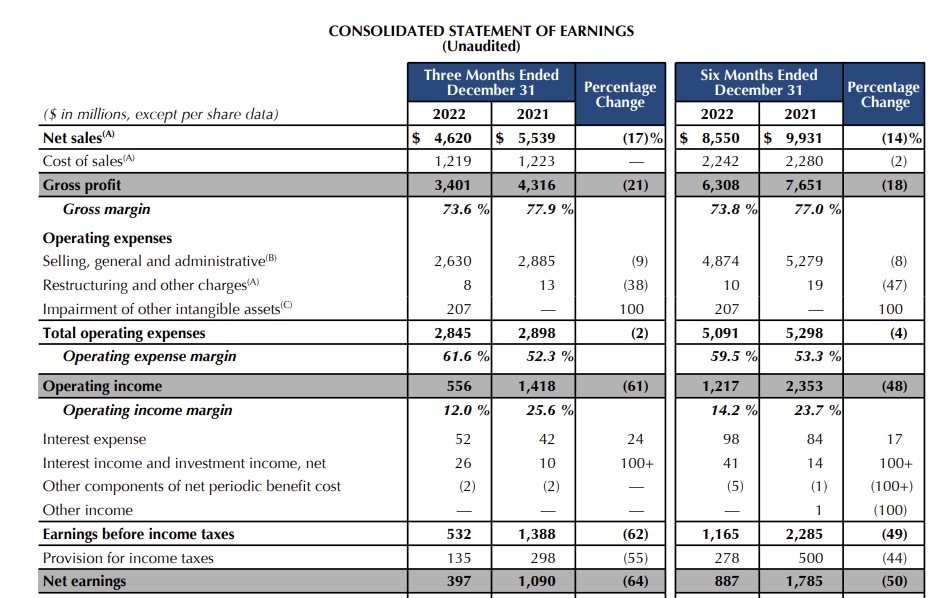

A COVID-driven late 2022 downturn in the key Hainan offshore duty free market hit The Estée Lauder Companies’ second quarter reported net sales hard, with revenues falling -17% year-on-year to US$4.6 billion (including negative impacts from foreign currency). Organic net sales for the quarter ended 31 December 2022 fell -11%.

The US beauty products giant attributed the fall to the evolution of the COVID-19 environment, including restrictions in Mainland China and the rising number of COVID cases there, which led to stronger headwinds as the quarter progressed.

“As a result, tourism and product shipments to Hainan remained largely curtailed and traffic in brick-and-mortar in the rest of China was limited,” the company said.

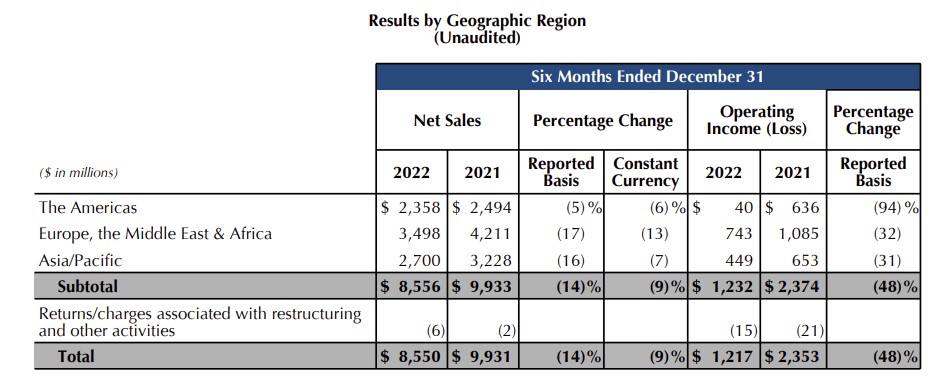

Global travel retail net sales decreased by double digits, reflecting the ongoing COVID-related impacts that led to reduced travel in Asia, particularly to Hainan. However, travel retail net sales grew in Europe, the Middle East & Africa and The Americas, benefiting from an increase in professional and personal travel compared to the prior-year period.

