SOUTH KOREA. Korea Customs Services is expected to reveal later this week which companies have been awarded three new downtown duty free trading licences in Seoul and one on Jeju Island.

The licences have been the subject of red-hot competition. Two of the Seoul agreements are open to all players but one is limited to small & medium enterprises (SMEs). The Jeju licence can only be won by an SME.

Korea Customs Service will hold presentation sessions this Thursday (for Seoul) and Friday (Jeju). The results are likely to be announced soon after.

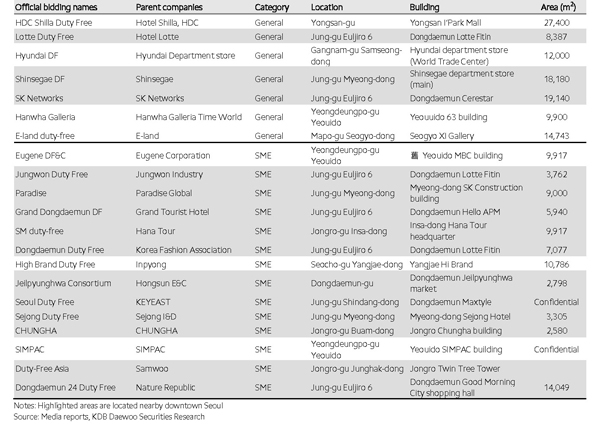

Seven retailers (see table) have applied for the two major licences in Seoul – the first such new opportunity for large corporations in 15 years. Currently, four companies run six downtown duty free stores in Seoul, where business has undergone an extraordinarily sustained boom over recent years in the wake of burgeoning Chinese tourism. The business has been hard hit by the outbreak of MERS since June but is expected to bounce back sharply once the health crisis is under full control.

|

White-hot interest. This table, courtesy of KDB Daewoo Securities Co, underlines just how competitive the contest for the three new Seoul downtown duty-free licences is. |

One of Korea’s most experienced travel retailer told The Moodie Report today: “The MERS epidemic is now almost handled and there have been no more new infected cases or newly deceased for the last few days and I hopefully guess the disease will be eliminated within the next month. But the sales decrease in the Korean duty free market will continue for the time being and currently the retailers are still suffering a -70-80 % decline from last year. I am afraid it will take three more months from now to recover to normal levels.”

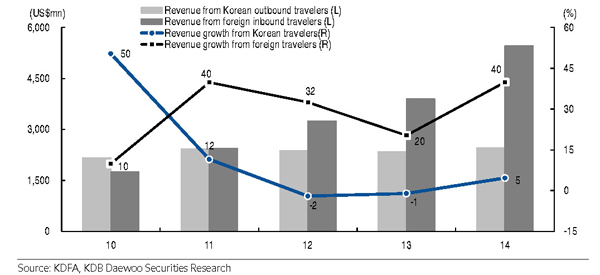

If so, that would represent perfect timing for the new stores. Interest in this week’s decision is intense. KDB Daewoo Securities Co Equity Analyst (Cosmetics, Hotel& Leisure, Fashion) Regina Hahm said: “The market is paying keen attention to the bidding for new duty free licenses, supervised by the Korea Customs Service. Indeed, the issue is closely tied to the medium- to long-term growth of Korea’s inbound tourism industry.”

|

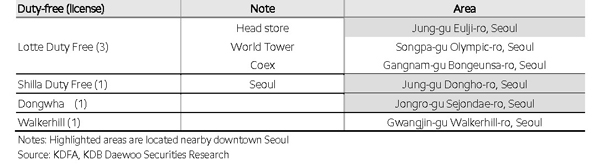

The current Seoul downtown duty free licences are limited to four major players |

But she warned that the simply granting of licenses is no guarantee of success. “Product sourcing is at the heart of the business, and operators that do not have diverse brand line-ups and long sourcing histories will face difficulties. In other words, if new licensees are granted to non-major players, they might not be able to enjoy the benefits of market expansion.”

|

Korea’s downtown duty free business is driven principally by Chinese shoppers (more so than the airport retail sector). With duty free revenue from Korean outbound travelers flat since 2012, the new licences assume even greater importance |

|

Industry giant The Shilla Duty Free (above) and Lotte Duty Free (below) face powerful competition for the two grand prizes in Seoul |

|