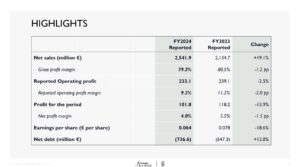

L’OCCITANE International’s net sales for the financial year ended 31 March grew +19% (reported) and +24% (constant) to €2.54 billion (US$2.68 billion) net sales.

Reported net profits dropped -13.9% to €101.8 million (US$109.2 million).

The result was driven by the continued success of Sol de Janeiro and the steady performance of flagship brand L’OCCITANE en Provence, particularly in China where it outperformed the market in the second half.

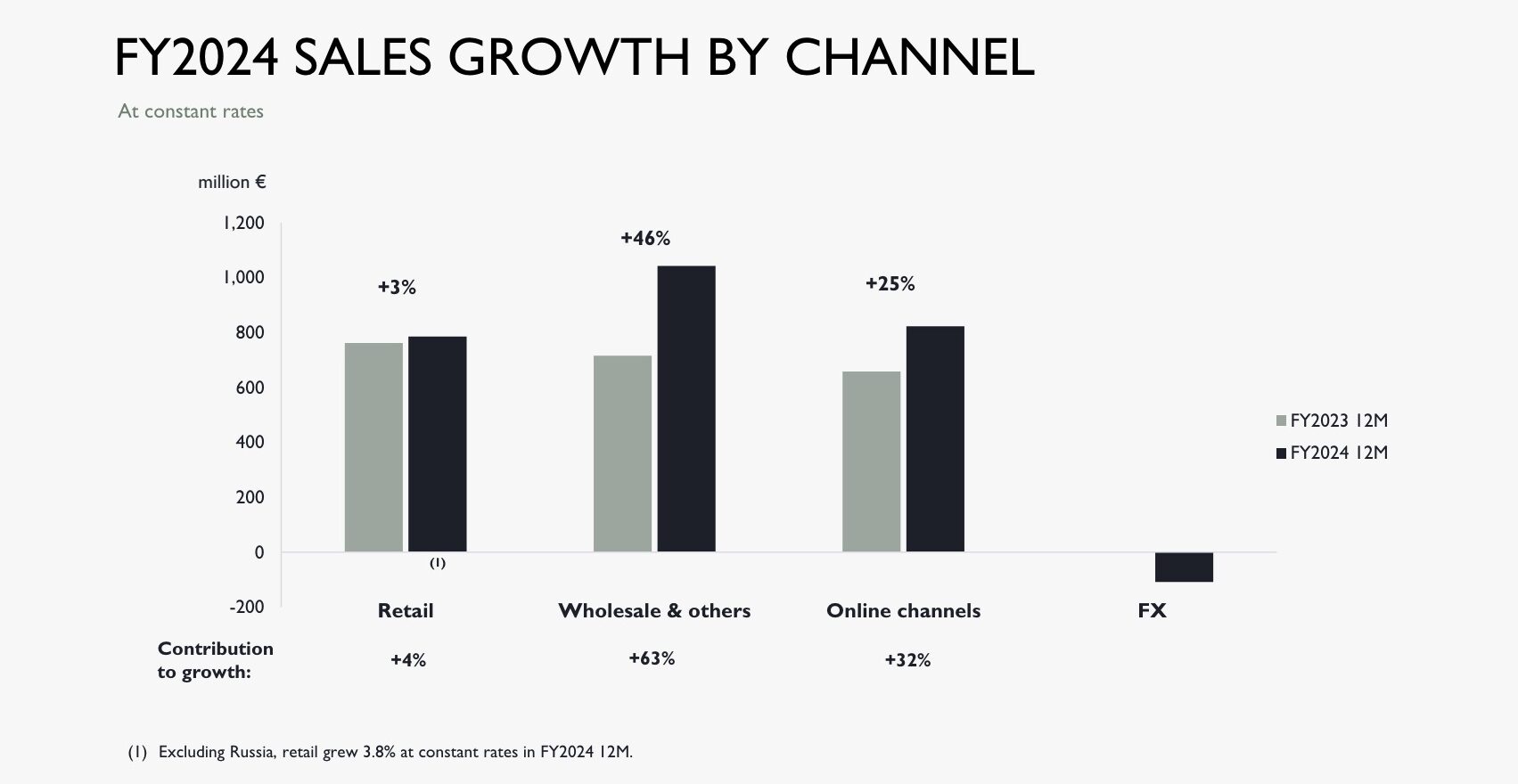

Gross profit margin declined to 79.3% and operating margins were at 12.1% due to a higher wholesale mix. Operating profits decreased -2.5% to €233.1 million (US$250 million) driven by increased marketing investments in key channels and geographies.

As reported, former Managing Director Laurent Marteau succeeded André J. Hoffman as Executive Director and CEO in April. Hoffmann remains Executive Director and a member of the Board. Effective 30 June, Samuel Antunes will be promoted to Chief Financial Officer.

Welcoming guests to an earnings call yesterday (24 June), Marteau said: “We maintained a positive momentum and achieved a solid sales growth of +24% at constant rates, further accelerating from a strong FY2023. This was mainly driven by our two largest brands, L’OCCITANE en Provence and Sol de Janeiro.”

Notably, L’OCCITANE International’s marketing expenses increased by 5.6 points to 22.8% of net sales. This was mostly due to higher strategic marketing investments to capture growth opportunities across all brands.

Marteau added: “To maintain and invigorate market share in a highly competitive environment and intense competition, we significantly invested in our brands to capture new market opportunities. While the increase in marketing investment has impacted our results near-term, we’re convinced it’s necessary to take the development of our brands to the next level and to gain market share in difficult times.

“Thanks to Sol de Janeiro and L’OCCITANE en Provence, we achieved our sales targets this year as we take a further step in our transformation into a multi-billion-euro group.”

