SOUTH KOREA. Doosan Corp is to shut down its Doota Duty Free downtown business, the Korean conglomerate has announced in a regulatory filing seen by The Moodie Davitt Report, writes The Moodie Davitt Report Senior Retail and Commercial Analyst Min Yong Jung (see full analysis below).

SOUTH KOREA. Doosan Corp is to shut down its Doota Duty Free downtown business, the Korean conglomerate has announced in a regulatory filing seen by The Moodie Davitt Report, writes The Moodie Davitt Report Senior Retail and Commercial Analyst Min Yong Jung (see full analysis below).

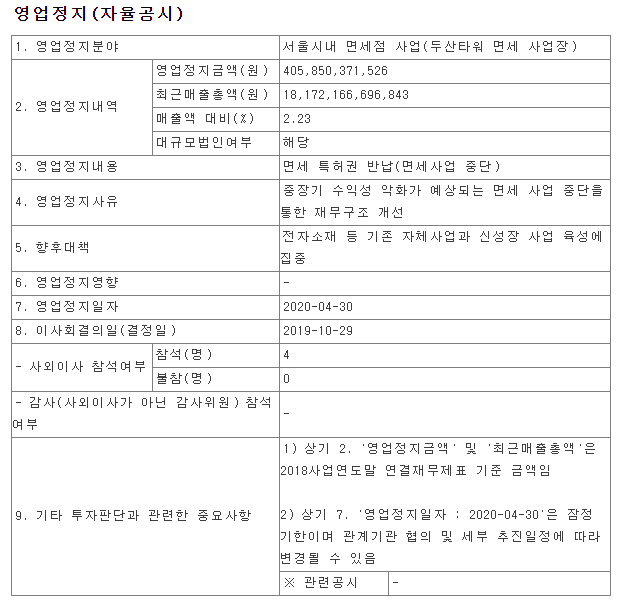

The group will return its licence and cease operations in Dongdaemun, eastern Seoul from 30 April 2020.

“We plan to improve our financial status by closing the duty free business that is expected to suffer low profitability in the long term,” the company said in its statement.

The forthcoming closure is the second high-profile exit from the Korean downtown market, following the decision by Hanwha Group in April to close its heavily loss-making Galleria Duty Free 63 business in Seoul in September.

As reported, Doota Duty Free opened to great fanfare in May 2016. But the combination of depressed Chinese tourism in the wake of the THAAD anti-missile system dispute between South Korea and China and intense competition in the downtown duty free market (with resultant escalating daigou group commission costs) placed the operation under great financial pressure from the start.

Concerns over the future of the daigou business in the wake of China’s new ecommerce law implemented on 1 January may also have been a factor in the decision.

Awaiting Hyundai’s next move

According to local reports, Hyundai Department Store wants to lease Doota Duty Free’s store. Hyundai Department Store is a new but ultra-serious entrant to the Korean duty free market, having opened its store at the company’s Trade Center branch in Seoul’s Samseong-dong business district in November 2018.

With a limited number of companies expected to bid in the tender for three new licences in November 2019, Hyundai’s bid to take over from Doosan is likely to be well received by the Korea Customs Agency and the licence review committee

Hyundai Department Store has been an aggressive bidder for new licences in previous tenders and is one of the few existing market players anxious to add scale to its duty free business portfolio (currently just one store). Korean media claim that Doosan Corp approached Hyundai Department Store with an offer to take over its duty free business, which was headed for an operating loss this year.

However, a duty free licence in Korea is gained through an official tender with each proposition thoroughly reviewed by a review committee. An existing operator can’t sell its licence and a new one can’t be issued to a location that currently has one. The most likely scenario? Doota Duty Free’s April 2020 exit provides Hyundai with the opportunity to bid for a new licence in the same location after it fellow newcomer’s brief spell in the market comes to an end.

With a limited number of companies expected to bid in the tender for three new licences in November 2019, Hyundai’s bid to take over from Doosan is likely to be well received by the Korea Customs Agency and the licence review committee. Additional points are usually allocated to proposals that promise to take on the employees and brands from the previous duty free operator. Industry experts expect Hyundai to make all the necessary arrangements to ensure a key addition to its duty free portfolio in a strategic area that is able to service both resellers and directly compete against the main stores of close competitors Lotte and Shilla.

Comment: Golden goose no more

Once considered the golden goose for Korean corporations, the once-coveted duty free licence is no longer looked upon with such admiration.

With the top three retailers (Lotte Duty Free, Shilla Duty Free, Shinsegae Duty Free) heightening competition and an ambitious new player (Hyundai Duty Free) intent on growing market share, the promise of future fortunes grows dimmer for those unable to match the financial prowess of the giants.

A Doota Duty Free representative explained that the mid- to long-term profitability of the duty free business is expected to deteriorate, prompting the decision.

Nonetheless, Doosan Corp’s decision to exit the business comes as a surprise to industry watchers as the company was seen as the one retailer outside the big three to have gained market share and improved profitability.

Doota Duty Free recorded strong share gains and a successful turnaround in its profits in 2018 by catering to daigou resellers who found the proximity of the store to The Shilla Duty Free and Lotte Duty Free convenient. Doota Duty Free’s sales increased +53.7% year-on-year to KRW618.7 billion (US$687.8 million) in 2018. Its market share improved from 3% to 3.3% in the same period.

Unlike Lotte Duty Free and Shilla Duty Free, which are making headway in expanding their footprint not only in Korea but on foreign soil, Doota Duty Free sees too many constraints for growth with just one Seoul downtown store, the spokesman said.

Despite growing sales, 2019 operating profit is expected to return to a loss and with three additional licences due to be tendered towards the end of the year, Doota Duty Free’s board has clearly decided enough is enough. The duty free business accounts for a mere 2.23% of the Korean conglomerate’s revenue as Doosan specialises in heavy industry and construction for the majority of its earnings.

Doota Duty Free’s decision to exit and return its licence to Korea Customs Agency means there will be just ten downtown duty free stores continuing their operation among 13 licences issued by the regulatory body (those to exit being City Duty Free Shinchon, Hanwha Timeworld Yeoido and Doota Duty Free Dongdaemun). It remains to be seen when – or if – Korea Customs Agency will tender the Doota Duty Free licence.

In collaboration with Globuy

|

As a lead partner of The Moodie Davitt Report, this story will also appear in coming days in Chinese and with a consumer voice on fast-growing Chinese B2C WeChat social media account Globuy [玩转全球免税],

As a lead partner of The Moodie Davitt Report, this story will also appear in coming days in Chinese and with a consumer voice on fast-growing Chinese B2C WeChat social media account Globuy [玩转全球免税],