INTERNATIONAL. Sustained revenue growth and record recurring EBIT at Lagardère Travel Retail were key talking points as ultimate parent company Louis Hachette Group delivered its market analysis during a post-HI earnings call on 24 July.

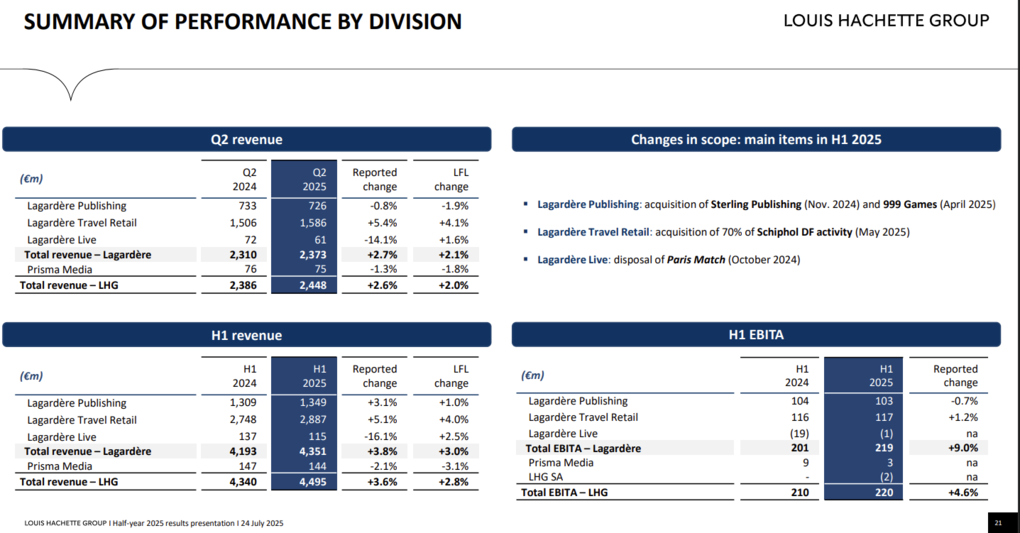

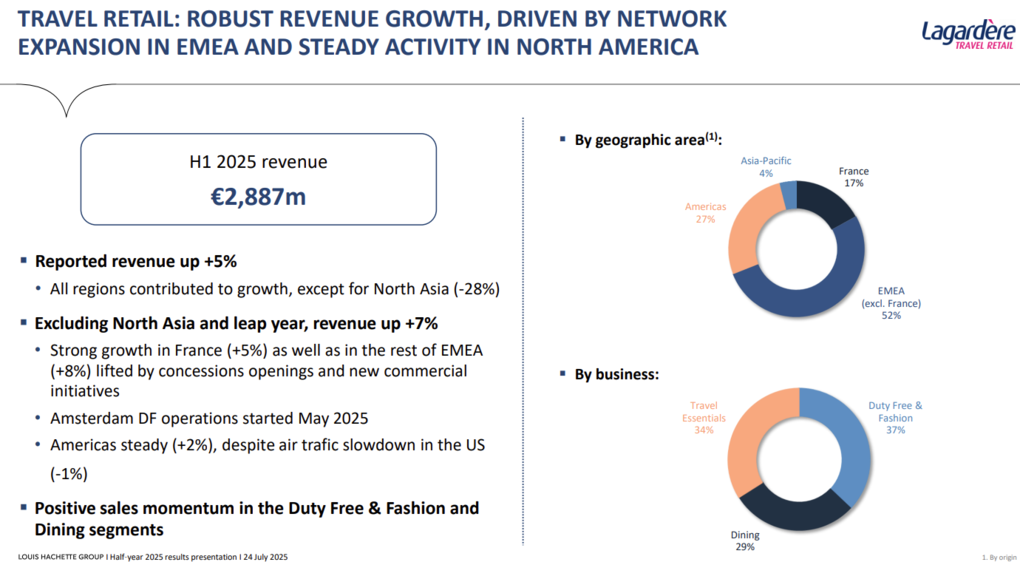

As reported, Lagardère Travel Retail revenue climbed +5.1% year-on-year (+4% like-for-like) in the first half of 2025 to €2,887 million, with all regions except for the troubled North Asia sector contributing positively. Q2 saw +5.4% year-on-year reported growth (+4.1% like-for-like)

The difference between reported and like-for-like revenue is attributable to the consolidation of the duty-free business at Amsterdam Airport Schiphol, where Lagardère Travel Retail began its joint venture operation on 1 May (click here for our exclusive on location report).

