Introduction: We present the key findings from Airport Dimensions’ annual survey, which takes a deep dive into airport passenger behaviour, desires and trends. Our story includes an interview with the global airport lounge and travel experience company’s Senior Vice President of Global Business Development Chris Gwilliam, who reacts exclusively to The Moodie Davitt Report about the data.

INTERNATIONAL. Global travellers, especially those from younger generations, are looking for much more than just utility and traditional shopping experiences when they visit the airport, according to a survey from Airport Dimensions.

The global airport lounge and travel experience company has released the results from ‘AX24: The Age of the Airport Experience’, its annual research into traveller behaviour based on the responses of more than 9,000 travellers from across the world.

This is the tenth edition of the well-known airport industry survey in which respondents have taken a minimum of two return trips in the last 12 months. Airport Dimensions noted this means they offer robust feedback based on multiple trips and airport experiences.

The data demonstrates altered spending patterns and explores the way airports need to develop if they want to increase the satisfaction of travellers and protect and grow revenue accordingly.

The study also analyses spending habits and consumption behaviour across the airport journey.

The 2024 results revealed that overall, travellers expected +8% growth in their travel over the next 12 months led by a strong return to travel in emerging markets, primarily from Millennial and Gen Z. Those in mature markets expected slower growth over the next year in comparison to emerging markets, many of which are still enjoying a post-pandemic rebound.

Here are summaries of four key trends which represent both challenges and significant opportunities for airports, concessionaires and brands identified from the survey:

A pivot to new experiences

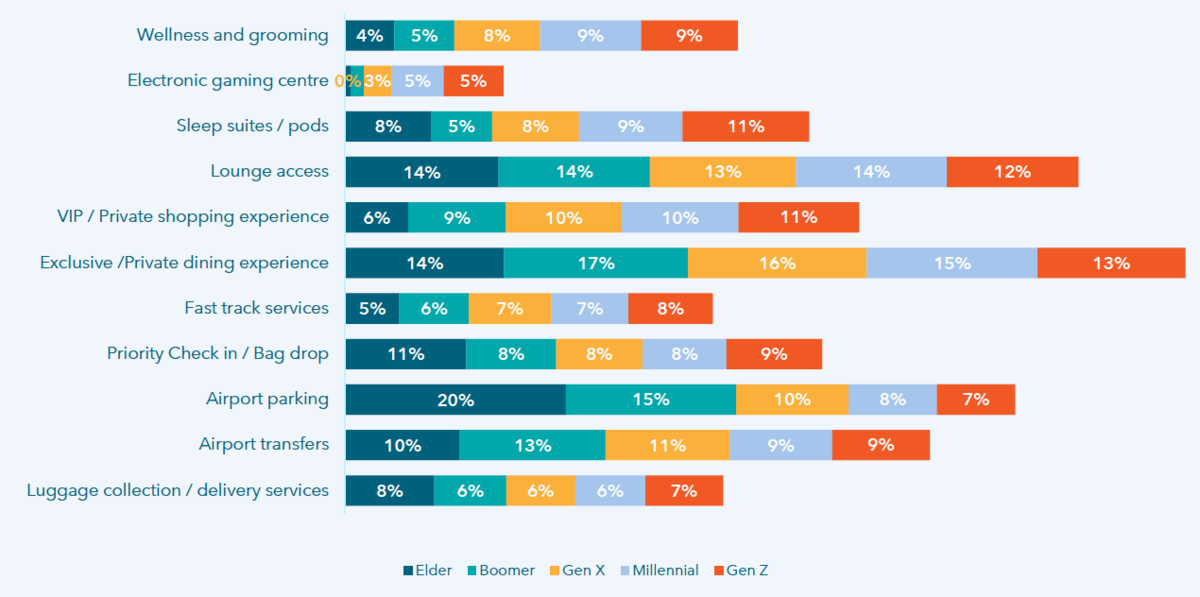

The travellers of today and tomorrow looking for new and better experiences is a key theme that emerged from the AX24 research. It shows that older travellers are still looking to spend on utilities that make the journey easier and more efficient. For instance, they are more than twice as likely than younger travellers to spend on areas such as airport parking.

Younger segments significantly outperform their seniors when it comes to spending on new services and experiences with the growing popularity of services such as sleep suites (9% of discretionary spend), gaming (4%) and wellness and grooming (8%).