Sales growth by geography and channel

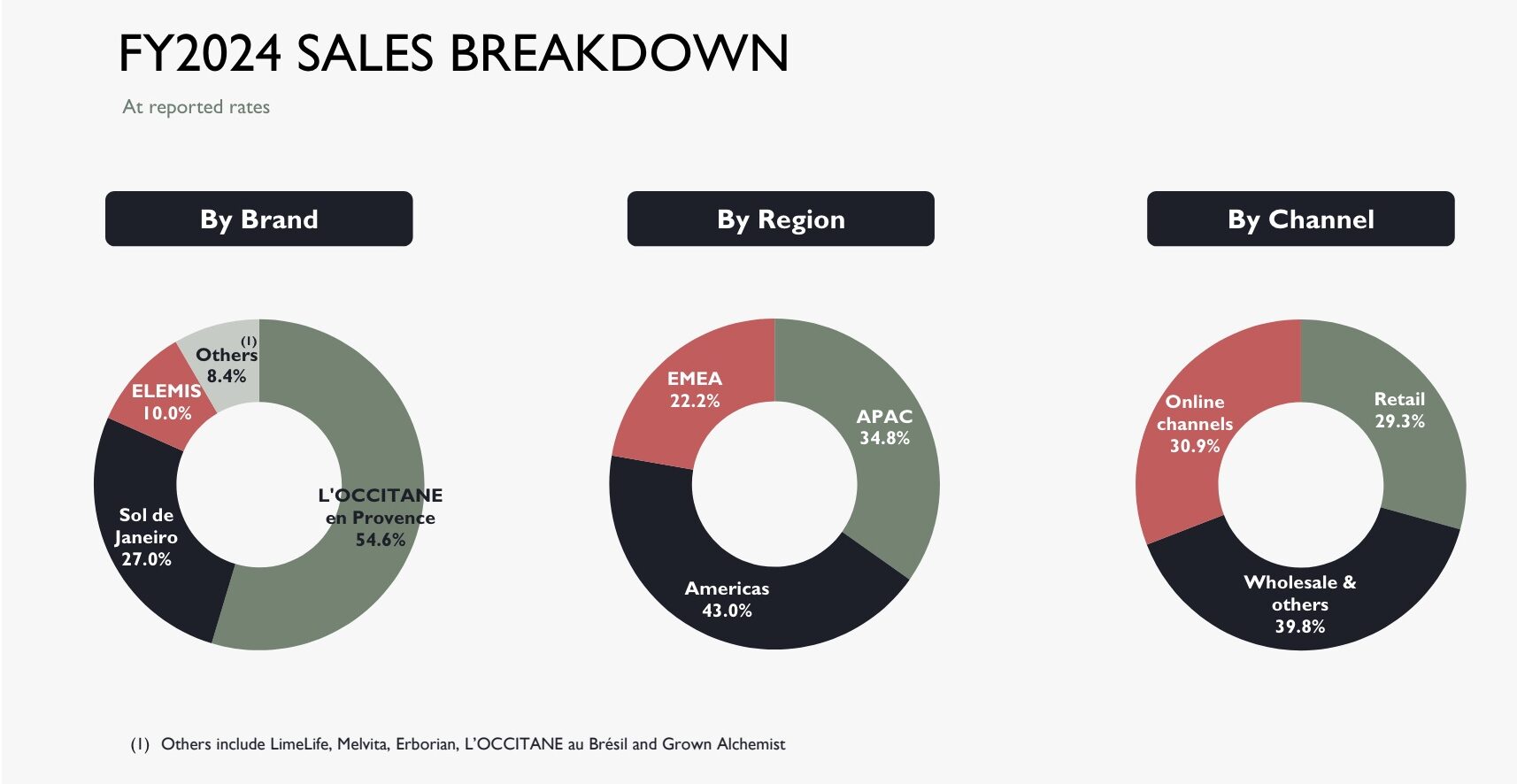

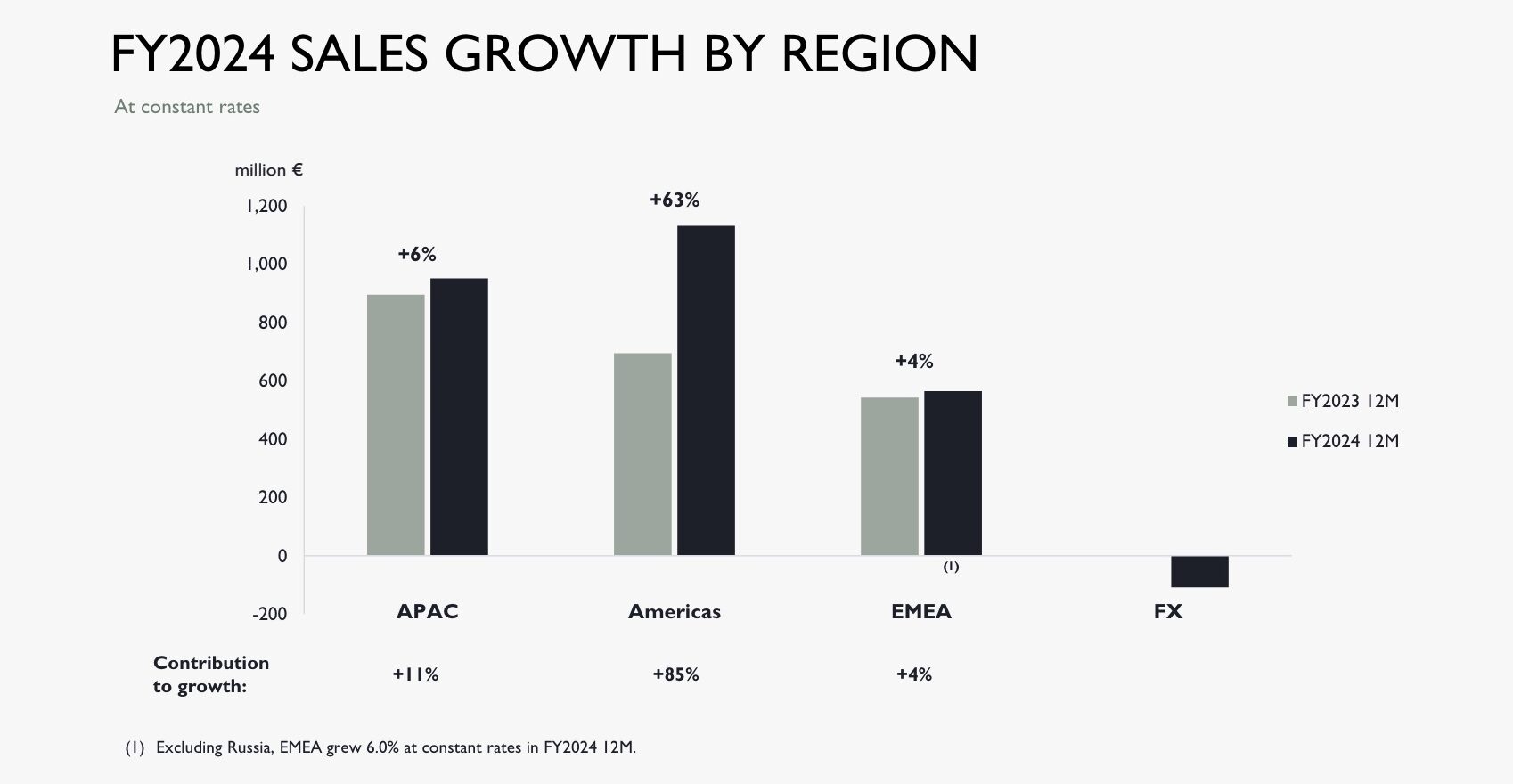

Commenting on the group’s performance across geographies, Antunes said: “The Americas continued to be our largest region at 43% mainly due to Sol de Janeiro. APAC was second at 34.8%, while EMEA counted for 22.2%. In terms of single markets, the US was our largest single market accounting for 28% of overall sales followed by China at 13% and the UK at 8%.

“APAC grew by +6.3% at constant rates mostly driven by L’OCCITANE en Provence’s steady growth in China and Elemis’ continued development there. The Americas was the fastest-growing region at +63% sales growth at constant rates mainly thanks to Sol de Janeiro in the US and double-digit growth from L’OCCITANE en Provence in Q4.

“EMEA grew by +4% at constant rates thanks to strong double-digit sales growth from Erborian in France, Sol de Janeiro in Europe and Elemis in the UK. Excluding Russia, EMEA grew by +6% at constant rates.”

