NETHERLANDS. Dutch brewer Heineken N.V. today announced strong organic net profit growth of +13.7% for the first six months of 2006, well up on the +5.4% upswing reported for the same period in 2005.

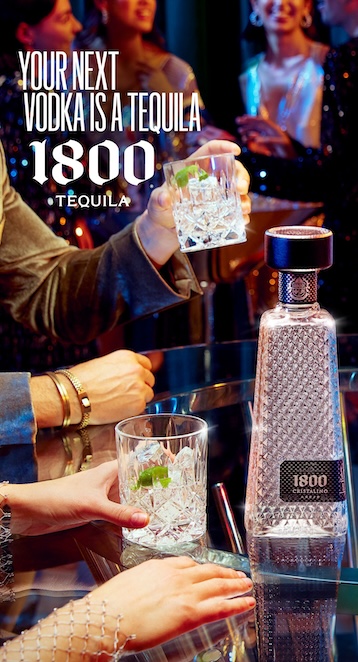

In other news, Heineken International has partnered with EON productions and Sony Pictures Entertainment to launch a worldwide promotional campaign for the 21st James Bond film, Casino Royale.

The campaign will include a television commercial featuring Eva Green, who stars as Vesper Lynd in the film. The ad, directed by Oscar-winning director Steven Gaghan, was shot on the Casino Royale set in the Czech Republic and will be broadcast on TV and cinemas throughout November and December 2006.

|

An advertising visual for the new James Bond movie released in November 2006 |

With Casino Royale, Heineken continues its well established association with international blockbusters which have a “natural fit” with the brand, the company said in a statement. Heineken has devised campaigns around three previous James Bond films.

The new campaign will comprise on- and off-premise promotions, interactive and digital activities, consumer competitions and tie-ins with local Sony events. It will be live in about 40 countries worldwide. Heineken beer will also feature in scenes from the movie.

Casino Royale is scheduled for international release on 17 November 2006 and introduces Daniel Craig as the new James Bond.

About the new Heineken Extra Cold

Heineken has launched a new Heineken Extra Cold brand extension. Instead of being served at a temperature of about 5-7 degrees Celsius, the premium Heineken beer is served at zero. The beer is cooled with a booster cooler to a temperature of around 2-3 degrees Celsius. The draught beer is then served into a frozen glass, which reduces the temperature of the beer to zero degrees. Heineken also provides special Extra Cold refrigerators for the storage of frozen glasses.

Key financial figures for first-half 2006

Heineken said it had achieved accelerated organic growth across all key metrics: +6.3% in revenues, +10.4% in EBIT (before exceptional items and amortisation of brands [beia]) and +13.7% in net profit (beia).

– Group beer volume grew +11.6%, to 62.8 million hectolitres, of which organic growth accounted for +6.6%. Consolidated beer volume amounted to 53.3 million hectolitres.

– Net profit (beia) grew 10.5% to €410 million mainly driven by strong topline growth. Net profit was +25.5% higher.

– Heineken brand volume in the global premium segment rose +12.7% to 11 million hectolitres, increasing the brand’s share of the segment. The Heineken brand – the world’s leading international premium beer brand – performed strongly in the Americas, Central and Eastern Europe and Africa, driven by engaging new marketing campaigns and consumer-driven innovations, the company said.

|

Heineken Extra Cold Tower |

The introduction of Heineken Premium Light in the US “exceeded expectations”, Heineken continued, with sales of over 300,000 hectolitres by the end of June. Heineken Premium Light is expected to achieve more than 600,000 hectolitres sales in 2006, +50% above the original forecast. The introduction has also had a positive impact on the volume growth of Heineken lager with depletions up 8% in the first six months, it said.

– In Russia, the integration of the breweries acquired in 2005 is proceeding on schedule, according to Heineken. The full-year sales forecast of 13 million hectolitres beer volume represents a high single-digit organic growth rate.

– The programme to reduce the fixed cost base by €200 million by the end of 2008, named Fit 2 Fight, is on track, the firm reported.

In a statement, the CEO said: “We have made a strong start to the year… One of the key drivers is the excellent performance of the Heineken brand in all regions, and most notably the successful launch of Heineken Premium Light in the US, and the accelerated rollout of DraughtKeg.”