The pivot to prioritising experience is reflected throughout the findings, as all segments reported the desire to spend less time shopping and browsing stores (13%), preferring to visit dining and bar options (15%) and increasingly airport lounges before boarding their flight.

A single app for all services and more lounge access is preferred by 71% and 70% of all respondents, respectively. This trend highlights the growing importance and influence of digital services for improving passenger experiences.

These findings, however, do not diminish passenger expectations for the basics, Airport Dimensions noted. For instance, 83% of travellers want better seating and 79% want to see fewer queues.

New experiences supplied in isolation don’t necessarily translate to increased traveller satisfaction, as the research reveals overall satisfaction fell -2% to 70% over the last year. However, Airport Dimensions asserted there is a real opportunity for airports to enhance the experience and drive new revenue, provided they ensure they have addressed the requisite hygiene and maintenance factors first.

Travellers want positive engagement

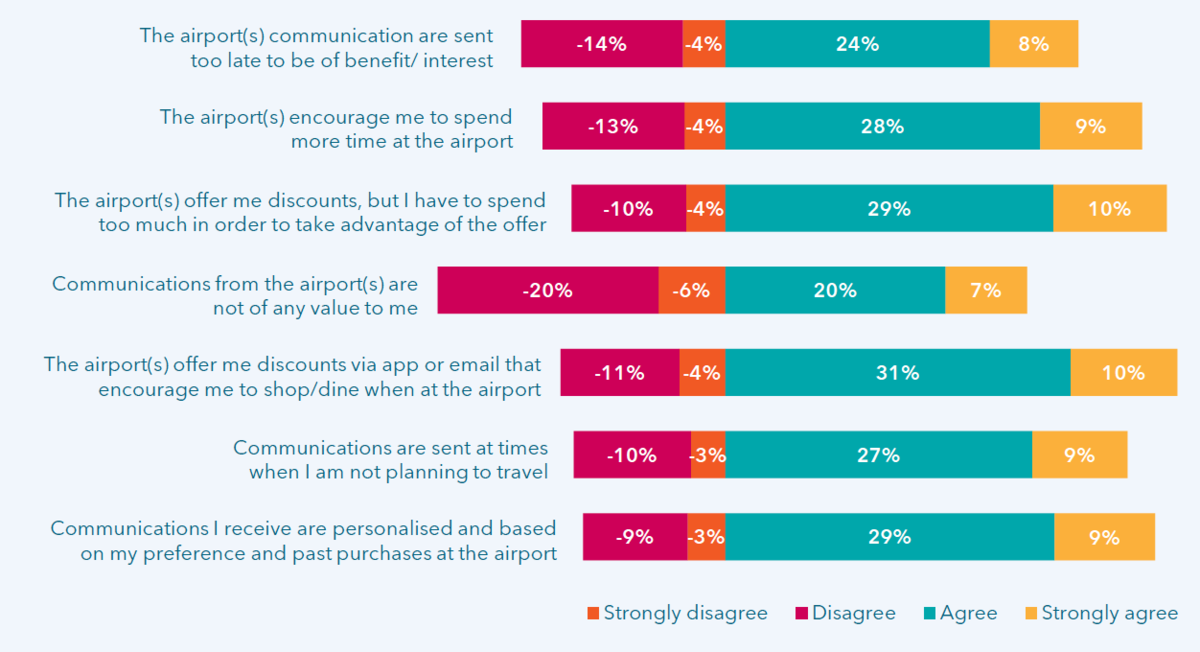

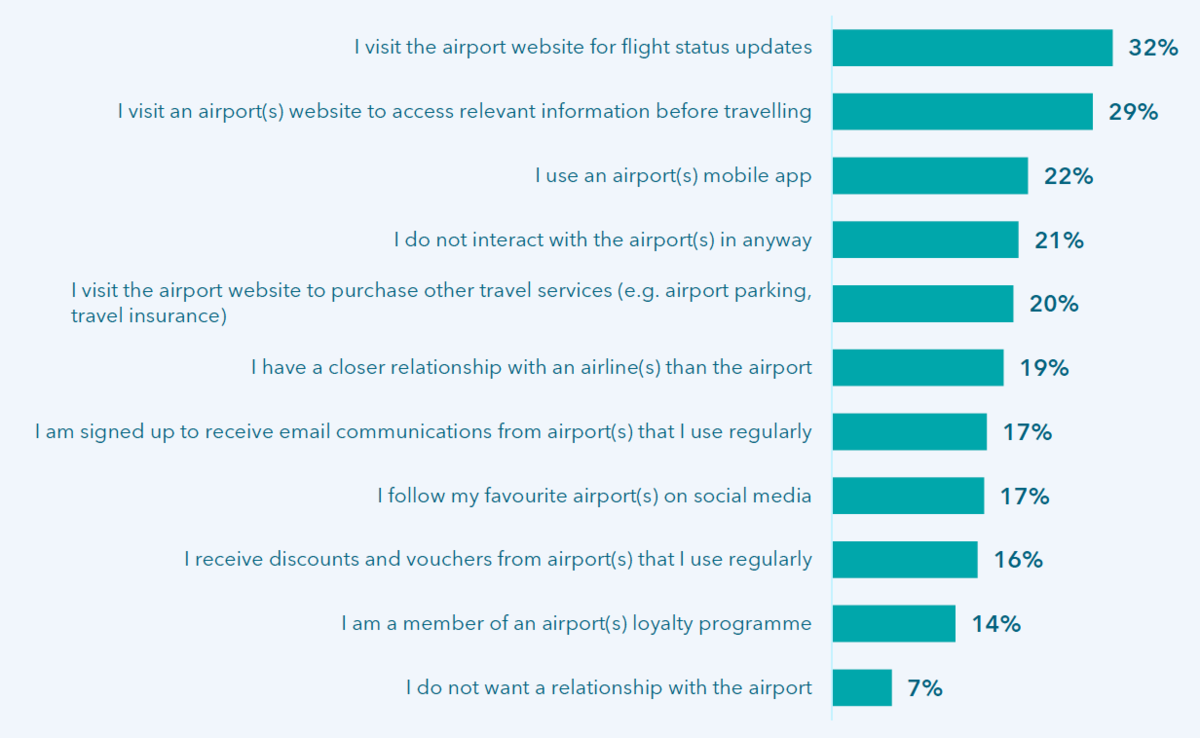