Outside of L’OCCITANE en Provence, Sol de Janeiro and Elemis, the company’s other brands together contributed +14.7% growth in FY2024.

Erborian and L’OCCITANE au Bresil maintained a growth rate of +35% over two consecutive years, while Melvita went from sales decline in Q1 to double-digit growth in Q4 and ended the year at +3% growth constant rates. LimeLife continued to be weak, declining by nearly -20%.

Retail sales saw a +3% rise, while wholesale and others was the fastest growth channel at +46%. Online channels achieved +25.2% growth mainly driven by Sol de Janeiro, Elemis and Douyin, China’s online marketplace channel for L’OCCITANE en Provence.

L’OCCITANE en Provence

L’OCCITANE International set to go private in US$6.4 billion dealAs reported, L’OCCITANE International is poised to go private after majority owner L’OCCITANE Groupe offered to acquire all remaining shares in the business and delist from the Hong Kong Stock Exchange in late April. The €1.7 billion (US$1.82 billion) take-private transaction values 100% of L’OCCITANE International at €6 billion (US$6.4 billion) on an equity value basis. L’OCCITANE Groupe, controlled by Chairman and Director Reinold Geiger, already owns 73.4% of both issued and outstanding shares in the company. Marteau commented: “As you are aware, our board received a proposal from L’OCCITANE Group expressing the intention to delist the company from the Hong Kong Stock Exchange and fully privatise the group. Our company has established an independent committee to evaluate the offer and they will make a recommendation to shareholders soon.” |

L’OCCITANE en Provence, which contributed to 54.6% of total sales, grew +2.7% at constant rates driven by double-digit sales growth in China.

