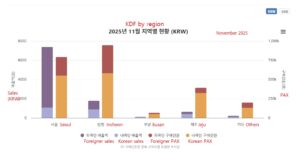

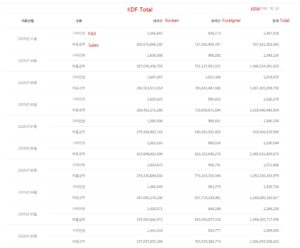

SOUTH KOREA. Duty-free sales nationwide (excluding inflight retail) fell -4.9% year-on-year in November and -1.7% month-on-month to KRW997,142,302,982 (US$691.3 million), according to newly released Korea Duty Free Association figures.

Customer numbers eased -3.9% year-on-year and -2.2% month-on-month to 2,487,018.

“In October, we had a week-long Chuseok holiday, so November sales to Koreans were lower as a consequence,” a senior Korean travel retail source told The Moodie Davitt Report.

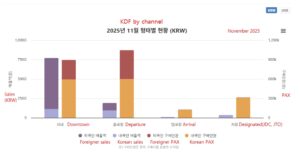

“However, downtown sales to foreigners also declined during November while airport departure sales to foreigners increased compared to October. Overall, this suggests airport sales are recovering while daigou sales purchases by foreigners are stagnating.”

Reinforcing that conclusion, sales to foreigners slipped -3.7% year-on-year and -3.1% month-on-month to KRW727,565,454,787 (US$504.4 million) despite customer numbers being up up +23.5% year-on-year and +3.5% month-on-month to 938,173.

Conversely, purchases by Koreans grew just over +4.0% year-on-year but (due to the Chuseok impact) declined -9.2% month-on-month to KRW269,576,848,195 (US$186.9 million) on a customer base down -5.2% over November 2024 and -5.4% month-on-month to 1,548,845.

Downtown decline

Total sales at Korean downtown duty-free stores (excluding JTO and JDC on Jeju island) declined -9.9% compared with November 2024 and -6.1% month-on-month to KRW697,712,139,768 (US$483.7 million) on customer numbers up almost +6.0% year-on-year and almost +2.3% month-on-month to 950,608.

Foreigners accounted for a dominant 82.2% of downtown sales.

Tellingly, sales to foreigners downtown slumped -12.9% over November 2024 and -6.9% month-on-month to KRW573,204,150,827 (US$397.4 million) despite customer numbers rising +29.1% year-on-year and +3.1% over October 2025 to 386,420.

Airport sales pick up

The airport departures channel again presented a more positive picture with sales climbing +31.1% year-on-year (down -1.8% over October 2025) to KRW250,186,176,700 (US$173.5 million). Customer numbers were up +4.5% year-on-year and down -6.2% month-on-month to 1,095,121.

Customer numbers were evently split between foreigners (49.1% and Koreans (51.9%), though the former accounted for 61.2% of sales.

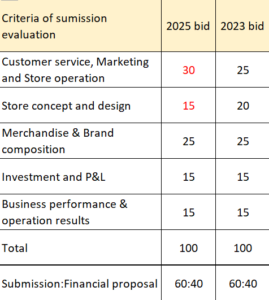

Incheon International Airport tender time nears

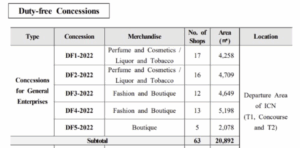

The November numbers will be closely scrutinised by retailers pondering bids for the current Incheon International Airport DF1 and DF2 tenders, which are up for grabs following the quitting notices served by incumbents The Shilla Duty Free (DF1) and Shinsegae Duty Free (DF2).

Shilla and Shinsegae are expected to exit their multi-store contracts on 17 March and 27 April 2026, respectively, in response to heavy operating losses and their failure to renegotiate financial terms with Incheon International Airport Corporation (IIAC). Each contract embraces liquor & tobacco and perfumes & cosmetics.

As reported, Incheon International Airport Corporation (IIAC) launched a tender for the DF1 and DF2 concessions on 11 December.

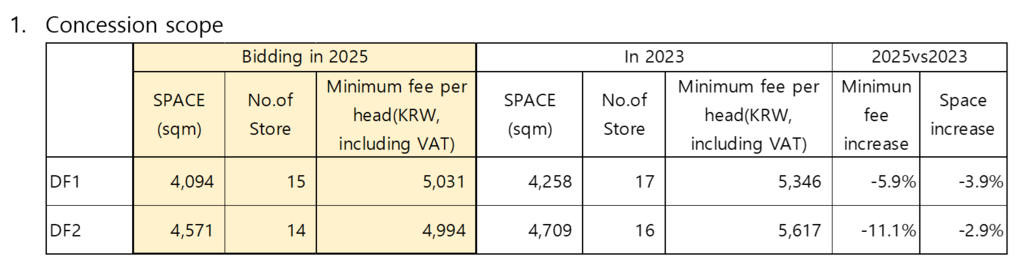

Here are the key details of the IIAC tender:

- Concession Period: From starting point of operation until 30 June 2033 (the tenure can be extended once during the concession period with a ten-year limit)

- Application to attend site briefing: By 16 December 16:00

- Site briefing: 18 December 10:00 (IIAC building)

- Application to take part in the bidding: 20 January 2026, 14:00-16:30

- Submission period: 20 January 2026, 14:00-17:00 ✈

TENDER ALERTThe Moodie Davitt Report is the industry’s most popular channel for launching commercial proposals and for publishing the results. If you wish to promote an Expression of Interest, Request for Proposals or full tender process for any sector of airport or other travel-related infrastructure revenues, simply email Martin Moodie at Martin@MoodieDavittReport.com. We have a variety of options that will ensure you reach the widest, most high-quality concessionaire/retailer/operator base in the industry – globally and immediately. The Moodie Davitt Report is the only international business media to cover all airport or other travel-related consumer services, revenue-generating and otherwise. Our reporting includes duty-free and other retail, food & beverage, property, lounges and other hospitality services, art and culture, hotels, car parking, medical facilities, advertising and other related revenue streams. Please send relevant material, including images, to Martin Moodie at Martin@MoodieDavittReport.com for instant, quality global coverage. |