While airports have made progress in investing in traveller engagement and dialogue, according to Airport Dimensions, travellers actually report a drop in engagement year on year. Only 17% of respondents receive regular emails from their preferred airport and 21% said they have no marketing interaction with the airport whatsoever.

This comes at a time when almost all travellers (93%) say they are open to having a relationship with the airport, highlighting the need for airports to close the engagement gap.

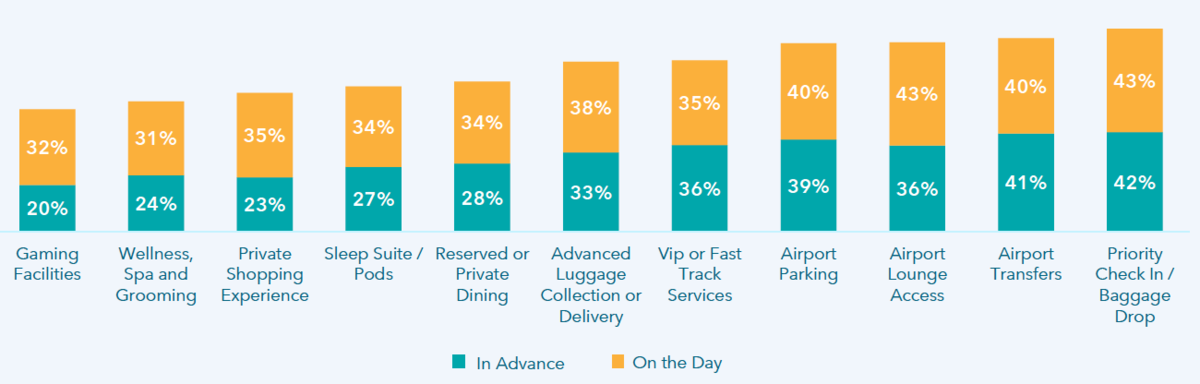

58% of travellers said they would be encouraged to purchase via airport ecommerce sites if they were better promoted and marketed. Airport Dimensions noted that as ecommerce becomes the ‘new normal’ for consumers, and travellers pivot to airport services and experiences more readily booked online, airports may be leaving revenue on the table by not moving fast enough on an ecommerce and relationship strategy.

The research revealed a decrease in airline frequent flyer programme participation since 2019, suggesting there might be an opportunity for airports to do better at using this opportunity to engage and own the relationship with receptive audiences.

