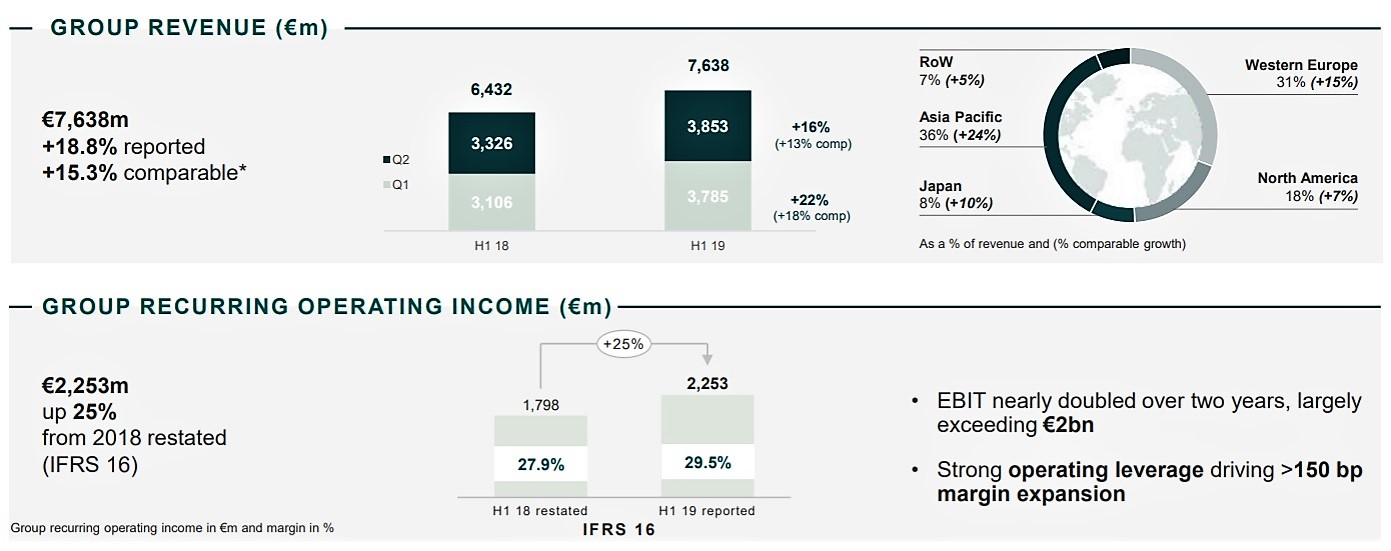

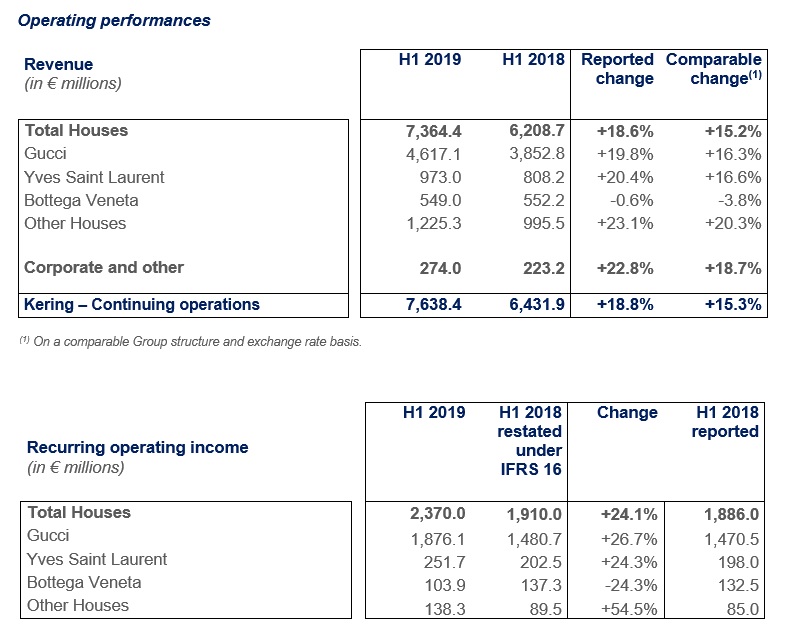

Global luxury group Kering has posted a +15.3%* boost in revenues on a comparable basis (+18.8% reported) to €7,364.4 million in the first half of 2019. Continuing, though slowing, growth for its biggest brand – Gucci – plus a strong increase at its ‘Other Houses’ division drove much of the increase.

