did not see any noticeable recovery during the first quarter of 2021. This was not unexpected considering the global pandemic situation. Nevertheless, we are confident that we are now reemerging from the bottom of the trough. Vaccination campaigns in Germany and many other countries are gaining momentum. Moreover, a number of Covid-19 testing options are now available.

Fraport Executive Board Chairman Dr. Stefan Schulte said: “The aviation industry still did not see any noticeable recovery during the first quarter of 2021. This was not unexpected considering the global pandemic situation. Nevertheless, we are confident that we are now reemerging from the bottom of the trough. Vaccination campaigns in Germany and many other countries are gaining momentum. Moreover, a number of Covid-19 testing options are now available.

“People still have a strong desire to travel and explore the world. Therefore, we are expecting passenger numbers to increase noticeably during the Summer months – particularly on European routes at first, but also for intercontinental destinations over the long run. At the same time, we have leveraged the crisis to substantially reduce costs and realign our company to become leaner and more agile for the future.”

A major cost-cutting programme continues across the group. By eliminating expenses deemed not essential for operations, Fraport said it is making savings of between €100 million and €150 million a year. The company has also scaled down or cancelled investments, particularly at its Frankfurt home base – reducing related capital expenditure by about €1 billion over the medium and long-term.

The company is reducing personnel costs in Frankfurt by up to €250 million yearly compared to 2019, and has cut about 4,000 jobs.

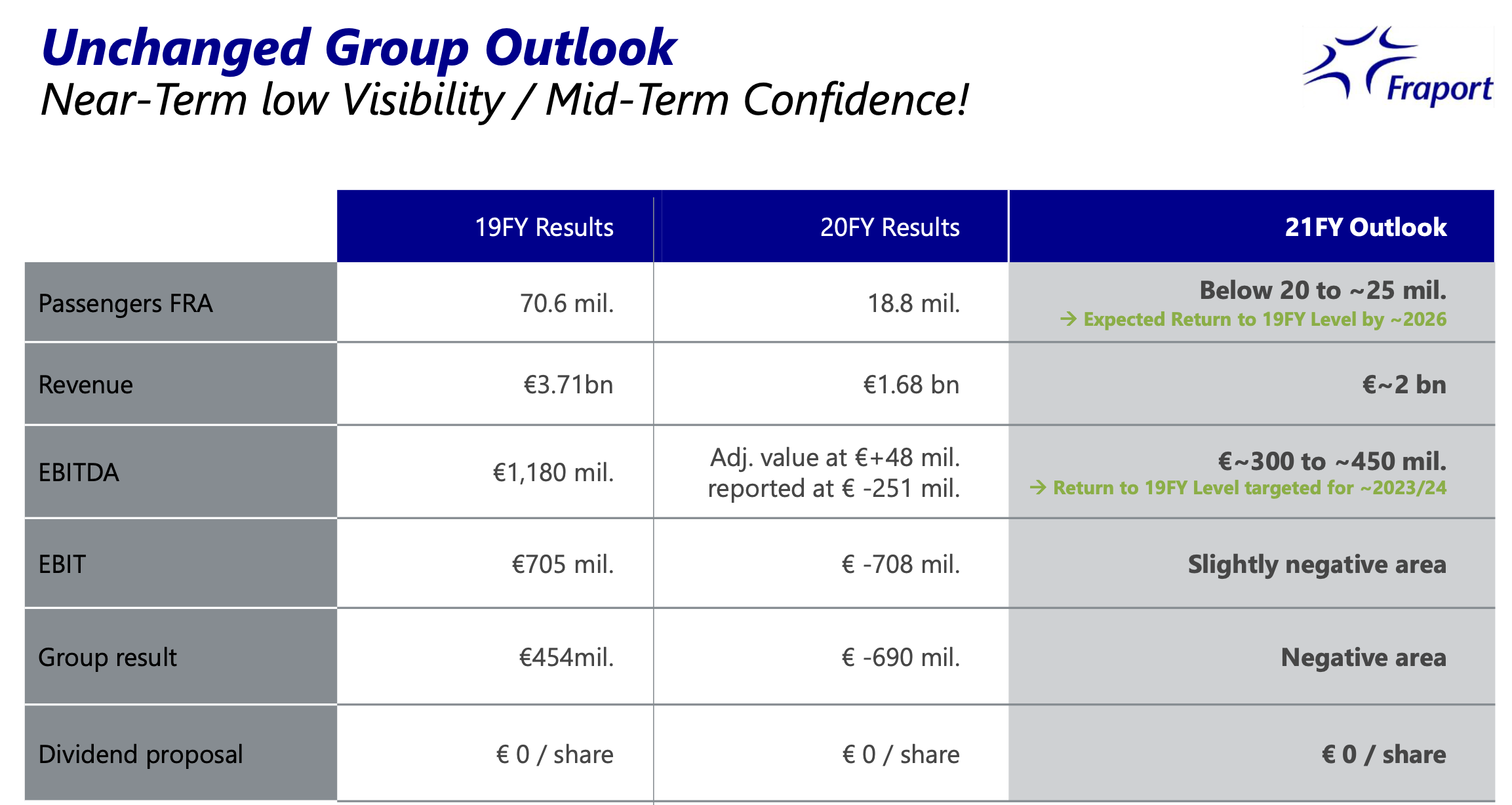

The board is maintaining its outlook for the entire 2021 business year. Passenger traffic at Frankfurt Airport is forecast to range from under 20 million to 25 million, compared to over 70 million in 2019.

Group revenue is expected to reach approximately €2 billion in 2021 (in 2019 it reached €3.7 billion). The company is forecasting Group EBITDA in the range of about €300 million to €450 million, which compared to €1.2 billion in 2019, with a net loss predicted.