He continued: “Our focus on Russia remains strong. Our volume performance, combined with our positive progress towards integration and our brand portfolio optimisation review, is a clear indication that we are on track to achieve our objectives for the market.”

|

The Heineken Extra Cold fridge |

In July 2006, Heineken raised its forecast of organic net profit growth for the full year 2006 to “slightly above 10%” (from “mid-single digit”). The upgrade reflected the good performance of the Heineken brand, strong volume growth in Central and Eastern Europe, the Americas, Africa and South East Asia, the better-than-expected volume performance of the expanded business in Russia and the successful introduction of Heineken Premium Light in the US. Heineken intends to boost marketing for Heineken Premium Light in the US.

Heineken expects the positive trend in its key markets and the strong growth of the Heineken brand to continue. However, in the second half of 2006 the comparison with prior year will be more challenging than in the first half, it reported.

Group beer volumes in the first six months of 2006 grew by +11.6% from 56.2 million hectolitres to 62.8 million hectolitres. Consolidated beer volumes totalled 53.3 million hectolitres. Organic growth in consolidated beer volumes amounted to +5.7%. Volumes were higher in all regions, including Western Europe. First-time consolidations added 2.8 million hectolitres to group beer volume, and are related to the acquisitions in Russia in 2005.

RESULTS BY BRAND

|

Volume generated by recent innovative beer systems such as DraughtKeg, BeerTender and the David draught system grew more than +30%, albeit from a low base, according to the company.

New activities in the first half of 2006 included the roll-out of Heineken Premium Light in the US and the launch of Amstel Pulse in Australia and Greece following the introduction in Russia in December 2005.

Volume of the Heineken brand in the premium segment grew +12.7% to 11 million hectolitres, while total Heineken volume (including the Netherlands) rose to 12.6 million. Volume of Heineken grew strongly in all regions with Western Europe up +4.5%, Central and Eastern Europe +14.5% higher and the Americas up almost +20%. In the US, depletions (sales by distributors to the retailer trade) of the Heineken brand including Heineken Premium

Light grew +18%.

Heineken announced several new global marketing programmes for the Heineken brand in the first half of 2006, including the renewal of Rugby World Cup sponsorship contract for the tournament in France in 2007 and a worldwide promotional campaign for the 21st James Bond film, Casino Royale.

Heineken launched the Xtreme Draught, an innovative mobile draught beer system, using 20-litre kegs for the on-trade, in July of this year.

Amstel volume grew 9.9% to 5.8 million hectolitres, driven by a good performance in Africa and the Middle East and Europe. Amstel Pulse was introduced in Russia, Australia and Greece.

RESULTS BY REGION

|

Western Europe

Regional beer volumes in Western Europe grew organically by 0.7% to 16.0 million hectolitres, helped by good weather in May and June. Heineken volume in the premium segment grew by +4.5% in the first half with growth in all countries except Italy where the brand’s volumes held firm in a declining market. Revenues grew +3.4% to €2,653 million and EBIT (beia) totalled 296 million (+2.0%). Introducing innovations such as extra-cold beer, shaped cans and new draught beer systems, drives top-line growth in the profitable Western European markets.

Group beer volumes were higher in all other Western European markets. In the UK, in particular, the brand portfolio again achieved strong growth (+27%), with the Heineken brand volume up almost +20%, thanks to an increase in distribution and the consumers’ growing acceptance of the brand’s premium positioning. Heineken

entered into a four-year agreement with Chelsea Football Club to serve Heineken in al bars and restaurants at Stamford Bridge and is now available onboard all British Airways flights.

Central and Eastern Europe: Regional beer volumes grew +18.8% to 25.1 million hectolitres. Organic growth was +5.3%, driven by a strong performance in Poland, Germany, Greece, Russia and Romania. The Heineken brand posted a healthy +14.5% growth throughout the region, exceeding the 1 million hectolitre mark for the first time. In particular Greece, Russia, Poland and Hungary contributed to the growth of the brand. Revenue grew +24.4% with an organic growth rate of +8.1%. First-time consolidations accounted for a +14.2% increase.

Russia: Beer volume in Russia grew strongly and Heineken forecasts sales of 13 million hectolitres by the year-end. Strong growth was recorded by the Heineken brand (+23%), Zlaty Bazant, Amstel, PIT and Guinness. Sales volume of the Ochota brand passed the 1.5 million hectolitre mark but Botcharev brand volumes were lower.

