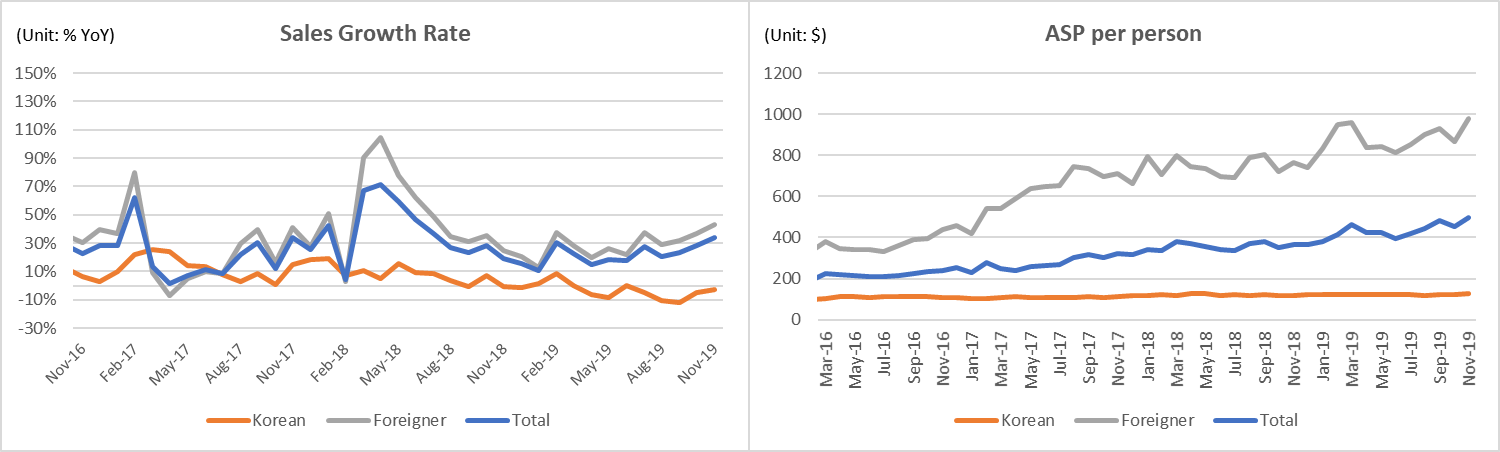

SOUTH KOREA. Duty free sales grew +34.3% year-on-year in November to US$1,960.5 million (KRW2,288.2 billion), as booming sales to Chinese resellers drove the world’s biggest travel retail market to an all-time monthly high, writes The Moodie Davitt Report Senior Retail and Commercial Analyst Min Yong Jung

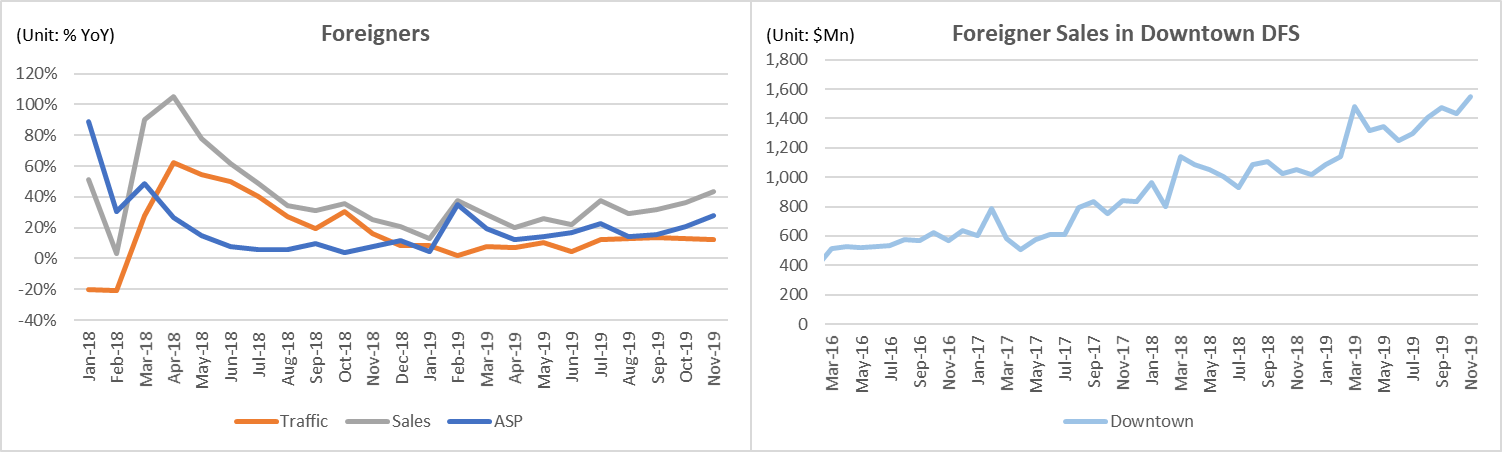

Sales to foreigners rocketed +43.4% year-on-year to US$1,682.4 million, continuing to drive growth.

