L’Oréal Groupe CEO Nicolas Hieronimus has expressed optimism about the French beauty group’s travel retail business, both globally and in relation to the Chinese traveller (inside and outside China).

Speaking during a post-results call on Thursday, Hieronimus acknowledged that China travel retail had been hit in December and early January by the surge in COVID cases nationwide after health controls were eased.

“But the early signs we are getting from the first weeks of February are very positive in terms of traffic, and as well in terms of purchases,” he said.

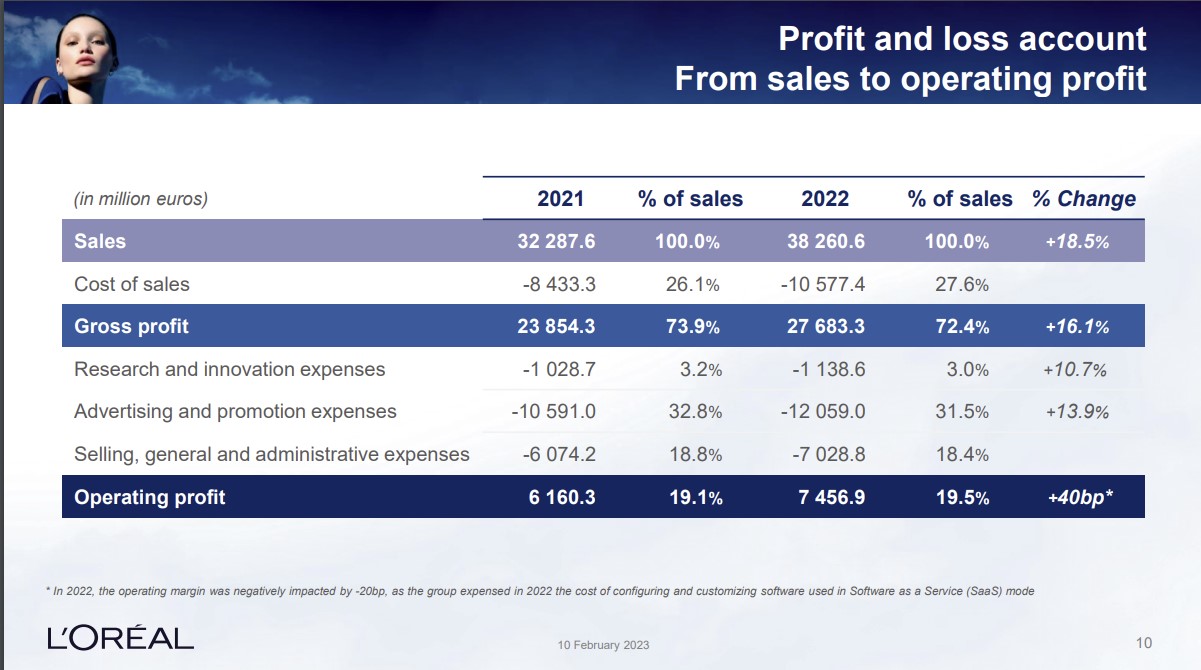

As reported, L’Oréal Groupe posted sales of €38.26 billion in 2022, a year-on-year rise of +18.5% on a reported basis and +10.9% like-for-like. Pre-tax profit climbed by +21.2% year-on-year to €7.8 billion.

L’Oréal Luxe, key to travel retail, recorded strong growth at +10.2% like-for-like and +18.6% reported. The division benefited from the performance of fragrance and skincare, and reinforced its position across key markets, said the group, despite a slowdown in China in the second half. All other divisions posted double-digit sales growth in the year.

Speaking about the overall China market, Hieronimus said, “I think that the Chinese market will rebound from Q2 – not {only} from the second half. But it probably will be progressive, as consumers need to regain trust.

“I think it will bounce back across all divisions. But the divisions that have a stronger brick and mortar footprint, like L’Oréal Luxe, will probably benefit even more from this reopening.”

Describing the Hainan offshore duty free channel as a “nice part of the of the Chinese market”, Hieronimus highlighted the benefits of travel retail and local market teams working closely together in China.

“We have a very good cooperation between our travel retail teams and our local market teams in China to make sure that the local market and the value for L’Oréal is perfectly protected,” he commented.

Hieronimus touched on the daigou or reseller business out of Hainan, noting again that L’Oréal constantly manages the equation between the Mainland China local market and travel retail. “What we can see is that our Mainland China share [of the total beauty market] is continuously growing, which tends to indicate that we must have struck the right balance between travel retail and domestic markets.”

Asked how the rebound in Chinese outbound travel might affect the balance of L’Oréal’s business in China, he said, “The driver of our growth in China is not so much whether they travel here or there. We don’t – unlike like some other luxury industries – have huge price gaps that justify bigger consumption abroad.

“Of course, our French teams are going to be very happy if Chinese consumers come and buy some Lancôme in Paris but overall our drivers are more the rise of the middle classes and the penetration of our brands in China.

“Today we have approximately 100 million customers that buy our brands in China and we have to double that. We have potential in tier-three and tier-four cities where our penetration is half of what we have in tier-one and tier-two so this is my focus on the Chinese growth market, rather than knowing whether they are going to go to Thailand or to Paris.”

Later Hieronimus was asked whether the group risked cannibalisation of the China local market from the growth in Hainan’s offshore duty free market, particularly with the recent opening of the giant cdf International Duty Free Shopping Complex in Haikou – the world’s biggest duty free retail operation.

He responded: “I wish I could go pretty soon to this new, incredible store, which by the way is totally LEED-certified {Editor’s note: As reported, the Haikou complex is China’s first mall to receive the Leadership in Energy and Environmental Design/LEED Gold Certification -Ed} which means that all stores were constructed using eco-certified and recyclable materials. All L’Oréal boutiques at the complex follow the L’Oréal for the Future sustainability roadmap. Six L’Oréal Groupe brands in the complex have also applied for LEED Certification, with Gold Label Certification expected for Lancôme, Kiehl’s, Helena Rubinstein, YSL Beauté, Armani Beauty and Shu Uemura,}.

“So it’s a huge store, but very eco-conscious. All our brands are there. What we’ve seen in the past is that travel retail in general – whether it’s in Hainan, in Hong Kong, in Macau, or even in Paris – is never a cannibalisation.

“It serves several purposes. First of all, it’s a fantastic exposure of our brands. We’re talking about the A&P and the way to create brand desire. These stores in some of the biggest airports [and downtown duty free stores] in the world are just incredible showcases for our brands. I haven’t seen it [Haikou] physically, but I’ve seen the film of the Lancôme boutique, the Prada counter and the Valentino Beauty counter.”

The Hainan stores offer a way for Chinese travellers from lower-tier cities (where L’Oréal is less developed) to discover the brands in a quality environment, Hieronimus said. “That’s a fantastic asset and a very important part of our strategy.”

No risk of YSL Beauté repatriation to Kering

Asked about the future of the key YSL Beauté business {the house of Yves Saint Laurent is owned by Kering which has just created its own in-house beauty group -Ed} – Hieronimus replied, “First of all, we take the decision of Kering to enter beauty as a very strong sign that beauty is definitely a category to invest in.

“And as it relates to the licence, I would say that it’s a very, very, very, very long term licence. And that’s about all I can say. But there is absolutely no risk that this licence is taken back from L’Oréal.” ✈

{Editor’s note: When it announced its €1,150 million total enterprise value bid for YSL Beauté Holding in 2008, L’Oréal said it would gain an exclusive and “very long-term” worldwide licence for the use of the Yves Saint Laurent and Boucheron brands in the perfumes & cosmetics sectors.}