Retail revolution

Some 40% of travellers said they would spend more if there was price parity between airport and high street pricing, and 32% want to see on and off-airport price comparisons. Gen Z travellers were the most enthusiastic when it came to spending on shopping activities, opening up new shopping formats and experiences for airports to bolster revenue streams.

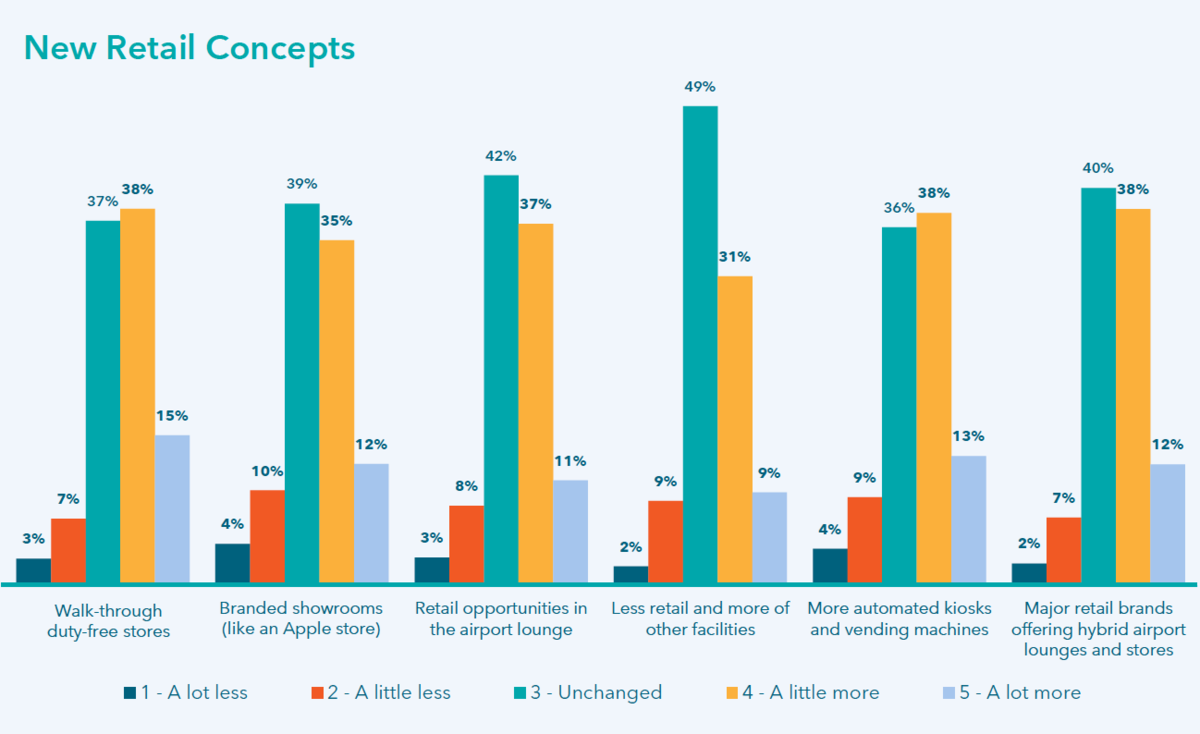

Evidently, Airport Dimensions said, there is an opportunity for retailers to continue to enhance the retail experience with concepts such as walk-through duty free remaining popular as 53% of travellers said they would like to see more of it.

Furthermore, 48% of respondents would like to see more branded showrooms. Integrating retail with airport lounges is important for travellers, as 48% stated the desire for in-lounge retail and 50% would like to see more hybrid retail lounges sponsored by leading brands.

There is a real opportunity for retailers to follow the pivot to experience, Airport Dimensions asserted, especially in areas such as the Middle East and Asia where travellers display a higher inclination towards shopping experiences.

By enhancing the retail experience, working with the airport on better engagement and making ecommerce easier, they can help to grow and bolster airports’ overall revenue streams, the company concluded.

Lounge demand is growing

Lounge access is the new democratic travel luxury, stated Airport Dimensions, with its popularity as a travel benefit showing no signs of slowing down, led by the market-leading airport experiences programme Priority Pass.

