SOUTH KOREA. Hyundai Department Store, parent company to the newest entrant to Korea’s duty free market, has posted a -23.8% slump in second-quarter operating profit, driven by heavy losses in the duty free business. The news comes as the retailer prepares to bid for one of three new downtown duty free licences being made available by the government, writes Senior Retail and Commercial Analyst Min Yong Jung.

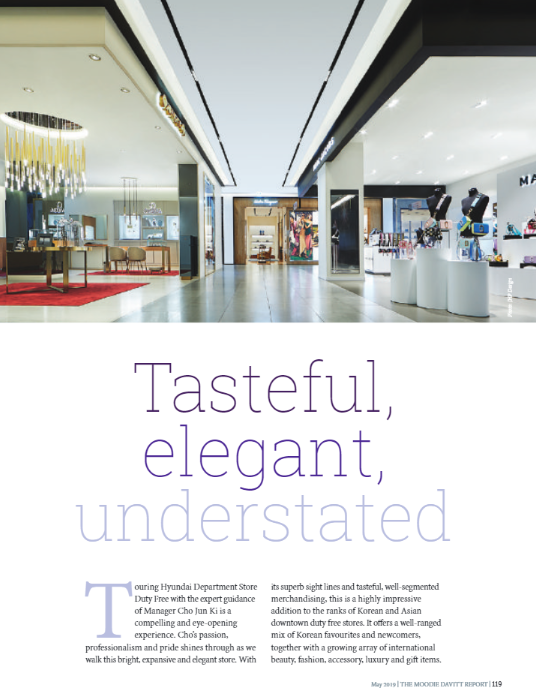

Hyundai Department Store Duty Free opened for business in the company’s renowned Coex Department Store in Seoul on 1 November 2018 and is keen to expand its market presence. The company seems sure to pick up one of the new Seoul licences in the tender which will be conducted this week between 11 and 14 November by Korea Customs Service (see below for details).

Industry insiders expect Hyundai Duty Free to be the only aggressive bidder as the powerful conglomerate seeks to bolster a duty free portfolio currently limited to just the Coex store in Gangnam.

Hyundai Department Store reported a +13.1% year-on-year increase in gross sales to KRW1,554 billion (US$1.297 billion) in the quarter. The department store grew just +0.2% year-on-year, which the retailer attributed partly to the widespread boycott of Japanese goods due to the escalating political dispute between the two countries.

Sales at the duty free store injected much needed momentum to the group’s top line with the duty free business grossing KRW11 billion (US$176 million) in sales.

Although the duty free arm’s operating margin improved quarter-on-quarter from -10.0% to -8.1%, the heavy loss resulted in Hyundai Department Store’s overall operating profit plummeting -23.8% year-on-year to KRW 1 billion (US$50.8 million).

Tender time comes around again

Hyundai will have the opportunity to add to its duty free portfolio this week if, as expected, Korea Customs Service opens the tender for five new duty free licences (three in Seoul, one in Incheon and one in Gwangju) from 11 to 14 November.

Despite the government’s bullish decision to provide more licences for large-scale operators, the business community’s assessment of the sector’s state of health is less upbeat, and few players are expected to bid for the once-coveted licences in the upcoming tender.

The Moodie Davitt Report has warned repeatedly of the dangers of the licence proliferation that has characterised the market in recent years. That overcrowding – and the subsequent need to pay excessive commission rates to reseller groups – contributed directly to this year’s high-profile exits by Doota Duty Free (Doosan Corporation) and Hanwha Duty Free (Hanwha Corporation).

Both are large corporations with plenty of financial capacity to make significant, long-term investments. According to Korea’s Fair Trade Commission Hanwha ranked seventh and Doosan 15th by asset size of the country’s biggest companies. While both have strong track records of making new investments, their respective decisions to exit the sector underlines the difficulty of making money in a channel dominated by giants Lotte, Shilla and Shinsegae and heavily reliant on one nationality, the Chinese, and one sector of that nationality – daigou resellers.

Hanwha’s store has stopped operating but Doosan is expected to continue operation until April 2020. While it remains uncertain if Hyundai Duty Free will take over that store (provided it picks up a licence as expected), Doosan’s bargaining power will inevitably deteriorate with the news of the store closure already resulting in slower customer traffic. Several employees at Doota were interviewed by the Korean media recently and commented that reports of the closing had circulated among Chinese customers on Wechat, prompting a decline in shopper numbers.

Flashback: How The Moodie Davitt Report covered the issue of licence proliferation in July 2017 Chickens come home to roost – but no more golden eggs Critics of the Korean licensing system, including The Moodie Davitt Report, spoke out in 2015 and 2016 against the proliferation of duty free licences and the lack of transparency over awards. The Moodie Davitt Report appeared at a National Assembly hearing in February 2016 and warned that such a scenario left the sector deeply vulnerable in the event of a downturn. That downturn transpired with a vengeance this year due to the row between South Korea and China over President Park’s decision to deploy the US-led Terminal High Altitude Area Defense (THAAD) system. The deployment (on Lotte land) has led to a disastrous fall in Chinese tourism to South Korea, with year-on-year visitor numbers falling by -40%, 66.6% and -64.1% in March, April and May, respectively. Chinese tourists represented almost one in every two visitors last year and generated some 70% of Korean duty free sales. In a January 2017 article, the highly influential Chosun Daily drew a parallel between current market conditions and the then-booming but Japanese-dominated Korean duty free market of 1984-1988. In that period Japanese arrivals rose by +94% to 1,112,000, earning the duty free industry the sobriquet of ‘the goose that lays the golden eggs’. A proliferation of licences led to 29 stores being open, far in excess of the necessary capacity. When the Japanese bubble economy burst in 1990, many stores were forced to close as tourist arrivals and spending slumped. Interviewed for the report, and asked if the Korean duty free industry was indeed a goose that lays golden eggs, The Moodie Davitt Report Founder & Chairman Martin Moodie said, “If there ever was such an egg, it cracked long ago.” He noted: “The proliferation of duty free licences in Korea was based on the perception that it is an industry full of easy and rich pickings. The reality is that excessive competition in the market has simply driven up the cost of business (especially with tour agency commissions) and left too many players fighting over a pot that is frighteningly vulnerable to a downturn in Chinese tourism.” As the old adage has it, the chickens have come home to roost. But this time they will not be laying any golden eggs. |