Excluding North Asia and the impact of the leap year in 2024, revenue grew +7% on a reported basis and +6% like-for-like.

€6 million in China restructuring costs and asset write-downs in China

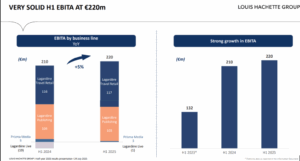

Lagardère Travel Retail reported €118 million in recurring EBIT, an improvement of €9 million on a year earlier, reflecting “a solid business performance, rigorous cost discipline and the effects of the business streamlining in North Asia”.

EBITA for the period included €6 million in restructuring costs and asset write-downs in China.

Factoring out these items, EBITA was up by €8 million thanks to stronger activity levels and a stronger contribution from equity-accounted companies. This was despite residual government support in the US in connection with the COVID-19 health crisis that was recognised in the first half of 2024.

Louis Hachette Group CEO & Chairman Jean-Christophe Thiery said, “We have demonstrated that our plan to be a diversified leader in the promising fields of publishing, travel retail and media is solid and the strong growth in our market capitalisation in recent months reflects our investors’ confidence in our development prospects.”

Commenting specifically on Lagardère Travel Retail’s performance, Louis Hachette Group and Lagardère Group Deputy CEO Gregoire Castaing said, “The first part of this year has been marked by a very solid growth, reflecting the strength of our strategy and the quality of execution in this uncertain and very volatile environment.”

Mirroring trading challenges faced by its peers in the region plus the need to close unprofitable stores, particularly in China, North Asia business declined by -28%.

Europe represented a much more positive story with business bolstered by multiple store openings – most notably the launch of the joint venture duty-free partnership with Schiphol Group at Amsterdam Airport Schiphol in which Lagardère Travel Retail holds a 70% stake.

“The beginning of this Amsterdam duty-free business is very encouraging for the second part of this year,” said Castaing.

While North America posted a modest +1% rise in revenues, he described the performance as “very good news” considering market challenges and a -1% decline in air passenger traffic. Travel Essentials and Food Service stood out in the region, Castaing said.

Seasonal peaks ahead

In Q2, Lagardère Travel Retail posted a +4.1% like-for-like rise in revenues, driven by strong growth in the EMEA region and improvement in North America.

“It’s worth also noting that in this activity, the peaks of the year are still to come with travel activity linked to summer holidays, Thanksgiving and then Christmas,” Castaing said.

Highlighting the “very solid” €117 million H1 EBIDTA, he observed, “This is impressive if you compare these figures to the one that we delivered in ’23 for the same period. As the result, our operating margin reached 4.1% of revenue, which is actually a high level considering again our seasonality.”

The positive result was driven by a robust top line performance, the positive effects of rationalisation in North America and North Asia, and rigorous cost control, Castaing explained.

Lagardère Travel Retail Chairman and CEO Dag Rasmussen said the second half had begun positively. “For travel retail, the trend is good. Obviously, you have some good weeks, some bad weeks, but we feel that the summer has a good start,” he commented.

“Obviously, the takeover of Auckland [Airport], Singapore Cruise Centre and Schiphol in Amsterdam is contributing significantly. Europe is good – it’s mainly intra-Euro traffic, which is driving the growth and international traffic is fairly flat. North America has seen flat traffic until now, though we see some improvement in traffic very recently. China remains negative with the evolution of our network.”

Rasmussen underlined the critical importance of the Schiphol joint venture. “The takeover was a huge success, and we had huge congratulations from our landlord. This being said, it was a takeover from one [partner] to the other. Then progress comes progressively. We opened a new area on July 1, and we’ll do further improvements.

“So we will have a positive ramp-up progressively along the year and with a full impact in ’26. Then we will continue to modernise and improve the situation so it will be a progressive improvement in sales in Schiphol. But right now, we are slightly above expectations, which is great news.

A new tender reality?

“In China, we are continuing to rationalise the network. Traffic is not bad but spend per pax continues to be bad,” said Rasmussen in comments that echo widely held industry sentiment.

Rasmussen mused on whether this new North Asia reality – effectively the end of the golden age of Chinese travel retail spending in The Moodie Davitt Report’s view – will be reflected in a commensurate change in how airport owners tender their businesses.

“The big question mark is how quickly will the landlords understand the evolution of the market,” he commented. “So we’re answering some tenders right now. We’ll see whether we come back to reality or not. Obviously, we will remain very cautious in this area.”

Looking forward to H2 prospects, Rasmussen closed on an upbeat note, “If we look more globally, we can say that in the second half we should have sales which increase by a high single digit. If you average out between the 5% we have now and the high single digit, you can have an idea of how we see sales going forward.” ✈