Glamour brand Gucci pushed forward by +16.3% to reach €4,617.1 million. The Italian powerhouse label – popular across multiple product categories in the travel retail channel – accounts for over 60% of Kering’s total revenue. In 1H19, Gucci generated more sales than for the whole of 2016, indicating just how much demand there has been for the brand in recent years.

Meanwhile, the group’s ‘Other Houses’ division – which includes names such as Balenciaga, Alexander McQueen, Brioni, Boucheron, Pomellato, Qeelin and Ulysse Nardin – delivered +20.3% growth to €1,225.3 million. Kering said the division also saw a “very sharp rise in profitability”.

The group’s second biggest brand, Yves Saint Laurent, grew by +16.6% to €973.0 million in the period while Bottega Veneta was the only house to show contraction with a -3.8% fall to €549.0 million. However the Italian brand saw an improving trend over the period, turning a -8.9% contraction in 1H into +0.8% growth in 2H.

Commenting on the overall performance, Kering Chairman and CEO François-Henri Pinault said: “In the first half of the year, we delivered another very strong set of results. Kering’s revenue growth topped market trends, and was highly profitable. We created an additional €1.2 billion in revenue and our operating margin reached a record 29.5%.

“The success of our brands, built on creativity, innovation, and customer dedication, along with rigorous execution and financial discipline, are delivering a superior combination of organic growth and sustainable profitability.”

Gucci goes off the boil but Kering Eyewear rocks

However Pinault’s positive spin did not convince investors last week as Kering’s share price tumbled by almost 9% on release of the 1H19 numbers. A key concern was that the pace of Gucci’s growth, while good, was slowing. In the first quarter it was +20.0% but in the second it fell to +12.7%. Both were well off the +36.9% acceleration Gucci saw last year.

While Gucci is expected to ‘normalise’ after its growth spurt of recent years, Kering’s much-less discussed smallest division ‘Corporate and Other’ saw 1H19 growth of +18.7% to €274.0 million.

The division houses Kering Eyewear, a growing player in the travel retail channel, which saw a revenue gain of +21% to €259.4 million for the group (after eliminating intra-group sales and royalties paid to the group’s houses).

According to Kering, the eyewear business had a solid performance in both the first and second quarters on the back of the “continued strength of Gucci, Cartier and Saint Laurent and the successful roll-out of Balenciaga and Montblanc lines”, both new licences for the group.

Kering added that further initiatives to sustain sales performance going forward included “high-impact marketing events; the implementation and support of the Gucci Global Travel Retail campaign” as well as increased control of the supply chain through strategic partnerships.

By region, Kering saw the strongest growth in Asia Pacific (excluding Japan) at +24.2% in the first half. This was followed by Western Europe (+14.8%), Japan (+10.2%), and North America (+7.3%).

What lies ahead

In its outlook statement, Kering said it would focus on achieving same-store revenue growth while ensuring “a targeted and selective expansion” of its shop network. The group is also “proactively investing to develop cross-business growth platforms in the areas of e-commerce, omnichannel distribution, logistics and IT infrastructure, and digital technologies”.

The group said, however, that its operating environment “remains unsettled with regard to macroeconomic and geopolitical uncertainties, national trade policies, and fluctuations in exchange rates – events that could impact consumer trends and tourism”.

* All financial percentages shown based on a comparable basis unless stated.