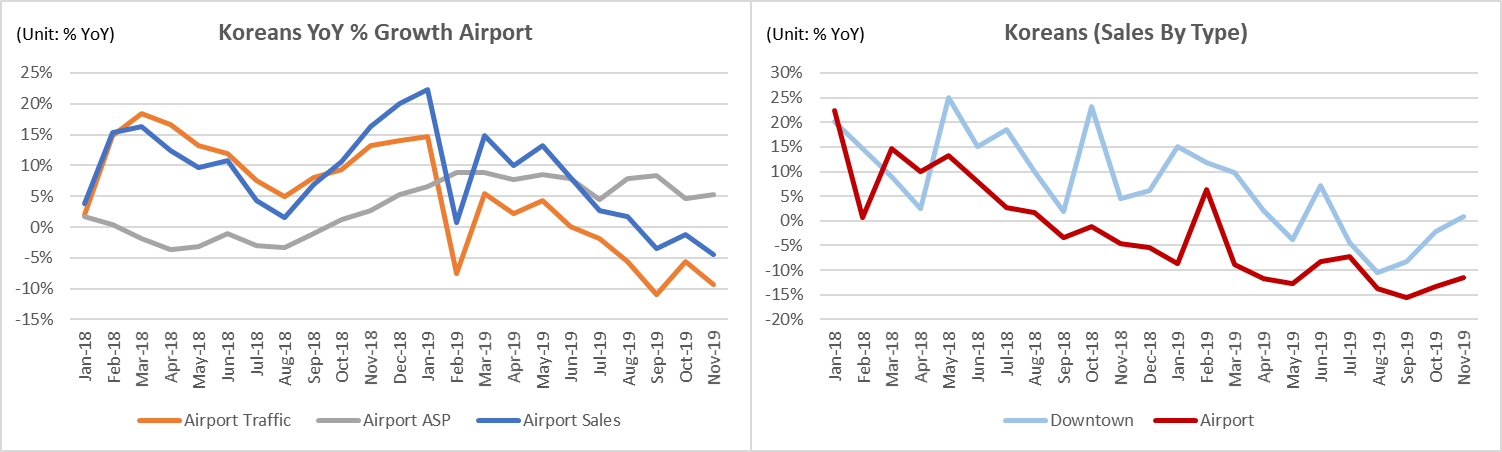

Sales to Koreans (down -2.8% year-on-year to US$278.1 million) continued to be soft despite heavy promotional activities to drive purchases online and in downtown duty free stores.

The continuing boycott Japan campaign, which prompted a -65.1% year-on-year slump in Korean visitor arrivals to Japan in November has depressed sales.

Duty free sales to Koreans have recorded negative growth in eight of the first eleven months of 2019 and it’s difficult to see a recovery without outbound travel recovering.

President Xi’s impending visit, his first since 2014, has sparked renewed hopes of a normalisation in relations which should see packaged tourists return to Korean shores