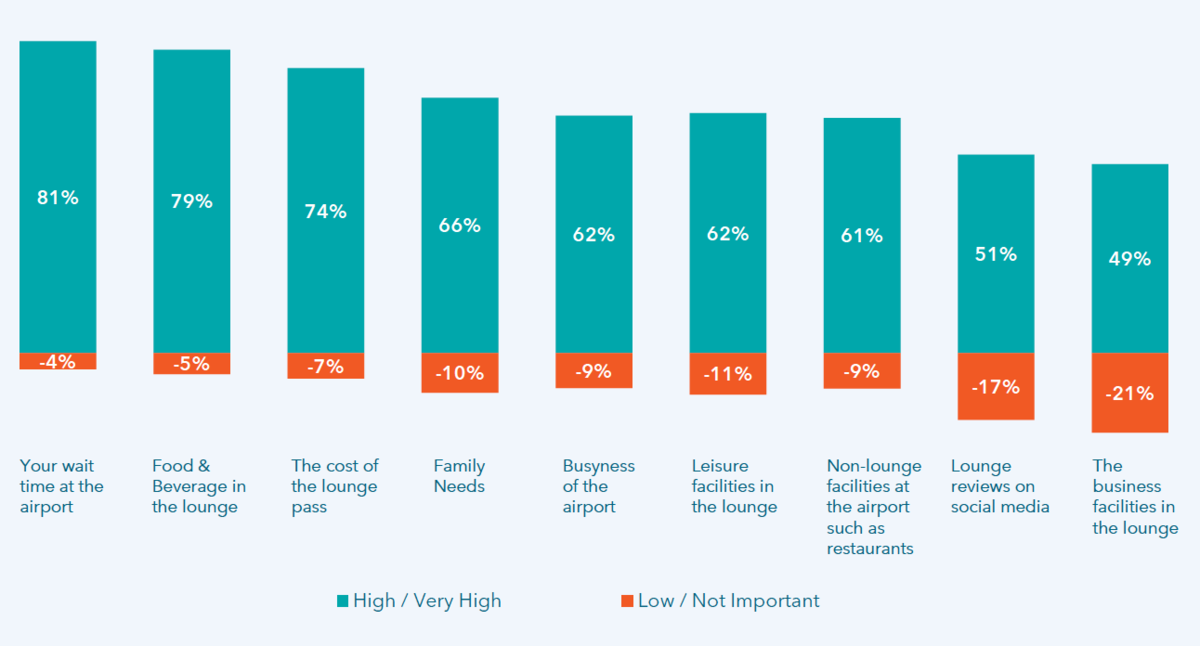

In the markets surveyed, 30% of travellers said they paid directly to access a lounge, following the trend of seeking out and paying for a better airport experience. Indeed, travellers continue to value lounge access, with 70% saying more options in this area would improve their time at the airport.

Once exclusively the domain of the business traveller, the research highlights an increased emphasis on leisure and lifestyle for lounge guests. Facility to pre-book the lounge has grown in importance, ranking even higher than parking among traveller priorities.