The Americas

|

Volumes grew in most countries in the region, with particularly strong progress in the US. Across the region, the Heineken® brand grew strongly by 19.6%, fuelled by strong sales in South America (+21.7%), the good performance of Heineken lager in the US, and the successful introduction of Heineken Premium Light. Regional beer volume grew +13.4% to 8.1 million hectolitres. Revenues grew 17.4% to €964 million.

USA: Overall beer market conditions in the US improved only slightly, but import and speciality beers performed strongly. Revenues increased +20.1% to which organic growth contributed 18.6%, driven by higher volumes of the Heineken brand and the Femsa portfolio of Mexican beers. Group beer volume of Heineken USA (excluding the Femsa brands) grew by +19.1% to 3.7 million hectolitres, boosted by the success of Heineken Premium Light. Total Heineken brand volume in the US leapt by +23% to 3.2 million hectolitres. Heineken lager benefited from the successful introduction of DraughtKeg and from the halo effect of the introduction of Heineken Premium Light. Heineken® lager volume grew 11%, while depletions (sales by distributors to the retail trade) climbed +8%.

Heineken Premium Light volume sold to distributors up to the end of June exceeded 300,000 hectolitres, well ahead of forecast. This volume includes the “˜pipeline filling` by the distributors and retail trade. Depletions in July and August have continued at a high level and Heineken forecasts sales of more than 600,000 hectolitres of Heineken Premium Light in 2006. Heineken intends to increase the marketing investment in Heineken Premium Light. The effect of higher sales volumes and increased marketing investments are expected to reduce the forecast negative impact of the launch on EBIT by 7 million to 18 million in 2006.

Africa and the Middle East

|

The Heineken Paco presentation. The bottle is sold to premium travel retail locations worldwide. Together with its dedicated display and shelf positioners, Paco aims to give travellers a premium beer experience |

Regional beer volumes grew +15.5% organically to 8.2 million hectolitres. Sales volume was notably strong in Central Africa, while volume in the Middle East was affected by the political situation. Revenues grew +16.7% to 564 million, and EBIT increased 14.7% to €115 million, on the back of a strong volume performance and better prices and sales mix. The improving political and economic environment in Central Africa was a major driver of

volume growth. The Heineken brand grew +25.5%, with positive performances in all countries except Lebanon. Growth was particularly strong in South Africa, Egypt, Israel, and Central Africa.

South Africa: Brandhouse, the South African joint venture between Heineken, Diageo and Namibian Breweries, started its second year with a strong performance. The focus on the Heineken brand resulted in a volume growth of +45% while volume of Amstel, brewed under licence in South Africa, jumped by +36%.

Asia Pacific

Regional beer volumes grew +8.2%, with Asia Pacific Breweries (APB), the Heineken joint venture with Fraser & Neave in the region, reporting +9.7% higher beer volume. In Australia, beer volume grew double-digit and in Indonesia beer volume edged up +2.1%. The Heineken brand grew more than 10%, and performed particularly well in China and Taiwan. Profit levels in the beer market in China overall are adversely affected by continuing pressure on selling prices and overcapacity.

The Asia/Pacific region offers attractive volume growth potential, according to Heineken. The establishment of positions in India and Laos and the expansion of the operations in Vietnam are recent examples. In India, APB bought a 76% stake in the Aurangabad breweries, and announced an investment in a greenfield brewery in Andhra Pradesh. In Vietnam, APB acquired two breweries from Foster’s establishing a strong number two position in this growing and profitable market.

For details on Heineken, contact Melvin Broekaart, Trade Sales Manager Duty Free & Travel Retail, Heineken International, PO Box 28, 1000 AA, Amsterdam, tel: +31 20 5239 290, fax: +31 20 6724 804, or e-mail Melvin.Broekaart@heineken.com Visit www.heinekeninternational.com

MORE STORIES ON HEINEKEN

Heineken flies with British Airways in huge pouring deal – 21/07/06

TFWA Asia Pacific Picture Gallery: Evening Beach Party – 18/05/06

Heineken and SSP partner in pioneering bar at Hong Kong International Airport – 16/05/06

Heineken called to the bar for Frontier Star award – 15/11/05