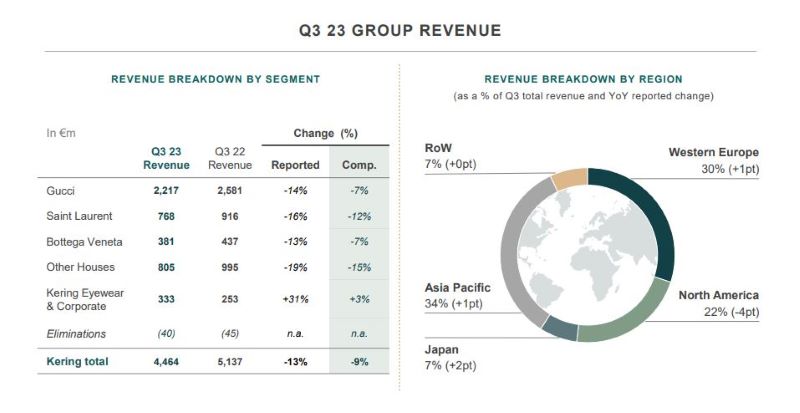

Kering Group’s third quarter group revenue declined by -13% on a reported basis (-9% comparable) to €4.5 billion (US$4.7 billion).

According to the group’s latest financial results, revenue from the directly operated retail network dropped by -6% on a comparable basis, driven by lower traffic and contrasted performances across regions.

Wholesale and other revenue also saw a steep decline, down -20% on a comparable basis, due to the group’s ongoing efforts to tighten its control over distribution.

Kering posted a revenue of €14.6 billion (US$15.4 billion) for the first nine months of the year. Kering Group Chairman and Chief Executive Officer François-Henri Pinault said: “Beyond the challenging macroeconomic conditions and softening demand across the luxury industry, the change in our revenue performance in the third quarter reflects the impact of our decisions to further elevate our brands and their distribution.

Kering Group Chairman and Chief Executive Officer François-Henri Pinault said: “Beyond the challenging macroeconomic conditions and softening demand across the luxury industry, the change in our revenue performance in the third quarter reflects the impact of our decisions to further elevate our brands and their distribution.

“The organisation we put in place in July will enable us to strengthen the steering of our Houses in the current market environment and to reclaim our positions and influence. With the acquisition of Creed completed last week, one of the world’s most distinguished high fragrance houses has joined our family, propelling our ambitions in beauty onto the next stage.”

By region, retail sales in Western Europe dropped by -10%, while that in North America also fell sharply by -21% and the rest of the world was down -4%. Japan and Asia Pacific delivered positive results, +29% and +1%, respectively.

Across its key brands, Kering Eyewear’s Q3 revenue stood at €331 million (US$349 million), representing a +34% increase as reported (+2% comparable), thanks to the contribution of Maui Jim. The growth was boosted by the “very strong sales” of sunglasses in the first half of the year.

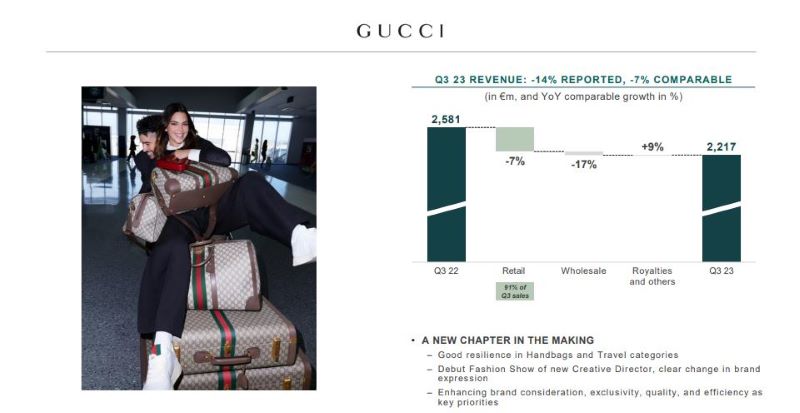

Gucci’s revenue fell -14% as reported and down -7% on a comparable basis, reaching €2.2 billion (US$2.3 billion).

The company recorded a -7% (comparable) decrease in sales in the directly operated retail network during the three-month period. It noted “resilient performances” in handbags and from the Valigeria collection. Wholesale revenue was down -17% (comparable). Yves Saint Laurent’s Q3 revenue stood at €768 million (US$810 million), down -16% as reported (-12% comparable), with significant differences across regions.

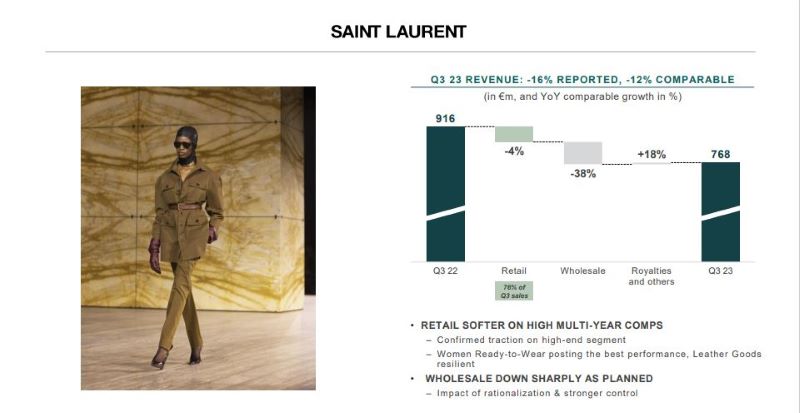

Yves Saint Laurent’s Q3 revenue stood at €768 million (US$810 million), down -16% as reported (-12% comparable), with significant differences across regions.

Comparable sales from the directly operated store network dipped by -4% due to a high multi-year base of comparison, particularly in Q3 2022.

The group saw positive momentum in women’s ready-to-wear and is pursuing its strategy aimed at elevating its offering.

Sales in the brand’s wholesale division slid by -38% (comparable). Reported revenue for Bottega Veneta in Q3 fell by -13% (-7% comparable), amounting to €381 million (US$401.8 million).

Reported revenue for Bottega Veneta in Q3 fell by -13% (-7% comparable), amounting to €381 million (US$401.8 million).

Revenue in directly operated stores slipped by -2% (comparable) during the quarter, while wholesale revenue declined by -30% (comparable).

Reported revenues from other houses reached €805 million (US$849 million), down by -19% (-15% comparable).

Reported revenues from other houses reached €805 million (US$849 million), down by -19% (-15% comparable).

In retail, Balenciaga’s growth was mixed across regions and was affected by a high base of comparison, while Alexander McQueen saw a slowdown in the three-month period.

The negative results reflect the lower wholesale activity at both houses.Brioni posted higher sales, which were boosted by its tailoring as well as leisurewear offerings.

Boucheron’s positive results were driven by the success of its High Jewelry and Jewelry collections. Pomellato saw robust growth in its stores, while Qeelin showed “excellent momentum”. ✈