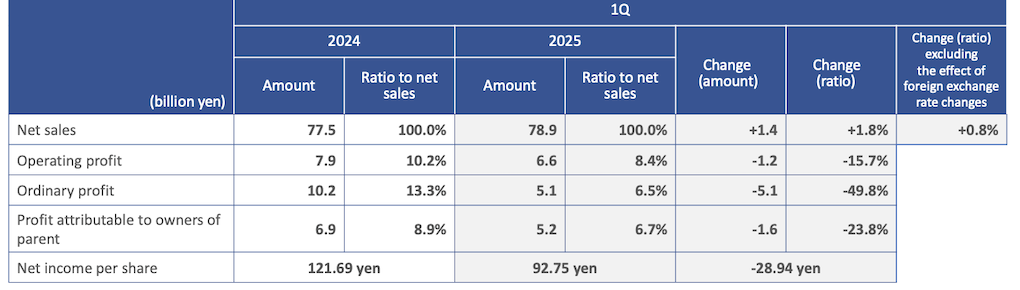

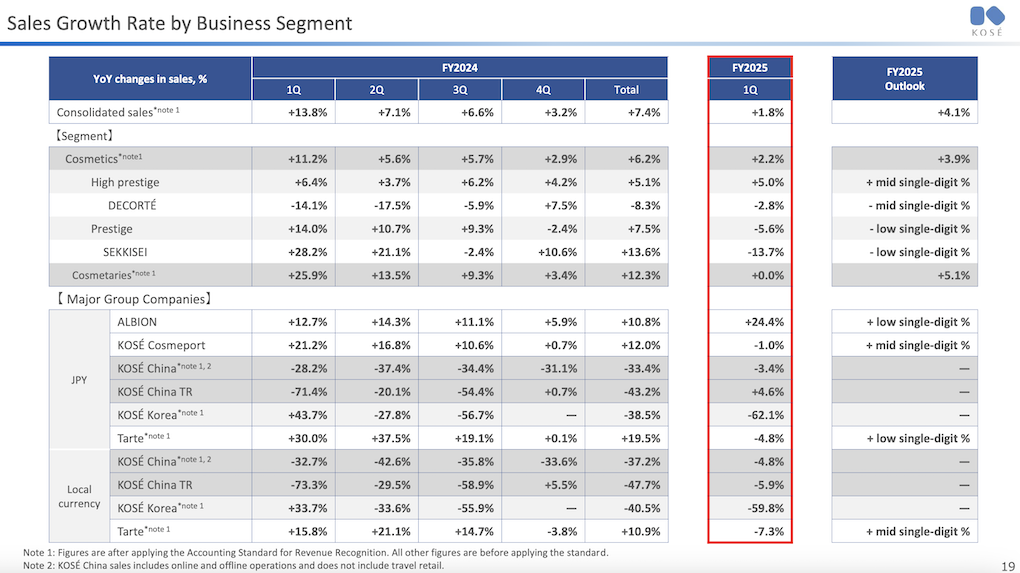

Japanese beauty group KOSÉ Corporation has reported net sales of ¥78.9 billion (US$544.4 million) for the first quarter of 2025, an increase of +1.8% year-on-year (up +0.8% at constant rates).

Travel retail sales (excluding the Puri brand) declined by -1.1% due to lower sales in South Korea and Hong Kong. The company said in a statement: “South Korea duty-free store sales declined following the upturn in shipments in 2024. Hong Kong duty-free store sales declined because of voluntary controls for the purpose of reducing bulk sales by duty-free store retailers to resellers.”

Newly consolidated brand Puri made its first contribution to sales in Q1. Sales were “as planned with a substantial contribution to sales from the duty-free store channel,” said the group.

Profitability declined as the company continued to navigate structural reforms and macroeconomic challenges, including a subdued China and travel retail business.

Operating profit fell -15.7% year-on-year to ¥6.6 billion (US$45.5 million), impacted by a higher cost of sales ratio and increased expenses, including costs related to the newly consolidated subsidiary Puri Co.