It received the largest portion of marketing budget, which had an unfavourable impact on the brand’s operating profit margins.

Importantly, Antunes noted that L’OCCITANE en Provence was affected by a high-single-digit decline in travel retail with the channel accounting for 9% of overall sales for the brand.

Marteau commented: “Significant investment went to driving L’OCCITANE en Provence’s brand awareness in China, which is the largest market for the brand, and the results were satisfactory. Sales outperformed the market in the second half of the financial year, reaching double-digit growth, despite a noted slowdown.”

In China the brand focused its campaigns on key festivals, helping it maintain leadership position in bodycare and achieve +40% sales growth for the Immortelle Divine cream line. The brand also successfully launched on Douyin with a strong celebrity and KOL campaign.

According to Marteau, L’OCCITANE en Provence will continue to refine its distribution channel and elevate omnichannel retail experiences to drive both recruitment and retention. In China, these investments boosted recruitment with over 200,000 new customers.

He said: “In January, L’OCCITANE en Provence launched an immersive pop-up hotel experience at the Global Beauty Plaza of the cdf Sanya International Duty Free Shopping Complex in Hainan. This initiative was the first major experiential project for the brand in China travel retail and has since launched smaller activations in the local markets of Malaysia, Singapore and Hong Kong.

“It gave visitors an immersive experience to discover our face care, bodycare and haircare ranges through specific services. This was launched to coincide with the opening of the brand’s flagship store in Block C with China Duty Free Group.”

Offering a breakdown of L’OCCITANE en Provence’s performance by region and channel, Antunes said: “L’OCCITANE en Provence had mixed performances across regions. APAC grew mid-single digits, mostly contributed by China’s +15% growth which showed a slowdown, quarter to quarter, linked to the overall market decline.

“Americas had mid-single-digit growth due to the better performance of the online channels in the US. EMEA declined by single digits due to our exit in Russia and from the pharmacy channel in France.”

L’OCCITANE en Provence celebrates 50th anniversary

“In the coming years, we are investing in elevating L’OCCITANE en Provence’s brand positioning and brand equity, designing more premium packaging and elevating both retail and digital experiences. These efforts are all part of preparations ahead of the brand’s 50th anniversary in 2026, a milestone that underscores its pioneering commitment to excellence, innovation and sustainability.

“However, additional investments in marketing, store refurbishments, IT infrastructure and supply as well as attracting talent will continue to weigh on our profit margins in the months and years ahead. These investments are necessary to build on L’OCCITANE en Provence’s existing strengths to grow its market share and strengthen its positioning.”

Sol de Janeiro

Sol de Janeiro grew by +167% in FY2024, delivering triple-digit growth across all geographies and contributing a quarter of the company’s overall sales. This was driven by the sustained performance of the Brazilian Bum Bum Cream, limited-edition releases and launches in the fragrance mist category.

Sol de Janeiro is now the company’s second-largest brand and the largest contributor to profitability with an operating margin of 23.6%.

Commenting on Sol de Janeiro’s sustained growth, Marteau said: “Sol de Janeiro crafted several global campaigns this year. The summer brand campaign and investments in the perfume mist category boosted brand awareness and recruited new customers. These marketing investments helped create a strong brand presence outside the US.”

These were supported by global activations for the perfume mists and Delicia Drench range. In March, Sol de Janeiro expanded into a new category with a body suncare line. The line leverages the brand’s equity in summer and body and is being promoted via a global 360 campaign featuring Sophia Richie Grange.