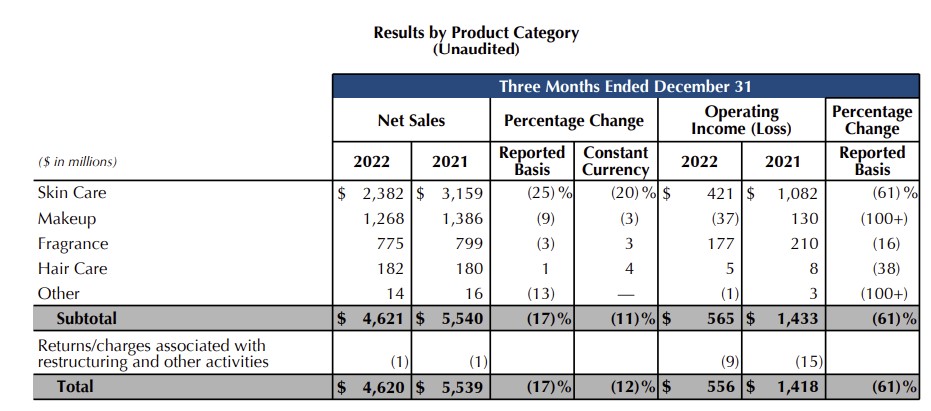

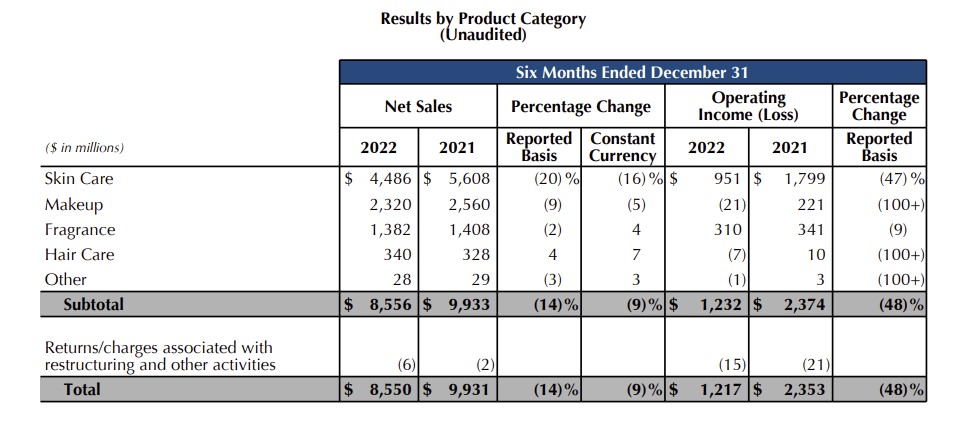

Across all channels, the key skincare category saw net sales decline by -20%, driven by prolonged COVID-related impacts. These included the anticipated tightening of inventory by certain Asian travel retailers and limited footfall in Mainland China. Lower replenishment orders in the US also negatively impacted the category’s growth.

Makeup net sales decreased -3%, again primarily reflecting the ongoing COVID-related impacts affecting Asia travel retail and Mainland China. This was partially offset by the progression of the makeup renaissance as usage occasions increased in many other markets. Net sales of makeup from Estée Lauder and Tom Ford Beauty were negatively impacted by the decline in retail traffic and travel due to the ongoing COVID-related impacts.

The multiple market challenges were partially offset by broad-based strong organic net sales growth across developed and emerging markets globally. Q2 organic net sales benefited from continued double-digit growth in fragrance as well as strong holiday offerings and performance during the 11.11 Global Shopping Festival.

The group reported net earnings of US$0.39 billion, compared with US$1.09 billion in the prior-year period. Diluted net earnings per common share reached US$1.09, compared with US$2.97 a year ago, including the impacts of other intangible asset impairments.

Excluding restructuring and other charges and adjustments, adjusted diluted net earnings per common share declined -49% to US$1.54, decreasing -44% in constant currency – better than the company’s expectations. These declines include a negative impact of -4% from certain foreign currency transactions in key international travel retail locations.

The Estée Lauder Companies President and Chief Executive Officer Fabrizio Freda said, “We delivered on our expectations for the second quarter of fiscal 2023, despite the incremental pressure of COVID-19 in China in December.

“Many developed and emerging markets around the world outperformed to realise our organic sales growth outlook and, given disciplined expense management and moderation of the stronger US Dollar, we exceeded our adjusted diluted EPS outlook. Fragrance excelled globally, while Makeup prospered in a great number of markets, as our brands are realising the promise of the category’s renaissance as usage occasions resume.

“For fiscal 2023, we are lowering our outlook given the November and December disruption to travel and staffing levels in Hainan that slowed the expected normalisation of inventory and the recently announced potential roll-back of COVID-related supportive measures in Korea duty free {changes in the Korean market, particularly related to daigou commissions, are the subject of a forthcoming Moodie Davitt Report feature -Ed}. Together, these are creating a near-term, transitory pressure to our travel retail business.

“In the third quarter, this is more than offsetting the initial positive impact from the resumption of international travel by Chinese consumers, as well as favourable trends from our second-quarter results, including outstanding performance across many developed markets in Western Europe and Asia/Pacific, as well as many emerging markets globally, and a less onerous currency environment.

“All told, our return to growth has shifted to the fourth quarter. We remain focused on investing in our brands, including for innovation, advertising, and entry into new countries, among others, to fuel our multiple engines of growth strategy.”

Freda concluded, “We are encouraged by both our strong momentum in numerous markets globally and improving macro trends. Moreover, so far this fiscal year, we have made exciting progress on several strategic initiatives to drive growth and resiliency in our business, with the opening of our China Innovation Labs as well as our first-ever manufacturing facility in Asia/Pacific, and with our deal to acquire Tom Ford, to name just a few. We have great confidence that we will emerge from this year even better positioned to realise the long-term growth opportunities of global prestige beauty.”

Business Update

The COVID-19 pandemic continued to disrupt the company’s operating environment through the first half of fiscal 2023, including the COVID-related impacts, affecting Asia travel retail, particularly Hainan, and retail traffic in Mainland China.

In Asia travel retail, these challenges led to prolonged store closures as well as the curtailment of travel and caused the tightening of inventory by certain retailers who had previously placed orders in anticipation of the return of travel that was since delayed.

During the first half of fiscal 2023, the Company’s business was also negatively impacted by the strong US dollar, along with inflationary pressures and recession concerns, which caused certain retailers in the United States to tighten inventory.

While the Company’s monthly retail trends improved sequentially during the fiscal 2023 second quarter in the United States, the pace was slower than anticipated resulting in lower replenishment orders compared to the prior-year period.

More details to follow. ✈