Daigou-driven market structure continues

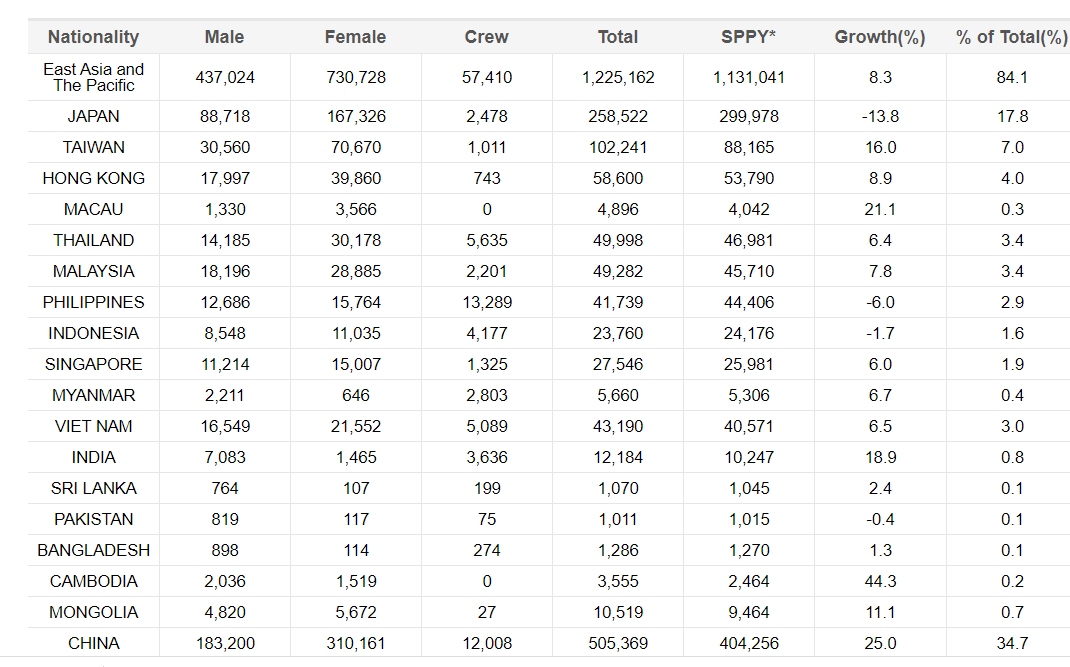

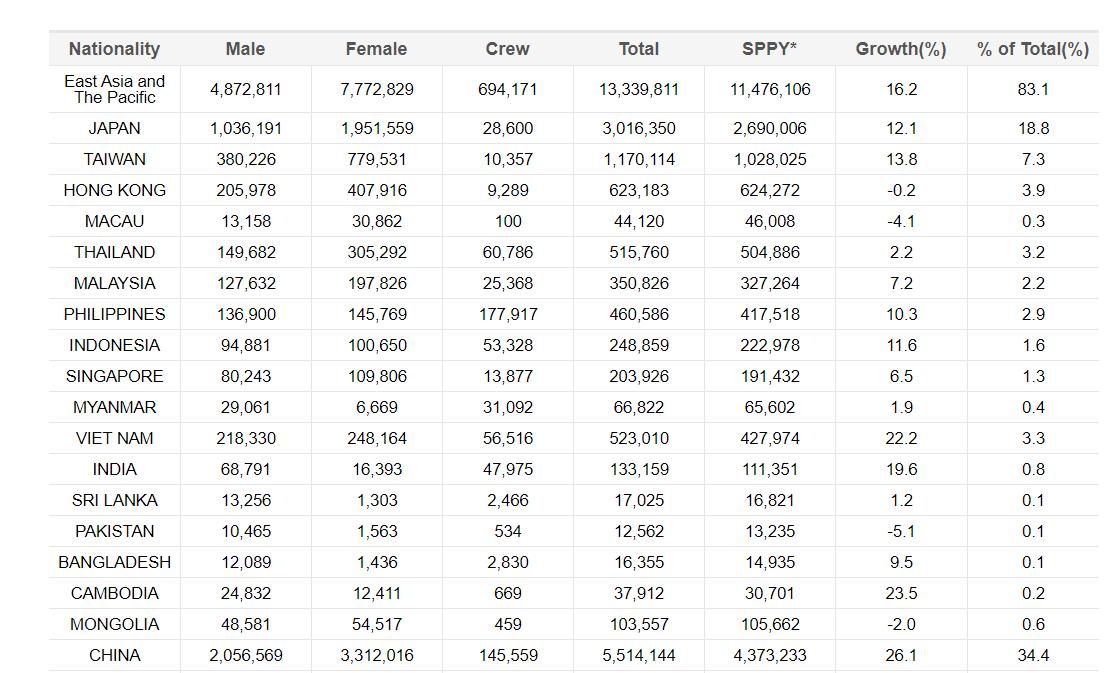

Despite widespread market rumors of a Korean government investigation of tax evasion by certain large-scale daigou (the large daigou are registered corporate entities in Korea), resellers remain the driving force in Korea’s duty free market. Foreigners generated 85.8% of sales in November, up from 80.4% in the same month last year. Most of that business was to resellers.

The record-setting month surprised market participants and observers. Many predicted slowing duty free sales growth due to the rumoured investigation of a large-scale daigou for tax evasion. A fight between the bulls and bears resulted in Korean beauty giant Amorepacific’s share price trending sideways since topping KRW 210,000 on 7 November, reflecting investment community uncertainty over whether the duty free channel will continue to grow.

December on track as icy political relations with Chinese thaw

The year and the decade are likely to close on a strong note with December seeing sustained strong momentum in the reseller market.

Following Korean President Moon Jae-in’s landmark visit to China on 23-24 December, the Korean Presidential Office officially announced that Chiense leader Xi Jinping is set to visit South Korea in the first half of 2020.

President Xi’s last visit to Korea was in July 2014, long before the deterioration in relations between both countries sparked by the THAAD anti-missile system row.

His impending visit has sparked renewed hopes of a normalisation in relations which should see packaged tourists return to Korean shores. Korean travel retailers are yearning for the return of package tourists who will spur more conventional growth in a duty free market far too dependent on resellers.