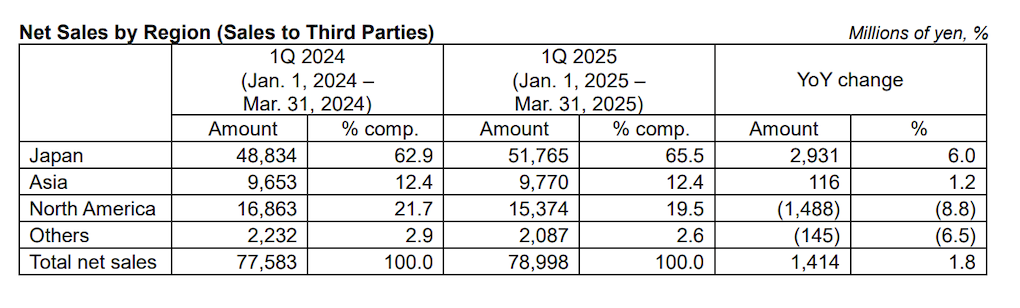

Regional performance

These results come as KOSÉ progresses with Phase 1 of its medium- to long-term growth strategy, Vision for Lifelong Beauty Partner – Milestone 2030, launched in November 2024. The strategy focuses on completing structural reforms and rebuilding business infrastructure, with particular emphasis on improving profitability in Japan and investing for growth in Asia.

In Asia, regional sales increased +1.2% to ¥9.7 billion (US$66.9 million). However, while Mainland China and travel retail were subdued due to shipment controls and weaker March sales, the inclusion of Puri supported the overall positive result in the region. KOSÉ China returned to profitability in Q1 2025 reflecting the early impact of 2024’s structural reforms.

By region, Japan posted strong results, with sales rising +6.0% year-on-year to ¥51.7 billion (US$356.7 million). Growth was led by Albion, supported by inbound tourist demand and strong domestic sales. Sales of DECORTÉ and SEKKISEI were sustained by reinforcing existing products despite a lack of major launches compared to the same period last year.

In North America, sales fell -8.8% to ¥15.4 billion (US$106.2 million). The decline was attributed to lower offline sales of Tarte, despite gains from new distribution channels. Sales in the other regions, including Europe, dropped -6.5% to ¥2.1 billion (US$14.5 million), primarily due to reduced demand for SEKKISEI.

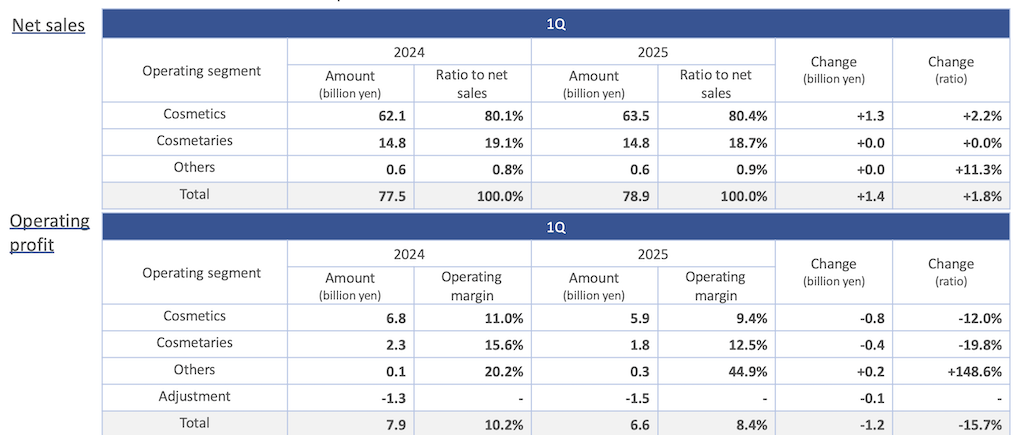

Performance by category

Sales in the cosmetics segment rose +2.2% to ¥63.5 billion (US$438.1 million), although segment operating profit declined -12.0% to ¥5.9 billion (US$40.7 million). The high-prestige category delivered growth, led by Albion and the newly consolidated Panpuri brand offsetting weaker results from DECORTÉ and Tarte. In contrast, the prestige category saw a year-on-year decline, particularly in SEKKISEI sales outside Japan.

The cosmetaries business segment was flat at ¥14.8 billion (US$102.1 million) in sales, with a -19.8% drop in operating profit to ¥1.8 billion (US$12.4 million).

In the others segment, which includes amenity products, sales grew +11.3% to ¥679 million (US$4.7 million) with operating profit surging +148.6% to ¥360 million (US$2.5 million), aided by a lower cost of sales ratio.

Outlook and strategic initiatives

KOSÉ forecasts full-year net sales growth of +4.1% and a +15.2% increase in operating profit for FY2025. The outlook reflects continued sales growth in Japan and the inclusion of Panpuri, which is expected to strengthen the group’s portfolio in Asia. The impact of lower travel retail sales is projected to be offset by an improved gross profit margin and enhanced profitability from ongoing structural reforms.

Key initiatives for Q2 2025 include the launch of innovative new products, such as DECORTÉ AQ Deep Pore Cleanser, and continued efforts to drive ecommerce growth, enhance brand counselling and optimise the group’s cost structure. ✈