Marteau added: “Sol de Janeiro continued its roll out in travel retail and across major airports worldwide including a dynamic pop-up in Paris Charles De Gaulle Airport. The 360-degree promotional pop-up campaign, strong visual merchandising and immersive experience helped introduce products and attracted global consumers.”

Elemis

Elemis continued its premiumisation strategy and accelerated marketing expenditures to drive expansion. Despite overall slower sales momentum, it reached the first and second top spots in earned media value rankings in the UK and USA respectively. It continues to rank within the top five face care brands in the UK and within the top 15 face care brands in the USA in Q4 of FY2024.

B Corp Certification

L’OCCITANE Group achieved B Corp certification in FY2024. In line with this, the company set the ambition of paying every team member across its global supply chain a living wage by FY2026.

L’OCCITANE Group achieved B Corp certification in FY2024. In line with this, the company set the ambition of paying every team member across its global supply chain a living wage by FY2026.

In addition, 81% of L’OCCITANE en Provence and Melvita’s current raw materials are traceable to the plants’ origins with a 90% target by FY2026.

“We have a clear focus on delivering on our triple bottom line: People, Planet and Profit,” Marteau explained. “This was exemplified by our company achieving B Corp certification in 2023, a significant marker for sustainable leadership for a company of our size and scale. This milestone builds on our commitments to empower communities, preserve biodiversity and mitigate climate change. Each B Corp company must re-certify every three years, encouraging us to raise our standards across all our areas of environmental and social responsibility.

“We continue to reduce our carbon footprint, promote a circular economy for plastic use and strengthen our partnerships with suppliers to ensure environmental impact management across our value chain. We are also working to certify our newly acquired brands, Sol de Janeiro and Dr. Vranjes Firenze, with B Corp by 2026.”

A cautious yet optimistic outlook

Offering his thoughts on the company’s outlook for FY2025, Marteau said: “Looking ahead, we remain cautiously optimistic about our performance in FY2025 as the competition in the skincare and global cosmetics industry continues to intensify and the cost of customer acquisition continues to increase, particularly in China.

“Each of our brands face different markets and industry specific challenges that require brand-tailored or geography-specific strategies to grow and maintain their market positions.

“Additional investments in marketing, IT and supply infrastructure and people and planet investments will continue to weigh on our profit margins in the months and years ahead. These investments remain necessary for each of our brands to grow.”

On the company’s guidance for FY2025, Marteau said: “We expect to achieve low-teens sales growth (+13-15%) and a slight improvement in the operating profit margin (1 percentage point) compared to FY2024.”

Delving into the details of the guidance per brand, Antunes added: “We are expecting to see low- to mid-single-digit sales growth for L’OCCITANE en Provence, strong double-digit sales growth for Sol de Janeiro and high-teens growth for Elemis.”

A multi-brand portfolio strategy

L’OCCITANE International is doubling down on its multi-brand portfolio strategy in the years to come. Marteau explained: “We will continue build and expand our portfolio, making it more geographically balanced and more appealing to Millennial and Gen Z consumers.

“Sol de Janeiro and Elemis are now taking up more than a third of our net sales and have diversified our brand mix. To build a portfolio of premium beauty brands and expand our presence in the niche fragrance and home fragrance market we acquired Dr. Vranjes Firenze, helping our position as a geographically balanced multi-brand group.

“With our portfolio of strong premium beauty and fragrance brands and our long-term approach to investment, we are well positioned to drive sustainable growth and profitability as a multi-billion-euro group.”

Dr. Vranjes Firenze is a Florentine lifestyle fragrance brand founded in 1983. The brand is centred on tradition, craftsmanship and the art of perfumery. It offers a multi-sensory approach to creating scents and was acquired by L’OCCITANE earlier this year.

“We are in the process of adjusting our strategy to refocus our investment and attention on our major brands, particularly our heritage brand L’OCCITANE en Provence,” Marteau added. “We will accelerate the expansion of our smaller brands which have potential for scalability profitability and the strategic enhancement of our portfolio.” ✈