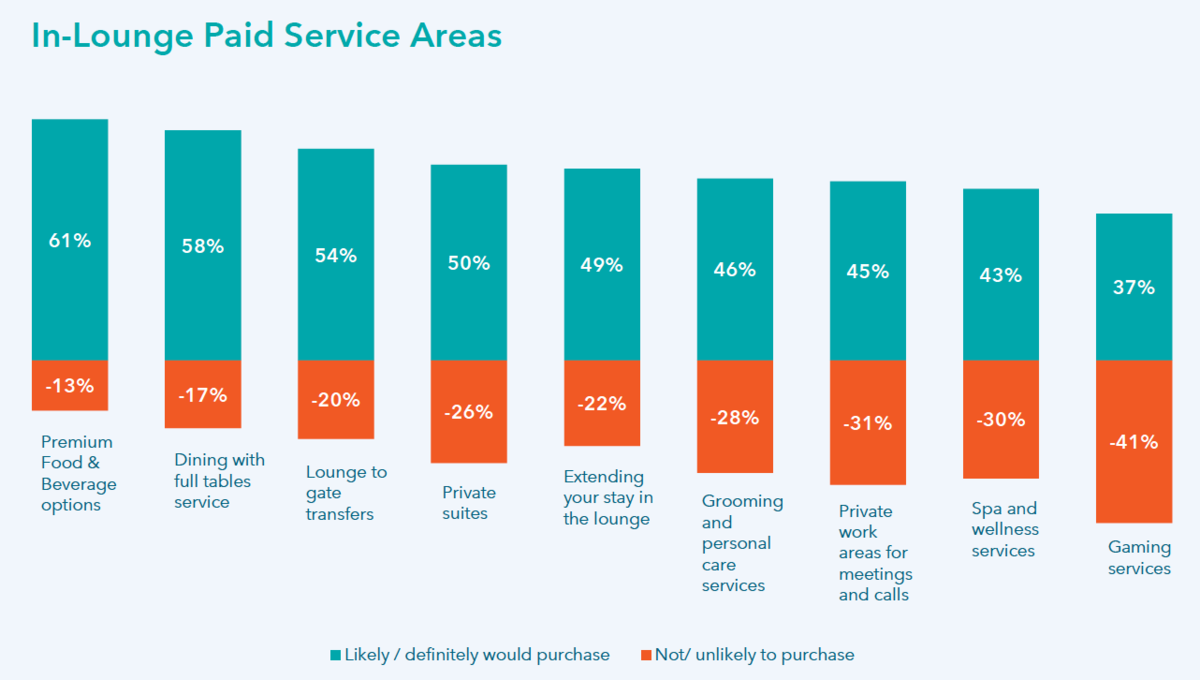

Lounges’ food & beverage proposition also holds key influence, with 79% of travellers ranking in-lounge F&B as a more important factor when considering access purchase than the cost of lounge entry, and 61% are willing to pay for premium food & beverage options once in the lounge.

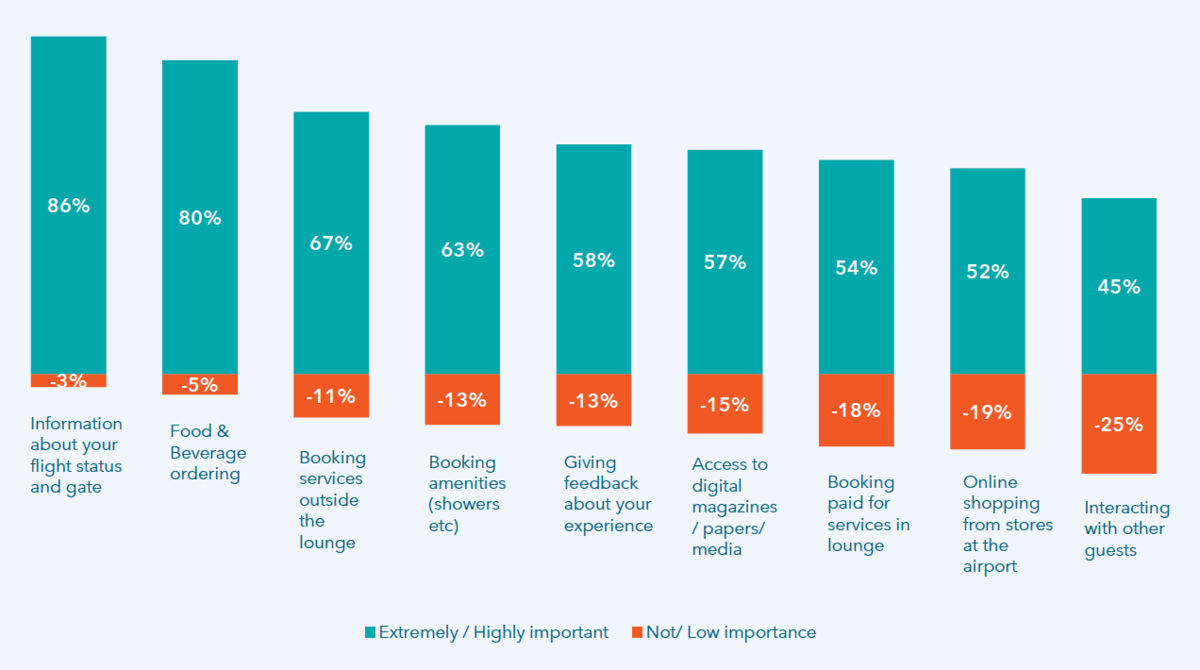

Lounge guests value digital services in lounges, with 86% of travellers saying access to flight information and 80% saying F&B ordering is important. But digital in-lounge also opens up opportunities for new spend, Airport Dimensions noted. 61% of lounge guests would likely spend on additional F&B and over half (52%) are interested in shopping at airport stores from the lounge.

