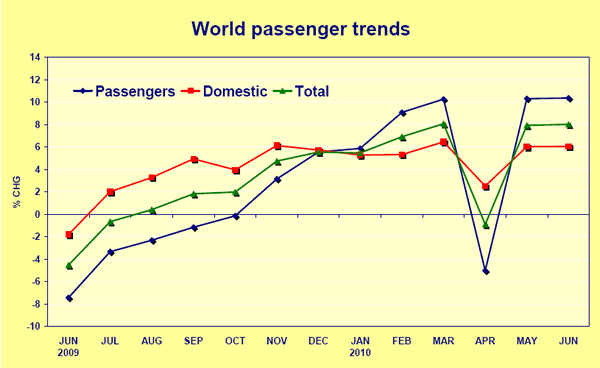

INTERNATIONAL. International passenger numbers climbed by +10.3% year-on-year at airports worldwide in May, according to the latest Airports Council International (ACI) figures. Domestic traffic also increased firmly, but at the more moderate pace of +5.8%. Total passenger growth was +7.9% worldwide in the month.

Top regional results were seen in Latin America/Caribbean (+32% international and +18% domestic) and Asia Pacific (+18.5% international and +11% domestic).

|

Overall growth in North America (+2.5%) and Europe (+5.2%) was more modest, although North America reported a strong +11.5% increase in international passengers – which in part reflects the business development plans of North American carriers, said ACI.

Both Africa (+9%) and the Middle East (+15%) delivered robust performances in May. As expected, the significant decline of traffic in April caused by the Icelandic volcano eruption did not have a lasting effect, and air traffic has resumed the growth path it had been following since August 2009.

ACI Director of Economics Andreas Schimm said: “Traffic is without a doubt on the rise. But there are a few considerations to keep in mind when analysing the figures. The Latin America/Caribbean region is comparing against low results in May 2009 when the outbreak of the H1N1 virus significantly dampened air travel demand across the region. The ensuing ripple effect in North America and Asia Pacific, where the fear of flu contagion slashed international travel, partially skews the figures and thus explains some of the extraordinary increases we observe this month.”

|

Cancún (+108%) and Mexico City (+46%) are examples of the huge leaps in volumes in that region, while overall the Latin America-Caribbean region was supported by continued strong domestic traffic growth as seen in Brazil and Argentina. Airports in North America that suffered from the H1N1 outbreak but have now rebounded include Dallas Fort Worth (+20%), Los Angeles (+16%), Toronto Pearson (+14%), New York JFK (+11%) and Miami (+10.5%).

Domestic traffic in North America (+0.8%) continues to stagnate as carriers are focused on increasing yields and load factors, said ACI. The airports growing in the domestic market are New York La Guardia (+15%), Boston (+7%), Baltimore (+5%) and San Francisco (+5%). All these airports have seen expansion of services by Southwest and Virgin America. Cincinnati (-31% in total) is suffering from being dropped as a hub of Delta Air Lines.

In Europe, Russia and Turkey brighten up the overall figures and much of the traffic increase can be attributed to traffic between these two countries. The seven top performing airports in May are located in these regions, reporting growth rates between +20% and +100%. Airports in the UK continue to suffer declines as aviation taxes, weak currency and British Airways cabin crew strikes take a toll on the industry.

“It is a worry to see all nine UK airports in the sample with negative figures,” Schimm observed. “The UK represents one of the world’s largest aviation markets yet is the only significant market in 2010 together with Ireland that keeps shrinking. First quarter passenger volumes in the UK were already -3% down on top of the declines a year earlier. Adding additional pressure by increasing so-called green taxes and driving passengers away through strike action is not the recipe to turn the situation around.”

In the Asia Pacific region, international passenger traffic in China rose significantly in part due to the beginning of the Expo 2010 in Shanghai. Bangkok was the only airport in the region with a decline (-10%), the result of violent unrest in the centre of Bangkok. Overall the major hubs in the region reported double-digit growth, in part a result of declines in May 2009. Results for five months of the year are encouragingly steady with international traffic and domestic travel rising strongly (+14.8% and+10.7 respectively).

In the Middle East, May traffic saw “˜business as usual’ with Muscat (Oman) leading growth at +26% followed by Beirut (+21%), Dubai (+14%) and Abu Dhabi (+12%). In the Africa region, popular tourist destinations Cairo (+13.6%), Hurghada (+25%) Marrakech (+17) and Sharm el Sheikh (+21.5%) were notable leaders in growth.

|