The link to airport retail is supported by very strong levels of interest for brand-sponsored lounge experiences, with 77% of guests saying they would like sampling of high-end beverage or food brands.

Airport Dimensions Global Strategy Director Stephen Hay said: “This is a really exciting time for airports. Travel is growing again, and travellers, especially younger travellers, have come back looking for new airport experiences.

“They tell us that they want to spend on new experiences like lounges, quality food & beverage and a different sort of retail experience. Airports need to seize this opportunity and ensure they have the tools, relationships and engagement capability in place to drive revenue growth.”

Access the full Airport Dimensions AX24: The Age of the Airport Experience report here. ✈

Survey reactionOur Senior Business Editor Mark Lane explores key themes from the Airport Dimensions research with Senior Vice President of Global Business Development Chris Gwilliam. Mark Lane: What are the main things that stood out from the research to you, Chris? Chris Gwilliam: We’re very focused on the Millennial and Gen Z responses and what they’re looking for in the airport – they are the future travellers that airports should really be thinking about when they are doing their master planning and concessions planning. The pivot towards new experiences came out as an important theme. The younger generation want to experience sleep pods, for example, they want increased lounge access, and access to wellness facilities and entertainment options such as gaming facilities. Another important theme is a shift in attitudes towards retail in the airport. There’s definitely now an acceptance of more automated retail, such as vending machines, and the contactless stores such as those using Amazon Just Walk Out technology have been well received. There are also strong indications people want to use their dwell time to experience brands. Some airports, especially in Asia Pacific, are delivering great experiential retail, whereas traditional in-line retail stores remain the norm at others. That’s a key area for development. The other thing that stood out to me was the potential for relationship building, the openness of respondents to have a relationship with the airport. CRM and loyalty [in this regard] exists, but it’s very much at the margins. There’s a real opportunity here for airports. Most people use their home airports, and they use it frequently – wouldn’t it be great if I had a relationship with the airport, and I knew all of the different things that were on offer, and they targeted me in advance?  Given all the investment we have seen in airport experience as we emerged from the pandemic, does it surprise you to see that overall satisfaction with airports has fallen since the last survey? What do you think the factors are that have led to that downturn in perception? It’s always difficult to pinpoint it on one thing, but I think it’s partly due to issues of movement through the airport as the industry resets itself after the pandemic. It varies across the world. Satisfaction has actually risen significantly in many Asia Pacific airports, where a lot of investment in experience has been made before and during the pandemic years, as they get back to full capacity. Some of the newer or expanded airports have been very thoughtful in their approach to design; they can be very relaxing for the passenger with the customer flow and modern concessions programmes. I think that really lends itself to having a much higher satisfaction level. However, in markets which recovered more quickly such as the US and Europe, there have been issues with security staffing and so on. The fall there is related to airports being busy and crowded, and maybe you can’t get access to certain things. I think that can drive dissatisfaction, it just compounds the need to be more innovative and help people access various services. The US in particular suffers from the need for renewal of a lot of old infrastructure. Now there is investment happening, and we have seen a lot of terminal development. Those airports are driving great experience and satisfaction levels. But many US airports need updating and I think this is a benefit of our survey – as airports look to modernise, and look to change, they can take these insights into consideration when making changes, so that they can really drive and improve their satisfaction levels.

One of the interesting things that I took from the report was integrating retail with airport lounges. What are you as a lounge provider doing on this front? We’re investors in Inflyter, the market-leading airport retail and duty-free ordering platform. We are currently working with them to get a pilot programme up and running, whereby customers can be in our lounges and order from the retail concessionaires that are in the airport and either have that delivered to gate, to the lounge or to home. In terms of getting that done, it requires a partnership with the airport retail companies and brands – it requires a delivery mechanism and the integration. All those things are currently in the process of being solved. We hope to launch that in the near future and pilot it in a couple of lounges, so we can really learn about the logistics, and everything around that, to then try and activate on that theme more broadly. I also think it will bring sponsorship opportunities, with brands having an actual presence in our lounges to promote their products.

The survey clearly indicates rising interest in airport lounges among travellers. That’s a very encouraging aspect of the survey for what you’re doing as a company. We were obviously very delighted to see that the data supports why we exist and what we are doing. It’s a very clear insight that airports need to allocate more space for lounges. The demand is definitely there and it’s a growing segment, particularly among frequent travellers. I think the research gives a strong message to airports with development space that lounges should be integral to their master planning and not be an afterthought. ✈ |